Startup India Registration

The Department for Promotion of Industry and Internal Trade under the Startup India Scheme introduced the Startup India registration to promote innovation within businesses. At LegalWiz.in, we support and promote businesses by assisting them in getting DPIIT recognition.

10,000+ Startups and MSMEs Served

4.7/5 Google Review

100% Satisfaction Guarantee Policy

What is a Startup India Registration?

Formerly known as DIPP registration, this scheme brings out that startups can leverage by registering their business as a DPIIT recognised startup. This scheme is envisioned at transforming India into a job-provider rather than a job seeker. Only an entity which is registered as a Private Limited Company or a Limited Liability Partnership (LLP) or a Registered Partnership Firm can opt for startup India Registration. All businesses opting to apply must be innovative, bringing an improvement in existing products or services, and capable of generating wealth and employment. These criteria are mandatory for DPIIT registration. If your PLC or LLP fulfills all these criteria, apply for Startup India Registration online today!

Why choose Legalwiz.in for DPIIT Startup Registration?

- A team of expert Lawyers, CAs and CS to guide you through each step;

- We understand your requirements first and then act;

- Amazing design team to help you create the perfect pitch deck for your innovative business;

- We don’t just fill the form, we also create the startup india login for you; and

- Lastly, we also resolve queries raised from the DPIIT portal

LegalWiz.in aims to provide fast and affordable Startup India Registration Services.

Benefits of Startup India Registration

Tax Exemption

The entity registered under the Startup India Scheme can apply for an exemption of income tax under section 80 IAC of the Income Tax Act. Such an entity can avail tax exemption for 3 consecutive financial years out of first 10 years from the date of incorporation provided following conditions are fulfilled:

(1) An entity shall be a Private Limited Company or Limited Liability Partnership.

(2) It shall be incorporated between 01st April 2016 to 01st April 2021.

Angel Tax Exemption

The Startup India recognized entity can avail tax exemption benefit from the funds received as angel investment. The exemption is only granted if the total amount of paid-up share capital and share premium does not exceed Rs. 25 Crore after the proposed issue of share. To avail this exemption the entity need to fulfil some conditions for investing in certain assets.

Rebate in Trademark and Patent Application fees

All the startups registered under this scheme can claim a rebate on the government fees for filing a trademark application. And up to 80% rebate in Patent applications and can avail the benefit of fast track patent application. Entire fees of Facilitators for any number of Patents, Trademarks or Designs a Startup may file, shall be borne by the Government. Hence Startups will have to bear the cost of Statutory Fees only.

Self Certification

Startups can self certify the compliance under 6 Labour Laws and 3 Environmental Laws for 5 years from the date of incorporation.

Government Tenders

Registering an entity under the DIPP recognition scheme enable Startups to apply for Government tenders. One of the requirements of having minimum prior experience/turnover for filing the government tender by the companies is not applicable to the companies registered under the StartUp India scheme. Startups recognised under DIPP have been exempted from submitting Earnest Money Deposit (EMD) while filing government tenders.

Interaction platform for Startups

Networking is an essential key for any entrepreneur to get recognition in the market and among other industry peers. After registering under the DIPP scheme, the startups get a platform to meet other startups, well-known speakers, investors etc. at various fests and summits organized by Government at a huge scale. Startups recognised under DIPP can register on Government e-Marketplace as a seller and sell their products and services directly to Government Entities.

Fund of Funds for Startups

The startup can raise funds and capital through the fund of funds initiative by Startup India. DIPP has proposed to release Rs.10,000 crore for Startups through this scheme. Small Industries Development Bank of India shall provide funds to Startups approved by Implementing Agencies.

Faster Exit

The startup entities registered under Ministry of Corporate Affairs (MCA) i.e A Private Limited Company and an LLP will be wound up on a fast track basis. Under the Insolvency and Bankruptcy Code,2016, Startups with simple debt structure or those meeting certain income specified criteria can be wound up within 90 days of filing an application for insolvency.

Documents required for recognition under Startup India Initiative

COI

PAN Card

PAN Card of an entity

Constitutional documents

MOA & AOA in case of company and Partnership deed in case of LLP or Partnership Firm

List of Directors, DP's and Members

List of Directors or Designated partners or members along with their photographs and contact details

Social link

URL of website & Mobile App of an entity (if any) and Social Profile’s (LinkedIn and/or twitter) of Directors, DP’s and members.

Fund related

If the entity has received any funds then the details related to the amount of investment and investor.

IPR Registration

Awards/Certificate

Annual Statements/ITR

To claim deduction under section 80-IAC, Form-1 needs to be filed along with Annual Accounts of the Startup for last three financial years (if applicable) and Copies of Income Tax Return for last three financial years (if applicable).

Eligibility for DPIIT registration

Your business entity should be registered as either one of these:

– Private Limited Company;

– Limited Liability Partnership; or

– Registered Partnership Firm

The turnover for your entity cannot exceed Rs. 100 crores in any previous years.

Your entity must be newly formed. It must not exist for a period of more than 10 years.

Startup India Recognition Certificate is only given to those entities that are working towards an innovation or an improvement to an existing product or service. This innovation/improvement should also be capable of generating wealth and income.

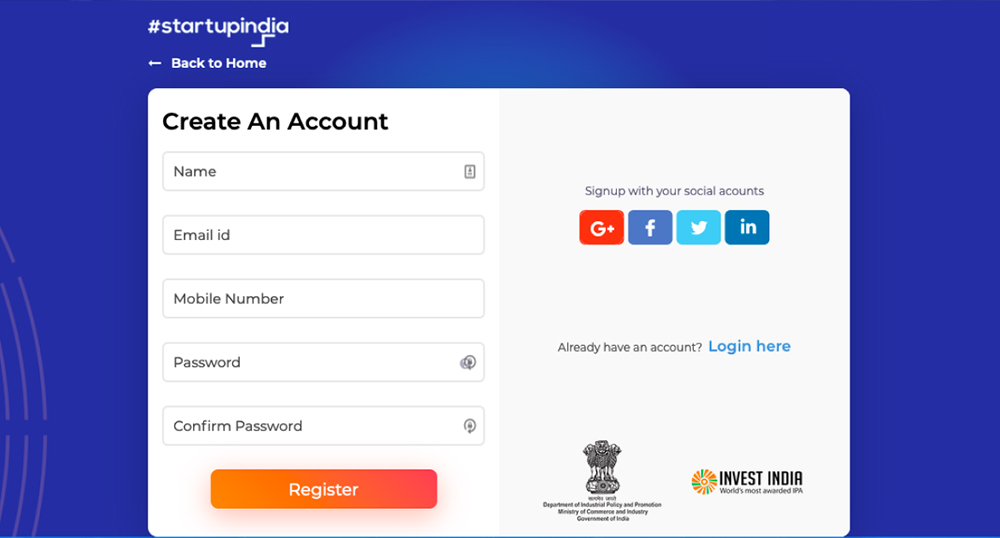

Register as recognized Startup under DIPP in 3 Easy Steps

1. Answer Quick Questions

- Fill in our questionnaires that take less than 10 minutes

- Provide basic details & documents required for registration

- Make payment through secured payment gateways

2. Experts are Here to Help!

- Assigned Relationship Manager

- Registration on Startup India Portal

- Drafting of Write Up based on Innovative, Improvized component of the product or service

- Filing of an online application

3. Generation of Startup recognition number

*Subject to Government processing time

Process to register under Startup India Scheme

Day 1

- Creation of Login Credentials for the entity

Day 2 - 4

- Review and verification of documents & information provided

- Drafting of application with required information

Day 5 - 7

- Filing of an online application using the credentials

Day 8 - 9

- Government processing time

Have Questions? Find Answers Here

StartUp Recognition is based on Government Scheme providing special benefits to Start Up entities subject to specific conditions as laid down in the rules.

Only Private Limited Company, Limited Liability Partnership and Registered Partnership Firm are eligible to apply for a StartUp Recognition certificate.

An entity working for innovation, deployment or commercialization of new products, process or services driven by technology or intellectual property is eligible to apply. A new product/service/process, or a significantly improved existing product/service/process, that can create or add value to customers or a workflow can also file an application to register itself under this scheme.

After registration you can connect to other Startups, investors or incubators on the Startup India portal under the Tab – ECOSYSTEM or you can connect by login into your account.

There is no government fee for the registration under the Startup India Scheme.

The government officers thorougly check all the information and documents provided in the application, hence the time period depends on the government processing time.

For the period of 10 years from the date of incorporation or up to the turnover increases the limit of Rs. 100 crore in any financial year.

DPIIT stands for the Department for Promotion of Industry and Internal Trade. It was formerly known as DIPP (Department of Industrial Policy & Promotion) until 2019.

Since, One Person Company is a form of a company it is entitled to be recognized as “StartUp”.

No, entities formed by Splitting Up or Reconstruction of Business already in existence are not eligible for registration under this scheme.

No, the DPIIT recognition for Startups is different from registration on Startup India website. To avail the benefits of Startup India scheme, the entity must be registered under Startup India Scheme provided by DPIIT. Only creating the account on the website of Startup India does not amount to getting DPIIT startup registration.

The application is to be submitted online at www.startupindia.gov.in

Yes, It can be availed later on also.

By registering under this scheme your entity will be eligible for availing tax benefits but to avail it, you need to separately apply for it by log in on the portal of Startup India.

Our clients love and vouch for our services

Amazing , fabulous and so so accurate in services that you can’t find a simple glitch in the process. Special thanks to harshita bhandari and Shalini Singh for the support and thanks to all the effort made by them to make the process flawless for me. They are prompt on calls and revert with the best solutions available. Kudos to team legalwiz.

LegalWiz.in took the stress out of trademark filing! Hetvi’s knowledge ensured I filed correctly, and Yashvi kept me updated every step of the way. Their professionalism and clear communication made the whole experience smooth and efficient. Highly recommend for anyone needing trademark assistance!

I really liked your service, very prompt & fast support I have received from legalwiz

Exceptional Service and Expertise! Our experience with LegalWiz has been nothing short of outstanding. From start to finish, they provided professional assistance and guidance throughout the registration process. Their team is highly knowledgeable and responsive, addressing all our inquiries promptly and efficiently. We greatly appreciate their dedication and expertise, making the registration process seamless and stress-free. Without hesitation, we highly recommend LegalWiz for all your registration needs.

The team of LegalWiz.in, Sachi, Hetvi, Yashvi to name a few, has been executing a systematic and productive approach towards establishing my company. Clear communication, Analytical problem solving ability, uninterrupted workflow and Solid Team Building are some of the highly noticeable attributes that I have experienced while getting their consultancy. I strongly recommend LegalWiz.in for all who want to start and/or manage their businesses and my best wishes to the Team LegalWiz.in to keep the flame alive !

Work with discipline.

I had a smooth experience incorporating my company with Legalwiz. Their platform and staff helps you have 100% clarity on the process and full transparency on what’s going on. I’m adding this review after almost one year of filling with them why even after such long time their team is just one call away and I got necessary documents in a snap. Best customer support I feel. Legalwiz should be goto platform for startups.

Legalwiz team know their stuff very well. Team is friendly and supportive and most importantly provides the right advice. Team helped me in all my company related setup and compliance processes. I highly recommend them to any founding team.

Excellent service by the team. The team was always there to take our calls and answer the queries in timely manner. A Big Thank You!

Helpful Resources

DPIIT-recognized startups in India have the option to save lacs, even crores in Taxes! Section 80 IAC of the Income Tax Act, is the provision that allows recognised startups to get a 100% tax exemption...

The Startup India Portal was created to facilitate the online filing of DPIIT recognition and give easy access to the inclusions of the Startup India Scheme...

With more than 90,000 DPIIT-recognised startups, India has become a huge part of the startup ecosystem. DPIIT recognition is a flagship initiative of the Startup India Scheme...

Over time, the startup ecosystem in India has developed a lot. The Government of India (GOI) is playing an active role in this development. As a result of this, they work towards creating...

The Startup India Scheme was a result of the Government of India realising the need to support and promote innovative small business’ in India...

Since the inception of Department for Promotion of Industry and Internal Trade (DPIIT) under the Startup India Scheme, India is becoming a hub for startups...