GSTR-9A: Annual Return, Due Dates, Eligibility, Late Fees

Are you GST Composition Scheme taxpayer? If so, you must be aware of the annual return form GSTR-9A. This document was a mandatory annual return for all taxpayers with a turnover of up to Rs. 1.5 crore. As of Finanacial year 2019-2020 GSTR-4 form has replaced GSTR 9A. However, if you still have any annual returns pending for up to Financial year 2018, you still have to file GSTR 9A. Whether you’re a small business owner or a budding entrepreneur, it’s important to file this return properly to avoid penalties and legal consequences. In this article, we’ll dive deeper into the world of this annual GST Return filing.

Meaning of GSTR-9A

As mentioned above, GSTR-9A is an annual return that taxpayers registered under the Composition Scheme of the GST had to file. As mentioned in the introduction, it is now been replaced by GSTR-4, but if you have any pending returns up until 2018, GSTR 9A still applies. It is a consolidated return that contains all the details of the supplies made, taxes paid, and input tax credits claimed during the financial year. The due date for filing used to be 31st December of the next financial year. For example, for the financial year 2021-22, the due date for filing would have been 31st December 2022.

How to file GSTR-9A?

Firstly, login to the GST portal using your credentials.

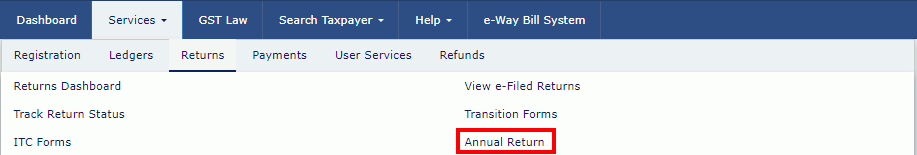

After that, click on the ‘Services’ tab and select ‘Returns’ > ‘Annual Returns’.

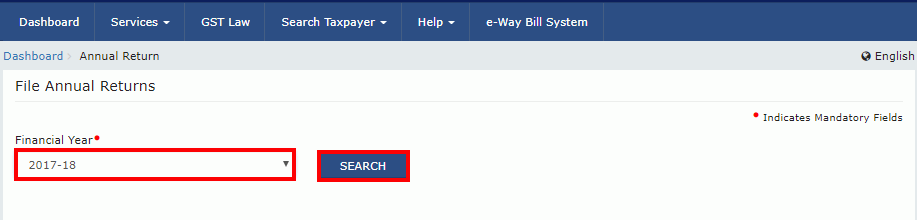

Once that’s done, select the financial year for which you want to file the return.

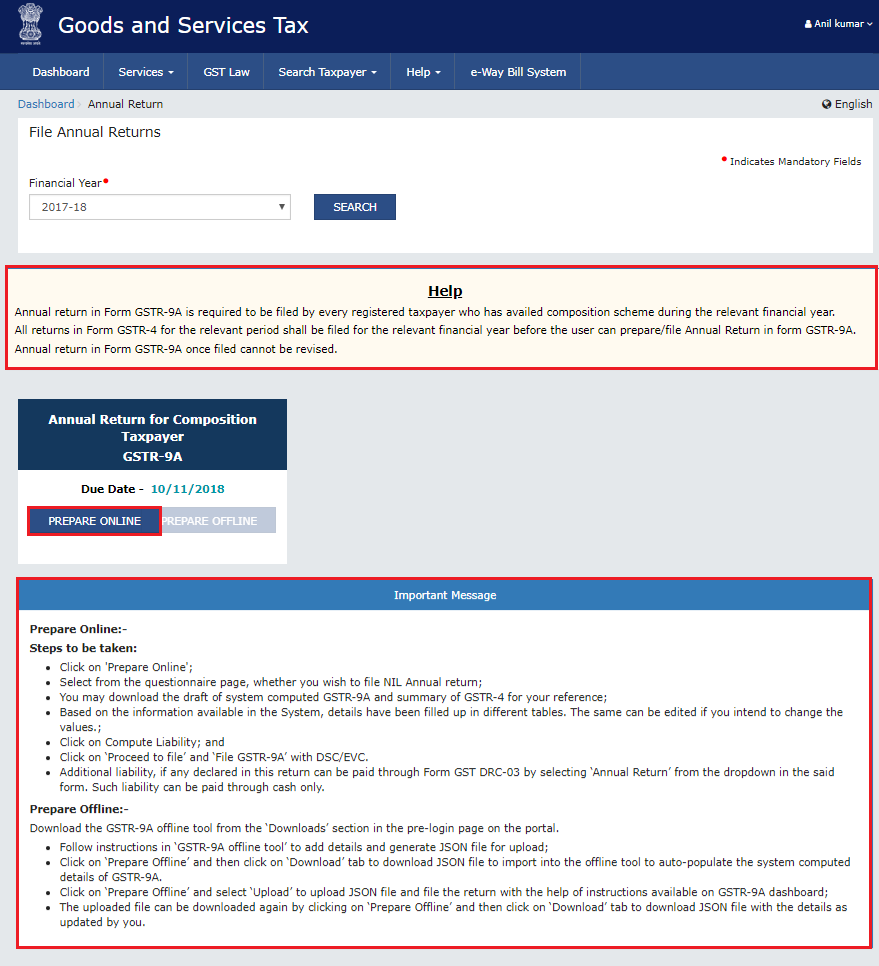

Next you have to click on the ‘Prepare Online’ button on the GSTR-9A tile.

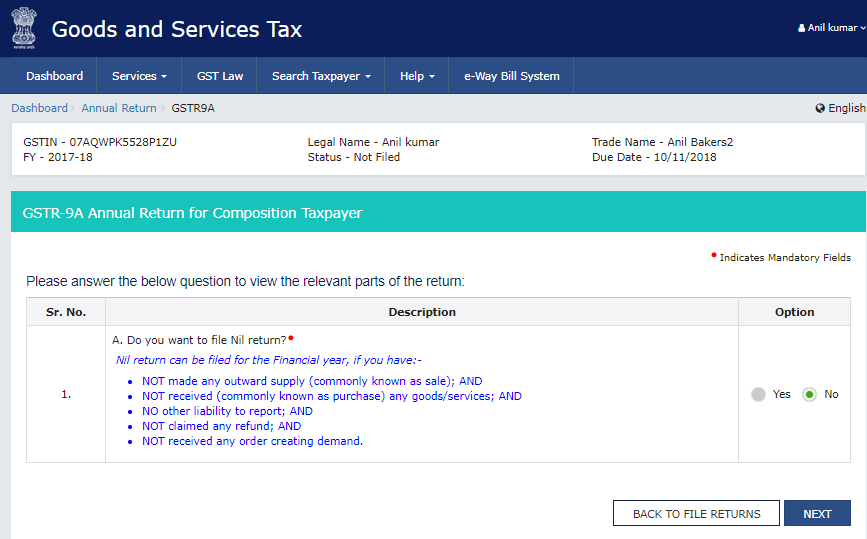

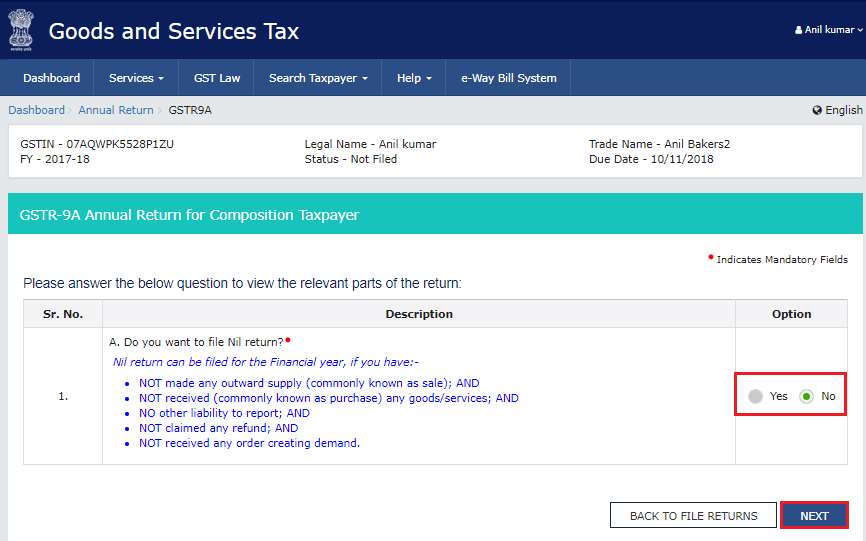

After that, a question will show asking if you want to file a nil return or not

If you want to file a nil return select “Yes” and click “Next”.

If you don’t want to file a nil return:

Select “No” and click NEXT.

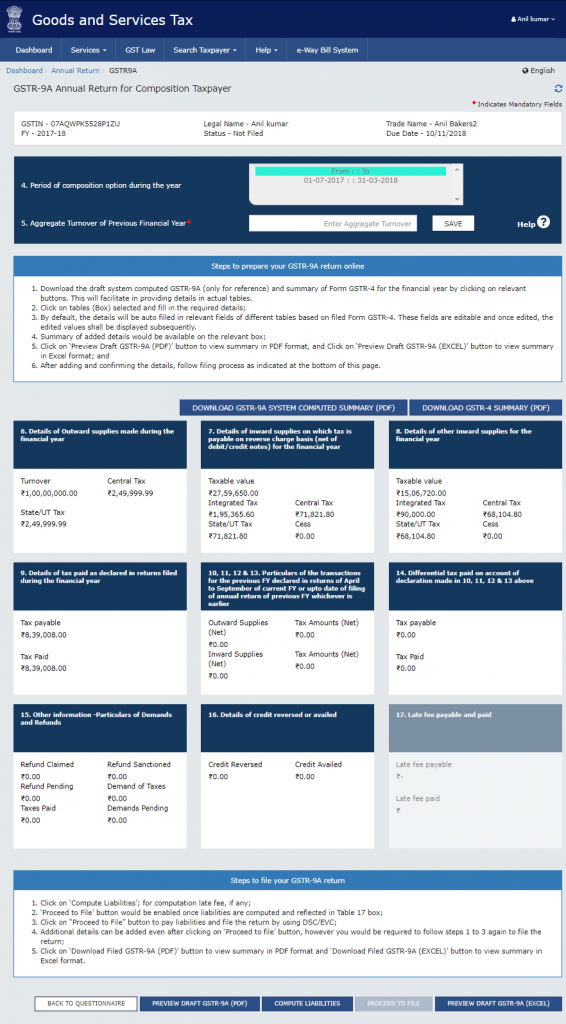

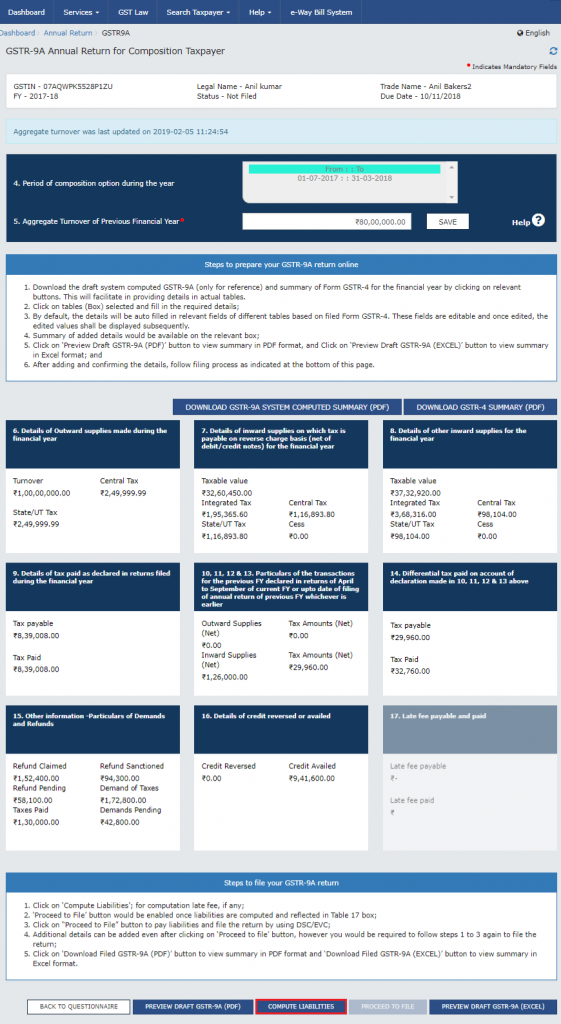

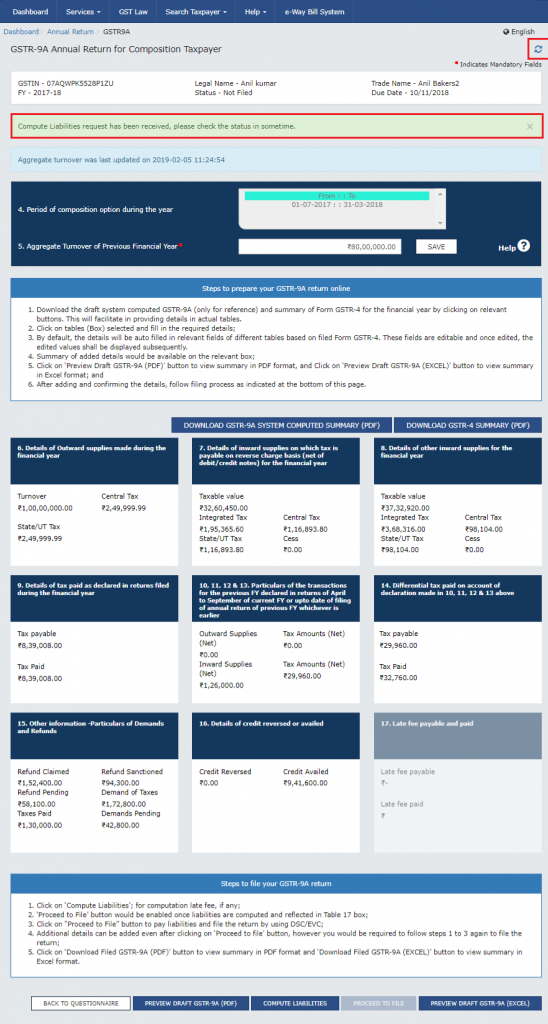

GSTR-9A Annual Return for Composition Taxpayers page will be displayed.

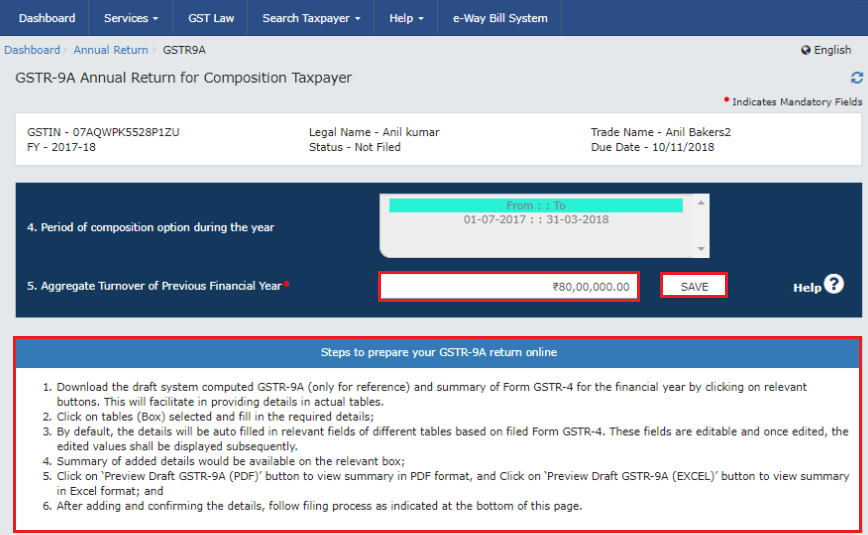

Fill in the details of the Aggregate Turnover of the last financial year and press “Save”. Also carefully read the box stating the steps to prepare GSTR-9A.

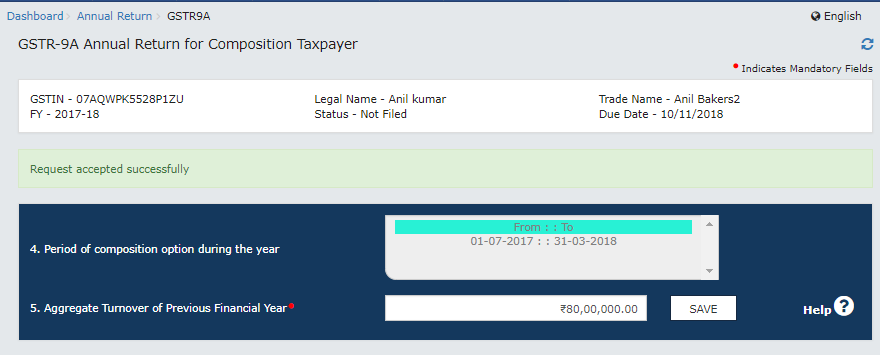

A confirmation message will display

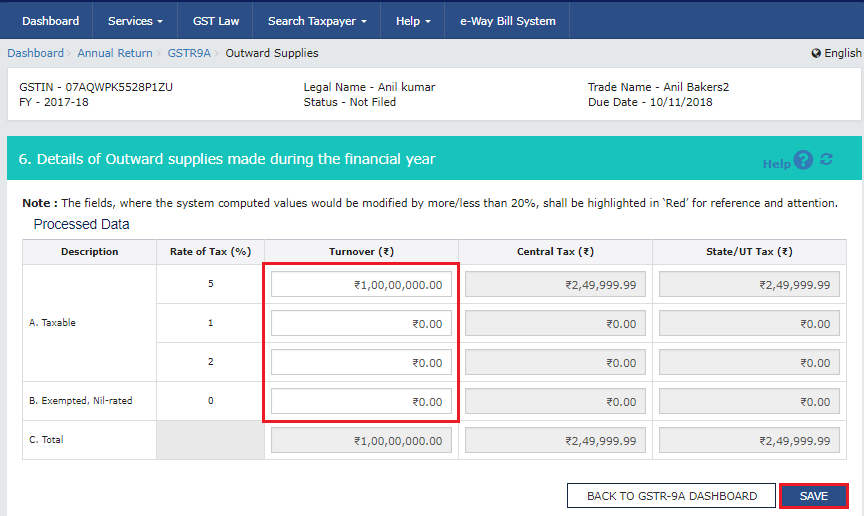

Preview each table on the Annual Return page. Click on the relevant tables to make necessary edits, click the “Save” button and then the “Back to GSTR-9A Dashboard” button.

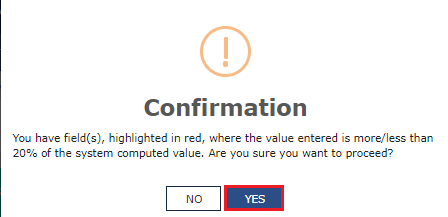

Click OK if and when a confirmation message appears. The GSTR-9A Dashboard tile summary keeps updating as you save details in every tile.

Once you have entered all the required details, click on the ‘Compute Liabilities’ button.

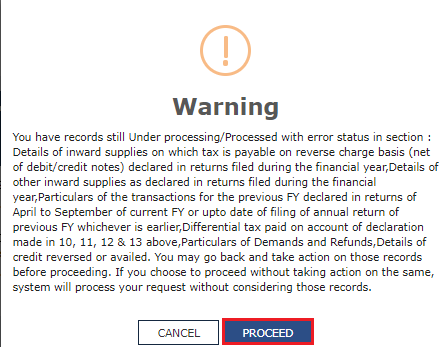

A dialogue box may show in case of any error. It will state where it thinks there is an error. Please click the “Proceed” button if you’re sure there are no issues, or click on the “cancel” button and go back to recheck.

A message will be displayed stating that “Compute Liabilities request has been received. Please check the status after sometime”. Refresh the page after sometime

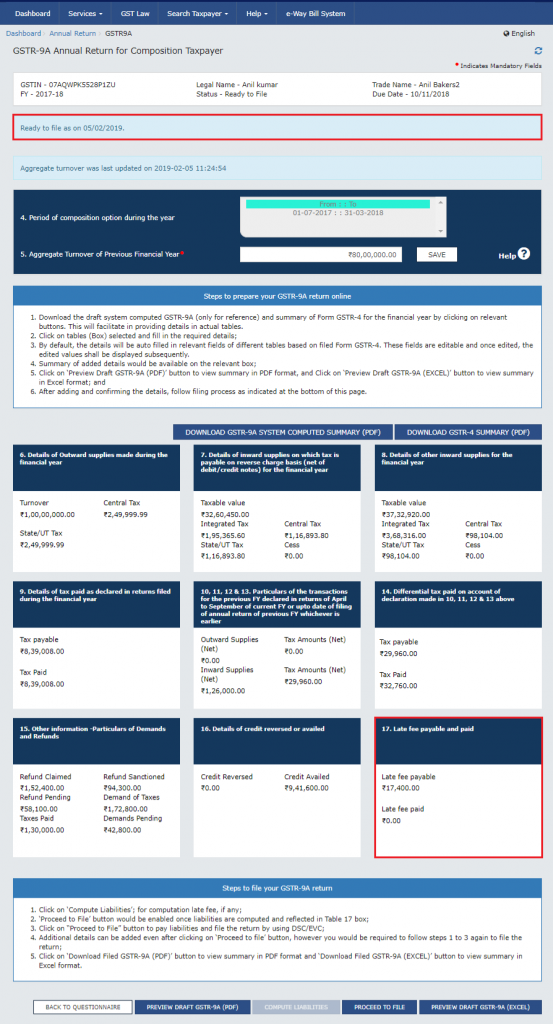

After some time the page will show a box saying “Ready to File..” Click on the Late Fee payable tile at the bottom.

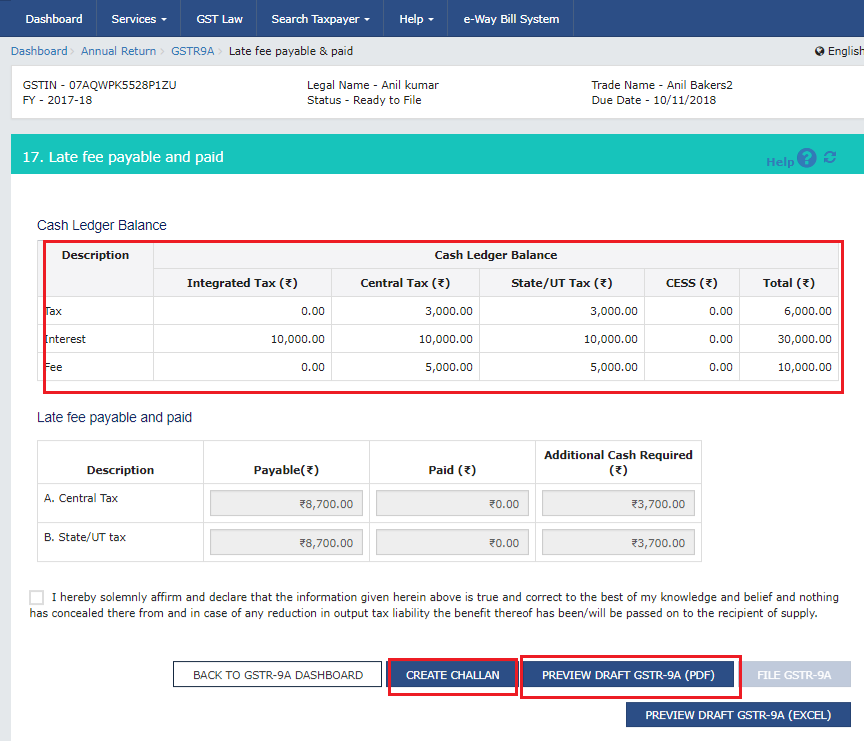

Look at the table, if there is enough cash balance in the ledger click on the “Back to GSTR-9A dashboard” button. Otherwise, click on the “Create Challan button” to create a challan. To learn how to create a challan, read this article: How to generate GST Challan online on GST Portal?

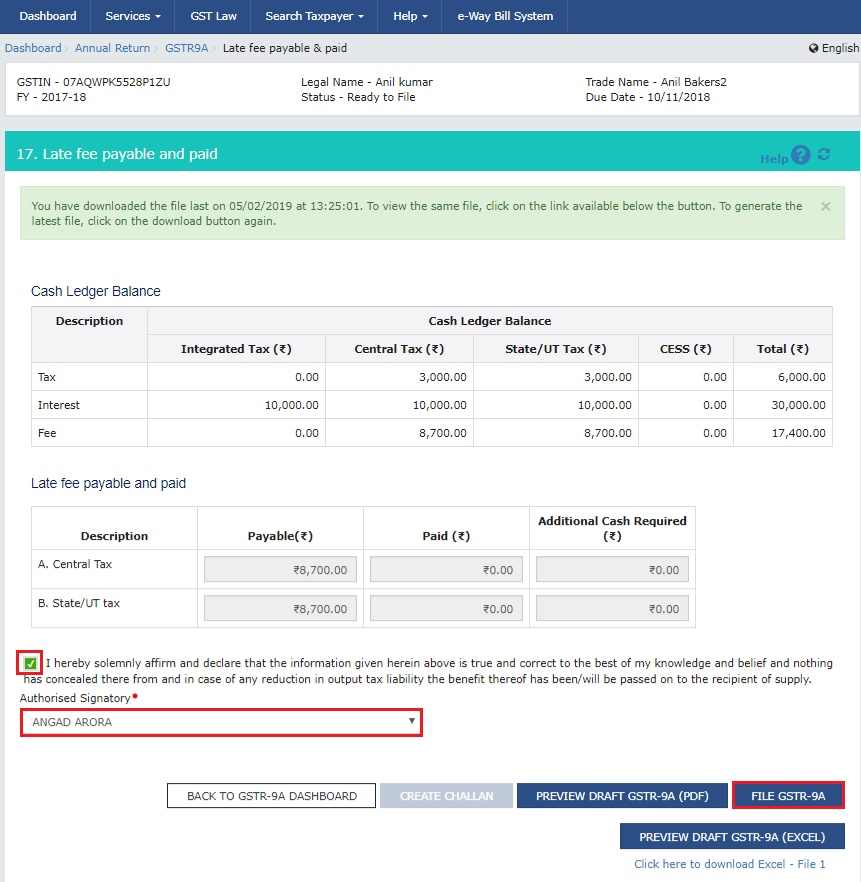

Finally, select the Declaration checkbox and an Authorized Signatory, then, click FILE GSTR-9A. Note: The FILE button only gets enables there is no additional cash required.

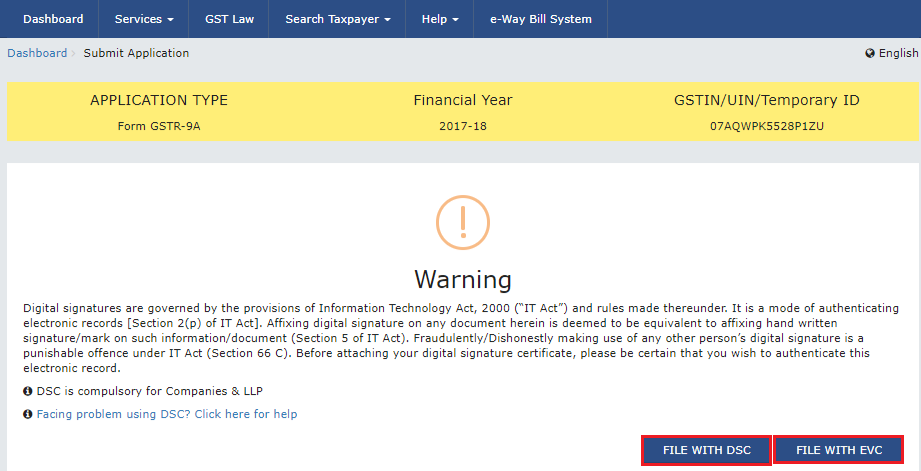

The Submit page will show. Click FILE WITH DSC or FILE WITH EVC.

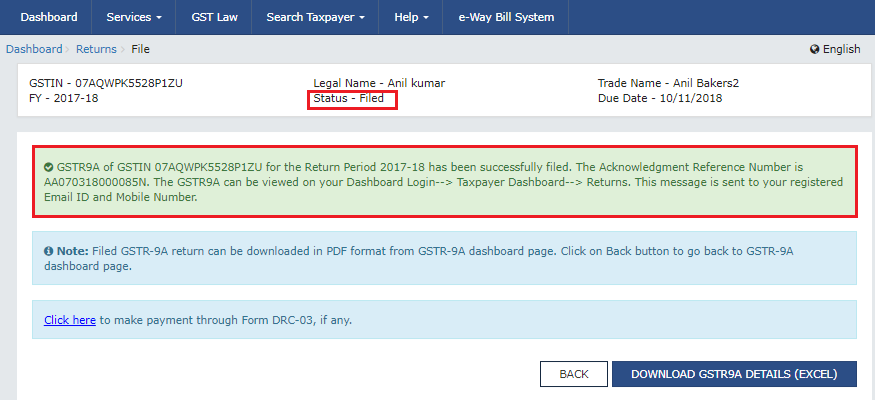

After submitting the return, a success message will be displayed, and an acknowledgement will be generated in PDF format.

If you choose FILE WITH DSC, select your certificate and click SIGN.

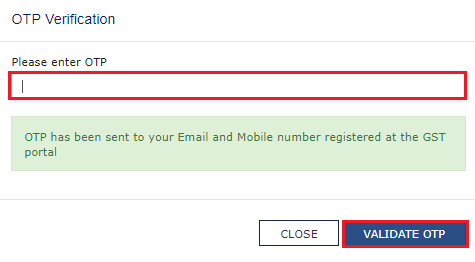

If you choose FILE WITH EVC, enter the OTP sent to your email and mobile number and click VALIDATE OTP.

A success message with details will show

Late Fees

Late filing will result in the imposition of a late fee. The late fee for non-filing or late filing is Rs. 200 per day, subject to a maximum of 0.25% of the taxpayer’s turnover in the state or union territory. This means that the late fee per day cannot exceed 0.25% of the taxpayer’s turnover.

Turnover Limit

GST Composition Scheme is only open to taxpayers with a turnover of up to Rs. 1.5 crore. Hence if a taxpayer’s turnover exceeded Rs. 1.5 crore, GSTR-9 must be filed instead of GSTR-9A.

Conclusion

In conclusion, GSTR-9A was an important annual return that had to be filed by all taxpayers who fell under the composition scheme. Even now for Composite Taxpayers who want to file old or pending GST anuual returns, they need to file this form. With proper preparation and understanding of the filing process, taxpayers can easily file their GSTR-9A returns easily.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.