Advance Tax: A Guide for Taxpayers

Introduction

Navigating the complex world of taxation can be a daunting task for many taxpayers in India. One very important part of income tax return filing is the concept of Advance Tax. Advance tax is a payment of tax in advance, made in four instalments throughout the financial year, to avoid a lump sum payment at the end of the year. In this comprehensive guide, we will start by understanding what is Advance Tax Payment and then understand its details. Such as its applicability, the Advance tax due date, and the procedure for online payment.

Who Should Pay Advance Tax?

Advance Tax is mandatory for all taxpayers, such as salaried individuals, freelancers, and businesses, if their total tax liability exceeds Rs. 10,000 in a financial year. However, there are a few exceptions to this rule:

- Senior Citizens: Taxpayers aged 60 years or more who do not run a business are exempt from paying Advance Tax.

- Presumptive Taxation Scheme: Taxpayers who have opted for the presumptive taxation scheme under sections 44AD and 44ADA must pay their Advance Tax in one instalment on or before March 15.

Advance Tax Due Dates for FY 2024-25

The Advance Tax due dates for the financial year 2024-25 are as follows:

| Deadline | Amount of Advance tax to be paid |

| June 15 | 15% of Advance Tax |

| September 15 | 45% of the Advance Tax (after subtracting the Advance Tax already paid, if any) |

| December 15 | 75% of the Advance Tax (after subtracting the Advance Tax already paid, if any) |

| March 15 | 100% of the Advance Tax (after subtracting the Advance Tax already paid, if any) |

How to Pay Advance Tax Online?

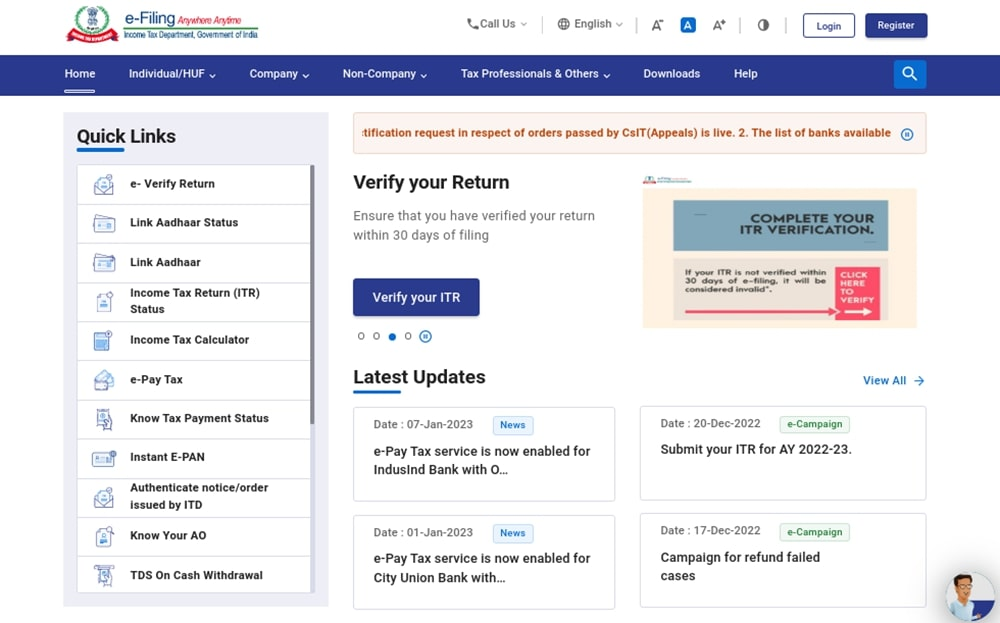

You can make your Advance Tax payment online on the e-filing portal. It is a convenient as well as an efficient way to comply with tax regulations.

To Pay advance tax online:

- Firstly, log in to the Income Tax e-filing portal.

- Select ‘Advance tax (100)’ payment under ‘Income Tax’ for AY 2025-26.

- After that, just crosscheck your details, choose a payment method and bank, and make the payment.

- You will receive an acknowledgement receipt, make sure to save it.

For a detailed step-by-step guide on how to make the payment, check out: How to Pay Income Tax Online

Advance Tax Late Payment Interest

If you fail to meet the Advance Tax Due Date, you will attract interest under sections 234B and 234C. The interest rates for late Advance Tax Filing are as follows:

- Non-payment of Advance Tax: Interest under 234B at 1% per month for three months.

- Delay in payment of Advance Tax: Interest under 234C at 1% per month for the period of delay.

How is Advance Tax Payment Calculated?

To calculate your Advance Tax liability, follow these steps:

- Estimate your total income for the financial year from various sources.

- Reduce various deductions under sections 80C, 80D, etc.

- Compute the tax payable based on the current tax slab rates.

- Subtract any Tax Deducted at Source (TDS) that has already been deducted or is expected to be deducted based on the TDS rates.

Example for Better Understanding

Let’s understand everything that comes under Advance tax with the help of an example:

- Ajay is a freelancer earning income from the profession of interior decoration.

- For the FY 2024-25, Ajay estimates his annual gross receipts at Rs. 20,00,000.

- Ajay estimates his expenses at Rs. 12,00,000. Ajay has deposited Rs. 40,000 in PPF account, paid Rs. 25,000 towards the LIC premium, and Rs. 12,000 towards the medical insurance premiums.

- Professional receipts of Ajay are subject to TDS, and he estimates a TDS of Rs. 30,000 on certain professional receipts for the FY 2024-25.

- Besides professional receipts, Ajay estimates an interest of Rs. 10,000 on fixed deposits held by him.

Ajay’s Tax liability for the upcoming Advance Tax Due Date will be calculated accordingly.

Conclusion

Advance Tax is a crucial aspect of income tax return filing in India. It is mandatory for all taxpayers who have a tax liability exceeding Rs. 10,000 in a financial year. The Advance Tax Due Dates are June 15, September 15, December 15, and March 15. Taxpayers can pay Advance Tax online through the e-filing portal of the Income Tax Department of India. Failure to pay Advance Tax on time will attract interest under sections 234B and 234C. By understanding the Advance Tax requirements and following the Advance Tax Due Date, all taxpayers can ensure compliance and avoid any penalties or interest charges. Reaching out to experts, such as LegalWiz.in can help you and your business ensure you never miss any important filings.

Frequently Asked Questions

Who needs to pay advance tax?

Following need to pay advance tax:

- Individuals whose estimated tax liability for the year is likely to be ₹10,000 or more (after considering Tax Deducted at Source – TDS)

- Businesses (including companies)

Are there any Penalties for non-payment of advance tax?

Yes! Interest is charged if you fail to pay advance tax on time.

What happens if I overpay advance tax

Any excess advance tax paid gets adjusted against your final tax liability while filing your ITR. You can also claim a refund for the excess amount.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.