How to File Nil GSTR 1

Introduction

All business registered under the Goods and Services Tax (GST) regime have a responsibility to file GST returns. In this article, we will explore the process of filing a Nil GSTR-1 return, focusing on its meaning, steps to file, applicability, due dates, late fees, and FAQs. Whether you are a small business owner or a taxpayer looking to file a Nil GSTR-1 return, this guide will provide you with the necessary information for GSTR-1 GST return filing.

Understanding GSTR-1

GSTR-1 is a monthly or quarterly return that captures the details of a taxpayer’s outward supplies (sales) made to registered and unregistered individuals, along with the details of debit and credit notes. It is an important form for reporting business transactions and ensuring compliance with GST regulations. GSTR-1 and GSTR-3B returns are inter-related. You need to file GSTR 3B before you can file GSTR-1.

Applicability of GSTR-1

GSTR-1 applies to all registered taxpayers, except those who fall under the composition scheme. The filing frequency can be either monthly or quarterly, depending on the taxpayer’s turnover.

Eligibility to File Nil GSTR-1

Taxpayers are eligible to file a Nil GSTR-1 return if they meet the following conditions:

- There were no outward supplies during relevant month or quarter.

- There is no need to make amendments to previously declared supplies.

- There are no credit or debit notes to declare or amend.

- There is no requirement to declare or adjust details of advances received for services.

Steps to File Nil GSTR-1

To file a Nil GSTR-1 return, follow these simple steps:

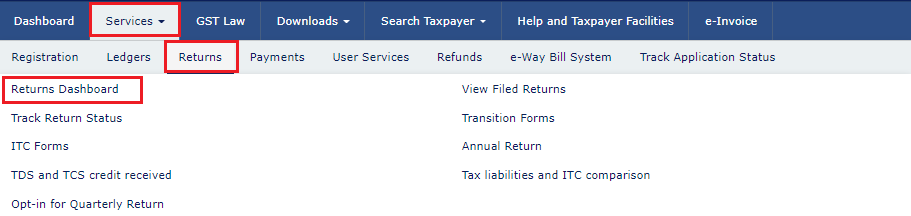

Step 1: Log in to the GST portal and navigate to the Returns Dashboard

Go to the services tab on the GST portal and click on “Returns”. From the Returns drop-down menu, click on “Returns Dashboard”

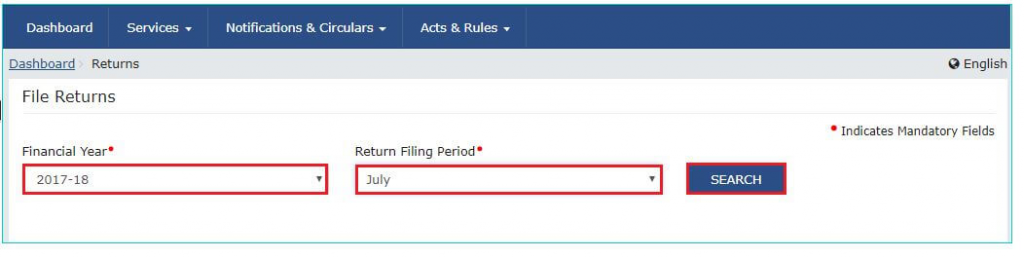

Step 2: Select the relevant GSTR-1 period on the Returns dashboard

Choose the relevant Finanacial and Return Filing Period

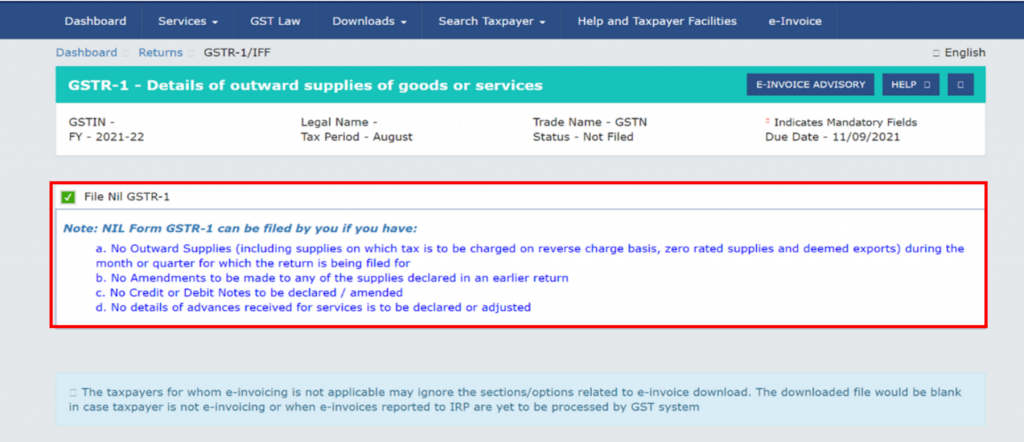

Step 3: Select the “File NIL GSTR-1” checkbox

On the GSTR-1 dashboard, you will find a checkbox labeled “File NIL GSTR-1” at the top, select this checkbox. The system will display a note related to Nil filing, and all the tiles/tables will be hidden. Make sure to edit GSTR-1 and make all necessary changes to it before this step.

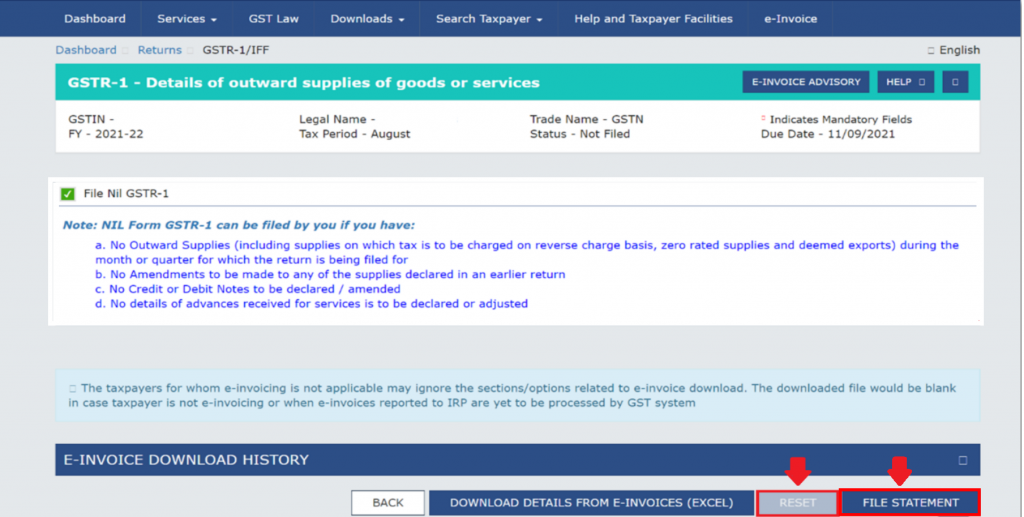

Step 4: File Statement

To file Nil GSTR-1, click on the “File Statement” button located at the bottom of the GSTR-1 dashboard page. This will redirect you to the filing page to file GSTR-1/IFF using DSC or EVC. For DSC you have to select the correct signature, for EVC you have to do a OTP verification.

Note: If any records have been saved in GSTR-1, Nil filing will not be allowed. In that case, you have to file normal GSTR-1. However, if the data is incorrect or irrelvant, you can delete any saved records or reset GSTR-1 data by just clicking the “Reset” button before clicking the “File Statement” button.

Due Date and Late Fee

For monthly filers, it is the 11th of the following month, and for QRMP taxpayers it is the 13th of the following month. It is important to file within the specified due date to avoid penalties. Late filing can attract a late fee of Rs. 20 per day, amounting to a maximum of Rs. 500.

Conclusion

Filing a Nil GSTR-1 return is a straightforward process that requires taxpayers to meet certain eligibility criteria and follow the prescribed steps on the GST portal. By understanding the meaning of GSTR-1, its applicability, and the due dates, businesses can ensure timely compliance and avoid penalties. If you have no outward supplies to report for a specific filing period, filing a Nil GSTR-1 return is the appropriate action to take. Stay updated with the latest GST guidelines and file your returns accurately to maintain compliance with GST regulations.

FAQs on Filing Nil GSTR-1

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.