How to File Form 26QB Online?

Introduction

Fulfilling your tax obligations has never been easier, thanks to the convenience of online tax filing systems. If you’re wondering how to file Form 26QB, you’ve come to the right place. Form 26QB is a crucial document for individuals purchasing real estate valued at over Rs 50 lakh, as it enables them to deduct Tax Deducted at Source (TDS) when making payments to the seller. In this comprehensive guide, we will walk you through the process of filing Form 26QB online, talk about its relevance for TDS Returns, and guide you through everything related to it, step by step.

What is the 26QB Form?

In compliance with the Finance Act of 2013, individuals or Hindu Undivided Families (HUFs) who purchase property worth at least Rs 50 lakh must deduct TDS. They must subsequently remit this deducted amount to the government by filing Form 26QB within a specific timeframe.

Form 26QB is a statement cum challan used for TDS payment on property transactions. It is mandated by Section 194-IA of the Income Tax Act, which requires a 1% TDS deduction on the property’s value for transactions exceeding Rs 50 lakh. This form collects essential information about the property, buyers, sellers, and tax deposits. You can access it on the TIN-NSDL website.

When Should Form 26QB be Filed?

Buyers must submit Form 26QB within 30 days from the end of the month in which they deducted the TDS. For example, if a property transaction occurred on December 15, 2022, buyers must submit the TDS by January 30, 2023. Failing to meet this deadline will result in a late fee of Rs 200 per day.

Procedure To Pay TDS Through Form 26QB

If you’re wondering how to fill out Form 26QB, follow these steps:

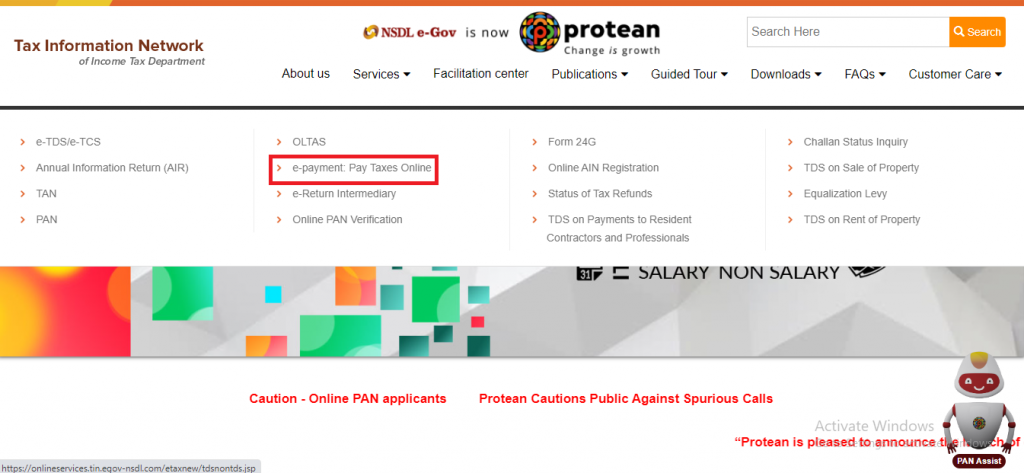

Step 1: Visit the official TIN NSDL Protean website.

Step 2: Under the ‘Services’ category. After that, select ‘e-payment: Pay tax online.’

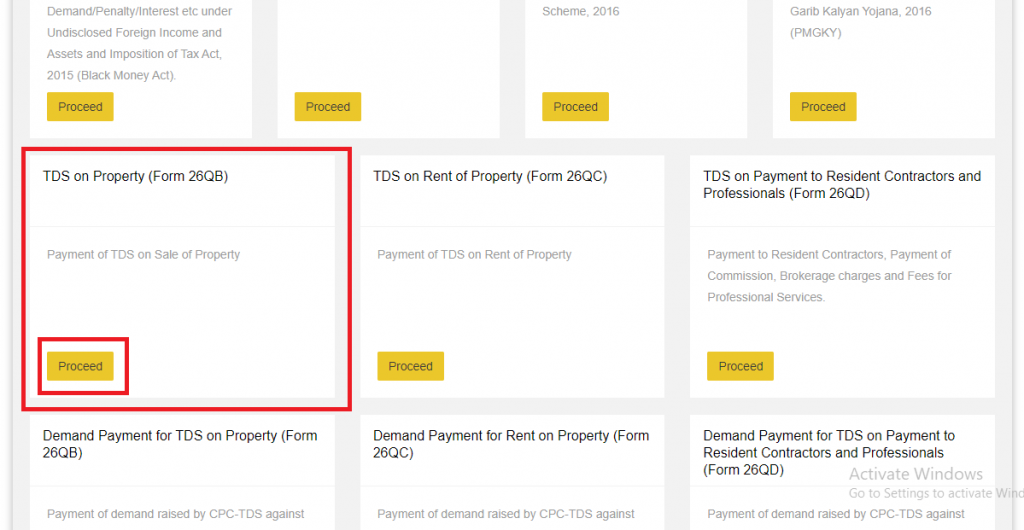

Step 3: Find and click on ‘TDS on Property (Form 26QB)’. Once that’s done, click ‘Proceed.’

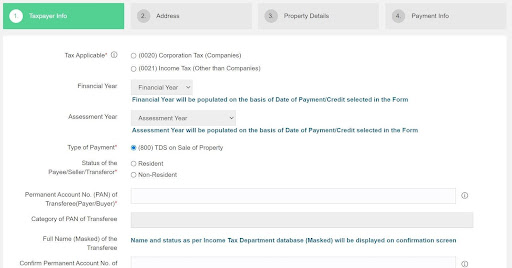

Step 4: Fill out the form with property details, PAN details, tax deposit details, payment amount, address, and contact information.

Step 5: Choose your preferred payment mode: ‘e-tax payment immediately’ or ‘e-tax payment on the succeeding date.’ Click ‘Proceed’ to pay the required TDS amount.

How To Download Form 26QB?

To download Form 26QB, follow these steps:

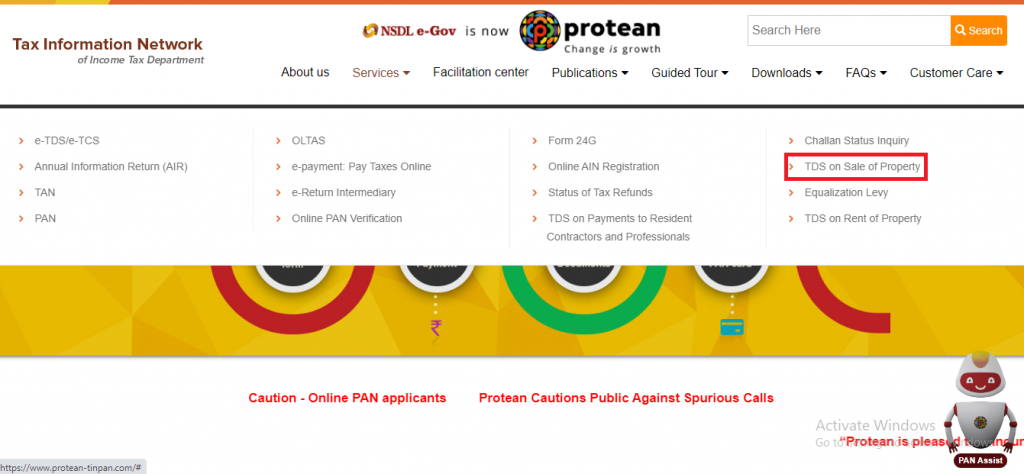

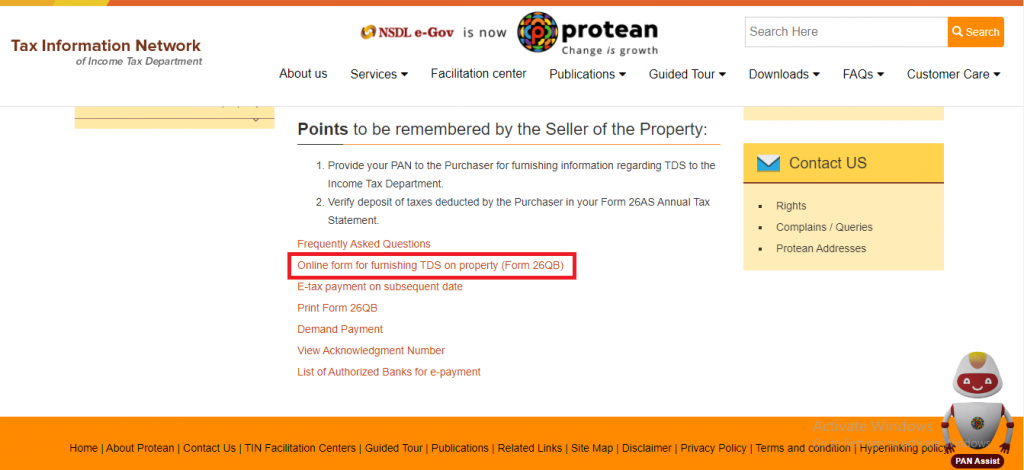

Step 1: Visit the TIN-NSDL website, “Protean”. Then, click on ‘TDS on Sale of Property’ under ‘Services.’

Step 2: Scroll down and click ‘Online form for furnishing TDS on a property (Form 26QB).’

Step 3: Fill in the required information and submit the form. Note down the unique acknowledgement number displayed on the screen.

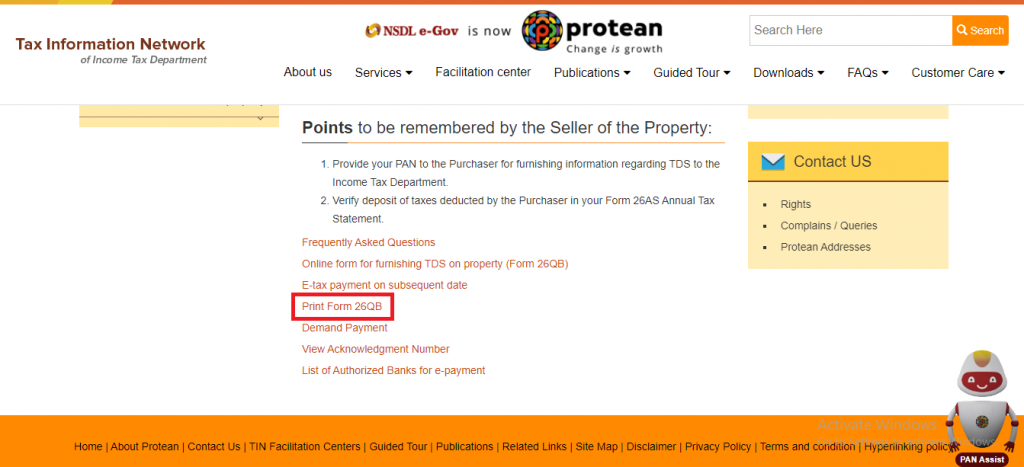

Step 4: To print the form, click ‘Print Form 26QB.’

Step 5: Click ‘Submit to bank’ to pay the required amount online through net banking.

E-Payment through Challan 26QB (Online)

Following these steps will enable you to pay TDS through Challan 26QB and obtain Form 16B for the seller. It’s important to navigate this process diligently to ensure compliance with tax regulations and facilitate a smooth transaction.

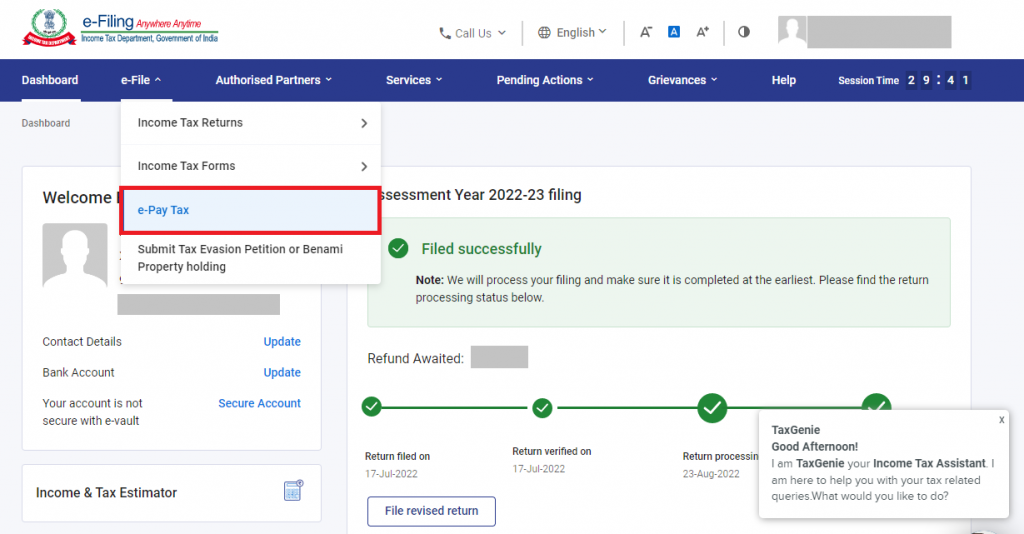

Step 1: Begin by logging in to your account on the Income Tax e-filing portal. Then, select “e-File” and choose “e-Pay Tax” from the dropdown menu.

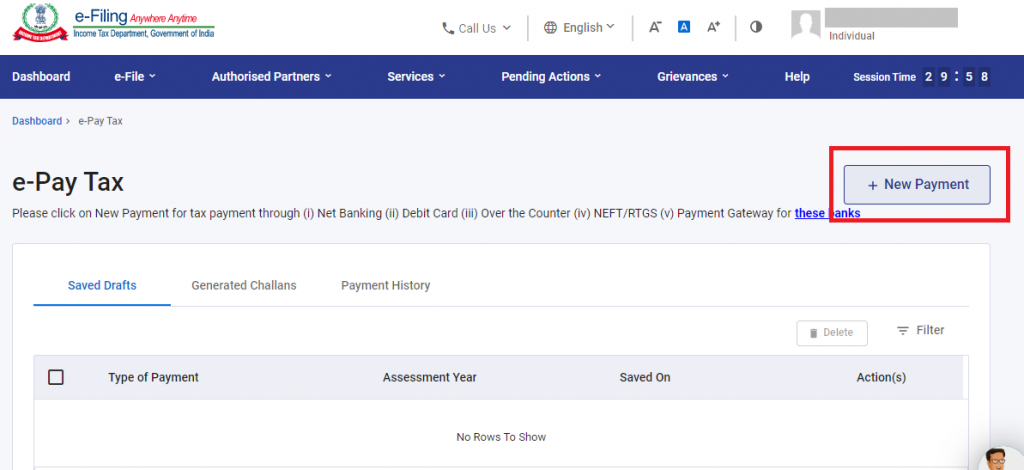

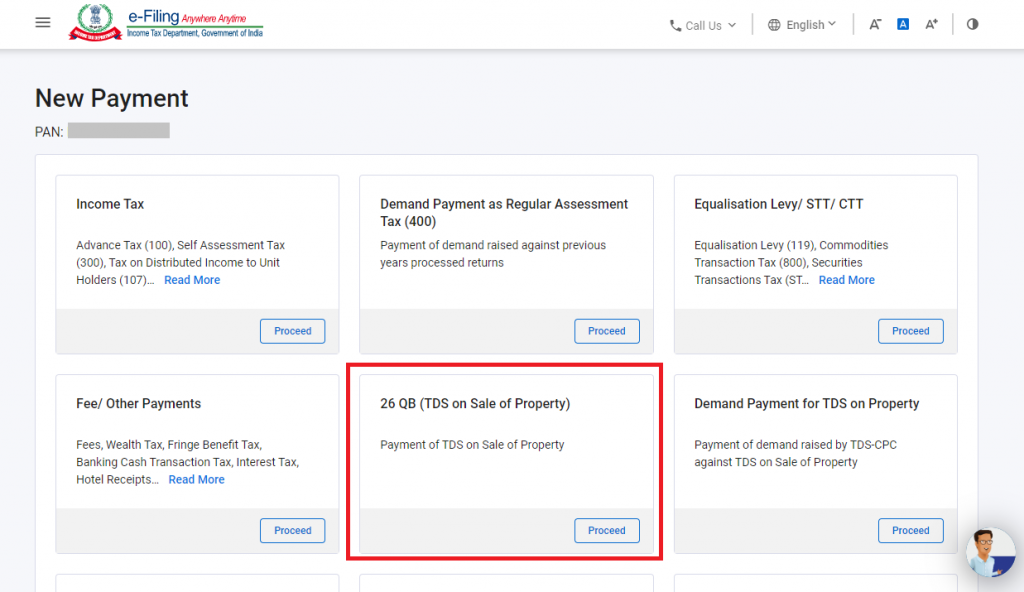

Step 2: Click on the “+ New Payment” option. This will initiate the payment process.

Step 3: Next, click on the “Proceed” button under the tab labelled “26QB – TDS on Property.”

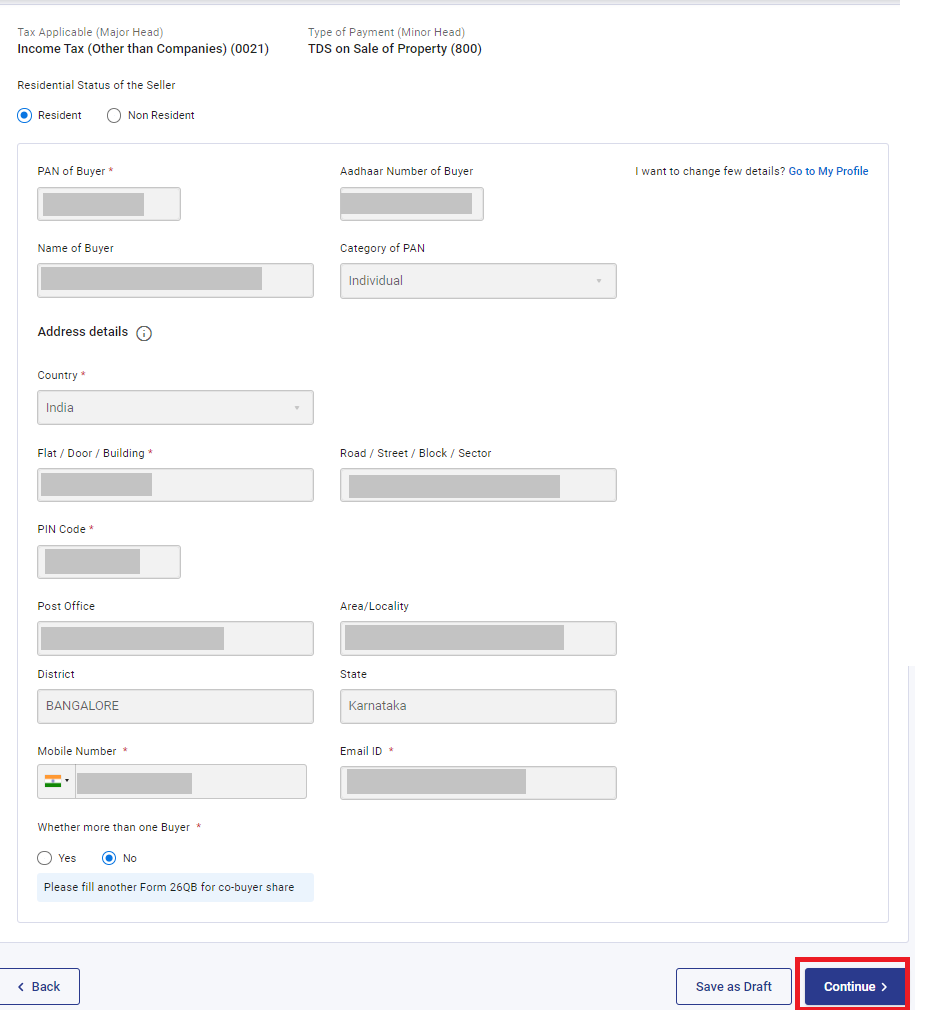

Step 4: The system will automatically populate your details, but you have the option to make changes if necessary. After entering or modifying the information, click “Continue.”

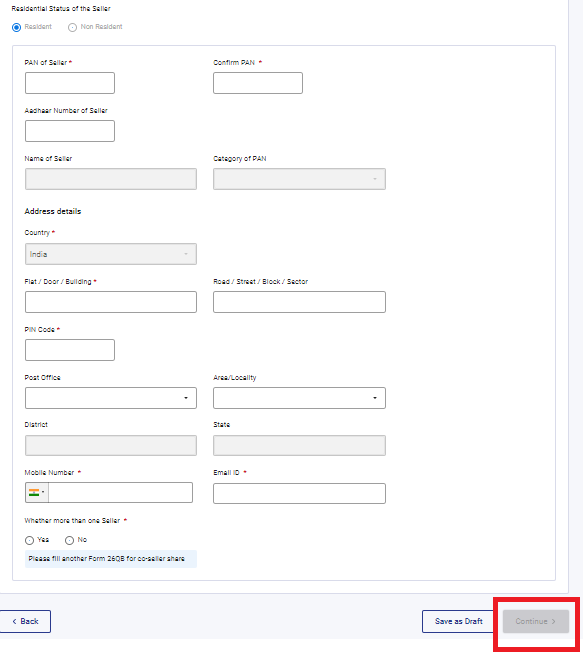

Step 5: Add all the necessary details of the seller, such as their PAN and address.

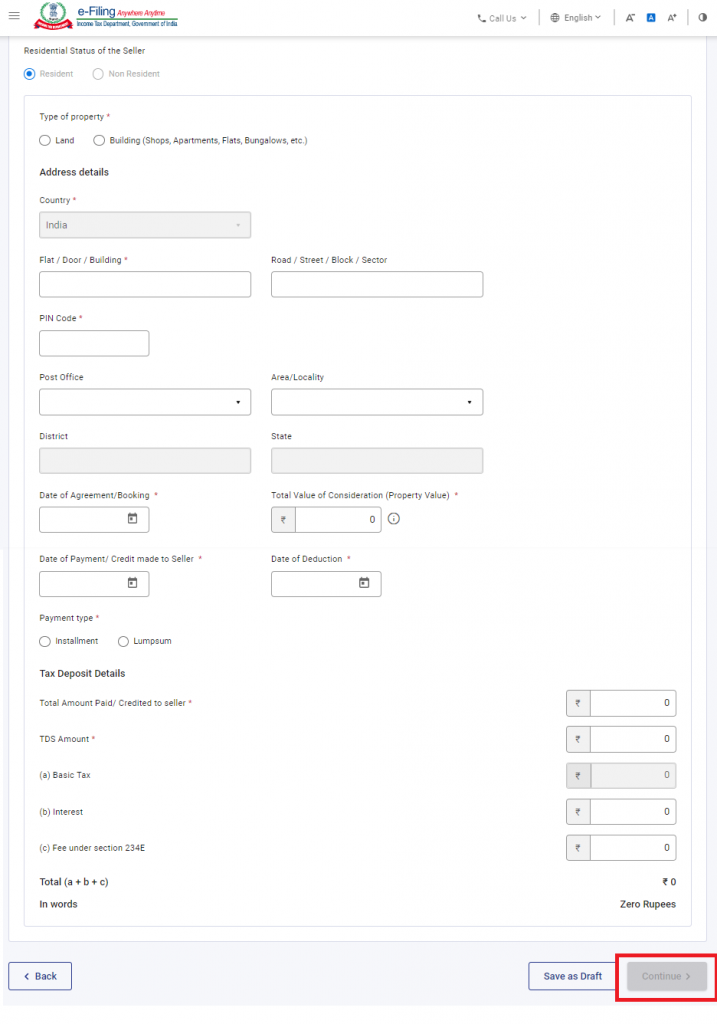

Step 6: Input comprehensive property details, including type, address, and sale specifics like the date of agreement and value. The system will automatically calculate the tax amount. Once completed, click “Continue.”

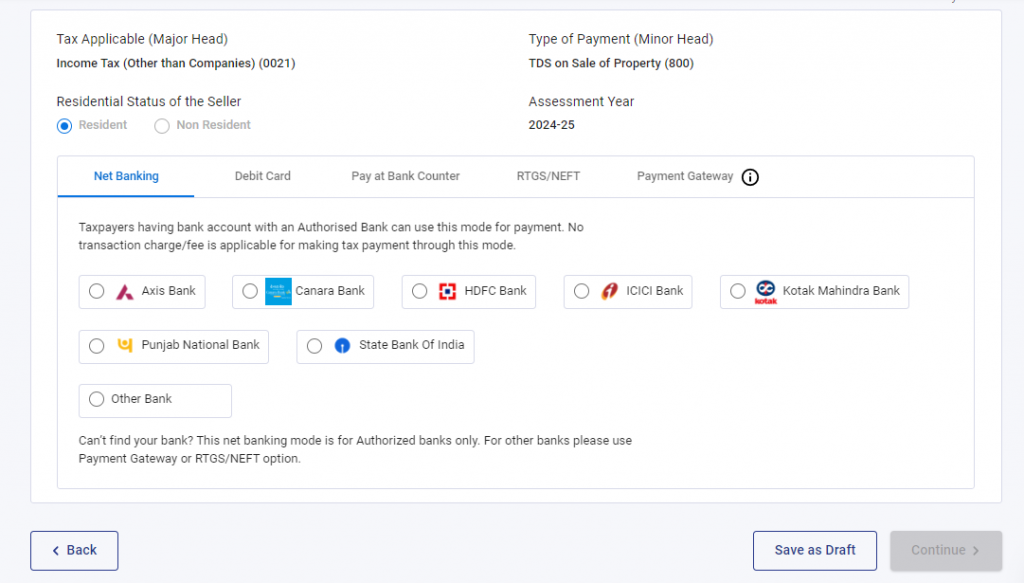

Step 7: Select your preferred payment mode and proceed to complete the payment. Once the payment is successfully processed, a challan will be generated.

Penalty Charges Associated With Form 26QB

Understanding the penalties related to Form 26QB is essential:

- Delay in filing TDS: Rs 200 per day as per Section 234E.

- Non-remittance of TDS to the government: 1% interest per month.

- Non-deduction of TDS: 1% interest on the un-deducted amount.

- If you don’t submit the necessary statement within the stipulated time, you are charged a penalty ranging from Rs 10,000 to Rs 1 lakh. No penalty is levied if you pay the TDS, fees, interest, and the statement within a specific time frame.

Conclusion

Form 26QB is a critical document for property buyers, enabling them to fulfil their TDS obligations seamlessly. Filing this form within the stipulated time is crucial to avoid hefty penalty charges.

Frequently Asked Questions

Do I need a TAN for TDS deduction?

Yes, a Tax Deduction and Collection Account Number (TAN) is mandatory for TDS deductions. It is allotted by the Income Tax department to individuals or entities liable to collect or deduct tax on payments.

Can I check my TDS deduction online?

Yes, you can check your TDS deductions online using Form 26AS, which is available on the Income Tax department’s e-filing portal. This form provides a summary of all TDS deductions made against your PAN.

What should I do if I forgot to deduct TDS when I purchased a property?

If you forget to deduct TDS, you may be subject to a penalty of 1% interest on the outstanding TDS amount. To rectify this, pay the penalty promptly, cancel the TDS payment to the government, and file the TDS return within the specified time to avoid additional penalties.

Can the builder pay TDS on behalf of the buyer?

No, the responsibility to deduct TDS lies with the buyer. Even if the property is purchased through a builder or financed by a home loan, it is the buyer’s obligation to make the TDS payment.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.

Thanks for creating this page with screenshots. Helped me locate 26QB filing page