MSME Form-1 – Simplified with instructions

Ministry of Corporate Affairs has taken a vital step to safeguard the micro and small sector businesses. Such businesses were incurring debts due to unpaid or delayed receipts of goods and services provided by them. To find and reduce such debts MCA has introduced a new form in which all specified companies have to file the return with MCA who has made delay in payment to the Micro and small business.

What is MSME Form 1?

It is the new form introduced by MCA. Such form is for the filing of half yearly return for the outstanding payments to Micro or Small Enterprises.

Applicability

Every specified company has to file details of all outstanding dues to Micro or small enterprises suppliers existing on the date of notification within 30 days from 22nd January 2019.

Specified company

All companies including Public, Private and One Person Company who get supplies of goods or services from Micro or Small enterprises and whose payment is due or not paid for more than 45 days are included in the specified company. All such specified companies have to file this form.

Definition of Micro and Small Enterprises

According to the MSME Act, the micro and small enterprises include the following enterprises.

- Company

- LLP

- Partnership firm

- Sole Proprietorship firm

- HUF

- Association of Person

- Co-operative Society, etc

| Sector | Micro | Small |

| Manufacturing- Investment in plant & machinery | does not exceed Rs. 25 Lakh | More than Rs. 25 Lakh but does not exceed Rs. 5 Crore |

| Service- Investment in equipment | Does not exceed Rs. 10 Lakh | More than Rs. 10 Lakh but does not exceed Rs. 2 Crore |

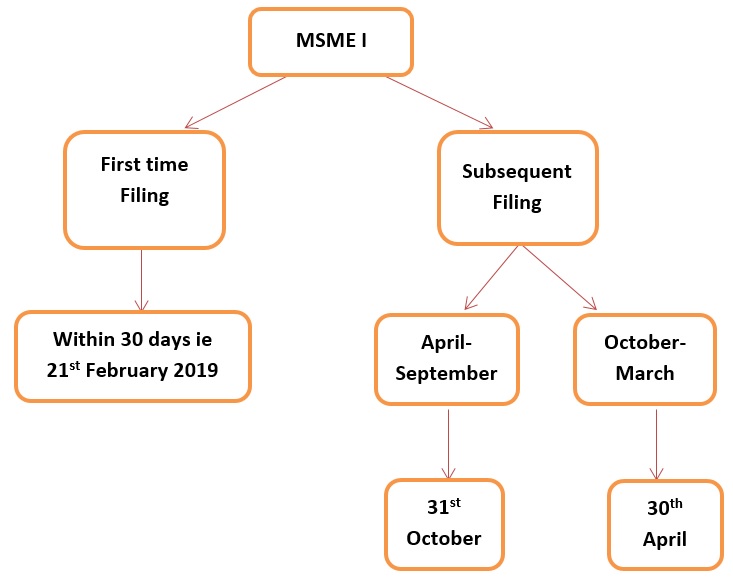

Due Date for filing form MSME 1

The form MSME-1 is to be filed twice every year. But the first time it is to be filed within 30 days from the date of notification which is 21st February 2019. After that half yearly return is to be filed every year. The due date is 31st October for the months April to September and 30th April for October to March of every year.

Exceptions

This form is not to be filed in the following cases.

- An enterprise which falls under the definition of medium enterprises (Manufacturing sector- Investment in plant & machinery is more than 5 crore but does not exceed 10 crores and Service sector- Investment in equipment is more than 2 crore but does not exceed 5 crores).

- If the payment is made within 45 days and there are no pending dues to such enterprises for more than 45 days.

- In case of pending dues for more than 45 days to enterprises other than Micro and Small.

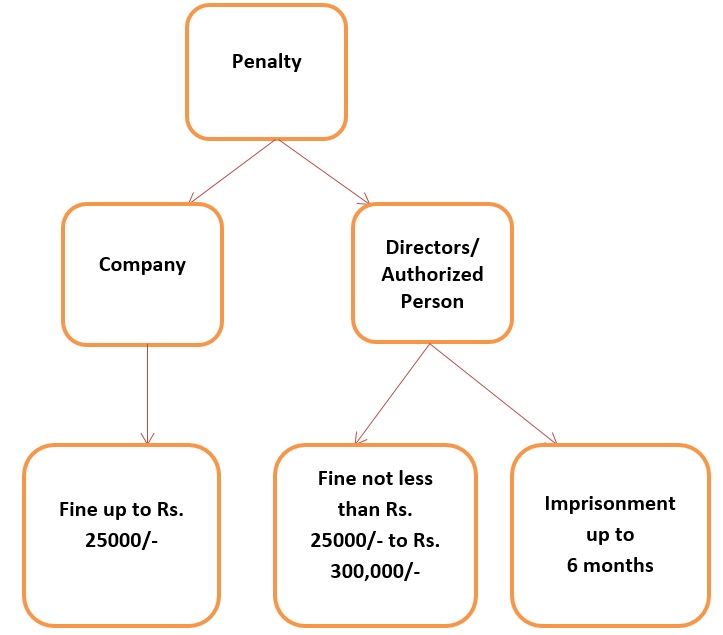

Penalty

In case of non-filing of form or filing incorrect information, the MCA shall charge a penalty to both- the Company and Directors or Authorized person.

Conclusion

All such companies to whom this form is applicable shall file the form within the due dates to avoid hefty penalties. Hence, start finding your suppliers who are Micro or Small enterprises and registered under the MSME ACT and whose payment is due for more than 45 days.

CS Shivani Vyas

Shivani is a Company Secretary at Legalwiz.in with an endowment towards content writing. She has proficiency in the stream of Company Law and IPR. In addition to that she holds degree of bachelors of Law and Masters of commerce.