How to generate GST challan Online

Introduction

Attention, business owners in India! Are you feeling overwhelmed by the process of generating a GST Challan for your regular GST payments? Don’t worry; we’ve got you covered! As you already know, GST is a consumption-based tax that requires you to pay GST regularly. GST challan helps you not only pay for your taxes but it is also used to pay for your returns if your tax liability is more than your ITC (Input Tax Credit). For example, if your GSTR-3B return liability is more than your available ITC, you need to create a challan! And the GST payment process is quite easy, owing to the GST challan mechanism, which is an electronic tax invoice.

Generating a GST Challan online is simple, and we’re here to guide you through the process. In this article, we’ll take you through the step-by-step process of generating a GST Challan. Plus, we’ll answer some of the frequently asked questions related to GST Challan generation, giving you peace of mind knowing that you’re up-to-date with the latest information. So, buckle up, and let’s dive into the world of GST Challan generation!

Process of generating a GST Challan online.

Step 1: Go to the GST Portal

Firstly, to generate a GST Challan, you must go to the GST Portal. If you have a GST registration, then you can use your GSTIN (GST Identification Number) and password to log in. On the other hand, if you are a new user, you can create a new account. However, as long you have a GST registration, you don’t need to log in for generating a GST challan.

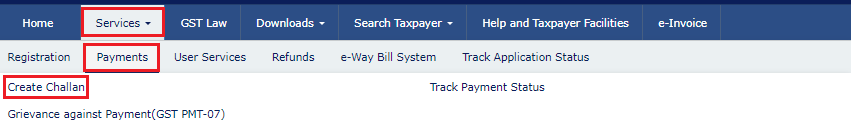

Step 2: Navigate to ‘Services’ and select ‘Payments’

Once you have logged in, navigate to the ‘Services’ tab on the top menu bar and select ‘Payments, Click on ‘Create Challan’ from the dropdown list.

Step 3: Fill in the details on ‘Create Challan’ page

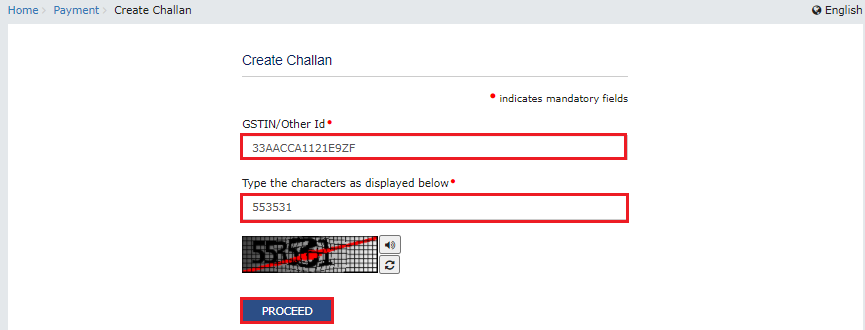

If you aren’t logged in:

If you’re not logged in, after that, you are redirected to the Create Challan page. Fill in your GSTIN and Captcha, and click on Proceed.

If you are logged in

However, if you were already logged in, you are directly be taken to the Reason for Challan page.

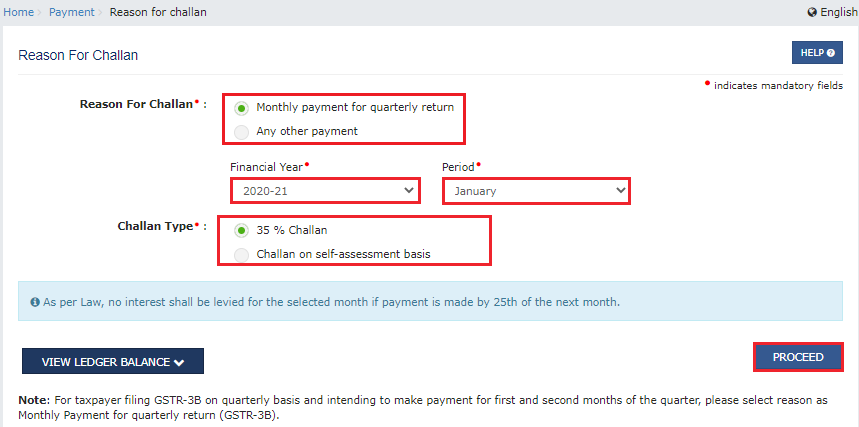

Step 4: Reason for Challan Page

At this point, you will be on the Reason for Challan page. Here you need to select the reason for the challan, the relevant Financial year, period and challan type. After selecting all the relevant options, click on proceed. Normal Taxpayers need to select “Any other payment” as their reason for challan.

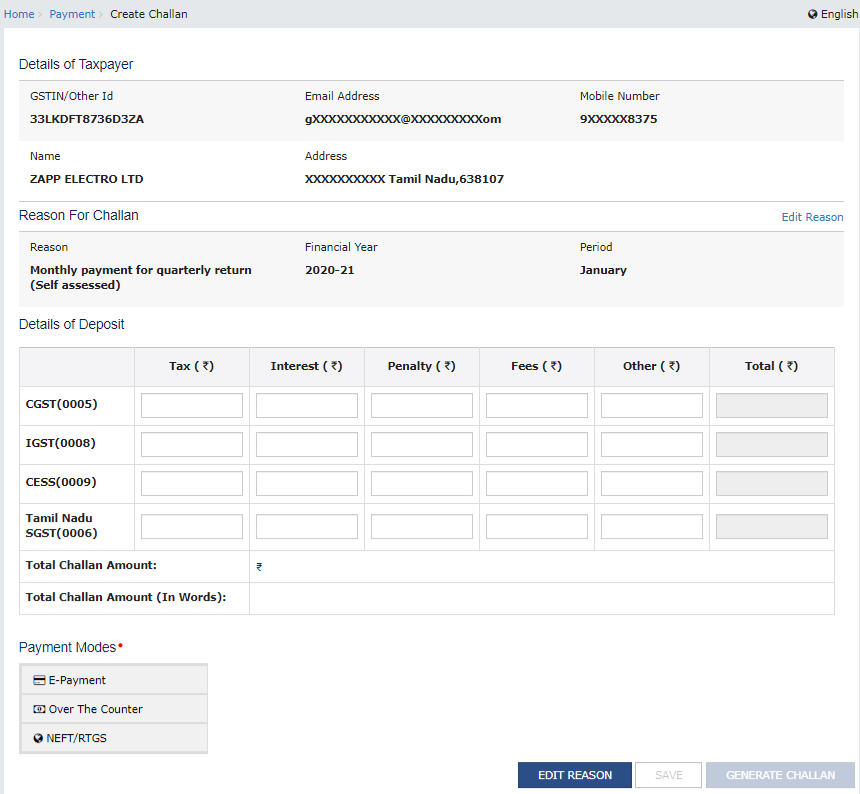

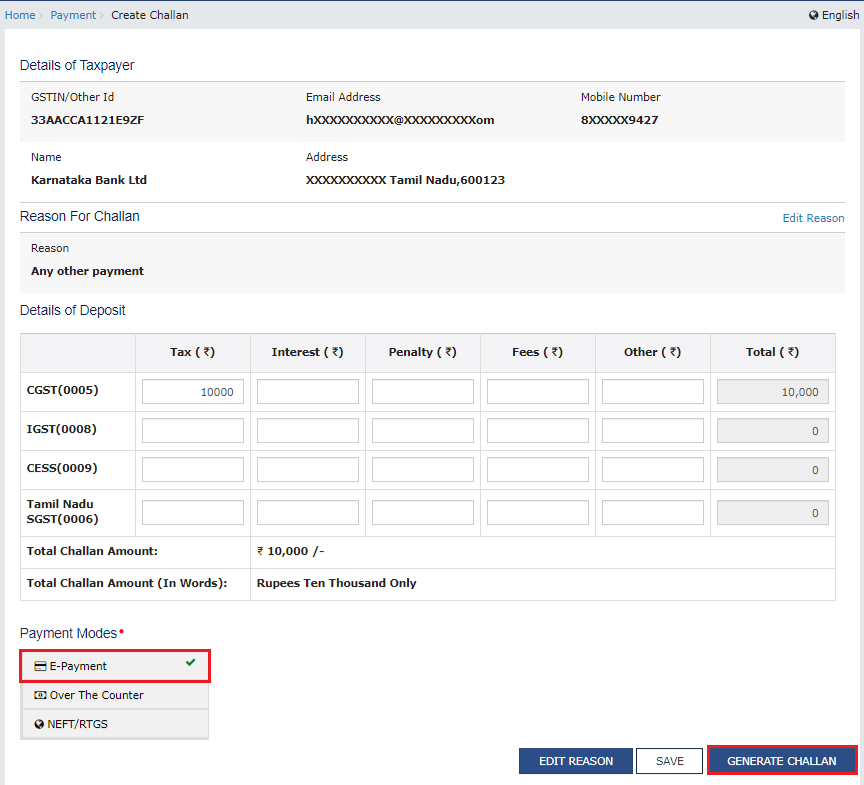

Step 5: Create Challan

On the create challan page you need to fill in your CGST, IGST, Cess and SGST details. Accordingly, it will calculate your tax liability (If you’re a QRMP taxpayer, your tax liability will be auto-populated. Hence, you so not need to fill in any data).

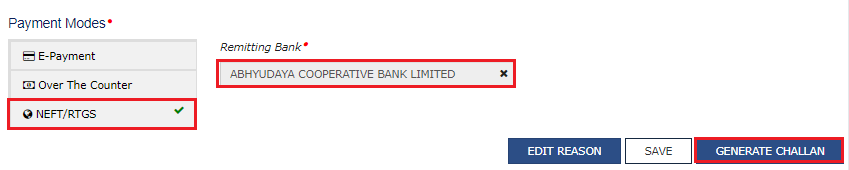

Step 6: Choose Payment mode and Generate Challan

Finally, you have to choose from the available Payment modes and click on the ‘Generate Challan’ button to generate the GST Challan.

Step 7: Payment Option details

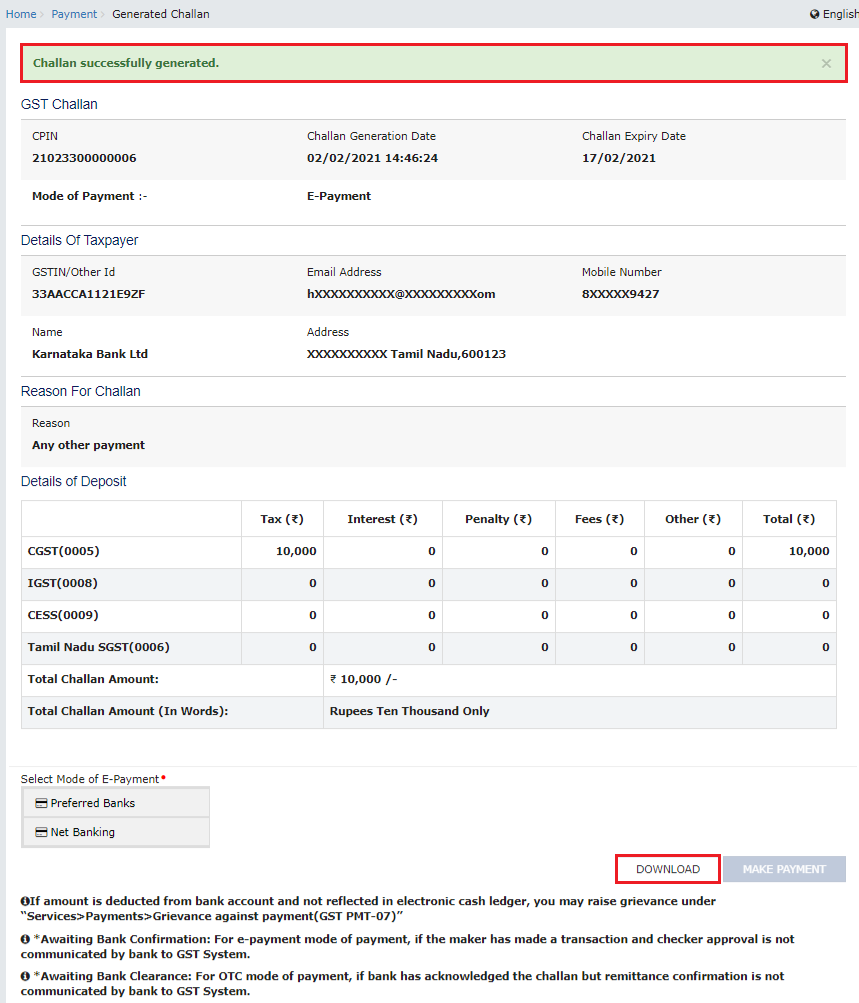

Provide the bank and other details based on your payment option. You can pay the GST amount right then using online Internet banking, a credit/debit card, or through a direct bank transfer or by going to the bank manually. And that’s it! You have successfully generated a GST Challan online. To learn more about how to pay GST challan, you should check out: How to pay GST Challan online on GST Portal?

Note: You cannot opt for ‘Over The Counter’ payment option if your tax liability is over INR 10000.

Step 8: Download the Challan

Additionally, after generating you can now also download the GSTR 3B Challan for future reference.

Conclusion

In conclusion, GST Challan generation is a crucial aspect of GST compliance. it’s also very important to include GST Challan generation in your 2023 Compliance calendar. By following the steps mentioned above, you can easily generate a GST Challan online and make the payment through any authorized bank. Moreover, it is important to ensure that you make the payment within 15 days of generating the Challan to avoid any penalties or late fees.

FAQs on GST Challan Generation

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.