How to e-file forms 15G and 15H on the Income tax Portal

Introduction

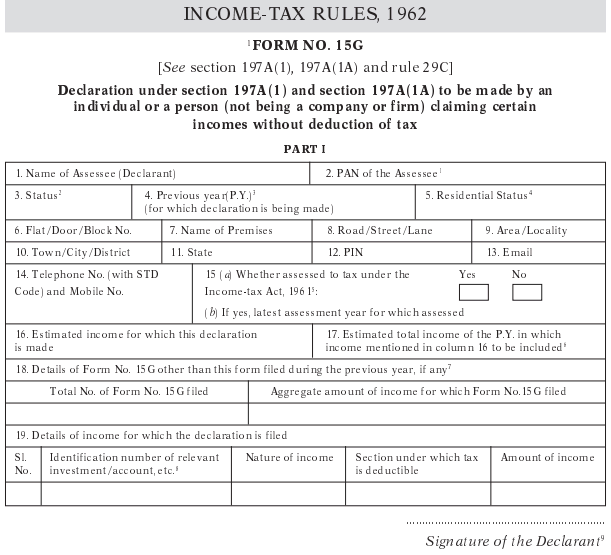

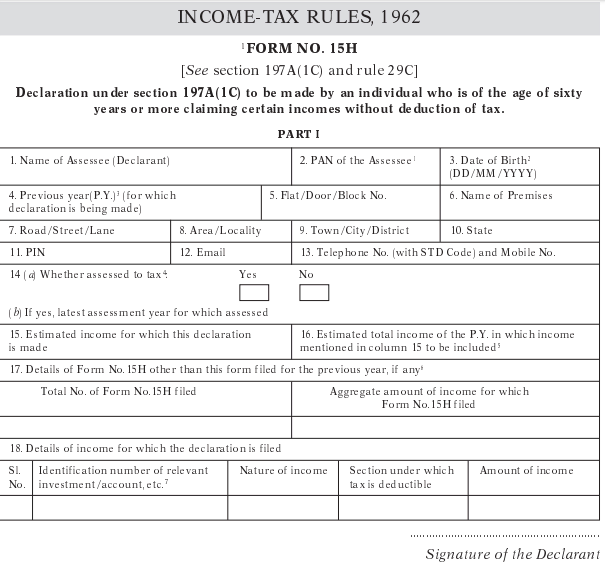

If you’re a taxpayer in India looking to save on TDS (Tax Deducted at Source), you might have heard about Forms 15G and 15H. These forms are a boon for individuals with low taxable income as they allow you to declare that your income is below the taxable limit, hence exempting you from TDS returns. However, to benefit from this, you need to know how to fill out Form 15G and Form 15H correctly and file them electronically. This article will guide you through the entire process, ensuring you get the most out of these forms.

Registration Process

Form 15G and Form 15h are two important forms when it comes to TDS returns. They are both related, however, there are certain subtle but important differences between form 15G and form 15H. To file Form 15G and Form 15H, you need a valid TAN (Tax Deduction and Collection Account Number) and must be registered as a Tax Deductor & Collector on the Income Tax Department’s website. If you haven’t registered yet, follow the process to apply for a TAN first.

Preparation Process

As a tax deductor, you must assign a Unique Identification Number (UIN) to everyone who submits Form 15G and Form 15H. You must retain this UIN for seven years, and it is essential to file these forms quarterly. The UIN consists of:

- Sequence Number: This is a 10-character alphanumeric code starting with ‘G’ for Form 15G and ‘H’ for Form 15H, followed by nine digits (e.g., G000000001 or H000000001).

- The Financial Year: Mention the financial year for which you are submitting Form 15G/H.

- TAN of the Payer: Provide the Tax Deduction and Collection Account Number of the payer.

- To digitize paper declarations, you should digitize them and ensure they use the same ‘running sequence number’ series (Field ‘a’ of UIN) as utilized for online submissions.

- Reset UIN Running Sequence Number: The UIN running sequence number series should reset to 1 for each TAN of the payer at the start of each financial year.

e-Filing Process

Now, it’s time to file the forms. Here’s a step-by-step guide:

- Go to the Income Tax e-Filing Portal.

- Click on ‘e-file’ and then ‘Prepare & Submit Online Form (Other than ITR)’.

- Select ‘FORM 15G/FORM 15H (Consolidated)’ and prepare the XML zip file.

- It’s mandatory to have a Digital Signature Certificate (DSC) to file FORM 15G/15H. Generate a signature for the zip file using DSC Management Utility.

- Log in on the Income Tax e-Filing Portal through TAN.

- Go to ‘e-File’ -> ‘Upload Form 15G/15H’.

- Select the Form Name (either Form 15G or Form 15H), Financial Year, Quarter, and Filing Type. Click ‘Validate’.

- Once the details are validated, you’ll see a success message.

- Browse and attach the ZIP file and Signature file.

- ZIP and Signature files can be generated using the DSC Management Utility.

- Click ‘Upload’. On successful upload, a success message will be displayed.

e-Filing Status

To check the status of your uploaded file:

- Go to ‘My account’ -> ‘View Form 15G/15H’.

- Once you upload the statement, it will change to the status of “Uploaded.”

- We will process and validate the uploaded file.

- After validation, we will update the status to either “Accepted” or “Rejected” within 24 hours of the upload.

- If we mark the status as “Rejected,” we will provide the reason for rejection, and you can then upload a corrected statement.

Conclusion

Filing Form 15G and Form 15H is a crucial step for individuals with low taxable income to save on TDS deductions. By following the steps outlined in this guide, you can successfully file these forms on the Income Tax e-Filing Portal.

Frequently Asked Questions

What is the purpose of Form 15G and Form 15H?

Forms 15G and 15H are self-declaration forms that individuals can submit to declare that their income is below the taxable limit. This helps in avoiding TDS deductions.

Is it mandatory to have a Digital Signature Certificate (DSC) to file these forms?

Yes, DSC is mandatory for filing Form 15G and Form 15H online.

How long should I retain Form 15G and Form 15H?

You should retain these forms for a period of 7 years.

Can I file Form 15G and Form 15H on paper?

No, these forms must be filed electronically on the Income Tax e-Filing Portal.

What happens if my Form 15G or Form 15H is rejected?

If your form is rejected, the reason for rejection will be provided, and you can make the necessary corrections and re-upload the form.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.