How to file ITR 6 form: ITR 6 Return filing process

ITR 6 is one of the seven forms applicable to different taxpayers under the Income Tax Act and related rules. This is the form applicable to companies as per section 2 of the Act. However, it excludes the companies who are eligible to claim exemption under section 11 of the Act. This section 11 provides exemptions to companies and other bodies gaining income from the property held for charitable and religious purposes. It is very important to file ITR correctly, especially for huge enterprises. So, here’s a step by step guide on how to file ITR 6 form.

Modes of filing ITR 6

There are two modes of filing the form ITR 6 on the tax efiling portal. This article covers a step by step guide on both modes.

- By submitting offline utility; and

- By submitting for ITR 6 online

Offline Utility Mode

To file the itr 6 using offline utility, you can follow the below steps:

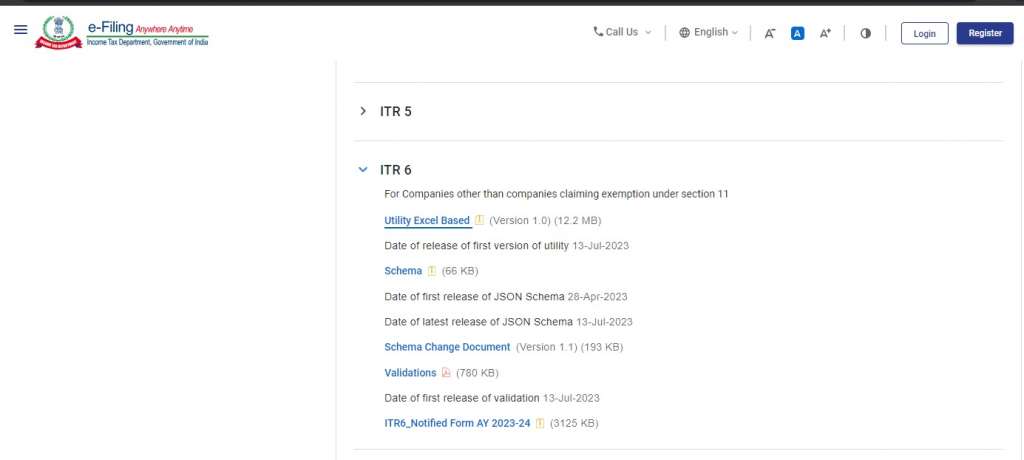

Step 1: Download offline Utility

Go to the e filing portal >> Downloads>> Excel Based Utility ITR 6.

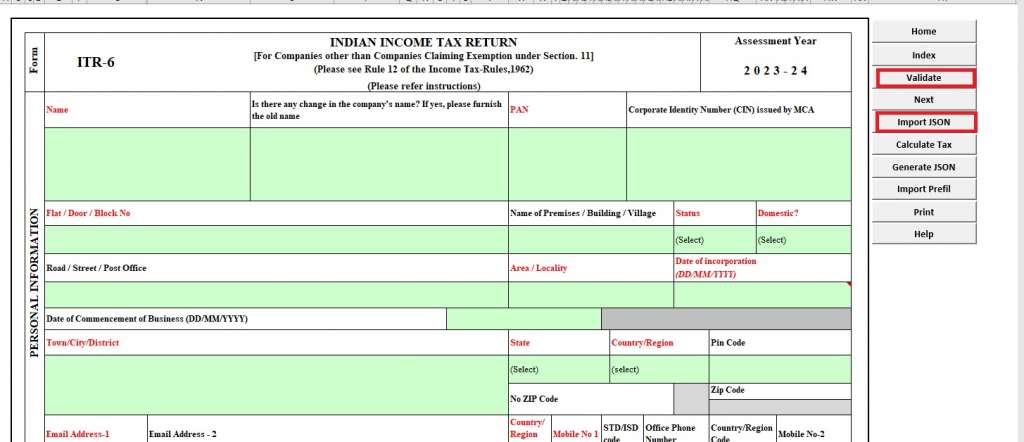

Step 2: Submit the details to file ITR 6

The ITR 6 is divided into Part A, schedules to the form and Part B. Once you fill out all the relevant information in the parts, you can click on ‘validate’ to validate the information given by you and generate the JSON format of the form.

Step 3: Furnish the JSON format on tax e filing portal

To complete the process of ITR Filing, you will need to login to the Tax e filing portal. Then, select the ‘Income tax return filing’ in the menu drop down list. Further, select the relevant assessment year, mode of filing as ‘offline’ and ITR form 6. Lastly, you will be redirected to the page where you need to attach the offline utility in JSON format. Then, you can proceed to verification. You can complete the verification of itr form 6 filing by a digital signature certificate.

Also Read: What is ITR 6?

How to file ITR 6 online?

The below steps give a guide to submit the online form electronically. Let’s dive in!

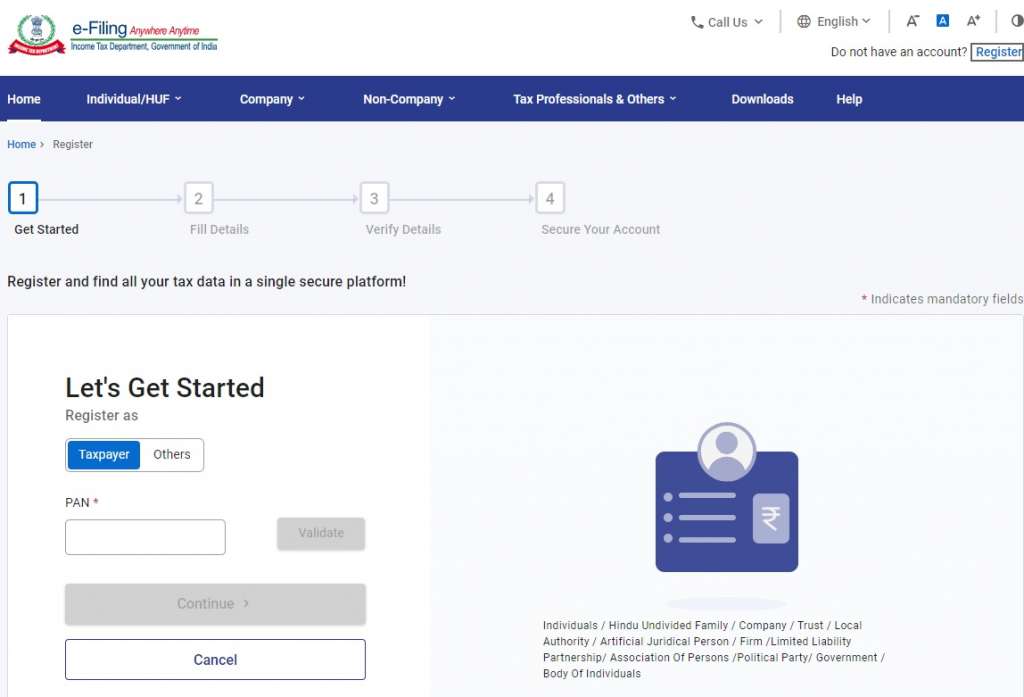

Step 1: Login to the portal

Go to the tax e filing portal. Then, login using your PAN and password. If you are not registered as a user, you cannot access the online ITR 6 form. Hence, you need to register yourself as a user before you can proceed further.

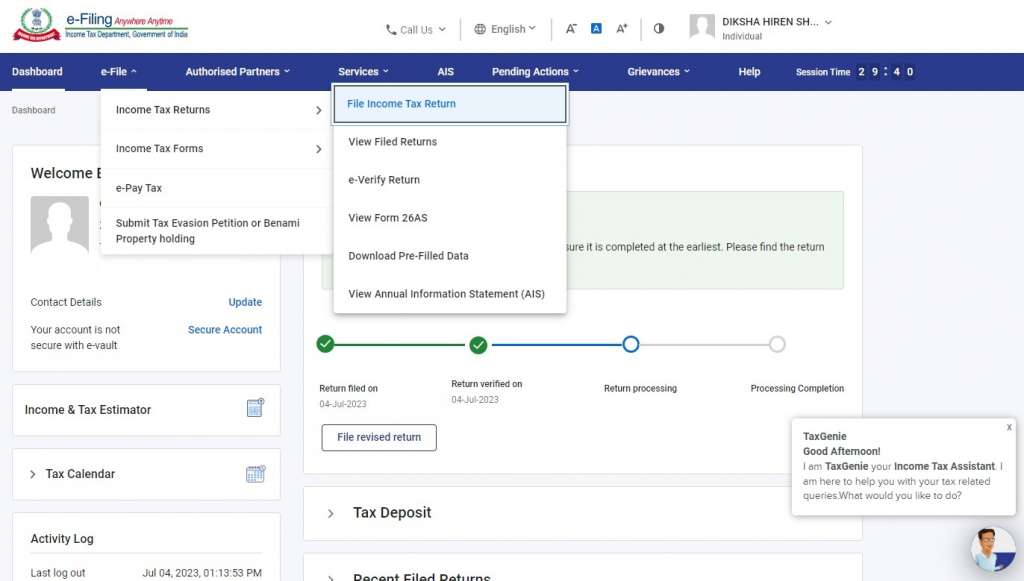

Step 2: Choose Income Tax Return Filing

When you are on the dashboard, select ‘e-file’ from the menu. Then, choose ‘Income Tax Return Filing’ from the drop down list. You will then be redirected to a page where you will have to choose the appropriate assessment year, mode of filing as ‘Online’ and the file ITR 6 form.

Step 3: Submit relevant details and verify

It is recommended by the income tax department that while you are filling the ITR 6 form, the ideal way is to furnish details in part A, then in the schedules and lastly in part B to compute total tax liability before verification. Once you furnish all details, you can verify the ITR 6 form using either the Digital Signature Certificate (DSC) or through aadhar generated OTP. After successful verification, you can submit the final form.

Structure of ITR 6 form

The ITR 6 form is divided into three parts. Part A, Part B, and the Schedules thereto. All the information that you need to submit in these parts respectively include:

Part A

Personal Details

This includes your name, number, aadhar, PAN and other details as the entity.

Audit information

IF the audit is applicable to your entity, you need to fill our the relevant details here. Such as the date of furnishing the audit report, name of the auditor who signed the audit report, etc.

Details of the Company

The nature of the business, whether the company is original, a subsidaiary, a holding company, etc. Whether there has been any amlagamtaion or not, etc. all information an be furnished here.

Details of Key Persons

Here, you need to mention the basic PAN based information of the members of the company, and also the shareholders and the shareholding pattern. The details include, name, contact and residential addresses, etc.

Nature of business and Profession

In this part, you need to furnish the codes of three main activities carried on by your business or profession to file ITR 6.

Balance Sheet

Furnish balance sheet as at the end of the financial year. Here, you need to furnish details of the balance sheet of your company such as assets, sources of funds, current liabilities, long term loans and advances, etc.

Manufacturing Account

All details from the opening inventory till the closing stock are furnished in this part of the form ITR 6 filing process.

Trading Account

Details of the trading account such as the gross receipts from business, profession, and taxes, duties receivable, etc are a part of this section.

Profit and Loss Account

This section includes the details of the debits and credits to the Profit and Loss account during the financial year to file itr 6.

Other Information

This section is mandatory for the entities where audit is applicable. For the rest, to out the information in this section is optional.

Quantitative Details

Details of opening stock, purchases, sales of goods, closing stock and remnants throughout the year are a part of this section.

Schedules

- Details of income from house property;

- Income from transfer of Virtual Digital Assets;

- Computation of income from Business or Profession

- Depreciation on plant and machinery;

- Depreciation on assets;

- Expenditure on Scientific Research etc;

- Capital Gains;

- Form for sale of equity shares;

- Income from other sources;

- Income after set off of losses;

- Unabsorbed Appreciation;

- Schedules 10AA, 80G, 80GGA, 80IA, 80IB, and 80IE, 80M;

- Details of exempt income;

- Pass through Income Details;

- Calculation of minimum alternate tax applicable;

- Computation of Tax Credit;

- Details of income from outside India;

- Shareholding in unlisted company;

- GST details;

Part B

Computation of Total income

Details of total income and the total tax liability computation from income form a part of this section of the form to file ITR 6.

Conclusion

For all companies, who are not eligible for exemption under section 11 of the Act, filing ITR 6 in an appropriate manner is very important. Yet, in case of errors, you can file the ITR U. Read more about how to file ITR U online. However, it is always advisable to seek help from experts. LegalWiz.in is just a click away!

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.