How To File ITR 5 Form Online

Entities earning income through different sources in India are required to submit their annual returns through different forms applicable to them on the basis of their income. One such form is ITR 5, applicable to Limited Liability Partnerships, Body of Individuals, Association of Persons (AOP), and such other bodies. This article gives a detailed guide on the steps on how to file ITR 5 form online. Let’s dive into the process of income tax return filing.

How to file ITR 5?

There are two modes of filing ITR 5, let’s understand both in detail here.

Step by step process to file ITR 5 offline

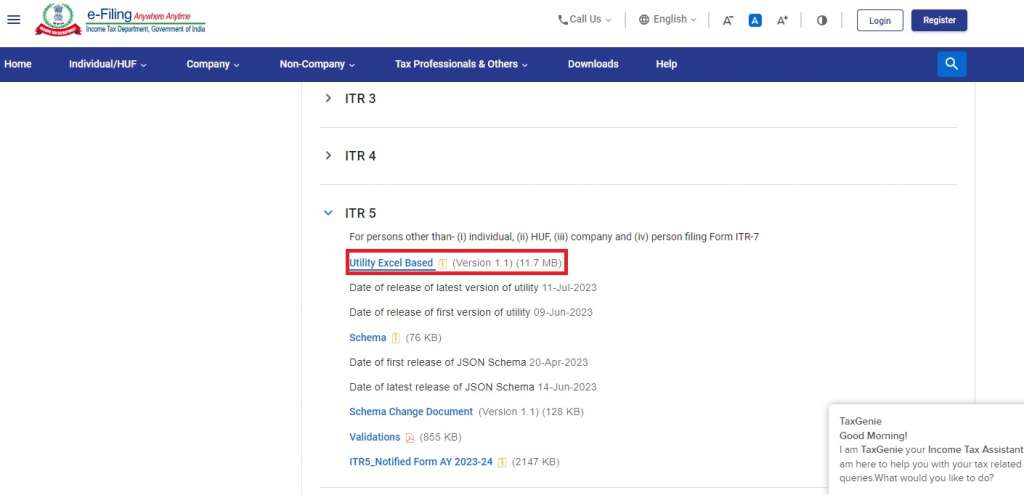

Step 1: Download the offline utility

Go to the tax efiling download menu from options. Then click on ITR – 5 offline utility. You will get the offline utility of to file itr 5 in XSL format in a ZIP folder.

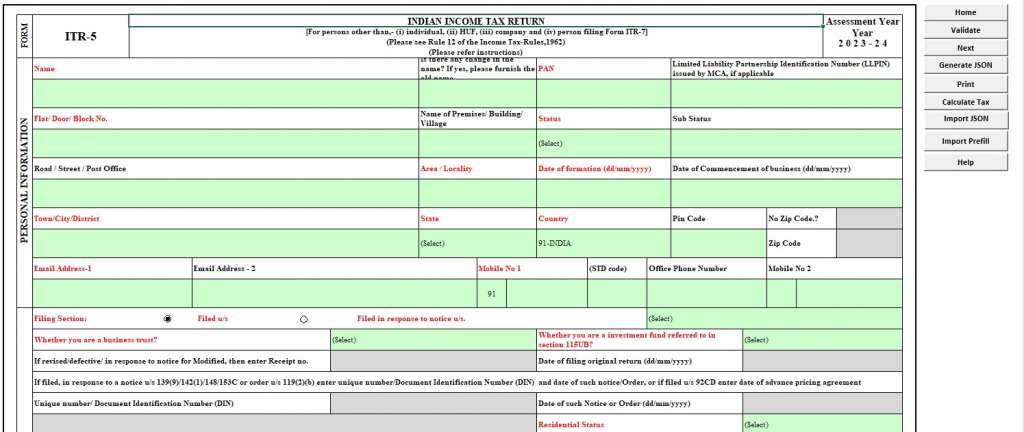

Step 2: Furnish the details in offline utility

You can enter all the relevant details (as mentioned below) in the offline utility mode. During this, you will be easily able to compute your final tax liability.

Step 3: Login to the Portal of efiling

Once you compute your tax liability, you can transfer the data to the portal online by attaching the final offline utility computation on the portal. Here’s how:

- Login;

- Select file income tax return from e-file menu;

- Select the mode of filing as ‘offline’;

- Choose the appropriate form ITR 5;

- Attach the .json format of your utility and import data;

- Lastly, Verify and Submit your income tax return.

The offline process is possible either by you submitting your return directly in paper form or by providing a bar-coded return. With the advancement of technology and the efforts of the income tax department to make the entire process easier, the ITR 5 online filing mode is recommended.

For more information on applicability of ITR 5 do read: What is ITR 5 and who should file it?

How to file ITR 5 online

The online filing process can happen in two manners:

- Furnish electronic return by verification through DSC; or

- Transmit data in the form electronically.

Let’s take a look at how this is possible:

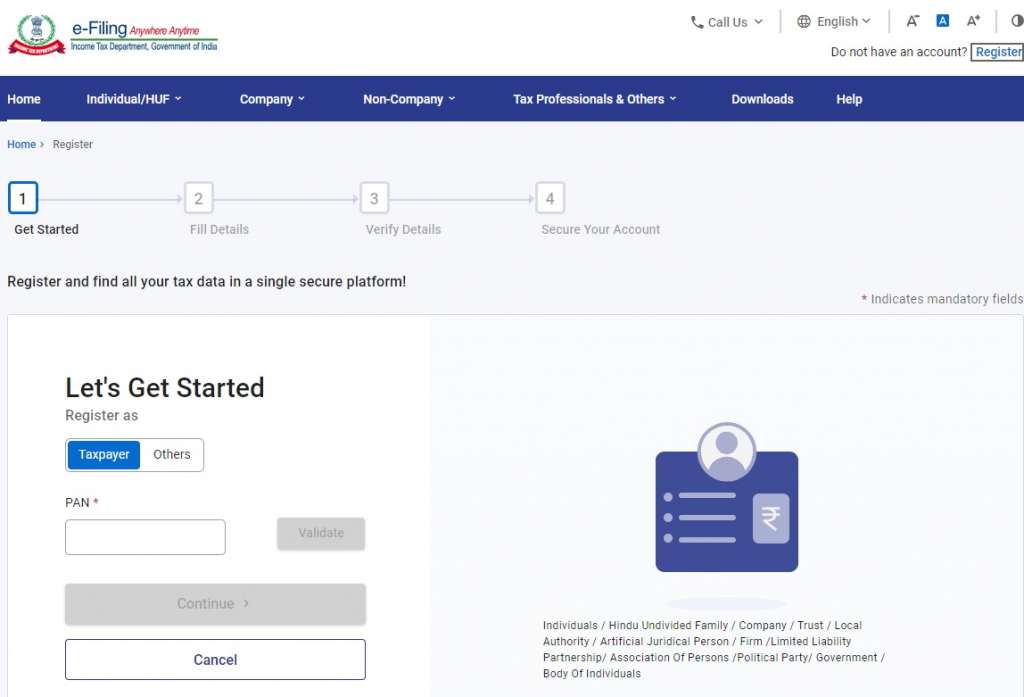

Step 1: Login to the Tax e-filing portal

For the online process to file itr 5 online, you need to register as a user on the portal.

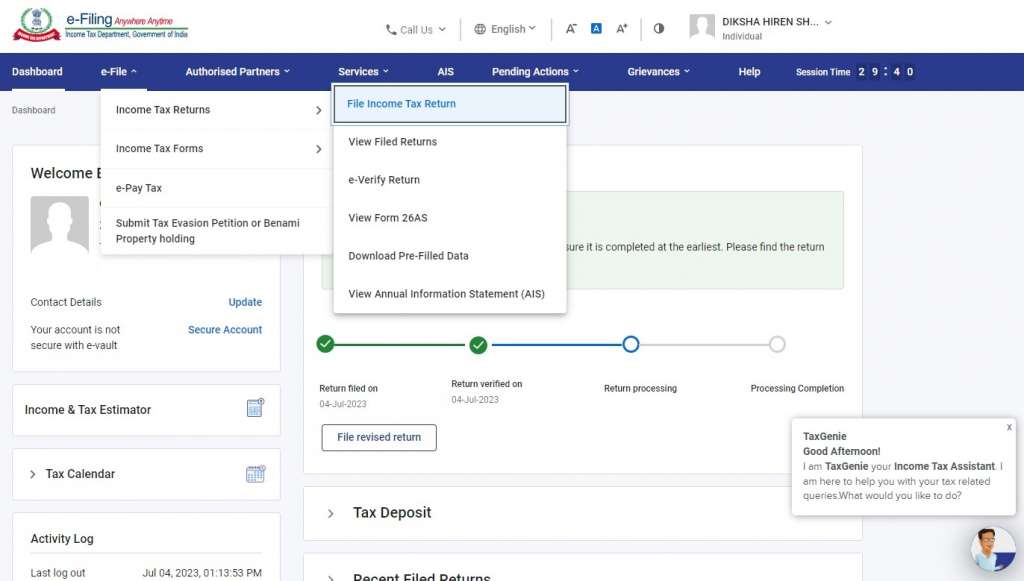

Step 2: Choose ‘File Income Tax Return’

On the dashboard, go to the e-file menu and select ‘File Income Tax Return’.

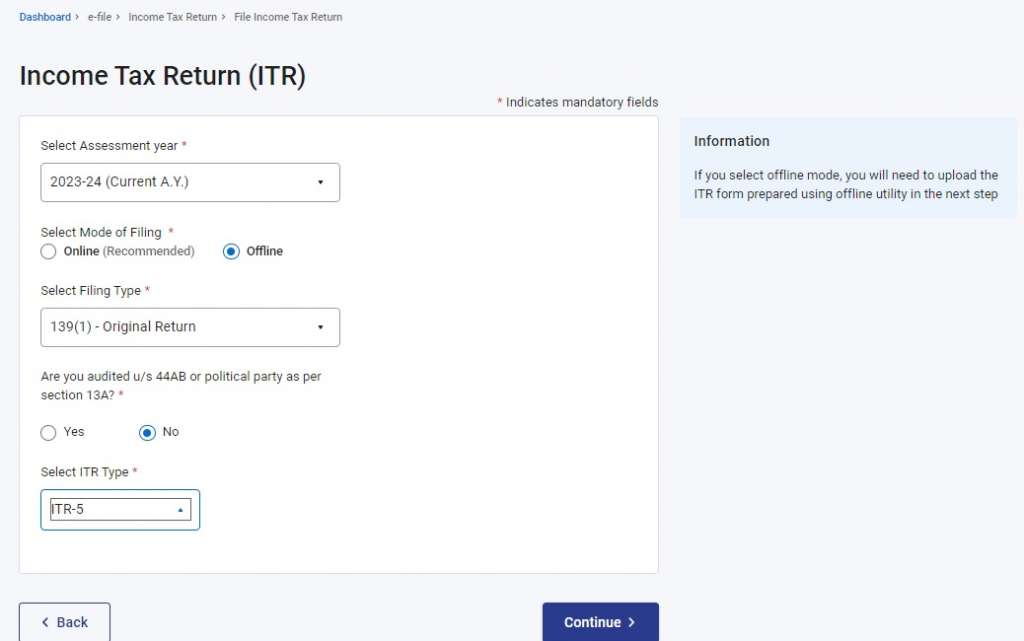

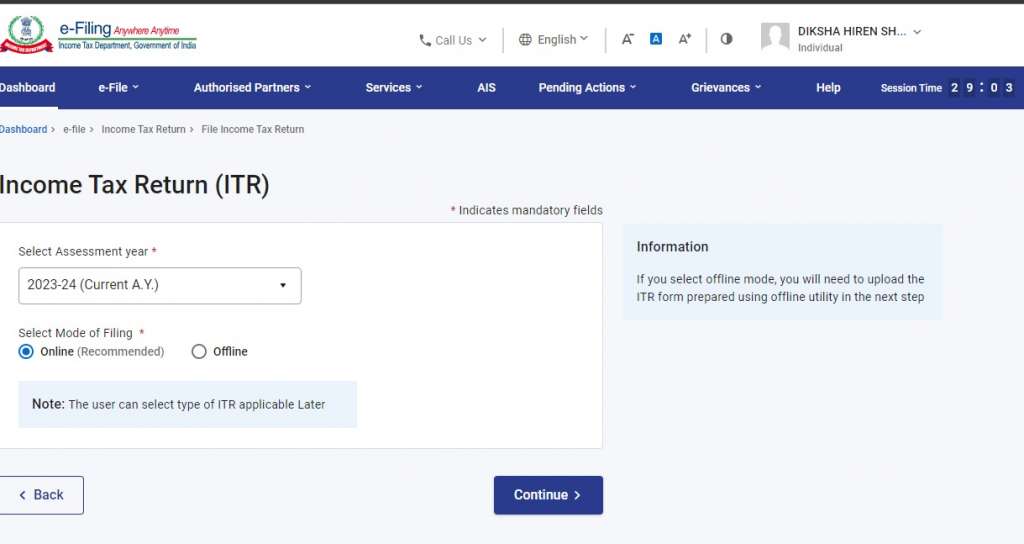

Step 4: Select the mode of filing, assessment year and the form applicable

To furnish the return of FY 2022-23 you need to choose the Assessment Year 2023-24. Then you will be redirected to the page to choose the applicable form. Hence, select ITR 5 and click on proceed.

Step 5: Furnish the Details in electronic form

Here, you will have to submit all the details of all parts of the form, as applicable to you. This information includes name, contact details, aadhar and PAN details.

Step 6: Verification and Submission

In online filing, the following measures to verify the filing of ITR 5 are available:

- Verification through Aadhar OTP;

- E-verification through EVC; and

- By sending a copy of verification and the return to the CPC office at Bangalore.

Keynote: it is mandatory to submit the complete verification of return filing of itr 5 within 30 days of submitting the returns.

What are the details to be furnished in the ITR 5 form?

The ITR 5 form is a bit more complex than the other forms, and is divided into different sections. Thus, let’s take a look at the detailed guide on the information to be furnished to file ITR 5.

Personal information

This part includes details of personal information, filing status and audit information.

General information

Here the details of nature of business/profession, info related to partners/members and trade names are required to be furnished.

Balance Sheet

If you are filing returns for the FY 2022-23, you need to submit the balance sheet as of 31st March, 2023. However, if you have undergone dissolution, you need to file the balance sheet as of the date of dissolution.

Manufacturing Account

Then the assesee needs to furnish details of the manufacturing account for the financial year. You need to give accurate information of every detail such as opening inventory, closing stock, etc.

Trading Account

Furnish the information related to the invoices from business or professional sales, duties paid, etc. in the trading account section to file itr 5 form.

P&L Account

Thereafter, you need to provide the profit and loss account statement for FY 2022 – 23.

Other Information

Such as method of computation of accounts, changes in methods used prior, details of increase or decrease in profits, etc are a part of this section of ITR 5 form.

Quantitative Details

Here you need to provide the details of quantities of the opening and closing stocks, raw materials, and finished products/by products etc.

House Property

If you own any house property and earn income from the same, you need to furnish the details of such income received/receivable in a financial year.

Computation of income from business or profession

Information about the profits and loss from businesses, the receipts, profits from life insurance, etc.

Depreciation on plant and machinery

If this section is applicable to you and you have faced any depreciation on the plants/machines used in business, you can furnish those details here.

Depreciation of assets

Relevant information about the depreciation of assets other than the plants and machinery form a part of this section.

Schedules in ITR 5 form

- Expenditure on scientific research etc;

- Details on Capital Gains;

- 112 A: income from sale of equity share in a company or unit of equity oriented fund or unit of business trust on which STT is paid under section 112A;

- For NON Residents – From sale of equity shre in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

- Income from transfer of Virtual Digital Assets;

- Income after set off of losses;

- Losses carried forward to future years;

- Unabsorbed Depreciation;

- Income Computation Disclosure;

- Deductions under section 10AA, 80G, 80GGA, 80IA, 80P, VI A; and

- Lastly, Alternate Minimum Tax.

Conclusion

As we know, income tax return filing is a very important responsibility of all people and entities who earn income in India. The form ITR 5 is more complex and hence, requires attention to detail while furnishing information. You can get your ITR 5 filing easily by experts at LegalWiz.in

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.

Absolutely insightful article! Filing ITR 5 form online can be a bit overwhelming for many, but your step-by-step guide makes the process seem much more manageable. Kudos for sharing such valuable expertise! Looking forward to more informative posts from you.

Thank you so much for the appreciation Ankita! Feel free to check out our other articles as well.