What is Form 16D?

Introduction

Form 16D – the term might seem a bit cryptic, but it holds significant importance in the realm of taxation. There are many different types of form 16, what is the difference between other Forms and Form 16D? And does Form 16D apply to you? For the right person, Form 16D can be especially important when it comes to TDS returns and Income tax filing. Let’s delve into the details of this document and uncover Form 16D’s crucial role in tax compliance.

TDS Certificate Form 16D

In simple terms, under section 194M, Form 16D is a TDS Certificate issued for payments related to the commission, brokerage, contractual fee, and professional fee. It is different from Form 16 for salaried individuals. Its core purpose is to outline the nature of the payment made and the corresponding TDS (Tax Deducted at Source) deducted from it. This certificate stands as a proof of the tax transactions in these domains.

Details of Form 16D

Form 16D is primarily associated with section 194M. This section came into effect on September 1, 2019. This means that this form has been relevant since the financial year 2019-20. You can conveniently access this form from the fiscal year 2019-20 onward via the TRACES portal.

Section 194M mandates the payer/deductor to deduct tax at a rate of 5% from the amount payable to the resident payee/deductee if they exceed payments to resident contractors and professionals of INR 50,00,000 during a Financial Year.

Payment of TDS – A Timely Affair

The Central Board of Direct Taxes (CBDT) has set the due date for TDS payment on payments to resident contractors and professionals. You must make the payment within thirty days from the end of the month in which you made the payment. Similarly, you must issue Form 16D within 15 days from the issuance of Form 26QD.

For instance, if the government disburses a professional payment of INR 65 Lakhs in the Financial Year 2019-2020 on August 15, it should deposit the deducted tax. The government needs to file Form 26QD by September 30, and it must issue the Form 16D TDS certificate by October 15.

Form 16D Components

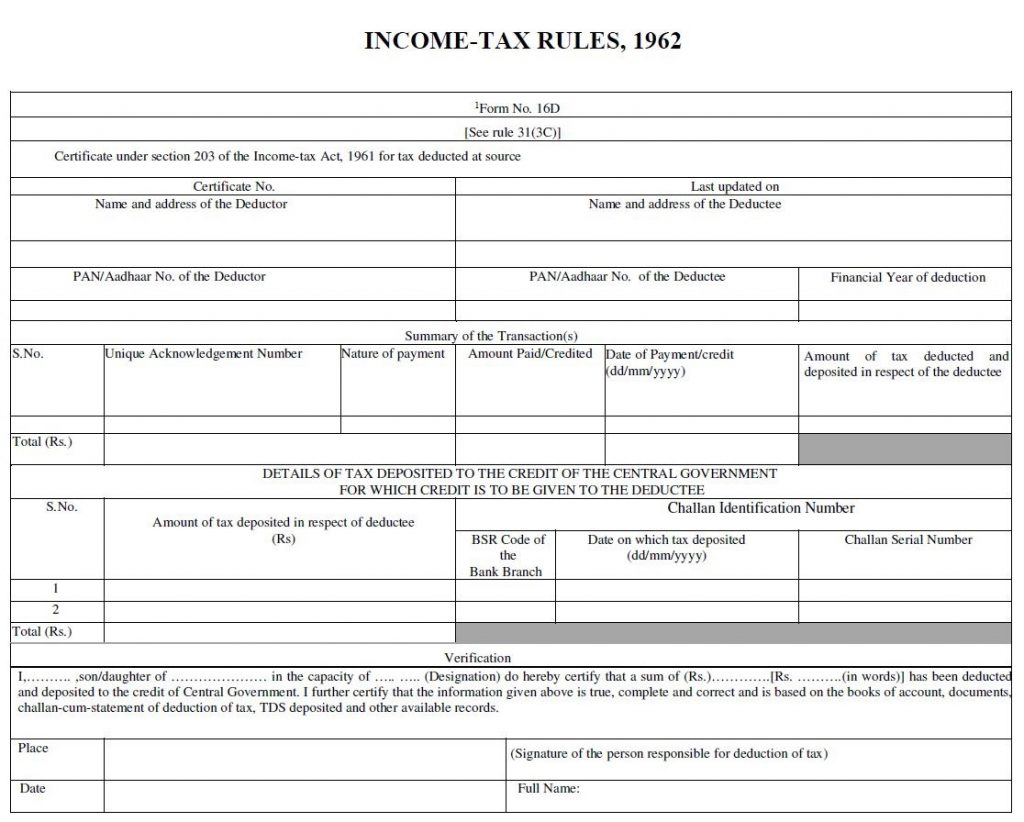

The Form 16D includes crucial details that need meticulous attention. These details encompass:

- Name and Address of Deductor and Deductee: The form starts with the basics, introduces us to the main characters, the ‘Deductor’ (the one deducting tax) and the ‘Deductee’ (the one from whose payment tax is deducted). Their names and addresses set the stage for the tax saga.

- PAN/Aadhaar Number of the Deductor and Deductee: In the digital age, identification is paramount. This section, through PAN or Aadhaar numbers, helps us precisely identify both the Deductor and Deductee.

- Financial Year of Deduction: Every financial year writes a unique chapter in your financial journey. Form 16D tells you which fiscal year the deduction is related to, so you can contextualize your financial tale.

- Transaction Details: The heart of Form 16D lies in the transaction details. It outlines the nature of the payment – whether it’s for commission, brokerage, contractual fees, or professional fees. It gives you a summary of all the TDS deductions.

- Details of Tax Deposited: Money matters are at the core of taxation. Form 16D discloses the exact amount of tax that’s been withheld from your payments. It’s the turning point where you realize how much you’ve contributed to the government’s coffers.

- Challan Identification Number: The story of Form 16D culminates with the Challan Identification Number. This number connects all the dots and confirms that the tax deducted has indeed been deposited with the government.

Final Thoughts

Form 16D stands as a bridge between financial transactions and tax compliance, streamlining the process for both deductors and deductees. Therefore, it carries significant financial implications, understanding the nuances of Form 16D can help individuals and businesses stay on the right side of the taxation landscape. The TRACES portal offers a platform to seamlessly access, and download Form 16D and manage their tax-related responsibilities. Embracing the digital era, this portal aids in simplifying the tax compliance journey. In essence, Form 16D is more than just an enigmatic document; it’s a vital tool that ensures the transparency and accuracy of tax deductions, fostering a streamlined tax ecosystem.

Frequently Asked Questions

What is Form 16D?

Form 16D is a TDS (Tax Deducted at Source) certificate issued by a payer to the payee in compliance with section 194M of the Income Tax Act. It is provided for payments made towards commission, brokerage, contractual fee, and professional fee.

Who issues Form 16D?

Form 16D is issued by the payer, which could be an individual, company, or entity, who is making payments subject to TDS under section 194M.

What is the purpose of Form 16D?

The purpose of Form 16D is to provide the payee with details about the TDS deducted from the payments received on commissions, brokerage, etc. It helps the payee in filing their income tax returns accurately.

What is section 194M?

Section 194M is a provision in the Income Tax Act that mandates TDS deduction at the rate of 5% by the payer when the payments to resident contractors and professionals exceed INR 50,00,000 during a Financial Year.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.