GSTR 4: Return Filing, Applicability, due date and late fees

Are you a registered taxpayer who has opted for the composition scheme under the Goods and Services Tax (GST)? If yes, then you must file the GSTR-4 annual return. In this article, we will guide you on how to file this GST return online and what you need to keep in mind to avoid late fees. Read on to know more about the GSTR-4 and its importance for composition scheme taxpayers.

What is GSTR-4?

The GSTR 4 an annual return is applicable to all registered taxpayers who have opted for the composition scheme under GST. The GSTR 4 is a return that summarizes all the sales, purchases, and taxes paid throughout the year. The return also known as the Annual Return for Composition Dealer. Earlier Composition Scheme taxpayers had to file form GSTR-9A as an annual return. However, from the fianancial year 2019, GSTR-4 annual return has to be filed instead. The composition scheme is a scheme for small taxpayers, which allows them to pay taxes at a lower rate.

Due Date for GSTR 4

The due date for filing the GSTR 4 is 30th April of the following financial year. For example, for the financial year 2022-23, the due date for filing the GSTR 4 would be 30th April 2023. However, it’s important to keep in mind that the govermnet may change this due date from time to time.

How to File GSTR 4 Annual Return Online

To file GSTR 4 online, you need to follow the steps below:

Firstly, login to the GST portal using your credentials.

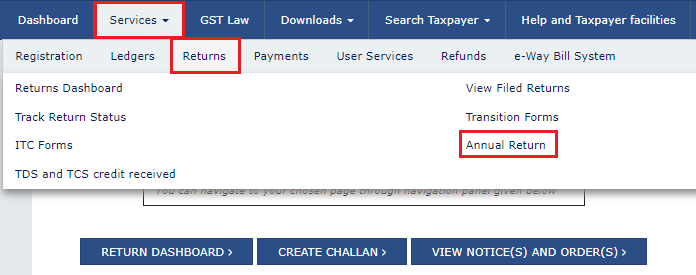

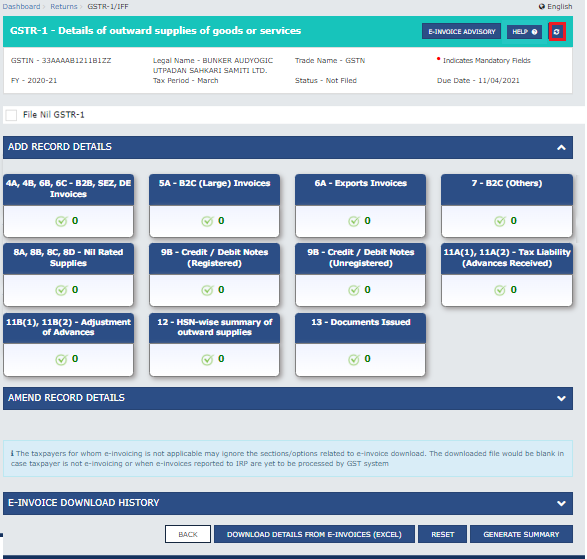

After that, navigate to the ‘Services Tab’. Click on ‘Returns’ and choose ‘Annual Returns’ from the drop-down menu.

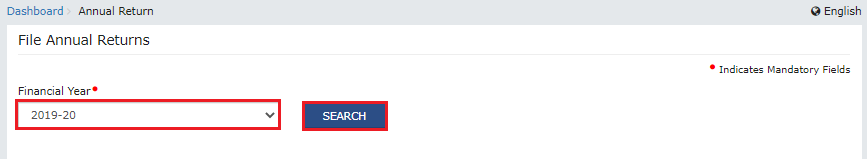

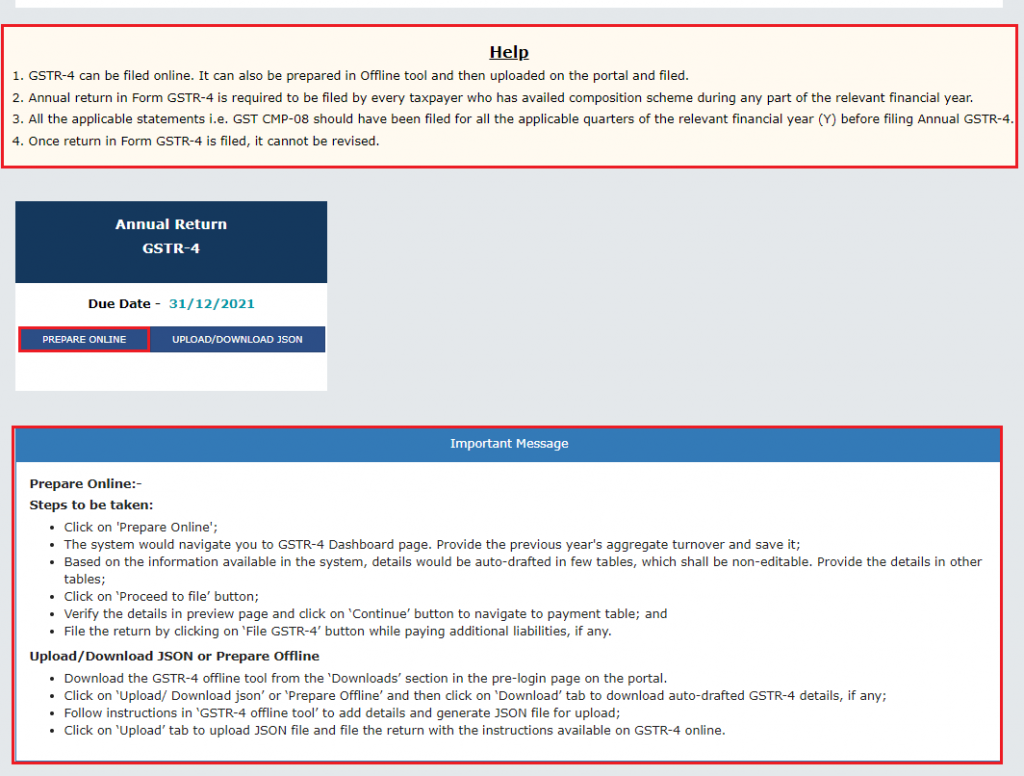

Once that’s done, select the financial year for which you want to file the return and click on ‘Search’.

You will now be on the ‘File Returns’ Page. Here you will find some dialogue boxes and the GSTR-4 annual return tile. Click on ‘Prepare Online’ button on the GSTR-4 tile.

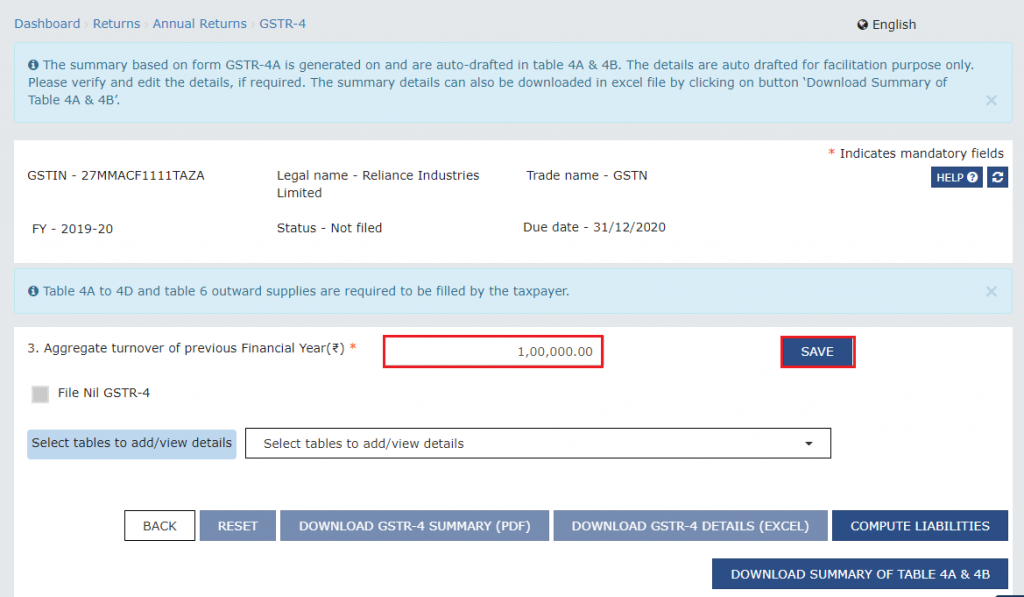

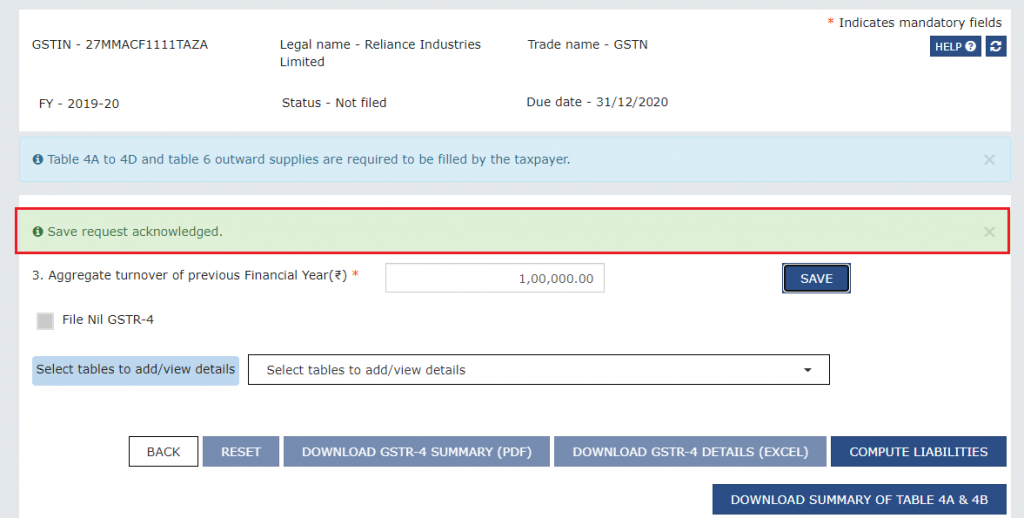

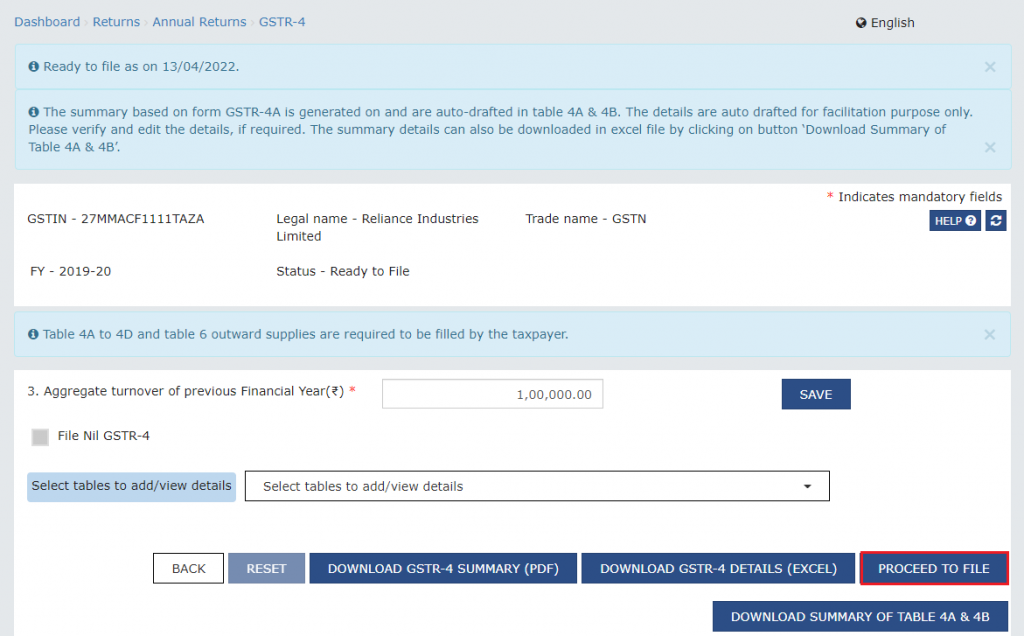

You will now be on the ‘GSTR-4 Annual Returns page’. On this page, you must first enter your aggregate turnover details and then click on the ‘Save’ button.

After this a success message will display if the saving is successful.

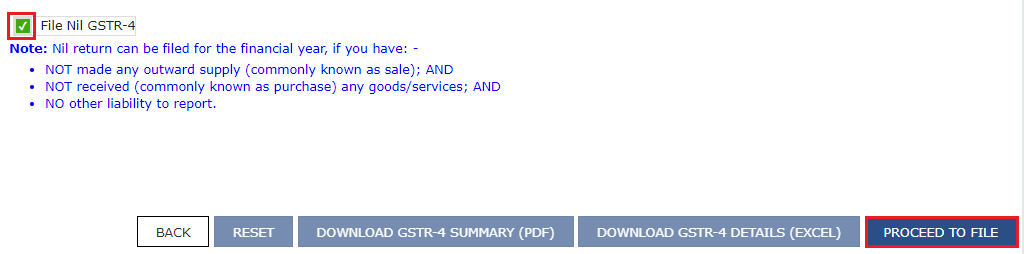

Next you have to decide if you want to file a NIL return or not.

If you want to file a NIL return for GSTR 4, click on the ‘File GSTR-4’ check box and click on ‘Proceed to file’.

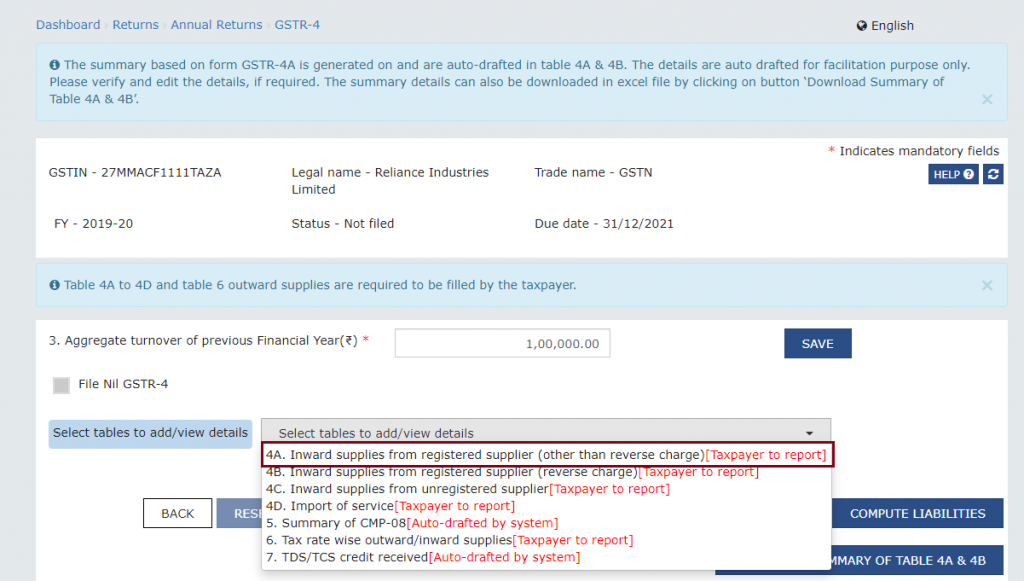

If you dont want to file a non-nill GSTR-4:

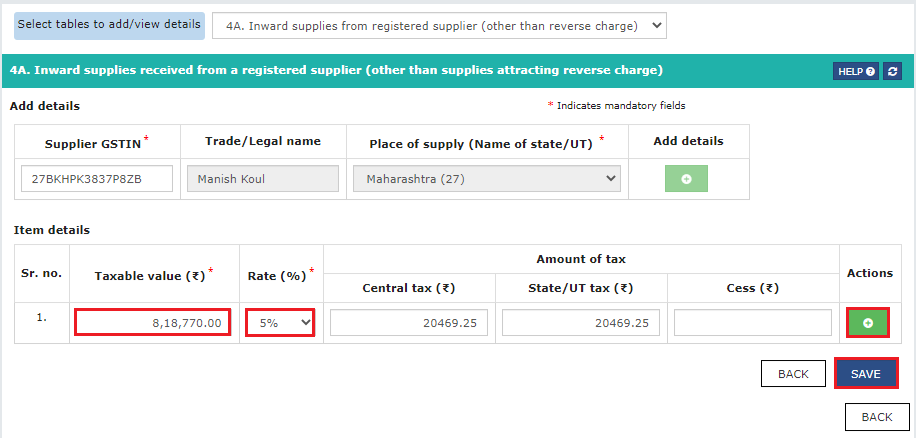

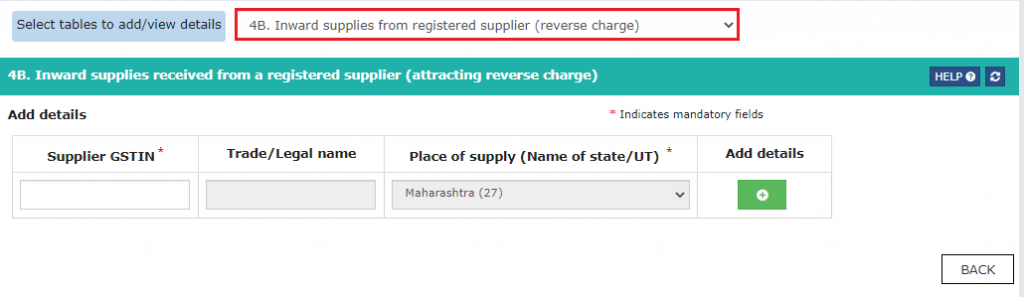

Choose a table from the Drop-down menu

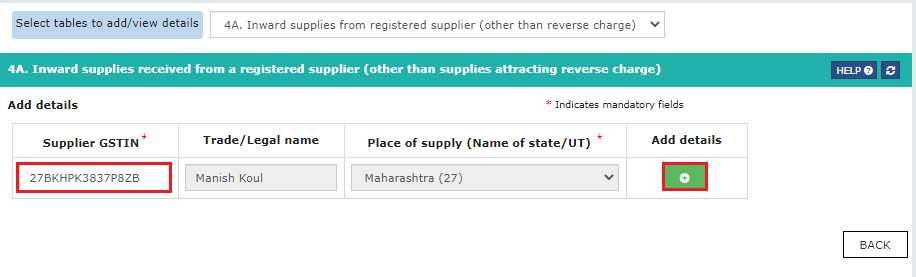

You will be shown the relevant table. Click on the ‘+’ button to add details.

Add all the relevant details, Use the ‘+’ button to add additional details to the table. After you’ve added all the relevant details, clik on the ‘Save’ butoon and then the ‘Back’ button.

This will take you back to the GSTR 4 annual returns page. Choose the next table from the drop-down menu and repeat the above two steps. Do this for all the tables.

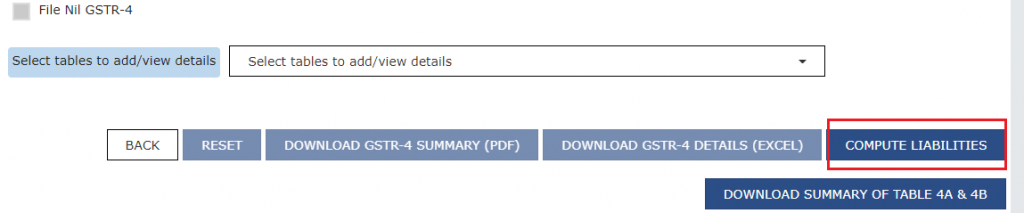

Finally click on the ‘Compute Liabilities’ button.

After sometime, click on the ‘Refresh’ button on the top-right. This will change the ‘Compute Liabilities’ button to ‘Proceed to file’ button.

Click on the ‘Proceed to file’ Button.

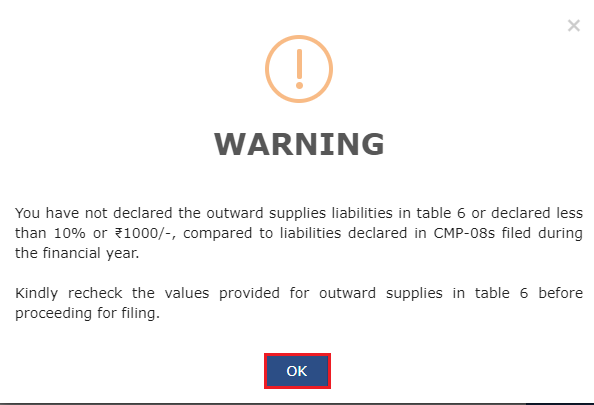

If a warning message displays, click on the ‘Okay’ button.

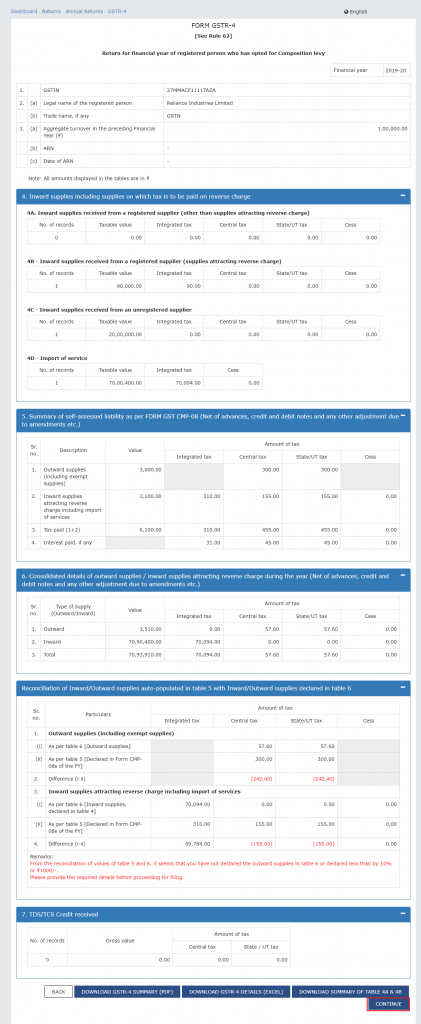

The page will show your GSTR-4 details. Go through all of them and click on ‘Continue’

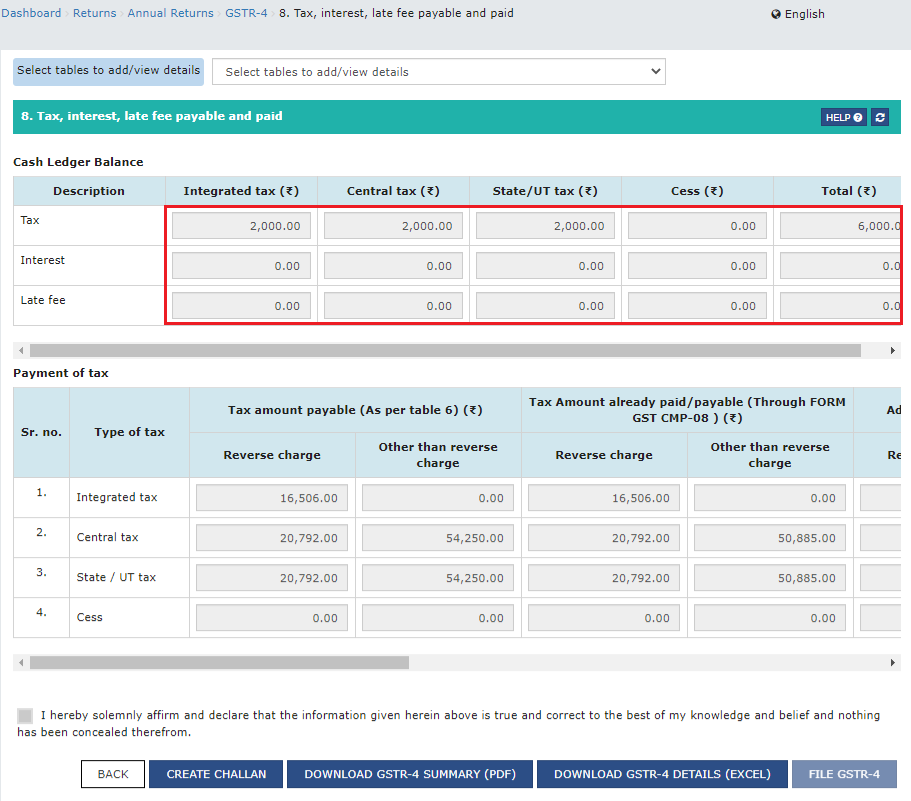

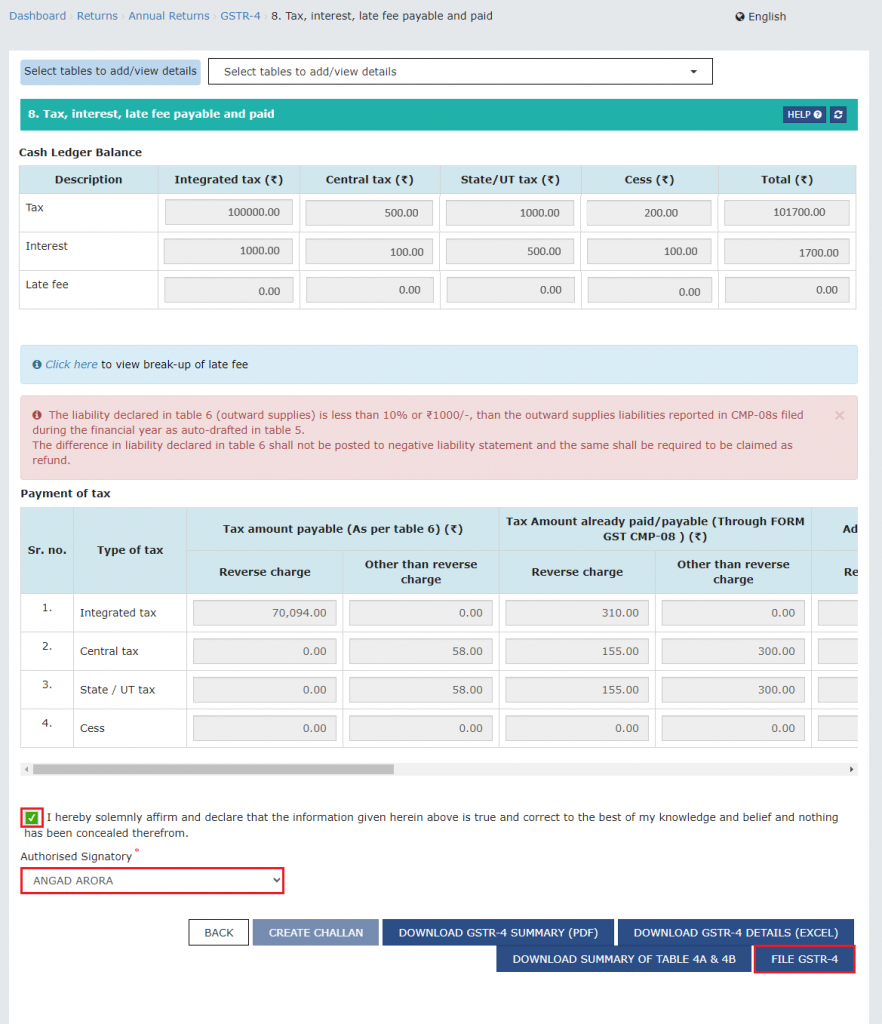

The ‘Tax, Interest, late fee payable and paid’ page will show. It will show what you need to pay as well as the cash balance in your electronic ledger.

Click on the check box and select your name, and click on the ‘File Returns’ button.

Note: If your ledger does not have enough balance, you will not be able to click the ‘File Returns’ button, You will instead have to click the ‘Create challan’ button and generate a challan. To learn how to generate a GST challan, read: How to generate GST challan Online

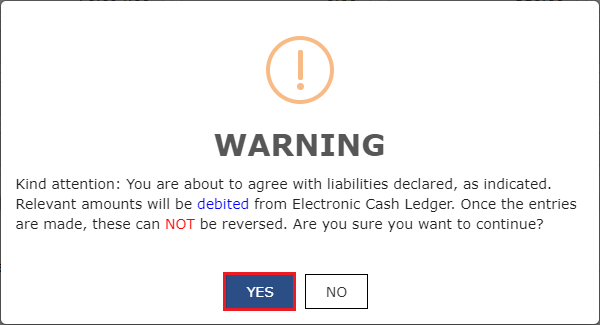

A warning box will show, click on ‘Ok’

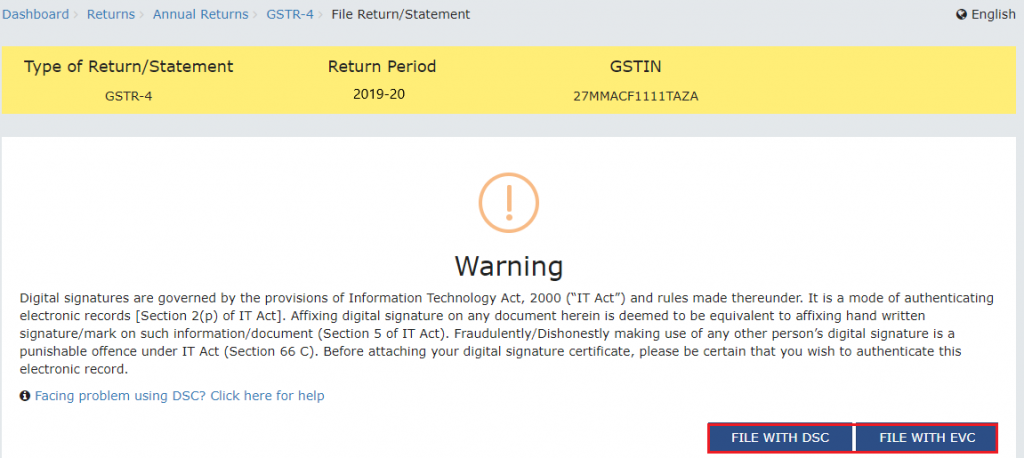

Finally, you will be on the File return/statement page. Choose whether you want to File with DSC or EVC. If you choose DSC you will have to select the approperiate signature next. For EVC you will have to do an OTP verification.

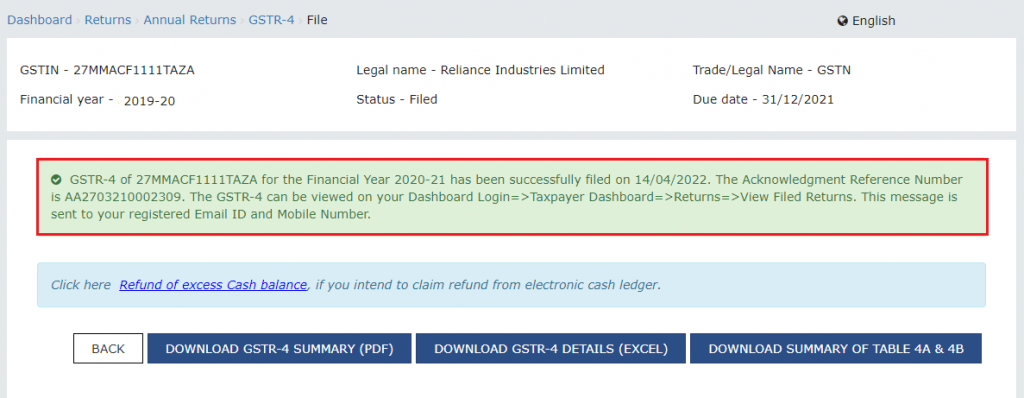

You will be able to see a message stating that your GSTR-4 has been successfully filed. You will also have buttons below to download the same.

Late Fees for GSTR 4 Annual Return

If you fail to file the GSTR 4 annual return within the due date, you will be liable to pay a late fee of Rs. 50 per day. The maximum late fee for normal filing is R.2000, whereas for nil filing it is Rs. 500.

Conclusion

In conclusion, GSTR 4 annual return is a mandatory tax return filing for composition scheme dealers under the GST regime. It is important to understand the applicability of GSTR 4, the due date for filing, and the late fees for non-compliance. Filing of GSTR 4 can also be done using the offline using the utility provided by the government. Non-filing or late filing of GSTR 4 can lead to hefty late fees and penalties, which can be avoided by timely compliance. Additionaly, composition dealers must ensure that they maintain proper records of their transactions throughout the year and file their annual return accurately to avoid any discrepancies or errors.

With the help of technology, filing GSTR 4 has become easier and hassle-free. It is always advisable to seek professional help if one is unsure about the rules and regulations of GSTR 4 filing. With proper knowledge and compliance, composition dealers can avoid any legal and financial implications and ensure a smooth business operation.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.