How to Download GSTR 1?

Introduction

Are you looking for a hassle-free way to download your GSTR-1 from the GST portal? Look no further! In this article, we will provide you with a step-by-step guide on how to download GSTR-1, both for offline filing and for already filed GST returns. Whether you prefer offline filing or need a PDF copy of your filed return, we’ve got you covered. Let’s dive right in!

Downloading GSTR-1 for Offline Filing

Step 1: Login to the GST Portal:

To begin the process, log in to your GST portal account using your valid credentials.

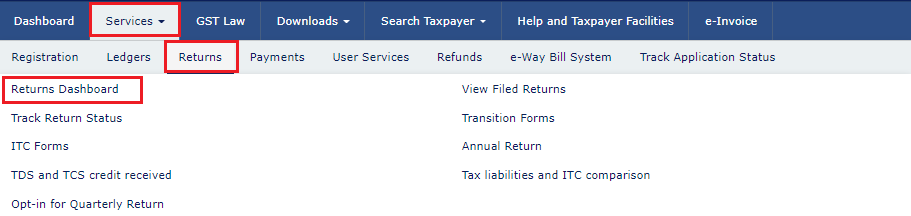

Step 2: Access the Returns Dashboard:

After logging in, navigate to ‘Services’ tab. From their, click on ‘Returns’ and choose ‘Returns Dashboard’ from the drop-down.

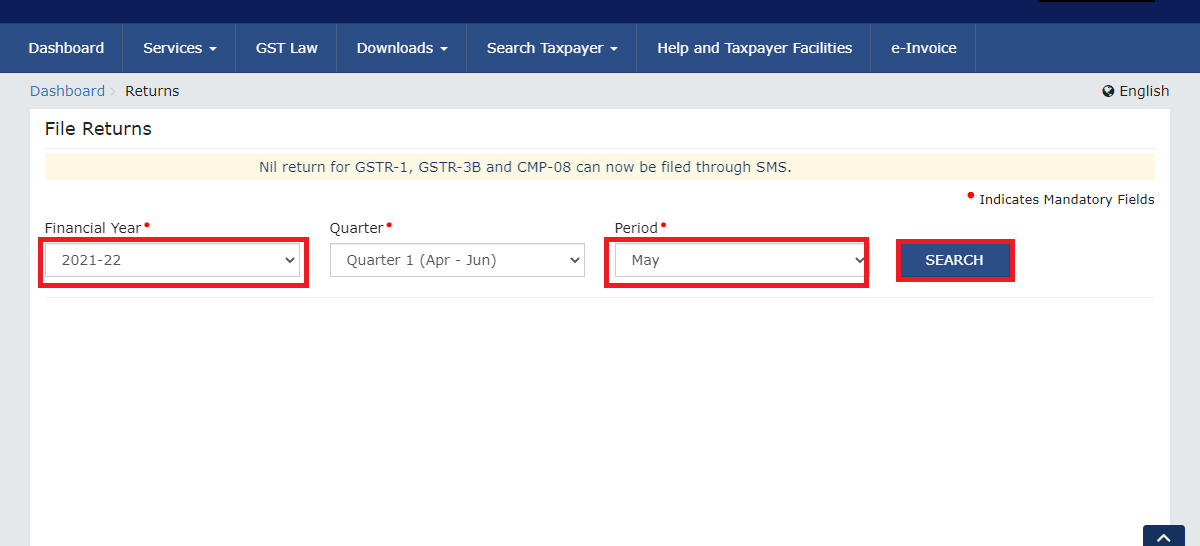

Step 3: Select Period and Year:

Choose the desired period and Year from the respective drop-down menus (Quarter for QRMP taxpayers), and click on ‘Search’.

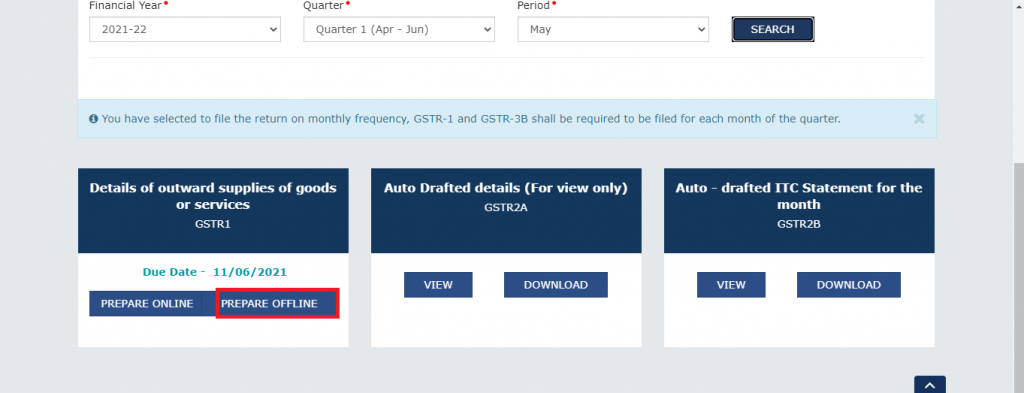

Step 4: Prepare GSTR-1 Offline:

Under the GSTR-1 section, click on ‘PREPARE OFFLINE’ to initiate the offline filing process.

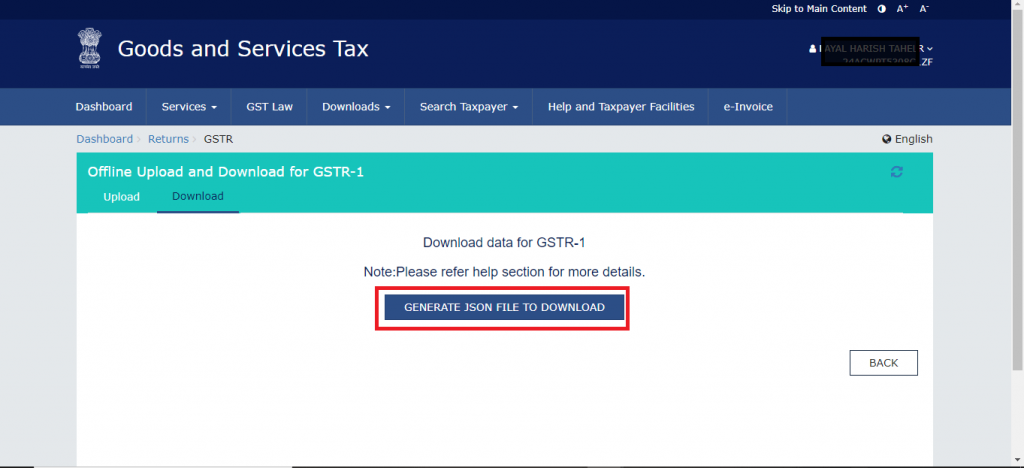

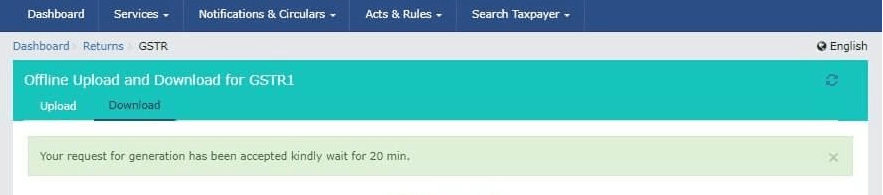

Step 5: Generate the File:

Proceed to the ‘Download’ tab at the top and click on ‘GENERATE FILE.’ This step may take approximately 20 minutes.

Step 6: Download the ZIP File:

The file will take about 20 minutes to be generated. Once the file is generated, you will see a ‘click here’ link, click on it download GSTR-1, it will get downloaded as ZIP file.

Step 7: File downloaded.

File will sucessfully downloaded. You can now open the ZIP file and extract its contents for offline filing.

Downloading Filed GSTR-1:

You might want to download your already filed GSTR-1 for documentation purposed. For that, follow the below guide. You can laso used this guide to dowload other filed returns, such as GSTR-3B Return.

Step 1: Visit the GST Portal and Login

Access the official GST portal by typing the URL into your web browser and login.

Step 2: Navigate to Services:

On the GST portal, click on ‘Services’ tab. Under the ‘Returns’ section, select ‘View Filed Returns.’

Step 3: Choose the Relevant Details:

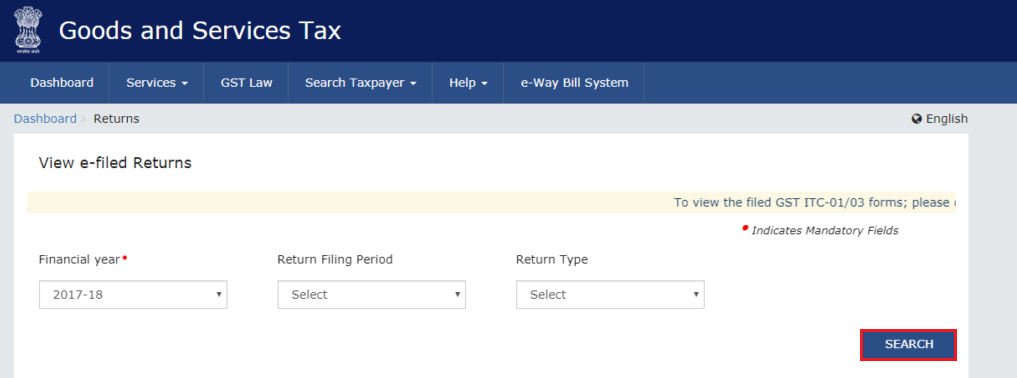

Select the appropriate options for the following:

- Financial Year: Firstly, choose the applicable financial year.

- Return Filing Period: After that, select Annual, Quarterly, or Monthly.

- Return Type: Finally, choose the GSTR form you wish to download

After that, click on the ‘Search’ button.

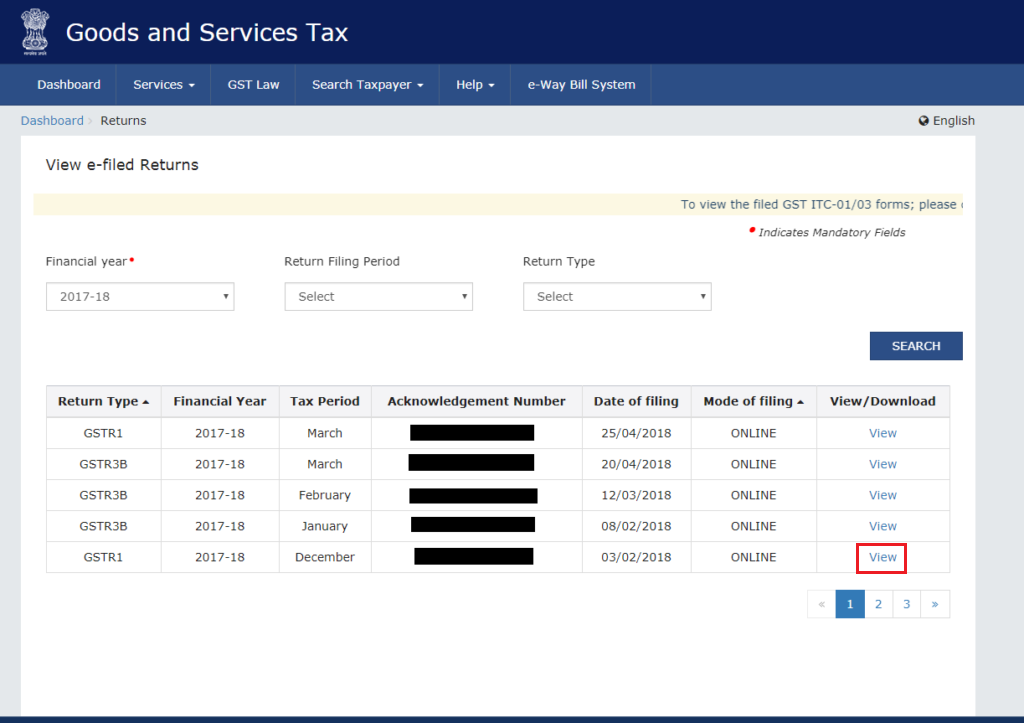

Step 4: View the Relevant Filing

After selecting the return, you will be able to view the relevant filings in a list. Click on the ‘View’ button for the relevant GSTR 1 filing.

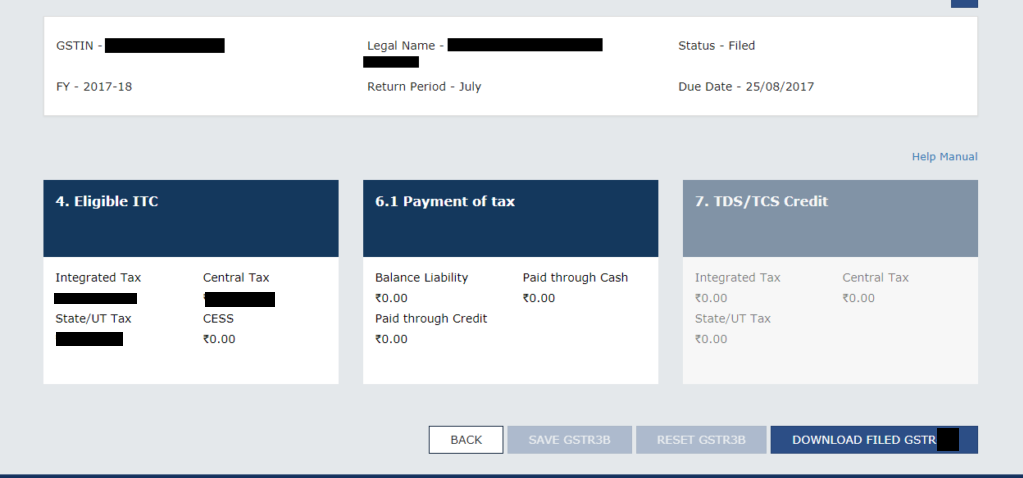

Step 5: Download Filed GSTR-1:

This will open a preview of the filing. Click on the download message at the bottom. The file will be downloaded as a pdf.

Conclusion

Downloading your GSTR-1 from the GST portal is now a breeze with the provided step-by-step guide. Whether you opt for offline filing or need a PDF copy of your already filed return, follow the instructions outlined in this article to obtain your GSTR-1 seamlessly. Stay compliant and keep your GST records organized with easy access to your GSTR-1 downloads.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.