Simplified Guide On PF Registration Process

Ensuring social security and financial planning post retirement is very important for all employees. Employees Provident Fund (EPF) is an investment concept prevalent in India that helps the employees in accumulating wealth for their retirement. EPF is governed by the Employees Provident Fund Organisation (EPFO). This EPFO is a statutory body that regulates the PF related matters of all the employers and employees subjected to it in India. Besides, the EPFO provides an online portal for all its members. For an organization to register itself as an establishment on the Member e-sewa portal of the EPFO, they need to follow certain steps. So, it is important for all employers and employees to be aware of the PF registration process. So, let’s delve into the EPF registration process for employers and employees in India.

Step 1: Check eligibility of Employer and Employee

Undergoing the PF registration process might be either optional or mandatory for employers and employees. Let’s check the circumstances and applicability of PF to both:

For employers

Any organisation, including a factory in any industry has to mandatorily get pf registration, if the number of employees engaged with them is more than 20. However, for organisations with less than 20 employees, voluntary PF registration is also an option.

Also Read: What is PF?

For employees

In India, making PF contribution for an employee is compulsory if their organisation is eligible for PF registration and their salary is up to Rs. 15,000/- per month. For the other employees, PF registration is not mandatory. Besides, even if the employees organisation does not have a pf registration, the employee can start his own contribution by opting for the Public Provident Fund Scheme.

Step 2: Collect all documents required for PF registration process

The next step after figuring out the eligibility is to create a checklist of all the documents required for pf registration of employer and employee. You can use the list below to collect all the mandatory documents. Let’s see the list:

For employers

- Digital Signature Certificate (DSC) for submission of the form;

- Permanent Account Number (PAN) of the firm;

- Bank Account Details of the frim (Cancelled Cheque or Bank Statement, etc);

- Address Proof of registered office address (utility bills, rent agreement, lease deed, etc);

- Certificate of Incorporation, GST Certificate, any licence, etc; and

- ID Proof of Director/Partner/Proprietor.

For employees

- PAN Card;

- Aadhaar Card;

- Bank Account Details; and

- Address Proof.

Step 3: Guide to epf registration process for employer

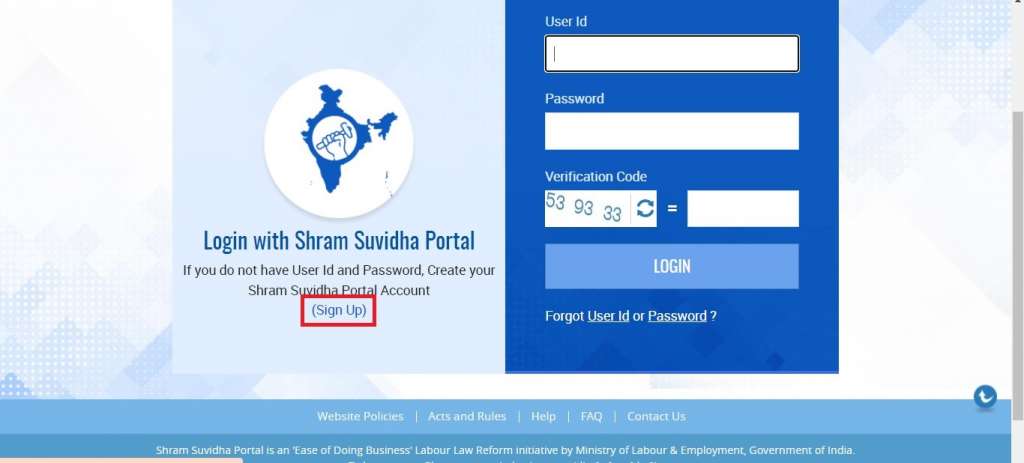

Visit the member portal by clicking here. Then, follow the steps as below:

- Click on “Establishment Registration”

- You will be redirected to the Shram Suvidha Page. Here, you will either have to create an account or login using existing credentials for your establishment.

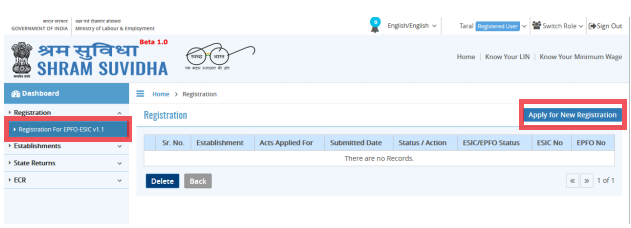

- Once you login to the portal, from the ‘Dashboard’ choose ‘Registration For EPFO-ESIC v1.1’. Then, select Registration for EPFO.

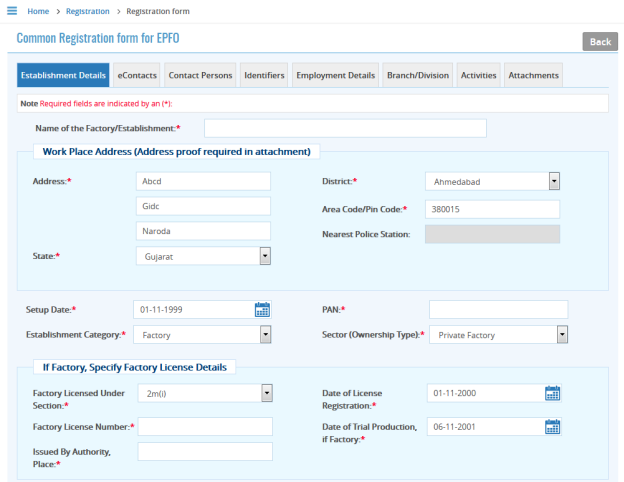

- Once you access the form for PF employer registration or establishment registration, you will have to fill in the details in the establishment registration form.

- The following details are a part of the form:

Establishment Details

To carry on PF registration process, all basic information of the organisation is a part of this section of the form. Name, Date of Incorporation, PAN, TAN and type of establishment, etc. are to be entered here.

eContacts

In this section, the employer needs to provide details of an authorised person representing the establishment. These details include email ID and mobile number.

Contact Person

Usually the Manager of an establishment is the authorised contact person. This is the official contact person for the EPFO. You will need the following details for the EPFO Employer registration:

- Name of Manager;

- Date of Birth;

- Gender;

- PAN;

- Address;

- Designation; and

- Date of joining the organisation

Identifiers

In this section of the EPFO registration form, the employer needs to submit details of various licences as identifiers.

Employment Details

The employer also requires to submit the information related to employee strength, gender, wages, etc.

Business Activities and Attachments

Lastly, the business owner is also required to mention the industrial classification codes pertaining to its business activities and attach the documents as mentioned above.

Step 4: Attach DSC and submit the form

Once you complete filling in the details and uploading all documents, you have to attach your DSC and submit the form.

Keynote: after submitting the form, you will receive an email with confirmation of successful EPFO employer registration.

Step 5: Login to the Member Services Portal

After the employer epf registration process is complete, the employer can login to the EPFO member portal and access the services. Once you login to your EPFO employer portal, you can complete various processes such as generating the PF Account Number (UAN) of your employees.

Also Read: How to create EPFO login for members

Step 6: Guide to epf registration process for employee

To access their PF account online, the employees need to follow the below mentioned process:

- Receive Universal Account Number (UAN) from the employer;

- Verify your personal information and UAN number;

- Activate your UAN; and

- Login to and access EPFO portal using your UAN.

Conclusion

To conclude, it is safe to state that PF registration is an integral part of the employer employee relationship. The employees provident fund scheme allows employees to create a secure fund for their future and emergencies. Besides, when you include the added benefit of employer contribution, it also helps in building a better employment relationship between the two. With that said, we can easily decipher the importance of the epf registration process for the employer and employee. Contact us today to get your EPF employer registration without any hassles!

Frequently Asked Questions

What is the establishment code in PF registration?

The EPFO assigns a unique code to all the establishments registered with the EPFO. This code is known as the establishment code. The establishment code is useful for the employers to manage the employees PF accounts and make contributions.

How do I get my UAN?

The UAN stands for Universal Account Number. This refers to the PF Account number of an employee. The employer is responsible for generating the UAN. Hence, you can connect with your company’s Human Resources Department to get your UAN number.

What if an employer does not register himself with the EPFO?

If the organisation has more than 20 employees, then it is mandatory to register with the EPFO. Failure to do so will lead to non compliance with the laws and result in legal penalties to the organisation.

Can I change the details in my PF account?

If you are an employer, you can change the details such as phone number by accessing your profile and editing the primary number. However, if you are an employee, you will need to ask your employer to make changes to your PF Account details.

If I own two establishments, do I need PF registration for both?

Yes, you have to get the PF employer registration for each of your establishments separately.

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.