Limited Liability Partnership in India- FAQS

Introduction

If you’re considering starting a LLP or have just started one, I am sure you have many questions regarding it. Knowing the answers to these questions can help you identify if an LLP is the right business structure for you, as well as the many benefits a Limited Liability Partnership registration can give you. In this article, we will be diving straight in into all the Frequently Asked Questions regarding Limited Liability Partnerships, such as what is the meaning of an LLP, its benefits, its compliance requirements, etc.

What is an LLP?

A Limited Liability Partnership is a hybrid version of a partnership firm and a company. As the name suggests it has a limited liability unlike that of a partnership firm. It includes less compliance unlike in companies. It’s governed by the Ministry of Corporate Affairs and regulated by the Limited Liability Partnership Act and agreement between partners. LLPs are a separate entity from partners hence it has a separate legal existence. Hence, partners are not personally liable for the debts of the firm. Further, it has perpetual succession.

What are the benefits of an LLP?

Due to its dynamic structure, it has many benefits as listed below:

- Simple Registration Process

- Limited Liabilities of the Partners

- Separate Legal Existence

- Fewer Compliances

- Unlimited partners

- An Audit is not Mandatory

- Flexibility

- Partners are not agents of other partners

What are the minimum requirements to register an LLP?

There must be at least two individuals to be appointed as Designated Partners, out of which one must be an Indian resident. Also, there is a pre-requisite to have an address of a business in India so as to register it as a registered office for your Limited Liability Partnership.

How to incorporate an LLP?

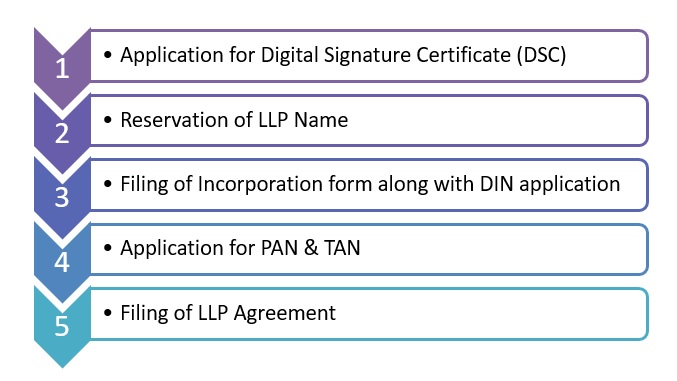

There is an online LLP registration process. It is registered with the MCA. You have to pay stamp duty during the time of incorporation. You must pay stamp duty stamp to the state in which the registered office of an Limited Liability Partnership is situated. The amount of stamp duty is decided on the amount of capital contributed at the time of incorporation and as per the state’s stamp duty Act. The process of registration is as under:

Who can be partners?

The following people can be partners:

- A Person with unsound mind

- Undischarged insolvent

- If an application for adjudication of insolvency is pending

What is the difference between designated partner and partner?

Both designated partners and partners are categorized differently in LLP. The designated partners are more liable than the partners. They are accountable for the day-to-day business activities as well as for all regulatory and legal compliances. Further, the rights and responsibilities can be shared between the partners by entering into an agreement.

What is Director Identification Number (DIN)?

DIN is a Director Identification Number. It is a unique number provided to an individual to become a designated partner in LLP or a director in a company. If a person has DIN then he can become a designated partner easily. Otherwise, DIN shall be allotted by MCA at the time of incorporation of the Limited Liability Partnership. The following documents are needed for the application of DIN.

- PAN

- Identity proof (Aadhaar card/Passport/Election card/Driving License)

- Address proof (latest bank statement/utility bill)

If any of the partners is a foreigner, then the passport is mandatory and all the documents must be apostilled. If there are changes in any information relating to the partners such as an address, name, etc. then it must be communicated to MCA in a specified form within 30 days.

What is Digital Signature Certificate (DSC)?

Digital Signature Certificate for partners is provided in the form of a token and issued by Certified Authorities. Any form filed for incorporation of Limited Liability Partnership (LLP) in India online shall be submitted after affixing the DSC of the designated partner.

What documents do I need to register LLP?

You need the following documents for Limited Liability Partnership incorporation:

Designated partner/partner

- Self-attested copy of PAN card

- Self-attested copy of identity proof (Aadhaar card/Passport/Election card/Driving License)

- Self-attested copy of Address proof (latest bank statement/ telephone/ mobile/ electricity/ gas bill)

- A scanned copy of a passport-sized photograph

Business address proof

- Latest electricity/telephone/mobile/gas bill or any other utility bill from the office location

- An NOC from the owner

- Rent agreement for rented office spaces

How to reserve the name for an LLP?

LLP name availability is an essential part of an online LLP registration. You can reserve the name for your Limited Liability Partnership via a web-based form named “LLP-RUN” (Reserve Unique Name). The partners can provide a maximum of 2 names in a preferential order to reserve anyone. The registrar may ask to re-submit the application with a different name if the names do not fall under criteria of uniqueness, and relevancy or do not fulfil the necessary requirements.

Are there any minimum capital requirements?

No. There is no minimum amount prescribed to form an LLP in India. It can be started with any amount of capital demanded by the business. Although there is no minimum requirement, every partner must make a contribution financially to form LLP. The amount of capital contribution is disclosed in the LLP Agreement and the amount of stamp duty is decided by the total contribution amount.

What is the meaning of an LLP agreement?

LLP Agreement is an agreement executed by all partners after LLP incorporation in India. The agreement prescribes all the clauses related to business, including the rights, roles, duties, and responsibilities of partners in LLP. The agreement must be filed within 30 days of the issue of a certificate of incorporation. Failure to do so will charge an additional fee of Rs. 100 per day till the date of filing.

How does one determine the stamp duty amount in an LLP agreement?

The stamp duty for a LLP Agreement in India is determined on the basis of capital contribution. The rate of stamp duty varies from State to State. The State Stamp Act will be applied depending on where the registered office is situated.

Can an LLP carry on multiple business activities?

Yes, a Limited Liability Partnership registered in India can carry on more than one business subject to their relevancy. But, the activities must be related or in the same field itself. So, unrelated activities, such as Interior design and Legal consultancy, cannot be carried out by the same firm. Additionally, whatever business activities a limited liability undertakes, they must mention in their LLP agreement. The activities also need RoC approval.

Can I register an LLP for Not-for-profit activities?

No, one of the essential requirements for setting up LLP is ‘carrying on a lawful business with a view to profit’. Therefore, you cannot incorporate a Limited Liability Partnership for undertaking “Not-For-Profit” activities.

Can I change the office address of a Limited Liability Partnership?

Yes, you can change the registered office address of the Limited Liability Partnership while shifting the office from one place to another. You can record such change by entering into a supplementary agreement. A Limited Liability Partnership must also file Form-15 for LLPs for a change in office address. Additionally, you must file the word with the MCA within 30 days of the change.

Can I add a partner in a Limited Liability Partnership?

You can add or remove a partner in an LLP. One must follow a specific process. If a partner does not have DIN then they must first apply for a DIN. No one can become a Limited Liability Partnership’s partner without a valid DIN. Next, the partner must get into a supplementary agreement with the Limited Liability Partnership. Finally, you need to file forms 3 and 4 for LLPs with the MCA within 30 days from the addition.

What are the mandatory compliances for an LLP?

Every LLP has to comply with the post-registration compliances. If such compliances are not followed then Limited Liability Partnership shall be liable for penalties. After incorporation, the LLP must open a current account in the name of the LLP and the partners have to deposit the capital contribution as agreed. Following are the mandatory annual compliances for a Limited Liability Partnership.

- Filing of Annual compliances with MCA

- Filing of statement of accounts and solvency with MCA

- Filing of form DIR-3 KYC for all partners with MCA

- Filing of Income tax return

Is Audit mandatory for an LLP?

LLP do not need to audit its books of accounts like a company; except in the following cases.

- If the turnover of an LLP exceeds Rs. 40 lakh, or

- If the capital contribution of an LLP exceeds Rs. 25 lakh

- The partners can also voluntarily get their books of accounts audited

What is the tax liability in an LLP?

Tax authorities classify Limited Liability Partnerships (LLPs) under the category of Partnership Firms, imposing a standard tax rate of 30% on the total income generated by the LLP.

Nevertheless, the personalized approach applied to partners’ tax liabilities sets LLP taxation apart. It computes partners’ individual tax obligations in accordance with their personal contributions to the LLP and the income they derive from their involvement in the firm.

Can LLPs get FDI?

The automatic route allows Foreign Direct Investment (FDI) in an LLP. Limited Liability Partnerships are permitted to engage in business activities in sectors that allow 100% FDI through the automatic route. Further, they must comply with the RBI provisions and file necessary forms.

Can I convert an existing partnership firm or company into an LLP?

Yes, you can convert an existing partnership firm or a company (unlisted) into a LLP. There are many advantages to converting a partnership firm into a Limited Liability Partnership.

Can I convert LLP into a Private Limited Company?

Yes, you can convert an LLP into a Private Limited Company. You can do it by following the provisions for the same provided in the Companies Act.

How can I close my LLP?

You can close an LLP in two ways.

- Declaring a Limited Liability Partnership as defunct

- Voluntary winding up

The MCA can also strike off the name of an LLP from the register in the following cases.

- If the number of partners reduced below 2 for more than 6 months

- The Limited Liability Partnership has not filed its annual forms with MCA for 5 consecutive years

- The LLP is not able to pay off its debts

- The Limited Liability Partnership acts against the sovereignty and integrity of India

- On just and equitable grounds

Conclusion

With the right knowledge and assistance, businesses can harness the advantages of this versatile business structure while ensuring legal compliance and smooth operations. We hope this article on FAQs helps you make a decision about starting an LLP, as well as help you in running it.

CS Shivani Vyas

Shivani is a Company Secretary at Legalwiz.in with an endowment towards content writing. She has proficiency in the stream of Company Law and IPR. In addition to that she holds degree of bachelors of Law and Masters of commerce.