GSTR-1 Return Format in PDF

Introduction

Goods and Services Tax (GST) has replaced multiple indirect taxes in India. GSTR-1 is one of the essential returns to be filed under GST. It is a monthly (or quarterly for QRMP taxpayers) GST Return filing. It has to be filed by registered taxpayers who are involved in the supply of goods and services. In this article, we will discuss the features of GSTR-1 and the GSTR-1 format.

Features of GSTR-1

GSTR-1 is an important return that captures all the details of outward supplies of goods and services. Youneed to file it on the GST portal Here are some of the features of GSTR-1:

- Monthly/Quarterly Return: Registered taxpayers with an annual turnover of up to Rs. 1.5 crores can file GSTR-1 quarterly, while those with a turnover exceeding Rs. 1.5 crores must file it monthly.

- Details of Outward Supplies: GSTR-1 captures the details of all outward supplies of goods and services made during the relevant period.

- Invoicing Details: GSTR-1 captures the details of all the invoices issued during the relevant period. It also captures the details of any amendments made to the invoices.

- HSN Summary: GSTR-1 captures the summary of all goods and services supplied, classified as per the Harmonized System of Nomenclature (HSN).

GSTR-1 Format

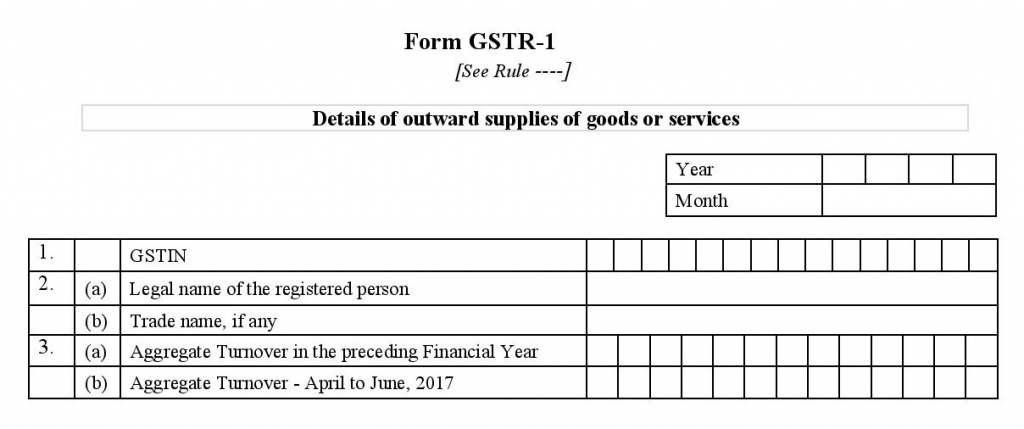

GSTR-1 form captures the details of all the outward supplies made by a registered taxpayer. You can download GSTR-1 from the GST portal. Its PDF format has 15 sections, here are the various sections of the GSTR-1 format:

GSTIN and Legal Name

Forstly, at the beginning of the GSTR-1 format, you need to provide your Goods and Services Tax Identification Number (GSTIN). The legal name of the registered person will be auto-populated based on the information provided during registration.

ARN and Aggregate Turnover

Secondly, the GSTR-1 form also requires you to provide the Application Reference Number (ARN) and the date of ARN filing. Additionally, you need to mention the aggregate turnover. That is the total value of all taxable supplies, exempt supplies, exports of goods or services, or both.

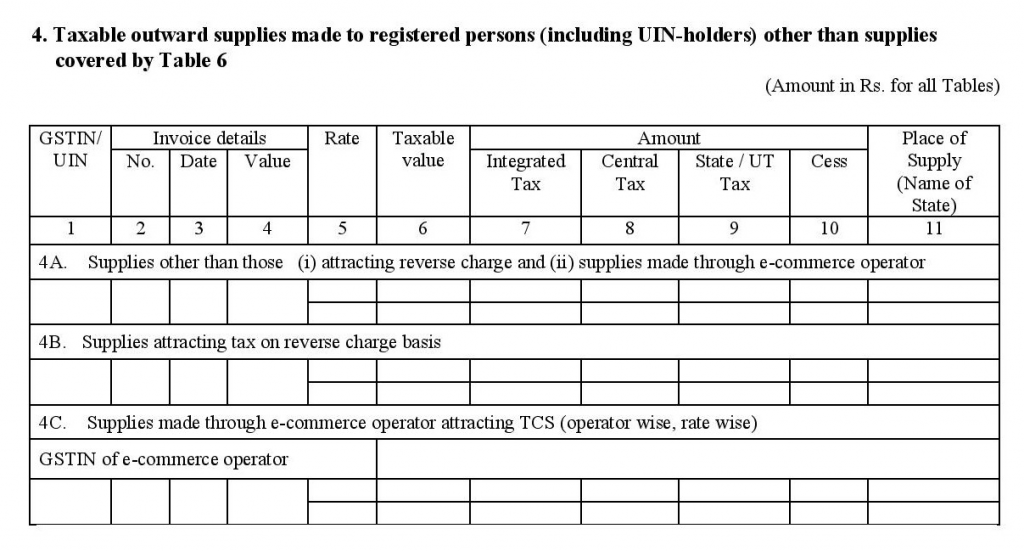

Taxable Outward Supplies to Registered Persons (B2B)

After that, this section of the GSTR-1 format is for reporting the invoice-wise details of taxable supplies made to registered persons. This inlcudes those made through e-commerce operators. It also includes supplies subject to reverse charge.

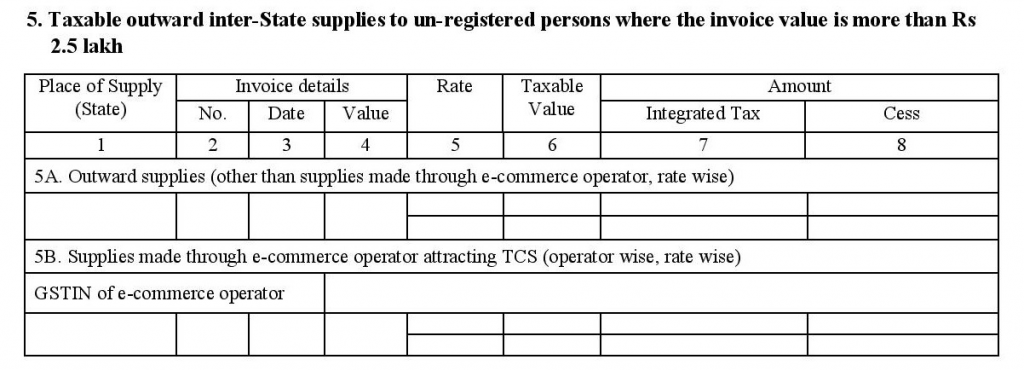

Taxable Outward Inter-State Supplies to Unregistered Persons (B2C)

In this section, you need to mention the invoice-wise details of inter-state supplies made to unregistered persons where the invoice value exceeds Rs.2.5 lakh.

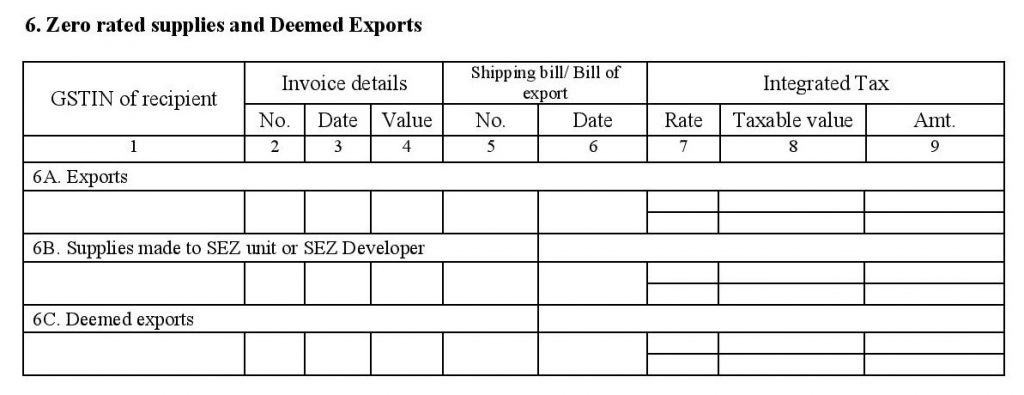

Zero-rated Supplies and Deemed Exports

Here, you must provide details of zero-rated supplies, exports, and deemed exports. This inlcudes supplies made to Special Economic Zones (SEZs) and Export Oriented Units (EOUs).

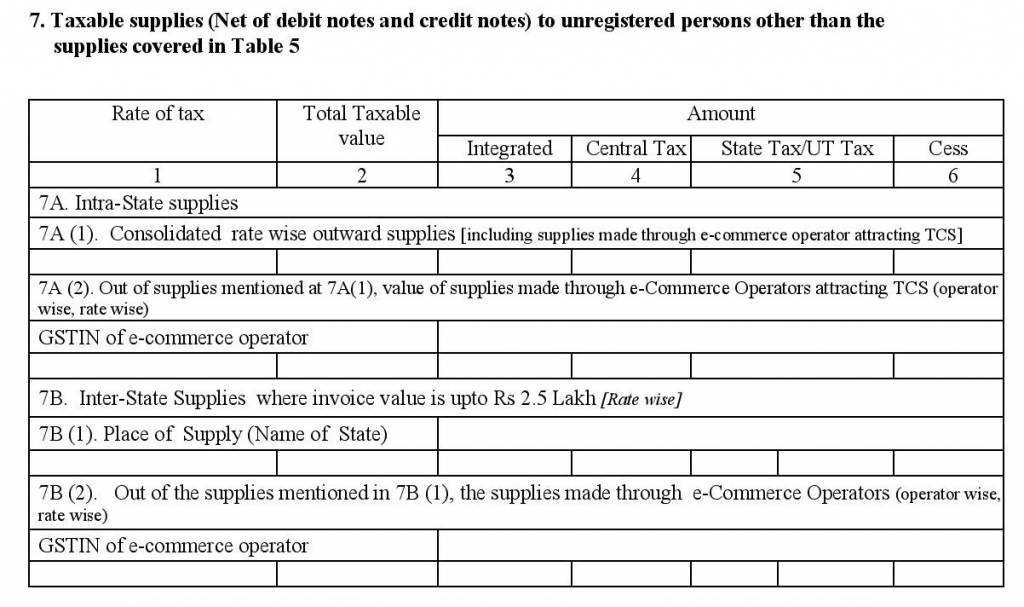

Taxable Supplies to Unregsitered persons (other than those covered in Table 5)

Table 7 of the GSTR-1 format captures the taxable supplies made to unregistered persons. (this excludes supplies covered under Table 5). This table provides a rate-wise summary of sales and supplies for the tax period, including the taxable value and the tax collected under various heads. It includes both intrastate and interstate supplies to unregistered individuals. Let’s take a closer look at the sections of Table 7:

- Intrastate Supplies

- Online B2C Sales

- Interstate Supplies (Invoice Amount greater than Rs. 2.5 Lakh)

- B2C Interstate Sales made Online

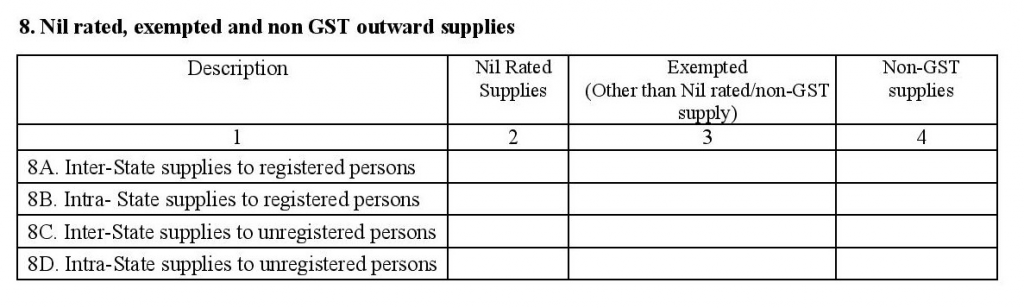

Nil-rated, Exempt, and Non-GST Outward Supplies

All supplies that are nil-rated, exempt, or not liable to GST and have not been reported under any of the previous sections should be mentioned here. It needs to be further bifurcated into inter-state and intra-state supplies made to registered and unregistered persons.

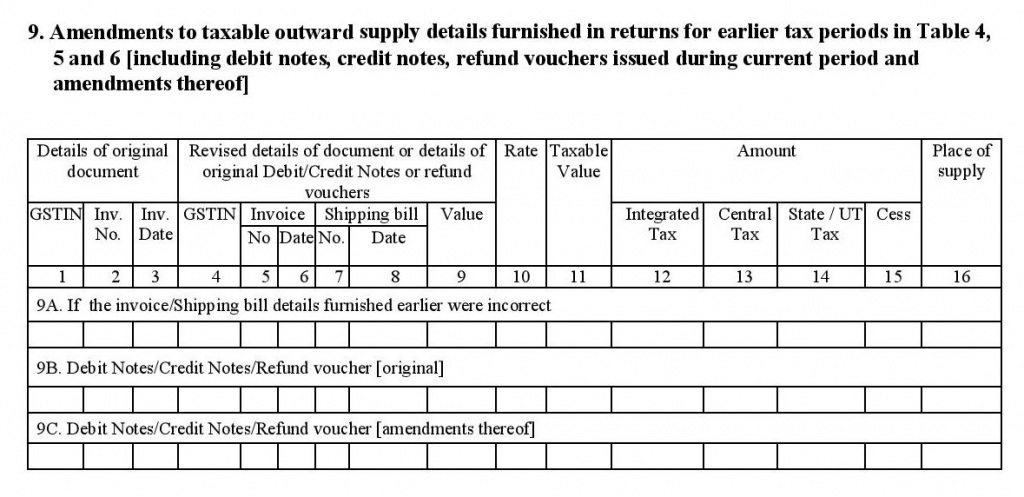

Amendments to Taxable Outward Supplies

This section allows you to make amendments or corrections to the taxable outward supplies reported in previous tax periods. It covers amendments related to B2B supplies, B2C large supplies, exports, and credit/debit notes.

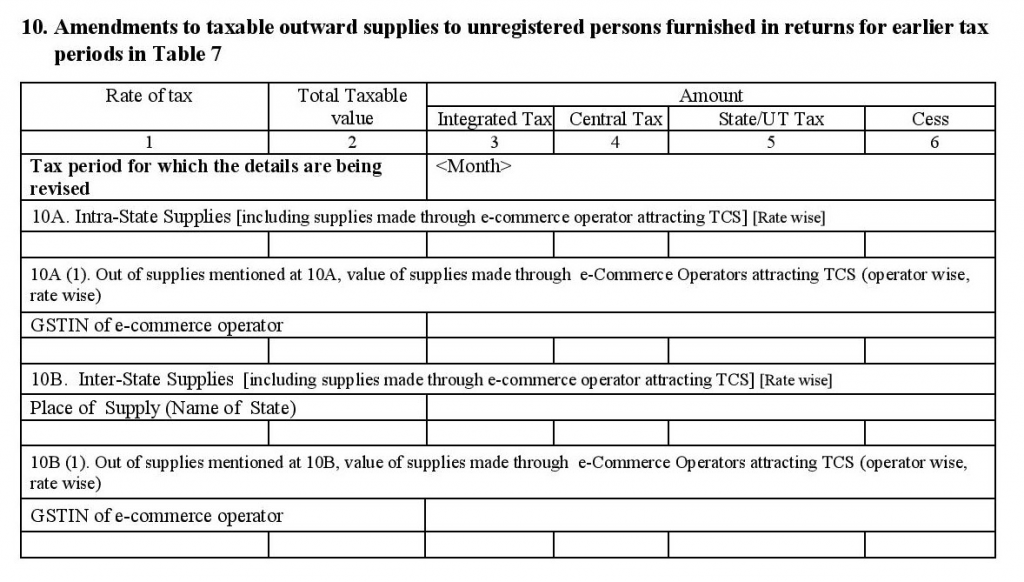

Amendments to Taxable Outward Supplies to Unregistered Persons

Similar to the previous section, this section is specifically for making amendments to the taxable outward supplies reported in previous tax periods in relation to B2C supplies.

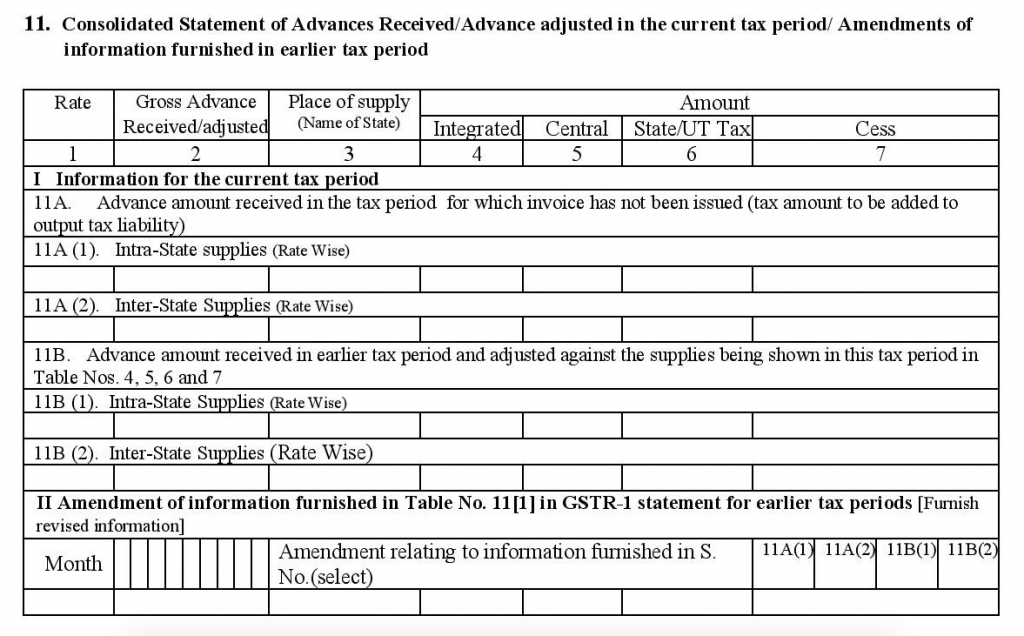

Consolidated Statement of Advances Received

In this section you have to provide details of all advances that you received during the tax period for which you had not raised any invoices.

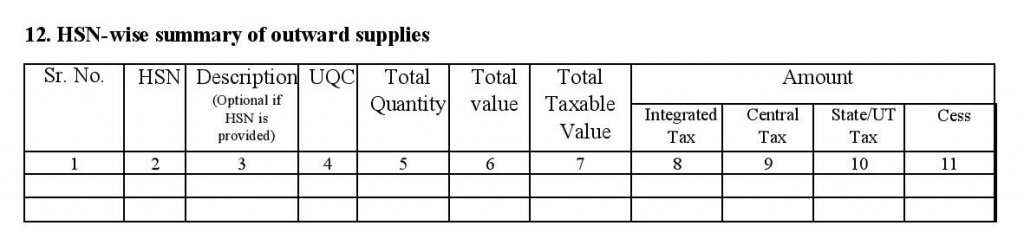

HSN-wise Summary of Outward Supplies

After the anove sections,, you need to provide a summary of the goods sold based on the Harmonized System of Nomenclature (HSN) codes.

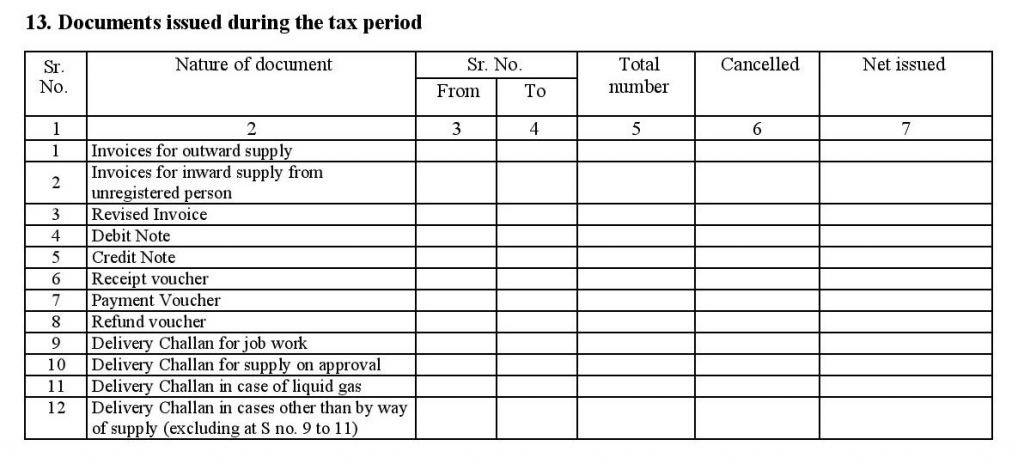

Documents Issued During the Tax Period

This section includes details of all invoices issued during the tax period. This includes revised invoices, debit notes, and credit notes.

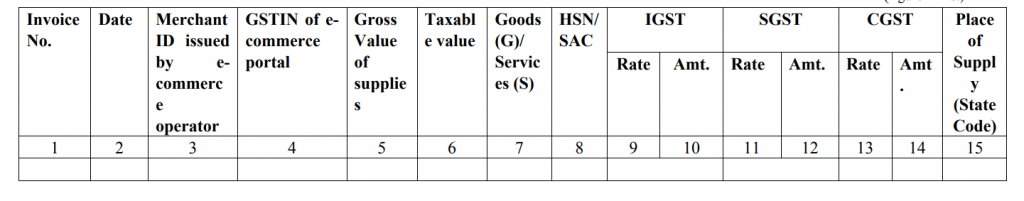

Sales Made Through E-commerce Operators

In this section, e-commerce operators have to report the sales made through their platform on which they have paid tax under Section 9(5) of the CGST Act. It includes reporting the GSTIN of the seller and the buyer for B2B transactions and rate-wise reporting for B2C transactions.

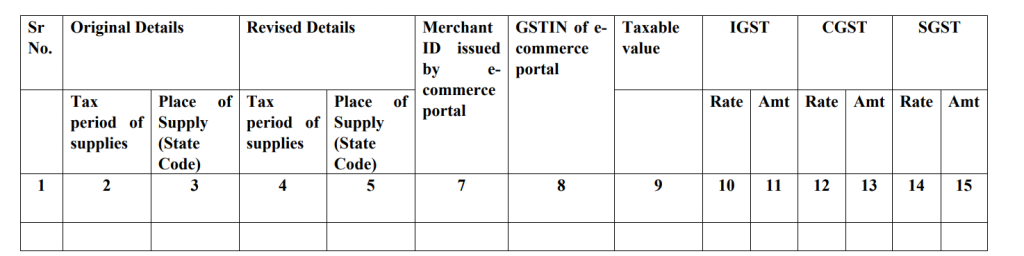

Amendments to Sales Through E-commerce Operators

This section allows you to make amendments to the sales made through e-commerce operators on which they are liable to collect TCS or pay tax under Section 9(5) of the CGST Act. It includes amendments to sales made in previous tax periods.

These are the key sections and components of the GSTR-1 format that businesses need to adhere to while filing their returns. It is crucial to accurately provide the required information in each section to ensure compliance with the GST regulations. Additionally, it is very important to note that taxpayers cannot file GSTR-1 unless they have filed GSTR-3B. To learn how to file GSTR-3B. read: How to File GSTR 3B on GST Portal?

Conclusion

In conclusion, the GSTR-1 format is a comprehensive and structured form. It requires businesses to report their outward supplies and comply with the GST regulations. Hence, by understanding the various sections and components of the GSTR-1 format, businesses can accurately provide the necessary details related to their sales transactions. It is essential to adhere to the prescribed format, timely file the returns, and make any required amendments to ensure compliance and avoid penalties. Moreover, by maintaining accurate records and diligently filing GSTR-1 returns, businesses contribute to the smooth functioning of the GST system and enable transparency in the tax ecosystem.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.