How to download Form 16B?

Introduction

In the intricate landscape of Indian taxation, where every financial transaction is scrutinized, understanding the nuances of tax documents is paramount. One such critical document that frequently enters the picture for taxpayers is Form 16B. If you’re seeking clarity on how to download Form 16B, then you’re in the right place. Form 16B is very important for TDS returns and Income tax return filings. In this article, we will guide you through the entire process, ensuring that your financial dealings remain aligned with the law and regulations.

What is Form 16B for?

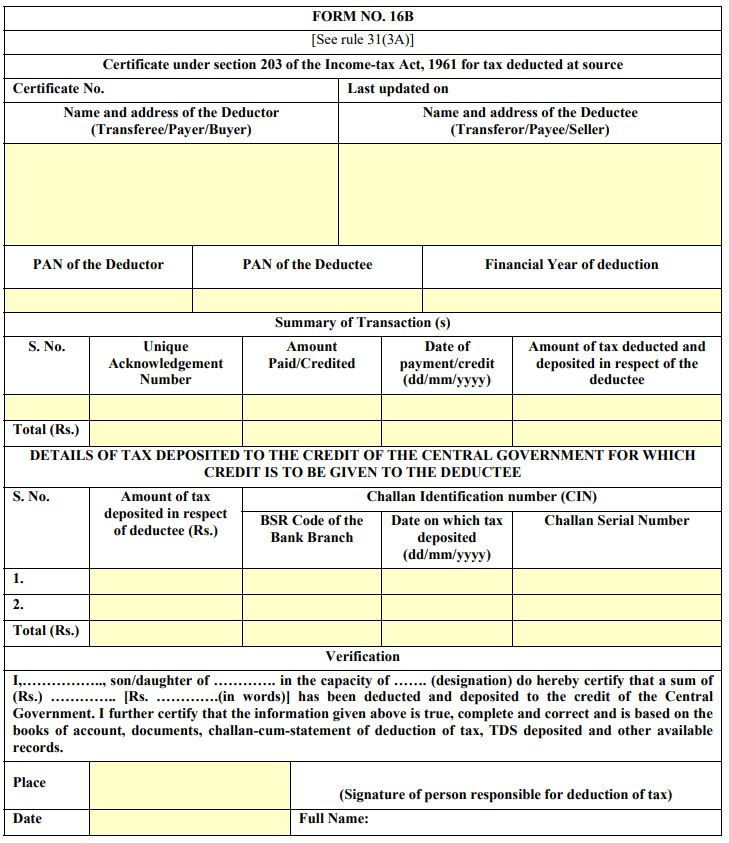

Form 16B primarily pertains to property transactions, particularly immovable property. It serves as a record of the tax deducted at source (TDS) from the consideration amount paid for the property. In essence, it outlines the amount of tax withheld by the seller and deposited with the government authorities. This form is pivotal for both buyers and sellers as it ensures transparency and accountability in property transactions.

Importance of Form 16B

In the intricate world of taxation, documents are not just pieces of paper; they hold the key to your financial compliance and accountability. One such document that holds immense significance is Form 16B. Issued under Section 203 of the Income Tax Act, Form 16B is more than just a certificate – it’s a testament to your adherence to tax regulations and a tangible proof of tax compliance.

Form 16B Download

When it comes to taxes and documentation, knowledge is indeed power. Equipping yourself with the knowledge of how to obtain Form 16B can save you precious time and effort, ensuring that your financial matters are in impeccable order.

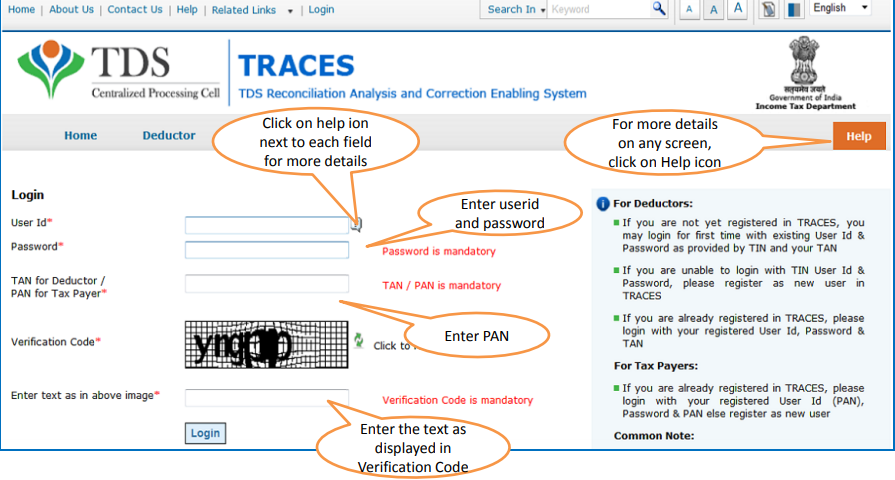

Visit the TRACES Website

Firstly, to initiate the process, access the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website. Here, you will need to input your taxpayer login credentials. If you’re a newcomer to the platform, fret not; we’re here to guide you.

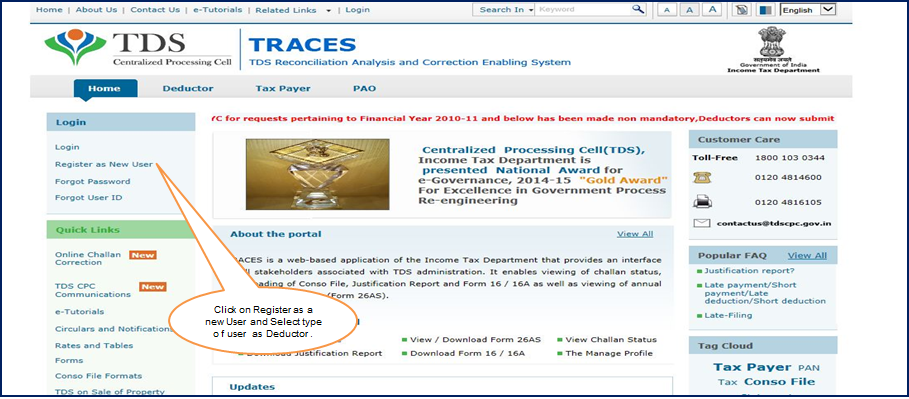

Registration:

On the other hand, for those new to the TRACES platform, the first step is registration. You need to choose “Register as New Use” on the home page. This will take you to a new page for Registration.

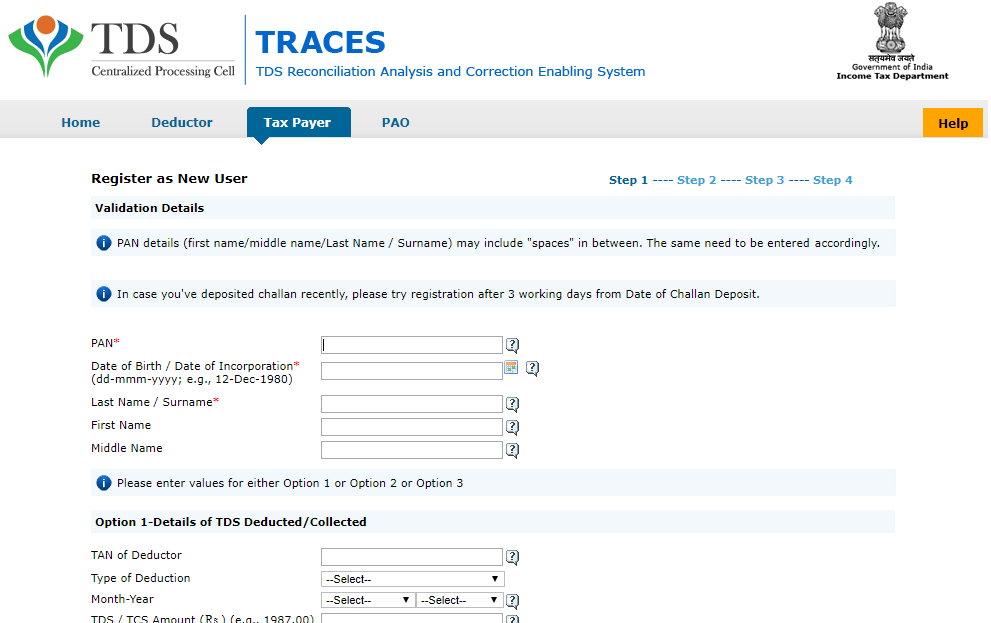

Registration Page:

After that, you’ll be taken to the Registration page. The essential details required for registration are your PAN (or TAN if you’re a deductor), Date of Birth, and your name. These details are pivotal for accurately verifying the tax deductions and payments conducted under your name.

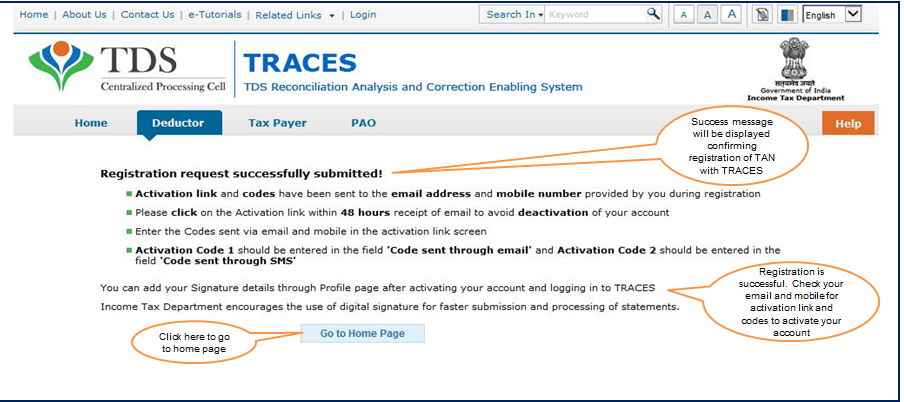

Activation:

Finally, after your information is verified, your PAN becomes your User ID. An activation link will be dispatched to your email, along with a code sent to your registered mobile number. Click on the activation link and then input the code to activate your account.

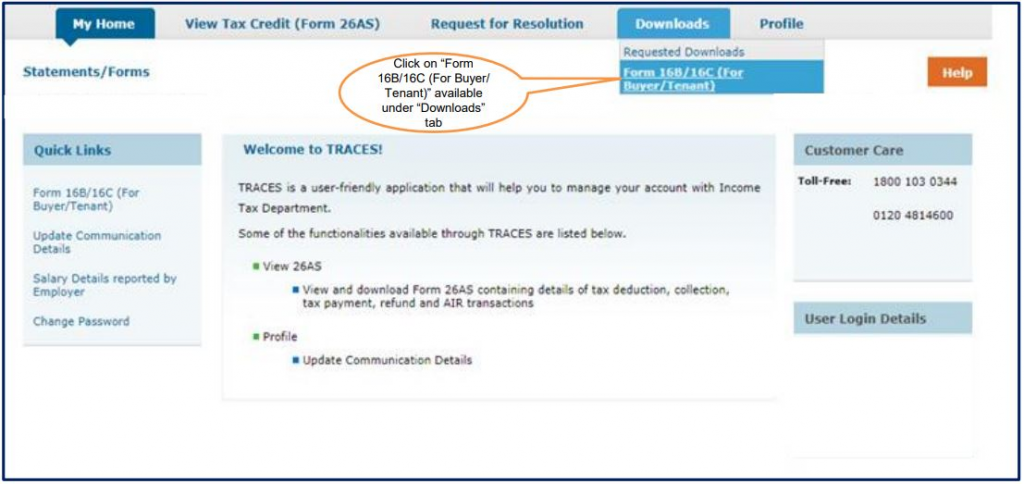

Form 16B Selection:

Upon successfully creating an account or if you’re already registered, log in. If you’re the buyer in the property transaction, then select ‘Form 16B’ from the list of available downloads.

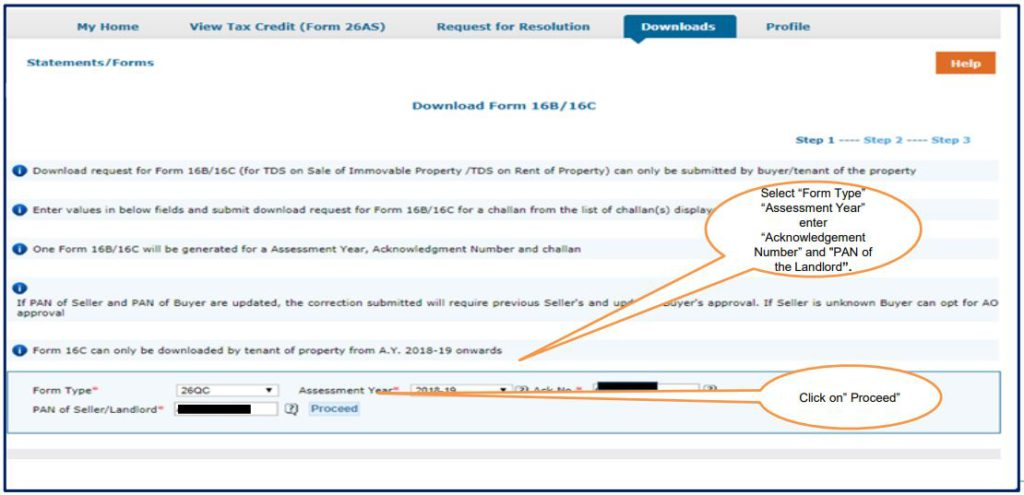

Data Input:

Next, input the seller’s PAN number, the Form 26QB acknowledgement number, the assessment year, and any other pertinent data requested.

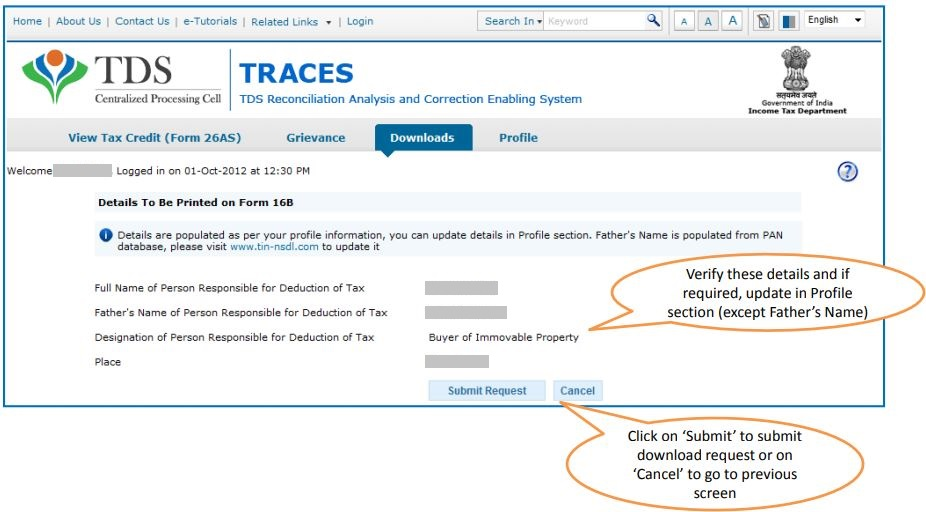

Authorised Person Details:

The details of the authorised person will show up on the screen. Review these details and then click on “Submit”

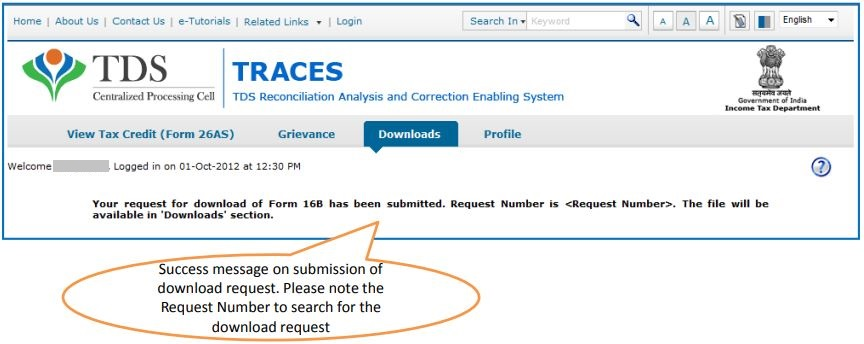

Success Page:

Finally, now the success page will show; what that means is that you can now download Form 16B from “Downloads”.

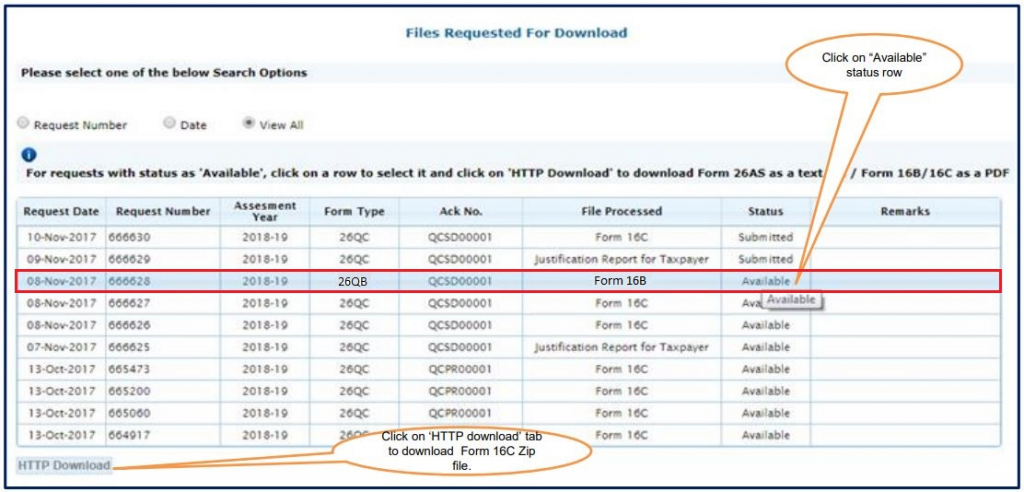

Requested Download:

Once you’ve submitted the requisite information, the option to download Form 16B will become available. Go to “Requested download” under the downloads tab. A list of all your requested downloads will show. Select the appropriate option and then click on “HTTP Download”.

Download:

You can opt to print, save, or maintain a digital copy of the form for your records.

Relation Between Form 16B and Form 26QB

An intrinsic link in this process is Form 26QB, which i a document issued in accordance with Section 194-IA of the Income Tax Act. This document is extended to individuals who make tax deductions at the source. It’s a digital document that necessitates meticulous completion due to the absence of provisions for post-submission modifications.

Points to Remember when applying for Form 26QB:

Here are some cardinal rules to bear in mind:

- Timely Submission: Form 26QB must be submitted within a 30-day window post the deduction month. Moreover, if deductions occur in multiple instalments, a separate Form 26QB is mandatory for each instalment.

- Buyer-Seller Dynamics: Each unique combination of a buyer and seller mandates a distinct Form 26QB. Whether you’re dealing with multiple buyers or sellers, each entity demands its independent form.

Conclusion

Paying taxes is a legal obligation that contributes to the government’s revenue collection. Tax deduction at source is an effective strategy to ensure accurate taxation and counter tax evasion. Form 16B, issued as a TDS certificate in real estate transactions, plays a vital role in this process.

By understanding the procedure to download Form 16B and its relation with Form 26QB, taxpayers can navigate the intricacies of property transactions with confidence. Always ensure timely submission and accuracy in forms to avoid complications. Remember, complying with tax regulations not only streamlines your financial dealings but also contributes to the nation’s growth and development.

Frequently Asked Questions

How does Form 16B relate to Form 26QB?

Form 26QB is an electronic document under Section 194-IA that needs to be submitted for tax deduction at source. Form 16B is obtained by the buyer based on the information in Form 26QB. Both forms are interconnected in real estate transactions.

Is Form 16B applicable only for residential property transactions?

Form 16B is applicable for all property transactions, including residential and commercial properties. It is essential whenever tax deduction at source is involved in property sales.

Can Form 16B be downloaded multiple times?

Yes, Form 16B can be downloaded multiple times from the TRACES portal as needed. Ensure that you have accurate details for successful downloads.

Is Form 16B applicable for property transactions of any value?

Yes, Form 16B is applicable for property transactions of any value where tax deduction at source is carried out. It ensures proper documentation of TDS for the buyer.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.