DIR-3 KYC: All you need to know

Under the Companies (Appointment and Qualification of Directors) Rules, 2014, every individual who has been allotted a DIN (Director Identification Number) on or before 31st March 2018 and the status of such DIN is ‘approve’ has to file the form DIR-3 KYC. This form needs to be filed to the ROC by the due date- 3Oth September 2022. The purpose of this form is to ensure that the ROC has updated and accurate records of directors. The types of information required to be shared are the addresses, contact numbers and email addresses of the directors.

Table of Content |

|

|

Here are the latest provisions applicable to form DIR-3 KYC.

Types of DIR-3 KYC form

The filing of the form is divided into two categories:

First time filing

For individuals, who have been newly allotted DIN or a person already holding DIN and has not filed DIR-3 KYC. Such persons have to file eForm DIR-3 KYC available on the MCA portal.

Subsequent filing

A DIN holder who has already filed the eForm in the previous year has to file a web-form DIR-3 KYC-WEB through the web service available on MCA portal for every subsequent year.

As notified, all the DIN holders are now required to update KYC annually with MCA. Further, if the existing DIN holders want to update the personal mobile number or email id then they are required to file form DIR-3 KYC for subsequent filing. Otherwise, they have to file web-form DIR-3 KYC-WEB.

Documents required for DIR-3 KYC

The attachments to the form are as under

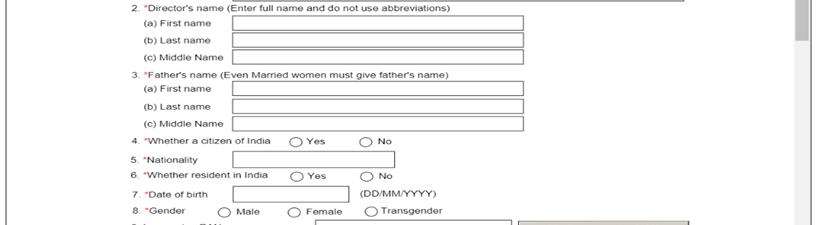

- Details of the director’s nationality and other details such as Gender and Date of Birth.

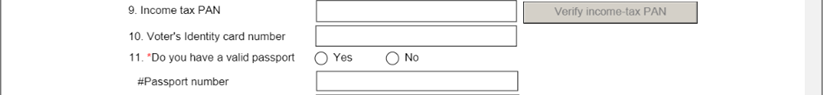

- PAN (mandatory for Indian nationals)

- Permanent address proof (Passport/Election card/Driving license/Aadhaar card/Electricity bill/Telephone bill)

- Present address proof if the present address is other than the permanent address

- Aadhaar card

- A unique personal mobile number and email id

- Voter ID

- Driving License

- Passport (For foreign nationals holding DIN)

Relevant points for eForm DIR-3 KYC

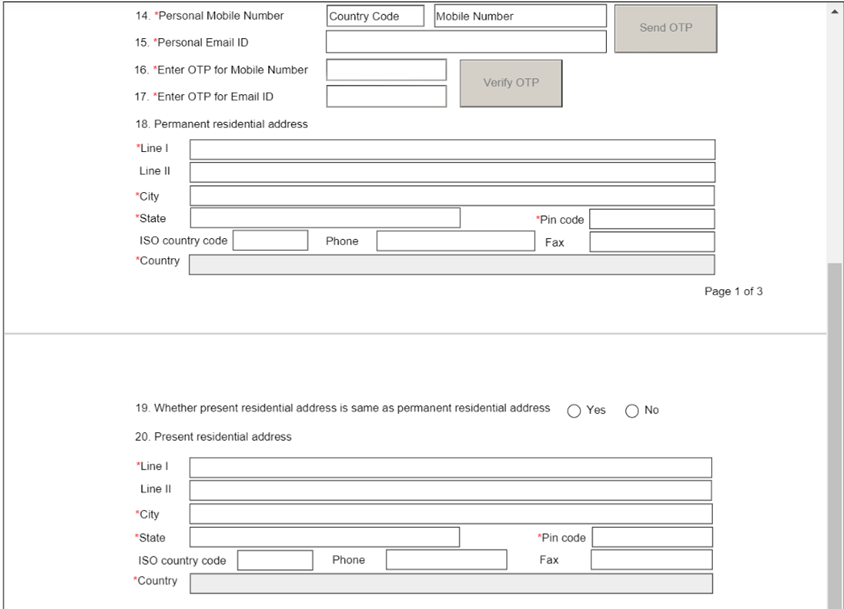

- The form requires every director to share their mobile number and email-id for OTP verification purposes. So be sure to provide your relevant and accessible number and email address.

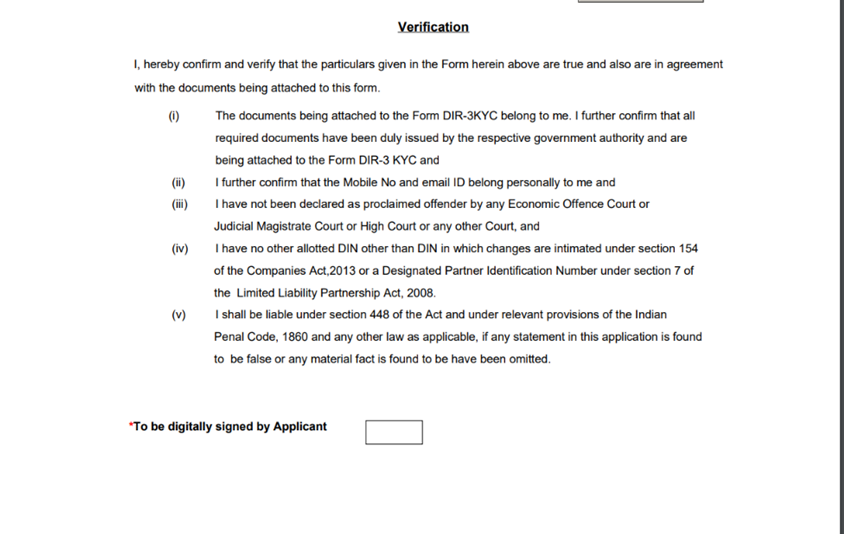

- Digital signatures are required on this form.

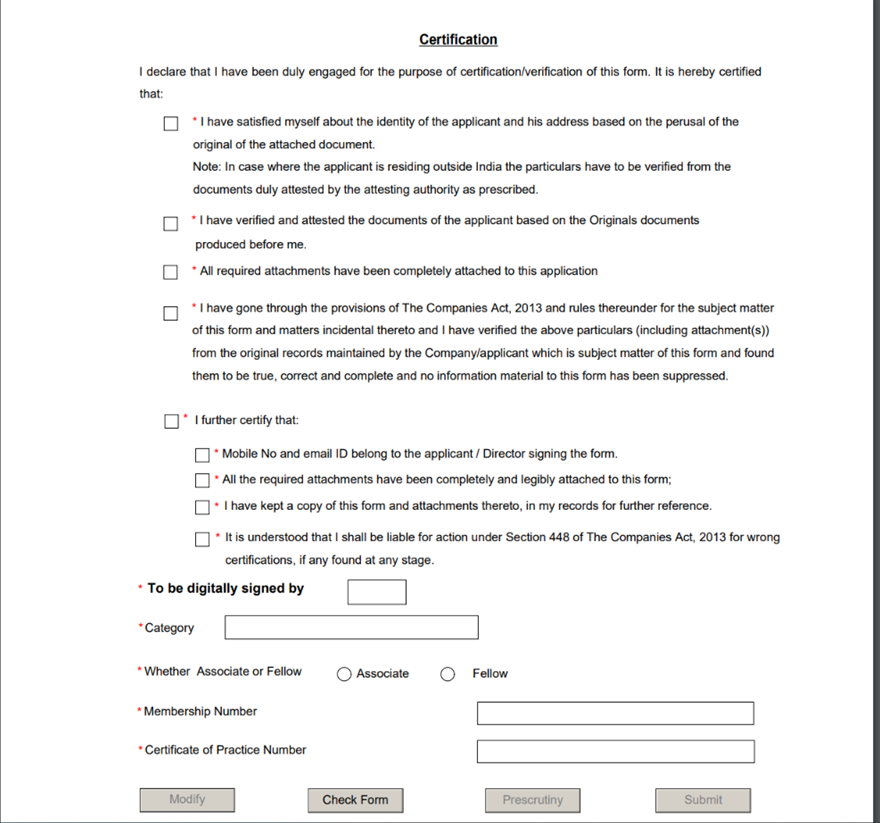

- Once you’ve filled the form, it needs to be certified by a practicing certified professional who is a CA or CS.

Due date for DIR-3 KYC

From the year 2019-2020 onwards every DIN holder is mandated to file the form DIR-3 KYC or DIR-3 KYC-web on or before 30th September of the immediate next financial year. Hence, for F.Y 2021-2022, the due date is 30th September 2022.

Penalty for missing the Due Dates

- Failing to file DIR-3 KYC within the due date or extended due date, as the case may be, leads to the the DIN of such an individual to be marked as ‘Deactivated due to Non-filing of DIR-3 KYC’ and, as the name suggests, to be deactivated. This restricts the director from being able to file any other form that requires his DIN.

- To reactivate the DIN, the director is required to fill the missed out form and pay late filing fees of Rs. 5000/- per year of delay.

Online legal-service websites, such as LegalWiz.in, can help you in filing your DIR-3 without any hassle keep you from missing due dates.

Steps to file DIR-3 KYC

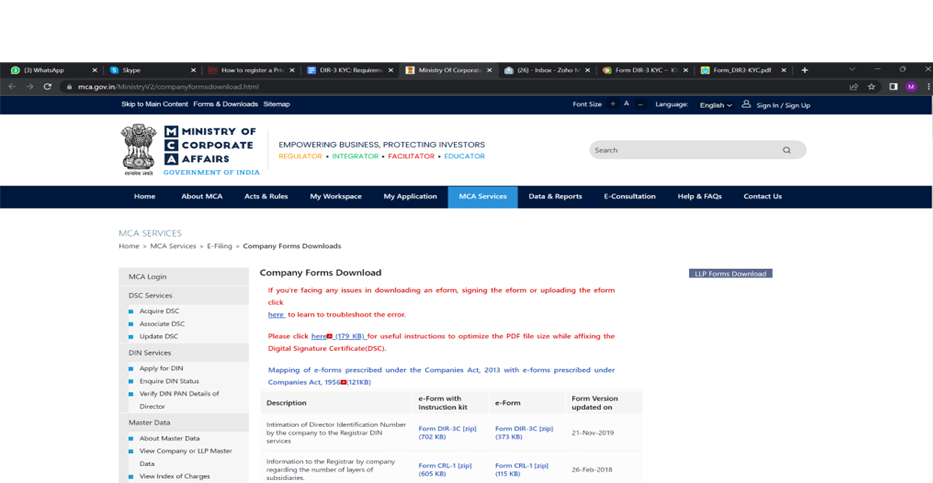

- The first step is to download the form from MCA website’s ‘Company Forms Download’ page.

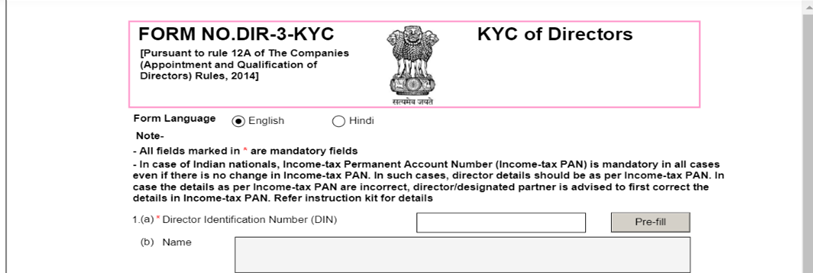

- The second step is to fill in the DIN details in the form.

- The third step requires one to furnish all the required information of the director such as their Name and relevant credentials, nationality, age and address.

- The fourth step is for PAN verification. Here a director is required to put in the details of their PAN card and the same is auto-verified. After this the director also has to share whether they have a passport, and if they do, they are required to share its number.

- The fifth step is to furnish the directors contact information. The same is OTP verified in this step. Post this, documents for the same need to be attached.

- The sixth step required the director to attest that all the information given is accurate, and digitally sign the document.

- The seventh and final step, as mentioned earlier, is that the form needs to be authenticated and digitally signed by a certified professional such as a CA or CS.

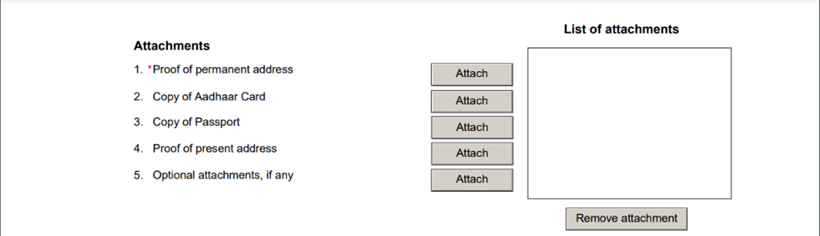

Attachments to be filed with the document

- Proof of permanent address

- Proof of present address if different from permanent address

- Copy of Passport

- Copy of Aadhar Card

- Any other attachments that may be required in special conditions.

(All the above documents need to be attested)

Post Form Submission

- Post e-form submission an SRN is generated. An email regarding the receipt of the form is sent on the director’s personal email id.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.