Union Budget 2024: Key Highlights

Introduction

The Union Budget 2024 has been presented by Finance Minister Nirmala Sitharaman on July 23, 2024. Unlike the Interim Union Budget 2024, this one outlines significant changes and initiatives. Named ‘Viksit Bharat’, it primarily focuses on 4 target audiences: Women, Farmers, the Poor, and the Youth. Here are the Union Budget 2024 highlights:

Overall Union Budget 2024 Summary

- Fiscal Deficit: The fiscal deficit for FY25 is estimated at 4.9% of GDP, an increase from 4.5% in FY24. The government aims to maintain a deficit below 4.5% by 2025-26, emphasizing fiscal consolidation.

- Infrastructure Spending: Infrastructure investment remains at ₹11.1 trillion, accounting for 3.4% of GDP. It will also focus on promoting private investment through Viability Gap Funding.

- Loans to State: The government has increased interest-free loans to states to ₹1.5 trillion.

Union Budget 2024 Income Tax and Other Tax Updates

- Standard Deduction Increase: Union Budget 2024 has raised the standard deduction under the new tax regime for income tax filing to ₹75,000. Hence, providing relief to taxpayers.

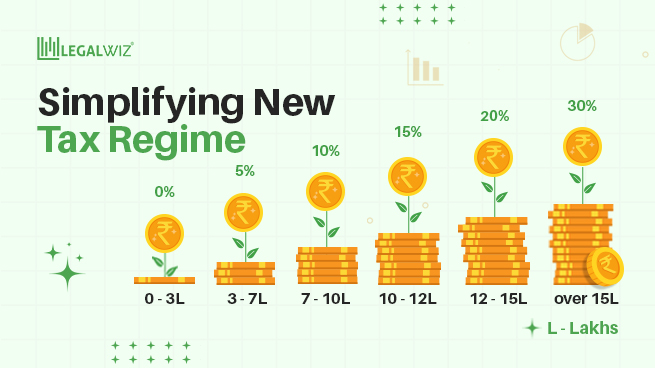

- Revised Tax Rates: The new tax regime will see a revised structure. It will now have zero tax for incomes up to ₹3 lakh and rates increasing progressively to 30% for incomes above ₹15 lakh.

- Abolition of Angel Tax: The government has abolished the angel tax for all taxpayers, promoting investment in startups and innovation.

- Custom Duty Adjustments: Customs duty on gold and silver has been reduced from 10% to 6%.

- Corporate Tax: The Union Budget 2024 has reduced the corporate tax rate for foreign companies from 40% to 35%. Simplifying the tax regime for various industries.

- Capital Gains Tax Simplification: The Union Budget 2024-25 has introduced a flat tax rate of 20% on short-term capital gains from certain financial assets

- Exemption Limit: The exemption limit for capital gains on specific financial instruments has been raised to ₹1.25 lakh annually.

Agriculture and Rural Development

- Agricultural Allocation: The government allocated a total of ₹1.52 lakh crore to agriculture and allied sectors to enhance rural demand.

- New Crop Varieties: The government introduced 109 high-yielding, climate-resilient crop varieties that will benefit farmers.

- Rural Development: A total of ₹2.66 lakh crore has been allocated for rural development, such as for the construction of three crore additional houses under the PM Awas Yojana. The government is launching Phase 4 of the PM Gram Sadak Yojana to improve rural infrastructure.

- Flood Management Support: The government will allocate ₹11,500 crore for flood management in states such as Bihar, Assam, Himachal Pradesh, and Uttarakhand.

Employment and Skil Development

- Employment Package: The government will utilize a ₹2 lakh crore package to create 4.1 crore jobs over the next five years. they further plan to skill 20 lakh youth through upgraded industrial training institutes.

- Skill Loan Scheme: The government will revise the Model Skill Loan Scheme to assist 25,000 students annually, providing e-vouchers for loans up to ₹10 lakh.

- Direct Benefit Transfer: First-time employees registered with the EPFO will receive a Direct Benefit Transfer of up to ₹15,000 in three instalments. This scene will benefit 210 lakh youth.

- Internship Program: A new internship scheme will provide opportunities for one crore youth across 500 companies, also offering a monthly allowance of ₹5,000.

Budget Updates for MSMEs

- Credit Guarantee Scheme: A new scheme will facilitate term loans for MSMEs, providing a cover of up to ₹100 crore.

- Mudra Loan Limit Increase: The Finance Minister has raised the Mudra loan limit from ₹10 lakh to ₹20 lakh for borrowers who have successfully repaid their previous loans. These additional benefits make MSME registration an even more attractive choice for people.

Environmental Budget Updates

- Rooftop Solar Scheme: The Union Budget 2024 has introduced a new scheme which aims to provide up to 300 units of free electricity monthly to one crore households. This will further promote renewable energy adoption.

- Nuclear Energy Development: As per the Union Budget 2024-25 the government is going to partner with the private sector to develop advanced thermal power plants and research smaller nuclear reactors. Further enhancing energy efficiency and sustainability.

Support for Women and Rural Development

- Women Empowerment: Various initiatives aimed at women-led development were announced. Such as higher minimum support prices (MSP) for crops and specific schemes to enhance women’s participation in the workforce, by introducing more hostels and skilling programs.

Some Additional Union Budget 2024 Highlights

- Manufacturing Job Creation: Firstly, a scheme will incentivize employers to hire first-time workers. I will reimburse them up to ₹3,000 per month for EPFO contributions.

- Critical Mineral Mission: Additionally, the government will establish a mission for the recycling and overseas acquisition of critical minerals. The government fully exempts custom duties on 25 critical minerals, promoting their processing and refining, which is crucial for strategic sectors.

- Integrated Tech Platform for IBC: Also, an integrated platform will enhance outcomes under the Insolvency and Bankruptcy Code. This will improve transparency and efficiency.

- Healthcare: Moreover, coming to healthcare budget updates, three medicines for cancer patients will be exempt from customs duty. Additionally, efforts to streamline customs duties on medical equipment are underway. This will be a key change.

- Tourism Development: The Union Budget 2024-25 includes plans to enhance tourism infrastructure at significant spiritual sites. Such as the Vishnupath and Mahabodhi temples, to position India as a global tourism destination.

Conclusion

The Union Budget 2024 expectations are to foster economic growth through targeted tax reforms, increased spending on infrastructure and agriculture, as well as robust support for employment and skilling initiatives. Through these new budget updates, the government seeks to create a more inclusive and resilient economy.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.