Union Budget 2020 Highlights and Updates

The Union Budget 2020 was presented by the Finance Minister, Nirmala Sitharaman. There is a lot in store for businesses and individuals. It was presented in two parts with part A being a theme-based budget allocation. Part B was a general tax reformation.

A. The first theme under Part A of the Union Budget 2020 was ‘Aspirational India’ which has three sub-sectors –

i. Agriculture, irrigation, and rural development

ii. Wellness, Water and Sanitation

iii. Education and Skills

B. The second theme was presented at the Union Budget 2020 which involved ‘Economic Development.’ It is divided into three other sectors;

i. Entrepreneurship

ii. Infrastructure

iii. Digitization

C. The third theme was labelled as ‘caring society’ by Nirmala Sitharaman in Budget 2020. It involves three sub-divisions;

i. Save a Girl Child & Education

ii. Tourism Industry

iii. Environment and Climate Change

General Budget 2020 Overview

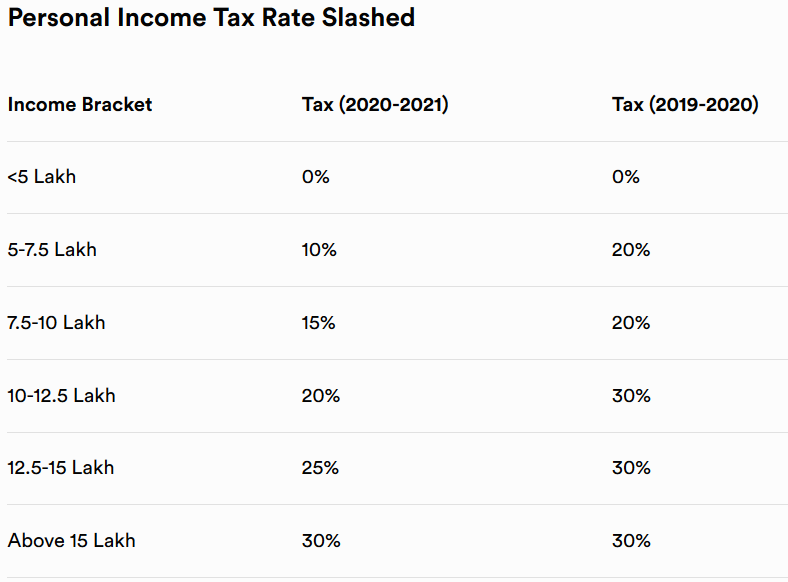

- Change in Personal Income Tax Slab as follows;

- 100% tax exemption to the interest, dividend and capital gains income on the investment made in infrastructure and priority sectors before 31st March 2024 with a minimum lock-in period of 3 years by the Sovereign Wealth Fund of foreign governments.

- Deposit insurance hiked from Rs. 1 Lakhs to Rs. 5 Lakhs

- Dividend Distribution Tax removed. Dividend taxable in the hands of the Recipient.

- Power Generation Sector also eligible for 15% concessional Corporate Tax Rate.

- Cooperative Societies granted an option to be taxed at 22% with no exemption benefit.

- The government proposed to sell a part of its stake in LIC through Initial Public Offer.

- Deduction of Rs.1.5 lakhs for affordable housing extended by one year.

- Companies Act to be amended to decriminalise civil offences.

- No income tax for income up to Rs 5 lakh.

- Tax holiday for affordable housing extended by one more year.

- Govt. to launch new direct tax dispute settlement scheme; interest, penalty waived till March 31, 2020.

- Excise duty hiked on tobacco, cigarettes raised.

Benefits to Startups and MSMEs

- The threshold limit for Tax Audit increased to Rs.5 crores provided less than 5% turnover is in cash.

- Ease of the tax burden of ESOP on employees by deferring the tax payment by 5 years or till they leave the company or when they sell their shares, whichever is earliest. Know more about ESOP.

- An eligible startup with a turnover of up to INR 25 Cr is allowed a deduction of 100% of its profits for 3 consecutive assessment years out of 7 years. In order to extend this benefit to larger startups, it is proposed to increase the upper limit of revenue to INR 100 Cr along with the extension in period of eligibility of deduction from 7 years to 10 years.

- App-based invoice financing platform for MSMEs will be launched.

Summing Up Union Budget 2020

There was a dire need to address the economic concerns of India and there is something for everyone in this budget. India is one of the world’s fastest-growing economy and this budget in 2020 is aimed at pumping more business and investments in the country.

Finance Minister Nirmala Sitharaman presented the union budget 2020 to boost incomes and enhancing purchasing power. She also stressed that the fundamentals of Indian economy are strong and the inflation will be under control with this budget.

Shreeda Shah

Shreeda Shah is a Chartered Accountant associated with Legalwiz.in as a Business Advisor. She has a good expertise over Direct Taxation and Indirect Taxation compliances.