How to pay GST Challan online on GST Portal?

Introduction

Are you struggling with the GST Return payment process on the GST portal? Don’t worry; you’re not alone. The process of paying GST returns, understanding what a GST challan is, all of that can be very confusing! especially for those who are new to the GST regime. You have to pay GST challan for many GST returns, one of the most important being the GSTR-3B return. However, with the right guidance, paying the GST challan online can be a breeze. In this article, we will guide you step-by-step on how to pay the GST challan online on the GST portal. We will also answer some of the most frequently asked questions related to GST challan payment. So, let’s get started and make the GST challan payment process hassle-free for you!

What is GST Challan Payment Online?

GST challan payment, also known as GST tax payment refers to the payment of GST by businesses to the government. GST (Goods and Services Tax) is an indirect tax that is levied on the supply of goods and services in India. As per the GST regulations, businesses need to pay GST regularly to avoid any legal consequences. To pay GST, businesses need to generate a GST challan and make the payment.

The GST portal allows businesses to pay the GST challan online. Businesses can pay the GST challan online through the GST portal using net banking, debit card, credit card, or NEFT/RTGS. To pay the challan online, businesses need to log in to the GST portal, select the “Payments” option, and generate a GST challan. After challan generation, businesses can select the payment method and complete the payment process. Here is our step-by-step guide on how to pay GST challan online:

Step-by-Step Guide on How to Pay GST Challan Online on GST Portal

Login to the GST portal

Visit the official GST portal and log in using your credentials. If you are a new user, you need to register first.

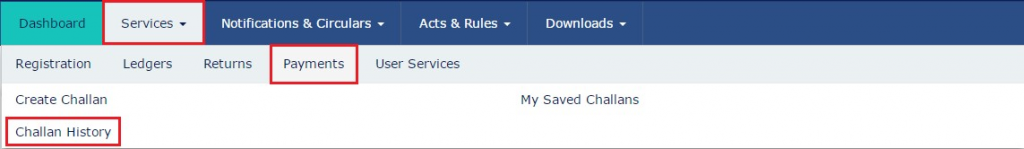

Choose “Chalan History” from the “Services” tab

After logging in, click on the “Services” tab on the top navigation bar and select “Payments”. Choose “Challan History” from the dropdown menu. Keep in mind that you can only make payment for existing Challan. If you’re confused about how to generate a challan, you should check out our article: How to Generate GST Challan Online

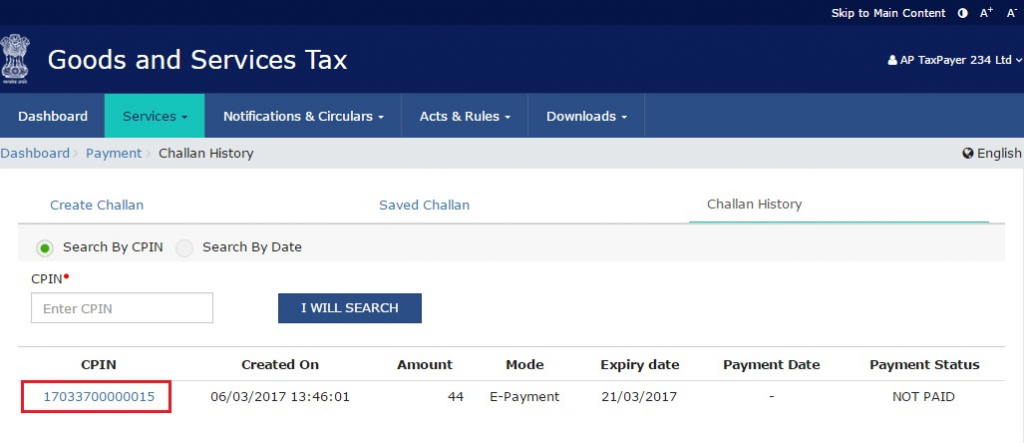

Click on the appropriate CPIN

Choose the appropriate CPIN from the list to make payment.

Select the payment method

Select the preferred payment method and click on “Make Payment”. The GST portal provides multiple payment options, including net banking, debit card, credit card, and NEFT/RTGS. Upon clicking the Make Payment button you’ll be taken to a net-banking page to make your payment.

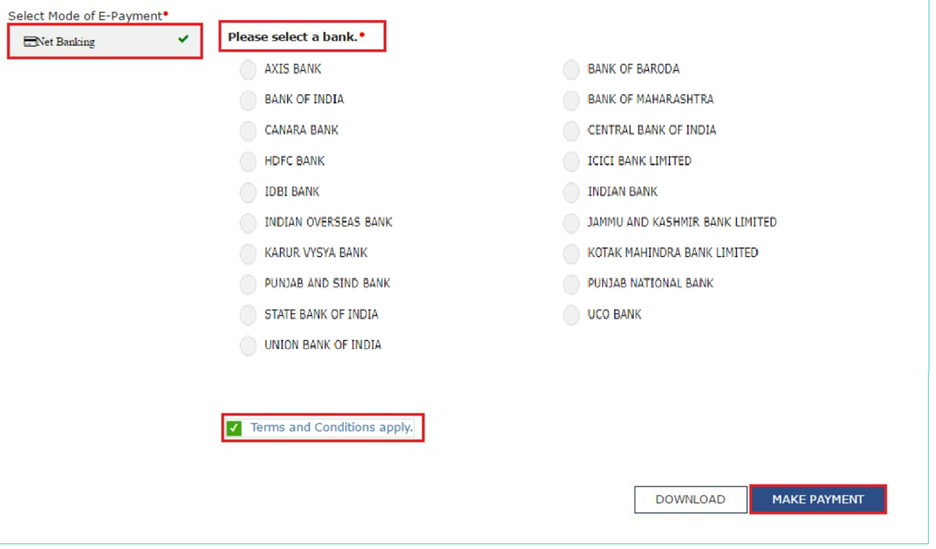

Net Banking

If you choose net banking, you have to select your appropriate bank next and click on make payment. You also have to click the “Terms and Conditions” checkbox. After this, you are redirected to a bank page to make payment.

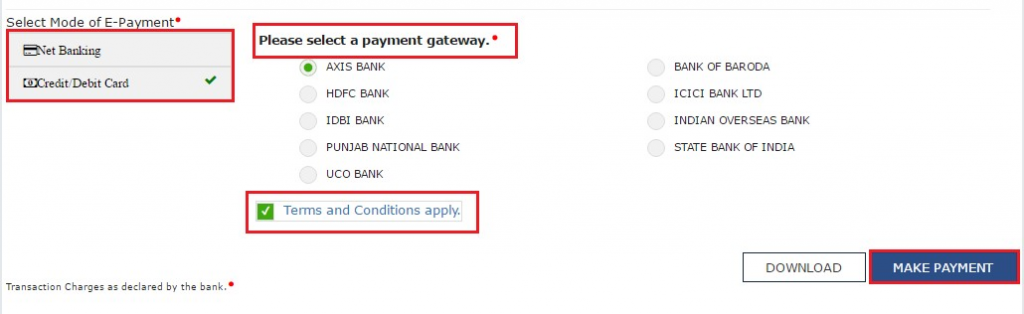

Credit or Debit Card

If you selected debit or credit card, you next have to click on the preferred bank, click on the “Terms and Conditions apply” check box and click on “Make Payment”. After this, you are redirected to a bank page to make payment.

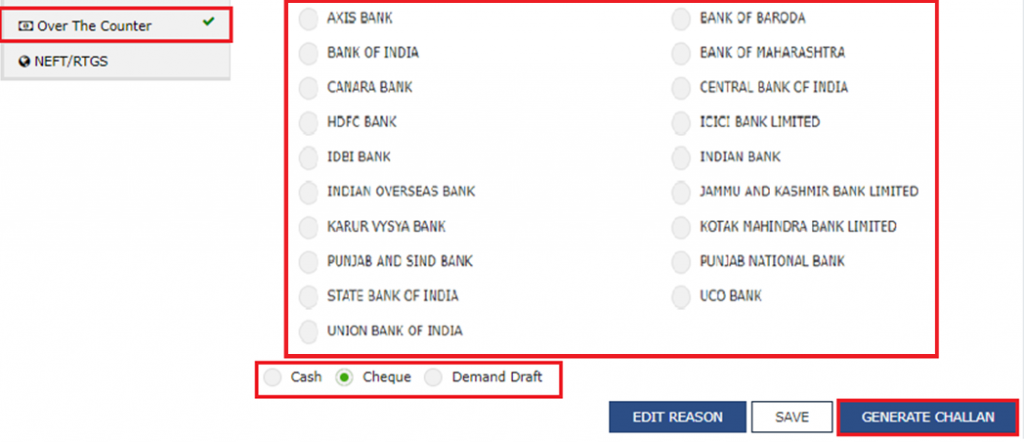

Over the Counter

If you pick over the counter method, you have to choose your preferred bank and the format in which you will be paying the amount (cash, cheque or demand draft), before clicking on generate challan. Unlike the other methods, after this, you are directly redirected to the payment summary page.

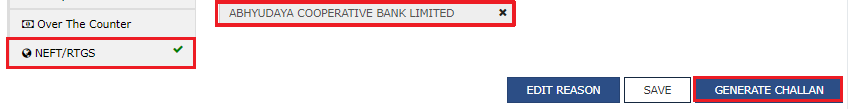

NEFT/RTGS

If you chose NEFT/RTGS payment method, you next have to choose your preferred remittance bank and click on Generate challan.

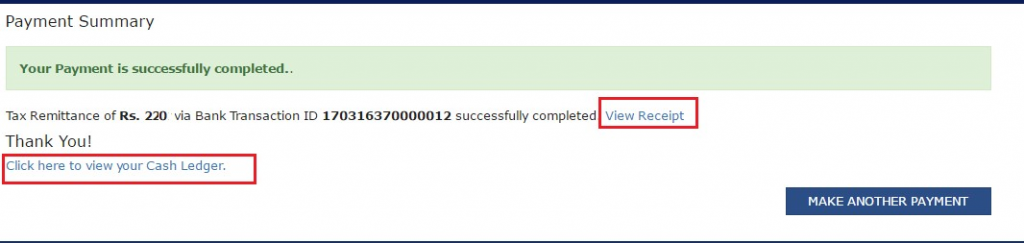

Payment Summary

Finally, you will be on the Payment Summary page. From here you will get to see the payment receipt as well as view the cash ledger.

Conclusion

In conclusion, paying the GST challan online on the GST portal is a straightforward process. Businesses need to log in to the GST portal, generate a new challan, and make the payment through the available payment options. It is an essential part of every business’s compliance calendar. You should make sure to verify all the details before making the payment to avoid any errors or legal consequences. The GST portal provides multiple payment options, making it convenient for businesses to pay their GST taxes. If you face any issues or have any queries, you can refer to the GST portal’s user guide or reach out to the GST helpdesk for assistance.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.