Everything about SPICe form for Company Registration

Overview

SPICe form is an e-form under the Ministry of Corporate Affairs to facilitate online company registration in India. SPICe form stands for the “Simplified Proforma for Incorporating a Company Electronically”. This SPICe+ form replaces by the older version SPICe form. The spice+ form exists under the Ease of Doing Business Initiative of the Government of India. As a result of these active efforts of the Government, young entrepreneurs today enjoy seamless online company registration in India.

What is spice form?

SPICe form also known as the INC 32 is an e-form used for the purpose of incorporation of a company. The spice form is submitted along with the eMOA and eAOA (INC 33 and INC 34 respectively). The spice form covers the following aspects of company incorporation:

- Company Name Reservation;

- Incorporation of Company;

- Application for DIN; and

- Application for PAN and TAN.

So, you can submit the spice form for any or all of these purposes. This form did make it extremely easy to do business in India. However, like the saying goes, change is the only constant in life, the form is now Spice+ form, under the ‘Ease of Doing Business’ scheme in India.

SPICe form vs SPICe+ form

As stated above, the new spice+ is an improvement to the original spice. The SPICe form was an e-form for incorporation of a company. Whereas the SPICe Plus form is an integrated webform allowing multiple services. Let’s take a look at all the improvements of spice+.

Improvements in the form

The spice plus is divided in two parts namely:

- Spice+ PART A: to reserve name of a company; and

- Spice+ PART B: this provides for 11 different incorporation related submissions, governed by 3 different central ministries.

Important Note: the Spice+ part B becomes available only after the successful completion of the spice+ part A.

Spice+ part A facilitates:

- Name Reservation of new company

Part B Spice plus form facilitates:

- Application for incorporation of new company;

- DIN Application;

- Issue of PAN;

- Issue of TAN;

- Applying for EPFO registration;

- Applying for ESIC registration;

- Professional Tax Registration for companies incorporated in Maharashtra, Karnataka and West Bengal;

- Applying for GSTIN;

- Bank Account opening; and

- Shop and Establishment registration for companies incorporated in Delhi.

Process of filing the form

The SPICe+ has to be filled in two different parts:

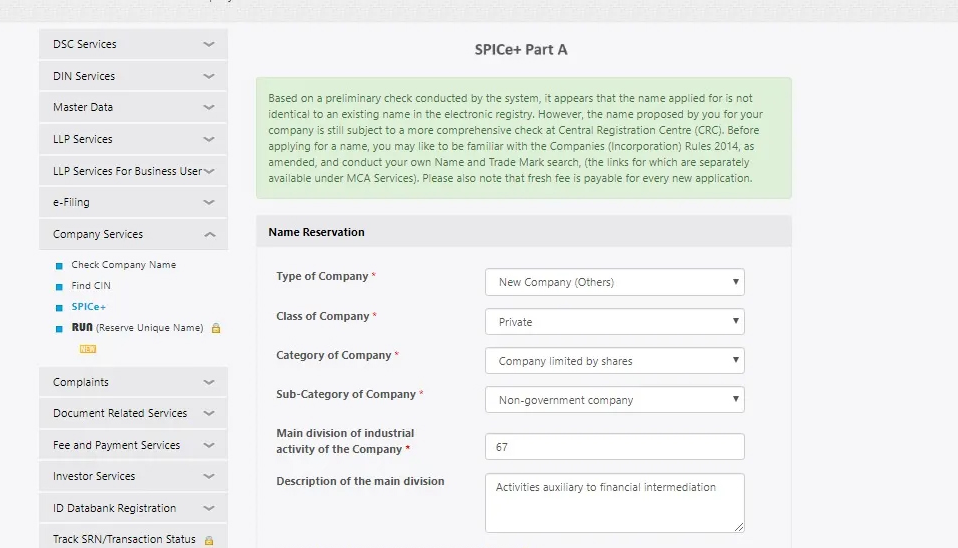

Steps for Part A of the spice form

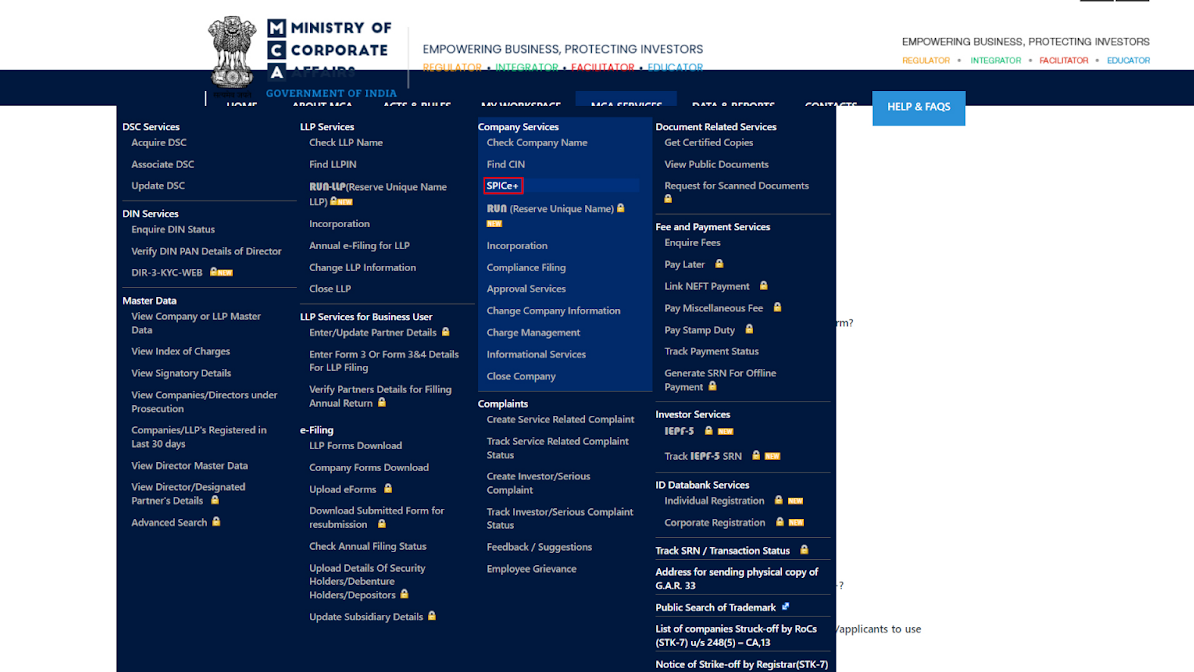

- Firstly, you have to login on the MCA website and click on “MCA Services”.

- After that, choose “SPICe+” from the options.

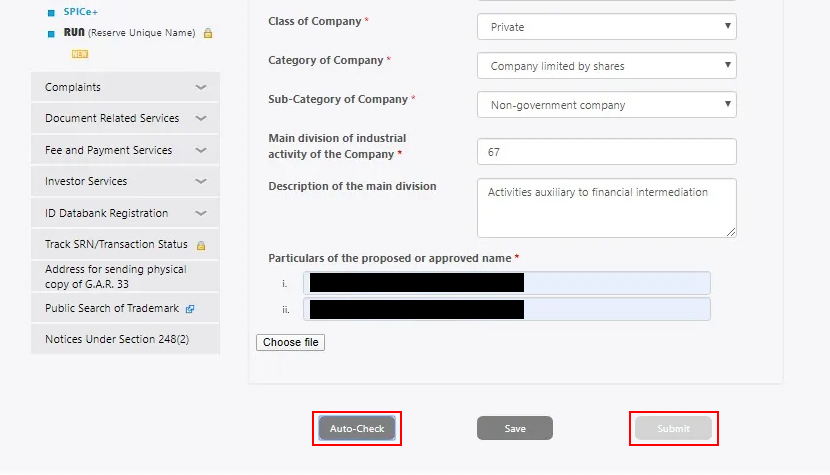

- This should take you to a new page. There click on the “New Application” option.

- Finally, duly fill out the form, auto-check it, and click on submit. On submitting this, Part B of the form will become accessible.

Steps for Part B of the form

- Firstly, you need to fill in the following information in spice part A:

- The address of the correspondence or registered office of the company;

- Names of the company’s proposed directors (having or not having DIN) & subscribers;

- The capital of the company;

- DIR 2 signed by the directors;

- Stamp Duty as per the state mentioned within the MoA (Memorandum of Association) & AoA (Articles of Association);

- Any additional information for PAN and TAN registrations.

- Secondly, users need to do a ‘pre-scrutiny’ check after filling in the necessary information. If it’s successful, the next step is to click on submit. A confirmation will show on the screen on successful submission.

- Thirdly, after successful submission, you have to download the Part B form as a PDF for the purpose of affixing a Digital Signature Certificate (DSC) and attaching any other relevant and required forms.

- After that, upload the form on the ‘upload e-forms’ page on the MCA portal. One needs to log in to the MCA website to access this service. You can upload up to 10 documents on the portal at once.

- After uploading and submitting the forms for company incorporation SRN is generated.

- Finally, you need to make payment for successful submission.

Pro Tip: Keep your file sizes as small as possible as the maximum upload size for Part B of the form is 6mb.

Documents Required for SPICe+ Part B

Spice Part B of the form needs the following attachments:

- For the address of correspondence/registered office: Any utility bill from within the last two months and a NOC from the owner of the premise.

- For directors and to-be shareholders: Self-attested copies of their PAN cards, Identity proof (Aadhar card, Driving License etc) and Residential proof.

Additional forms

Here are some additional forms that you will have to submit with the form:

- AGILE-PRO: Also known as “Application for Goods and services identification number, employees’ state Insurance corporation registration plus Employees’ provident fund organisation registration”, as the name states, this form lets you apply for:

- Goods and services identification number

- Employees’ state Insurance corporation registration

- Employees’ provident fund organisation registration

- SPICe+ MOA: An online form that lets you file the MoA of a company while applying for company incorporation.

- SPICe+ AOA: Lets you file the Articles of Association in company law while applying for company incorporation.

- URC-1: Form for registering as a Part I company.

- INC-9: An online form declaration form for subscribers and directors.

Frequently Asked Questions

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.