Form 26QD TDS on Contractual/Professional Payments

Introduction

In the ever-evolving landscape of tax regulations, Form 26QD has emerged as a critical element. Specially for those involved in contractual and professional payments. This form plays a vital role in the Tax Deducted at Source (TDS) process. It is specifically tailored for transactions in which individuals, Hindu Undivided Families (HUFs), and other entities that make contractual or professional payments are involved. In this article, we’ll explore the intricacies of Form 26QD. We will look into its purpose, how it’s relevant for TDS Returns, and how to navigate the process seamlessly.

What is form 26QD

The Central Board of Direct Taxes (CBDT) introduced Form 26QD to address TDS on payments made to resident contractors and professionals. This regulation came into effect from the financial year 2019-20, starting on September 1, 2019. The key point is that if the payment exceeds INR 50,00,000, the entity deducts TDS at a rate of 5%. In such cases, you use Form 26QD to file the TDS return, creating a clear record of TDS deductions.

TDS on Contractual Payments

Contractual payments often involve significant sums of money. The government has instituted TDS on these payments to ensure tax compliance. The deductor, often called the payer, must deduct TDS and then submit Form 26QD to the Income Tax Department. Tax compliance calendars are quite helpful in ensuring such compliance.

TDS on Professional Payments

Professional payments, including fees for services. Such as, legal consultations, accounting, or medical services, are also subject to TDS under Form 26QD. Just like with contractual payments, individuals or entities making such payments must adhere to TDS regulations and file Form 26QD.

What is Form 26QD in TDS?

Form 26QD is a document that plays a pivotal role in the TDS process for contractual and professional payments. It serves as the vehicle through which TDS deductions are reported to the government. The payee, the party receiving the payment, also relies on this form as proof of TDS deduction.

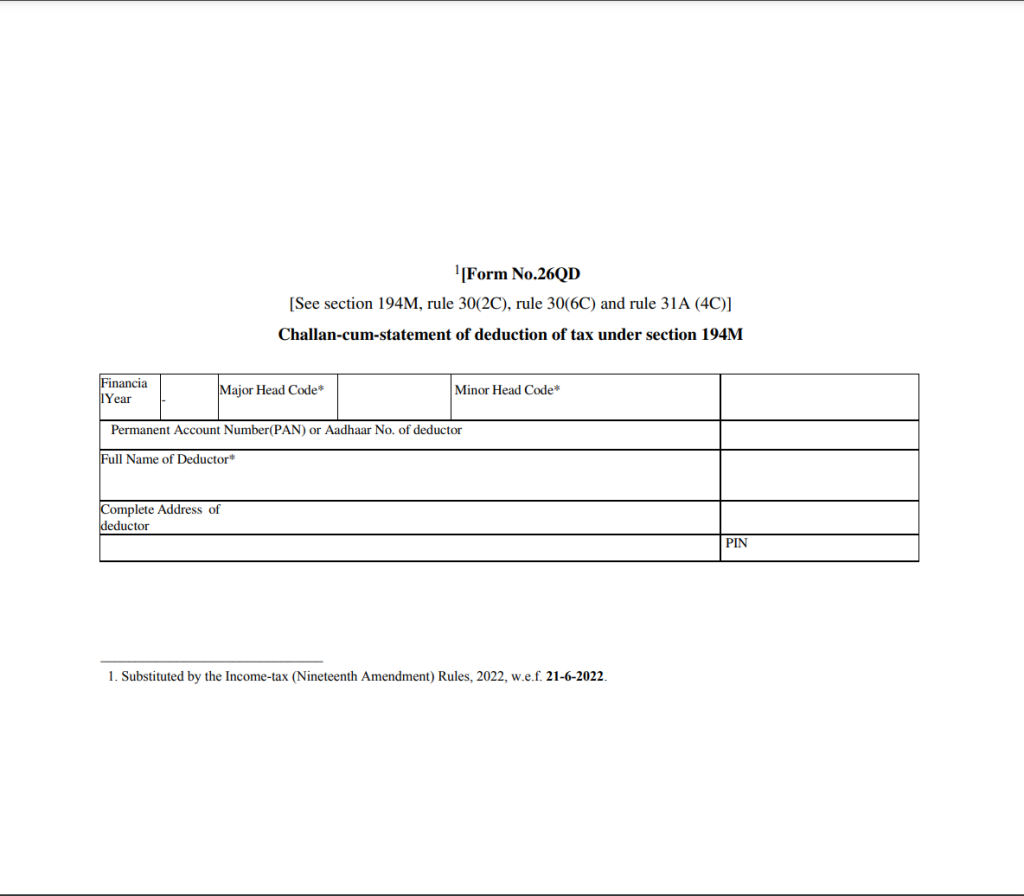

Details Required in Form 26QD

To file Form 26QD accurately, certain critical details must be provided. These include:

- PAN of Deductor/Payer: Firstly, the Permanent Account Number (PAN) of the individual or entity making the payment.

- PAN of Deductee/Payee: Secondly, the PAN of the individual or entity receiving the payment.

- Nature of Payment: Thirdly, you need to provide the nature of the payment. This indicates the type of payment, whether it’s for work in pursuance of a contract, commission, brokerage, or fees for professional services.

- Date of Contract/Agreement: Fourthly, you must provide the date on which the contract or agreement was executed.

- Amount Paid: Next, the total amount paid to the payee.

- Number of the Certificate: After that comes Number of the certificate. This refers to the certificate issued by the Assessing Officer under section 197 for non-deduction or lower deduction.

- Date of Credit: Also, the date on which the payment was credited to the account of the payee is an important detail.

- Rate of TDS: The applicable rate of TDS, which is typically 5% for payments exceeding INR 50,00,000.

- Details of TDS Payment: Finally, information regarding the payment of TDS, including the amount and date of payment.

Conclusion

Form 26QD in TDS is a critical tool in ensuring tax compliance for contractual and professional payments. It helps track and report TDS deductions, ensuring that both parties involved meet their tax obligations. Hence, staying informed about the requirements and procedures for Form 26QD is essential for individuals, HUFs, and entities engaged in such transactions.

Frequently Asked Questions

What is the purpose of Form 26QD?

Form 26QD is used to report Tax Deducted at Source (TDS) on contractual and professional payments. It ensures compliance with tax regulations for such transactions.

Who needs to file Form 26QD?

Individuals, Hindu Undivided Families (HUFs), and entities making contractual or professional payments exceeding INR 50,00,000 need to deduct TDS and file Form 26QD.

What is the rate of TDS under Form 26QD?

The standard rate of TDS under Form 26QD is 5% for payments exceeding INR 50,00,000.

When should I issue Form 16D?

Form 16D, which serves as proof of TDS deduction, should be issued by the payer to the payee by September 15 of the relevant financial year.

Where can I file Form 26QD?

Form 26QD can be filed online through the Income Tax e-Filing portal and the NSDL website, following the specified procedure.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.