How to e-Verify ITR Through EVC

Filing your income tax return (ITR) is an essential task, but it doesn’t end there. After filing your ITR, it is crucial to e-verify it to complete the process. The Income Tax Department of India offers various methods to e-verify your ITR after you file Income Tax Return, and one such convenient method is using the Electronic Verification Code (EVC). In this article, we will guide you through the steps to e-verify your ITR through EVC, ensuring a hassle-free process.

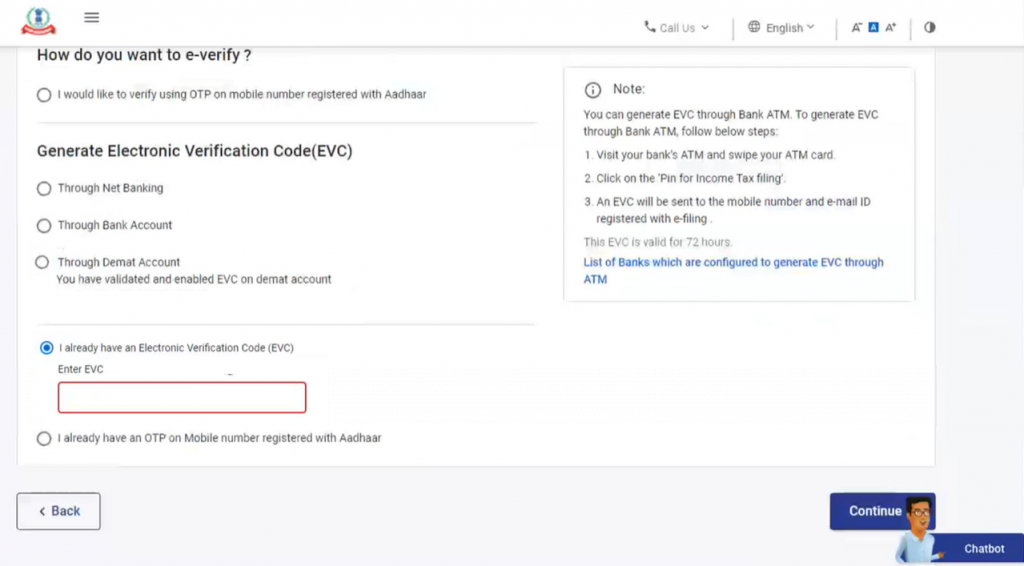

e-Verify using existing Electronic Verification Code (EVC)

Step 1: Visit the e-Verify page

Firstly, visit the e-Verify page on the official Income Tax e-Filing portal. Once there, select the option “I already have an Electronic Verification Code (EVC)” to proceed.

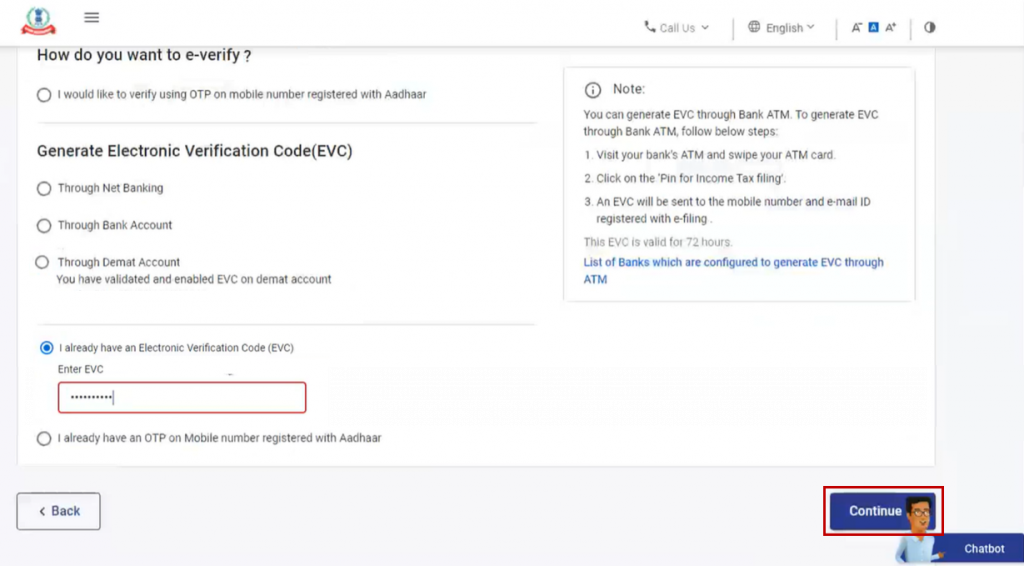

Step 2: Enter EVC

Once thats done, on the “Enter EVC” textbox, input the EVC that you have received through email or SMS. Make sure to double-check the accuracy of the code. After entering the EVC, click on the “Continue” button to proceed.

Step 3: Successful verification

Finally, upon successful verification, a page displaying a success message will appear, along with a Transaction ID and the EVC used. It is essential to note down the Transaction ID and EVC for future reference. Additionally, you will receive a confirmation message on the email ID and mobile number registered on the e-Filing portal.

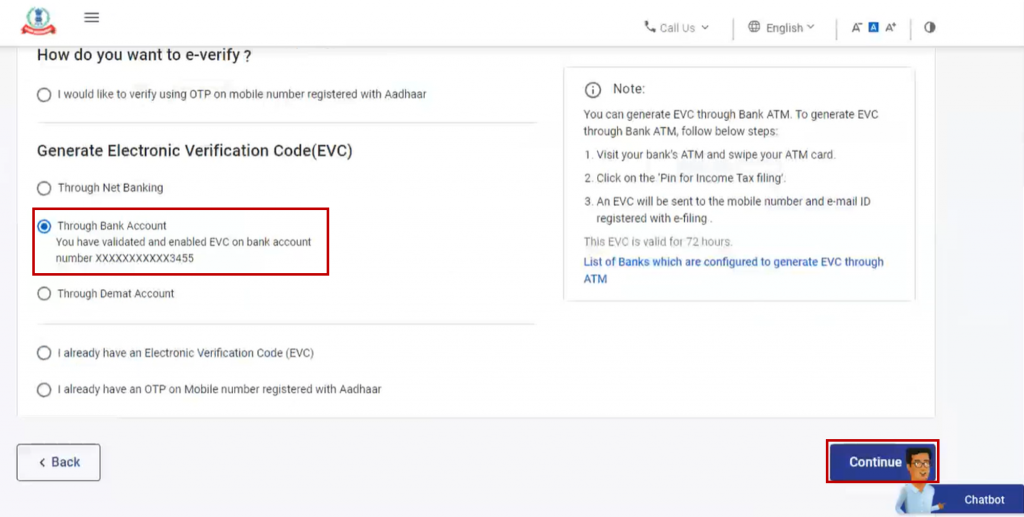

e-Verify using EVC generated through Bank Account:

EVC can also be generated through your bank account or demat account. Let’s explore these methods as well.

Step 1: Select e-verify through Bank Account

Firstly, on the e-Verify page, you will find several options to e-verify, such as e-verify using DSC, E-verify using Aaadhar etc. Select the option “Through Bank Account” and click on “Continue” to proceed.

Note: Ensure that your bank account is pre-validated and EVC enabled. If not, refer to the user manual on the Income Tax e-Filing portal to learn how to pre-validate and enable EVC for your bank account.

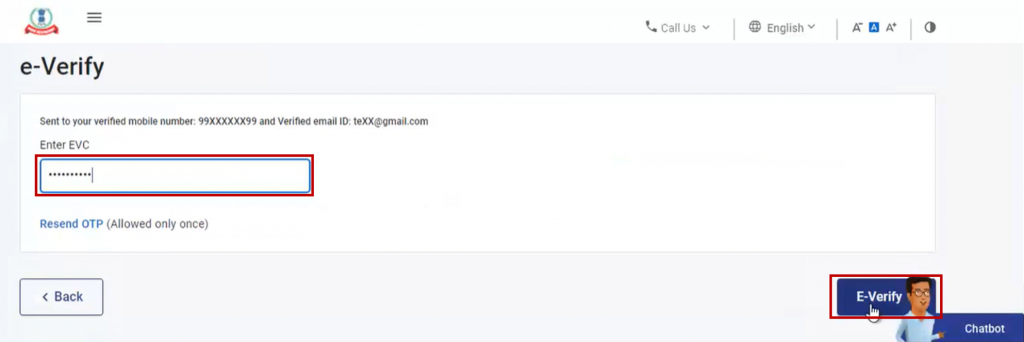

Step 2: Enter the EVC received

After that, enter the EVC received on your registered mobile number and email ID, associated with your bank account, into the “Enter EVC” textbox. After entering the EVC, click on the “e-Verify” button to proceed.

Step 3: Successful Verification

Finally, once the verification is successful, you will see a success message page displaying the Transaction ID and EVC used. Also, remember to note down the Transaction ID and EVC for future reference. You will also receive a confirmation message on your registered email ID and mobile number.

e-Verify using EVC generated through Demat Account:

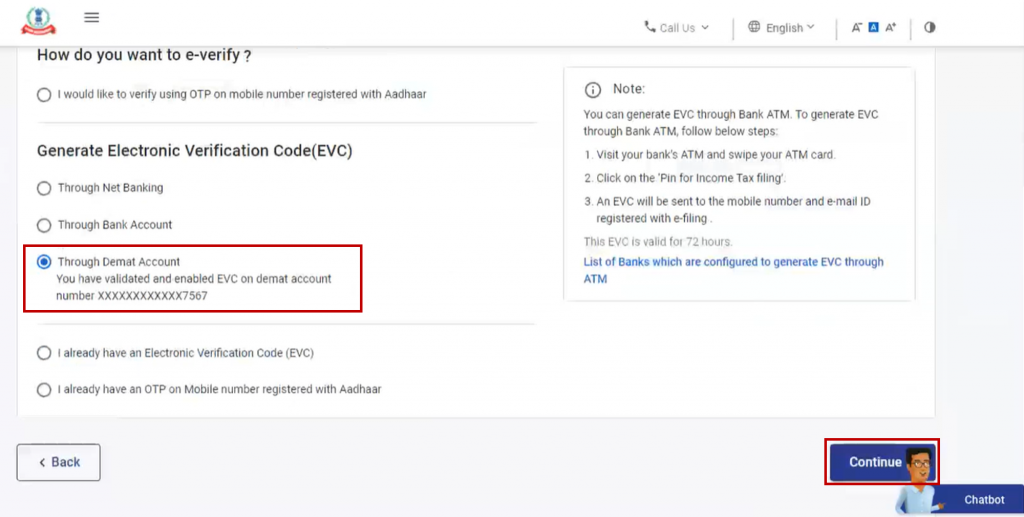

Step 1: Select e-verify through Demat Account

Firstly, on the e-Verify page, select the option “Through Demat Account” and click on “Continue” to proceed.

Note: Make sure your demat account is pre-validated and EVC enabled. If not, refer to the user manual on the Income Tax e-Filing portal to learn how to pre-validate and enable EVC for your demat account.

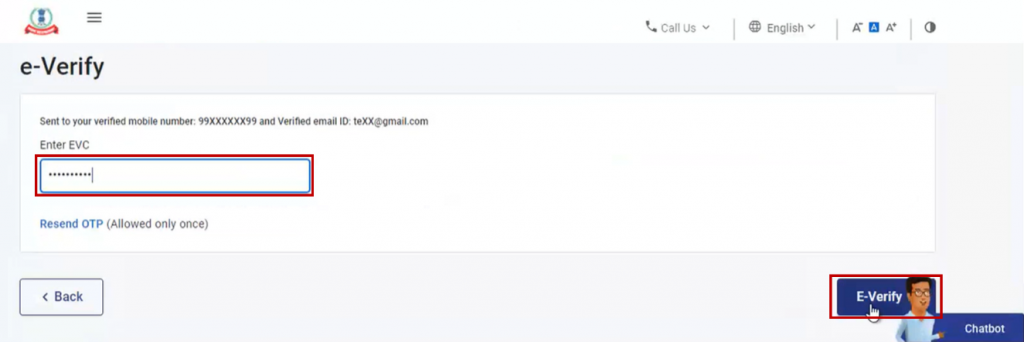

Step 2: Enter the EVC received

Secondly, enter the EVC received on your registered mobile number and email ID, associated with your demat account, into the “Enter EVC” textbox. After entering the EVC, click on the “e-Verify” button to proceed.

Step 3: Successful e-verification

Finally, after successful verification, a success message page will appear, displaying the Transaction ID and EVC used. Remember to note down the Transaction ID and EVC for future reference. Additionally, a confirmation message will be sent to your registered email ID and mobile number.

Conclusion

Apart from filing your ITR and paying your ITR offline or online, the E-verification of your ITR is a very important task for taxpayers. E-verification through EVC is a convenient and efficient method, streamlining the income tax filing process. By following the steps mentioned above, you can successfully e-verify your ITR and ensure compliance with tax regulations.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.