CMP 08: Form Filing, Applicability, Due Dates, and Penalties

As a taxpayer, you must file various GST returns and forms to comply with the law. One such form is CMP 08. All taxpayers who have opted for the Composition Scheme have to file CMP-08. In this article, we’ll explain everything you need to know about CMP 08 GST Return filing, such as its applicability, due dates, penalties for late filing, and more.

What is CMP-08?

CMP 08 is a statement cum challan that taxpayers registered under the Composition Scheme must file every quarter. It contains details of the taxpayer’s self-assessed tax liability, including the tax payable on inward and outward supplies. Moreover, you have to fill out this form even if there are no transactions during the quarter. Taxpayers have to file CMP-08 on a quarterly basis. The due date for filing CMP-08 is the 18th of the month following the end of the quarter. For example, for the April-June quarter, the due date for filing CMP 08 is July 18th.

How to File CMP-08

Go to the GST portal and log in with your valid credentials.

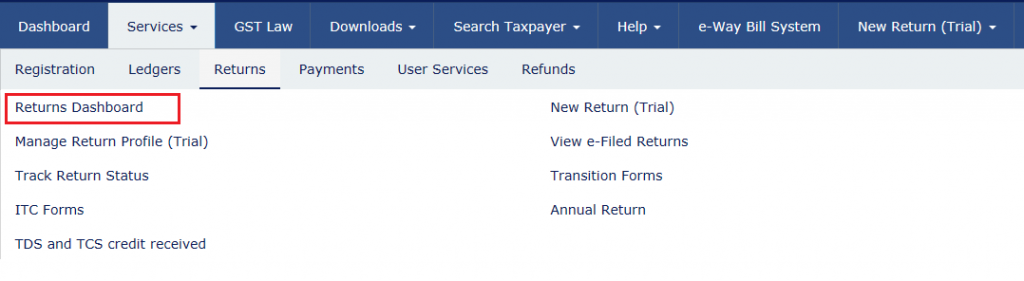

Click on the “Services” tab, choose “Returns” and click on “Returns Dashboard” from the drop-down menu

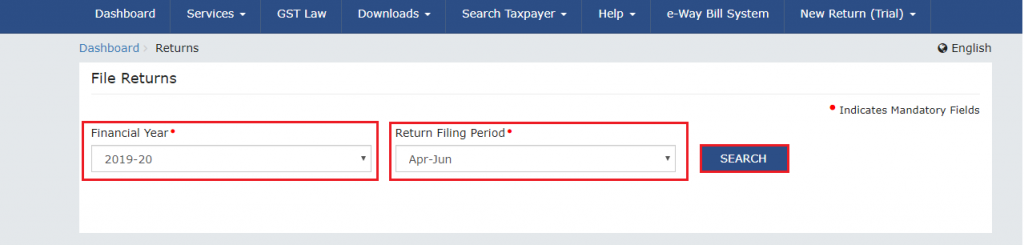

Choose the Financial Year and Return Filing Period (Quarter) for which you want to file the statement and click on the “Search” button.

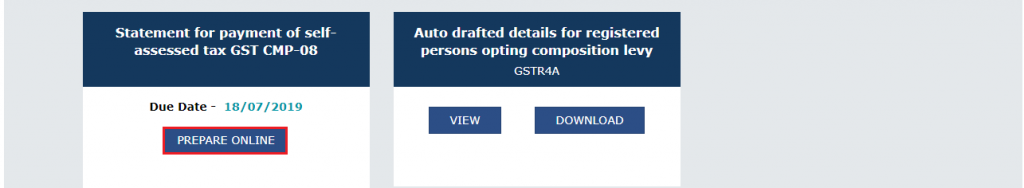

You will now be on the “File Returns” page. Go to the GST CMP-08 tile, and click on the “Prepare Online” button.

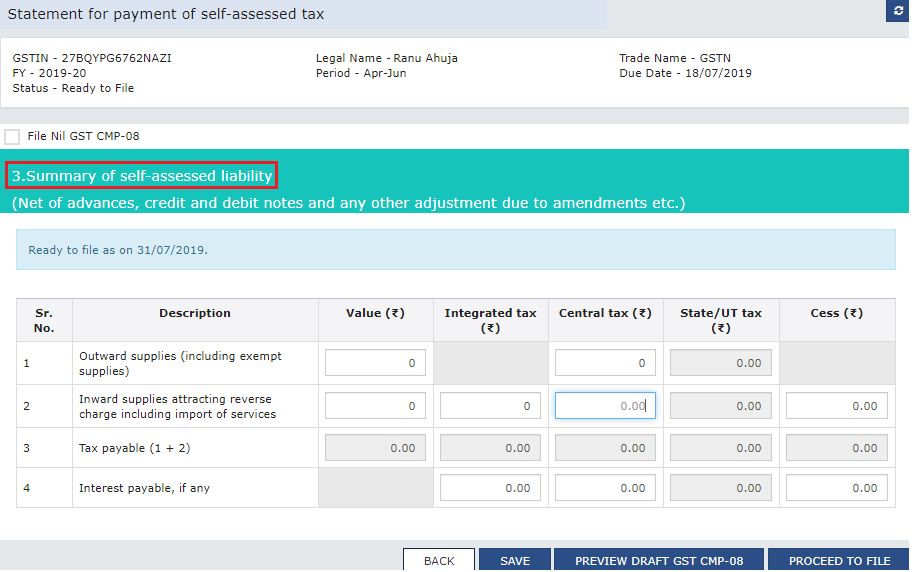

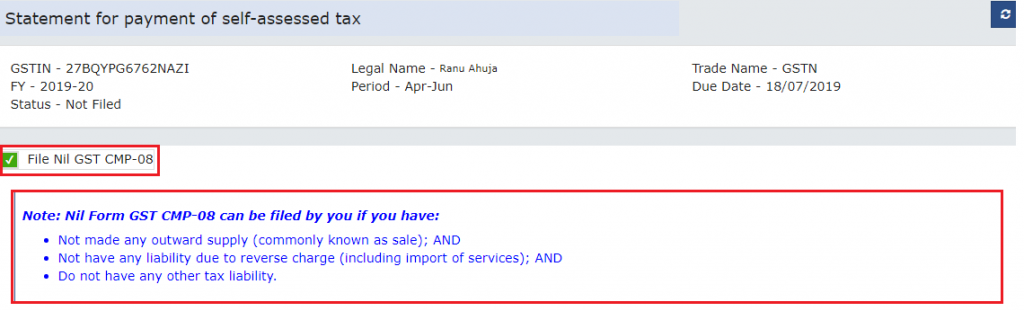

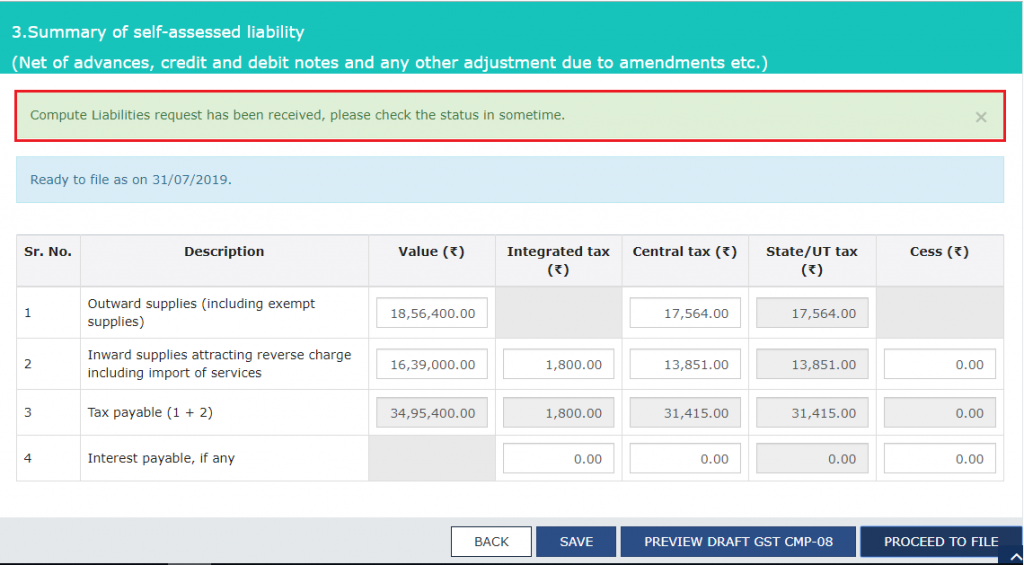

A summary for payment of self-assessed tax will be displayed.

If you are filing a Nil GST CMP-08, select the checkbox for File Nil GST CMP-08 and click on the “Proceed to file button” which will be displayed at the bottom.

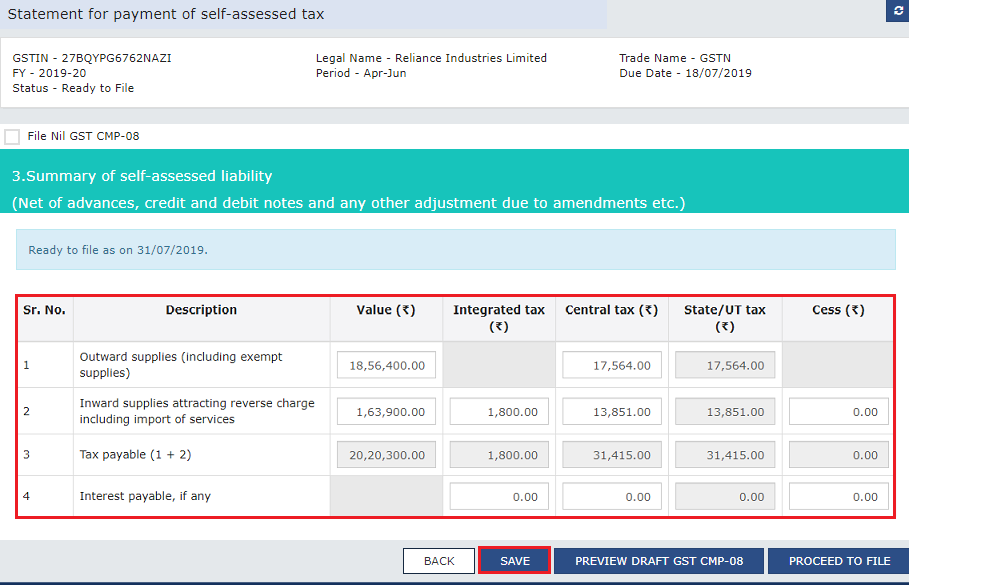

If you are filing a Normal or Non-Nil GST CMP-08:

First, fill in the relevant details in the table that is displayed and click on the “Save” button to save the details.

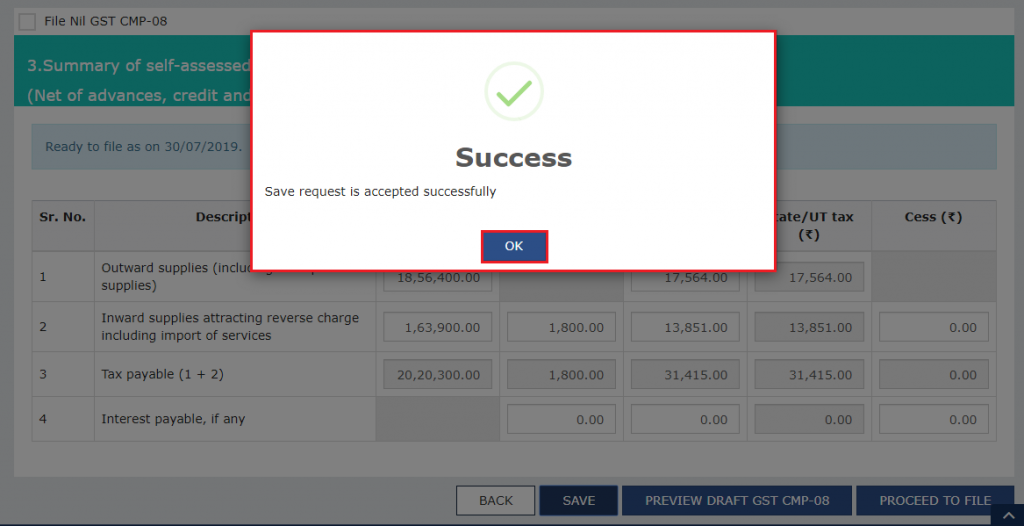

A success message will appear on the screen after you have saved the details. Click “Ok”.

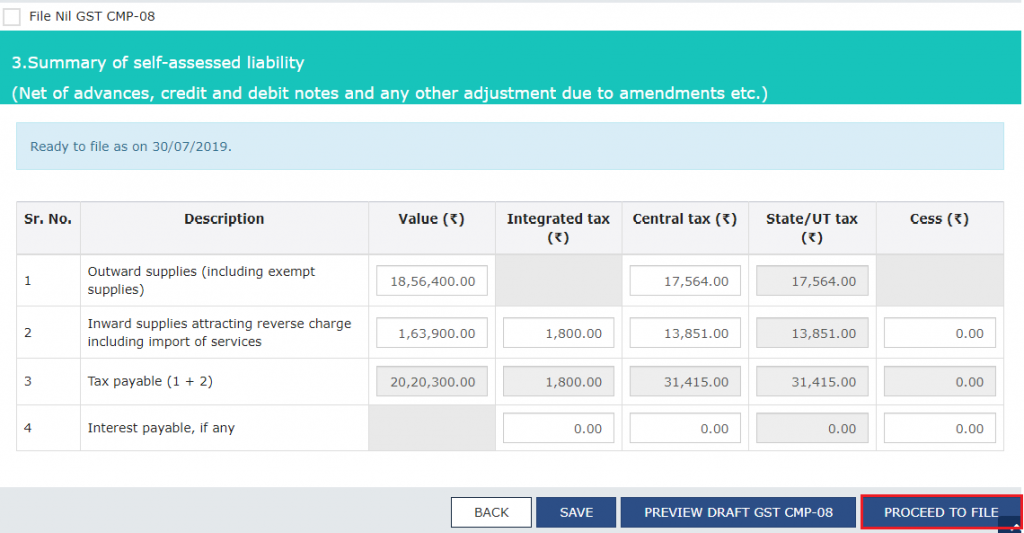

Finally, click on the “Proceed to file” button.

A message will appear in a green box above the table to check the status in sometime.

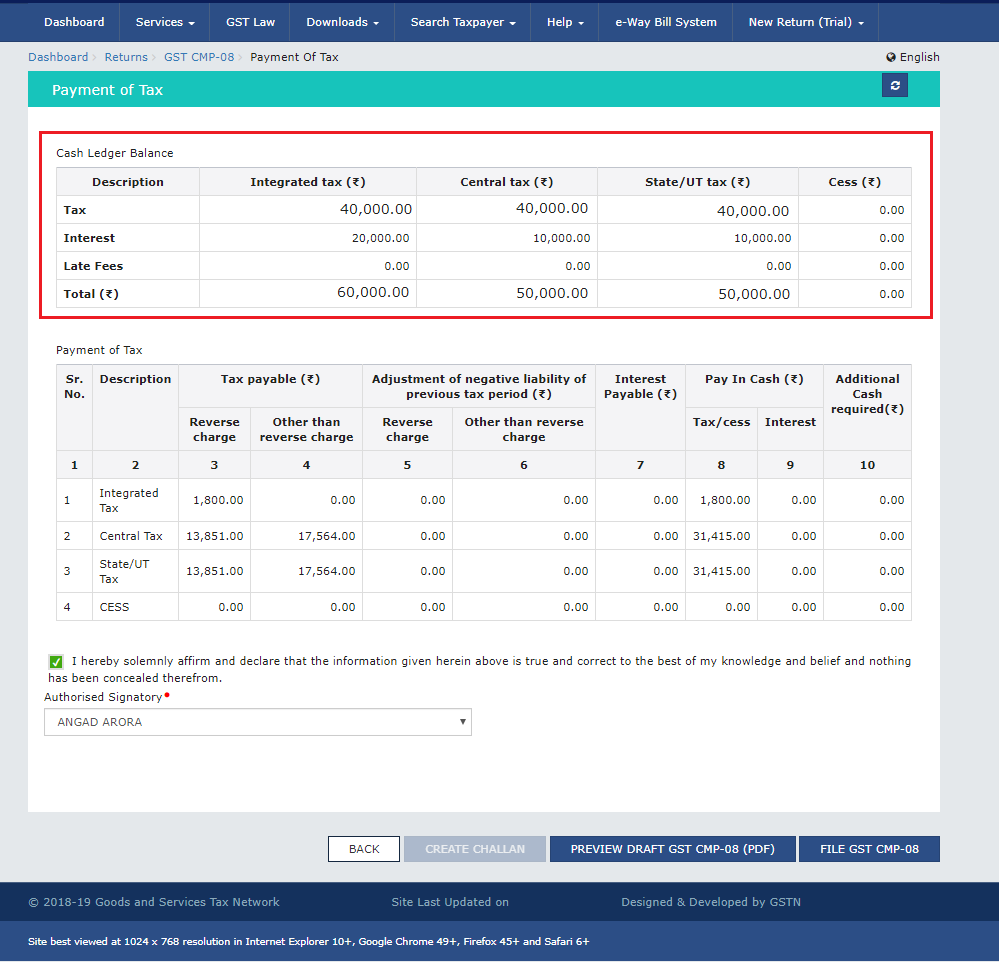

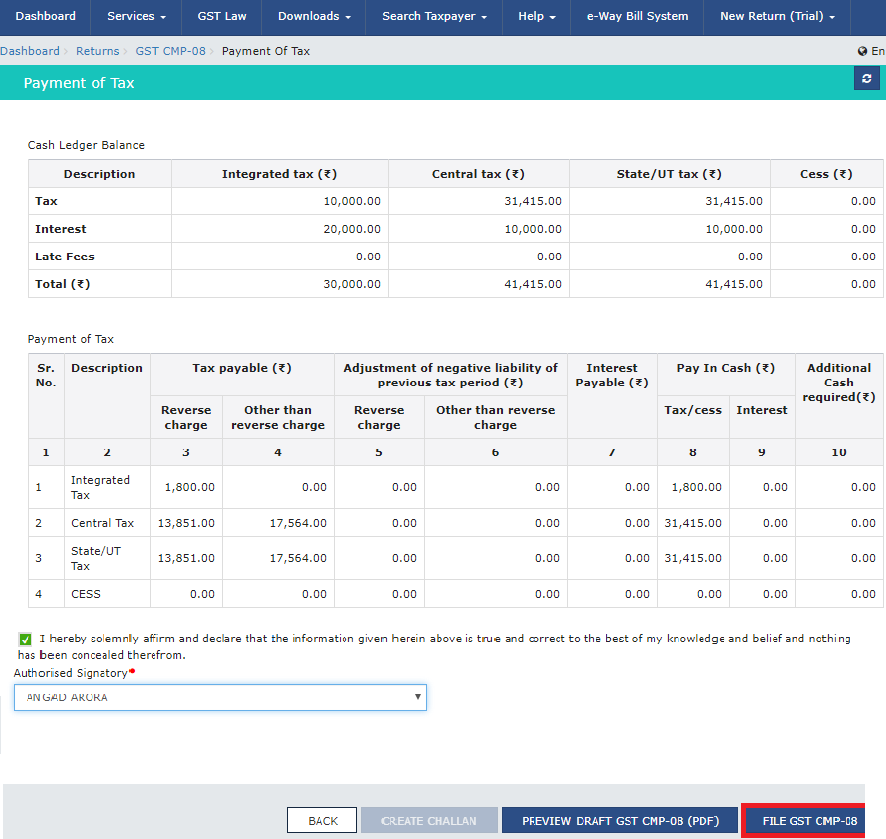

Refresh the screen after some time and the Payment of Tax page will show. Available cash balance as of date in Electronic Cash Ledger is shown to the taxpayer in “Cash Ledger Balance” table.

If all the information is correct, click on the check box and click the “File GST CMP-08” button.

Note: If the available cash balance in Electronic Cash Ledger is less then you need to click on the “Create Challan” button. For a guide on how to create a challan on the GST portal, you should read our article: How to generate GST challan Online

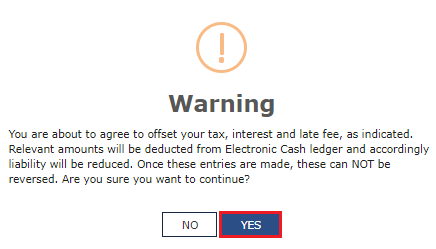

A dialogue box will appear with a message confirming the submission of the form. Click the “Yes” button to proceed.

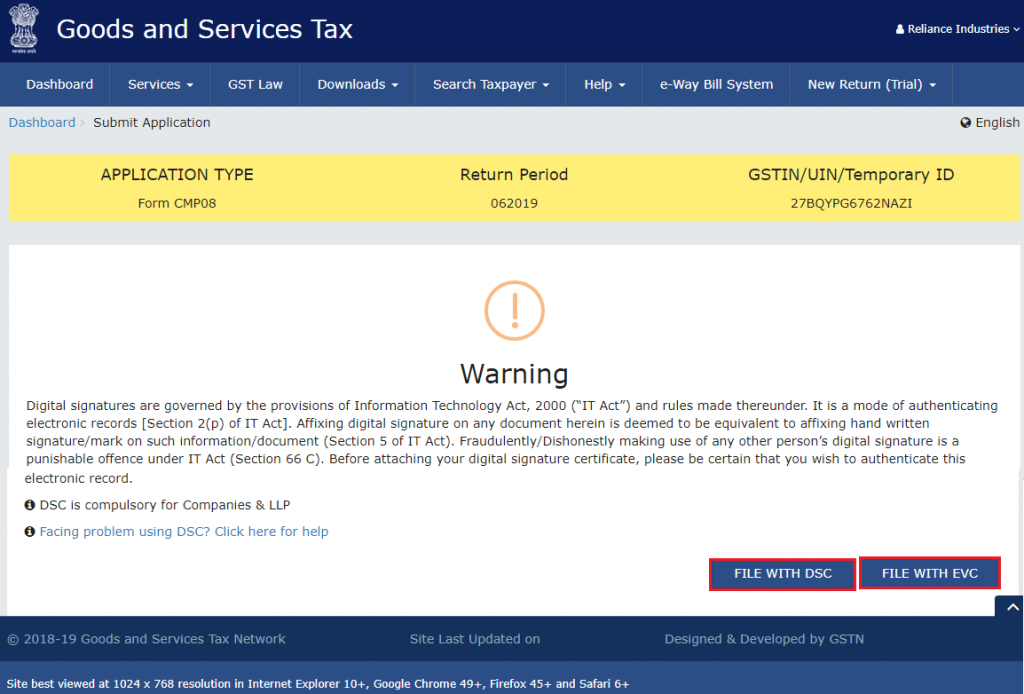

The Submit Application page shows. Click either the “File with DSC” or “File with EVC” button.

If filing with DSC, select the appropriate digital signature certificate and click the SIGN button.

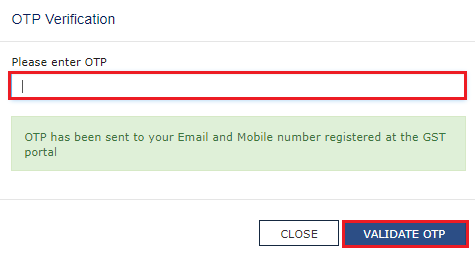

If filing with EVC, enter the OTP sent to the authorized signatory’s registered email and mobile number and click the VALIDATE OTP button.

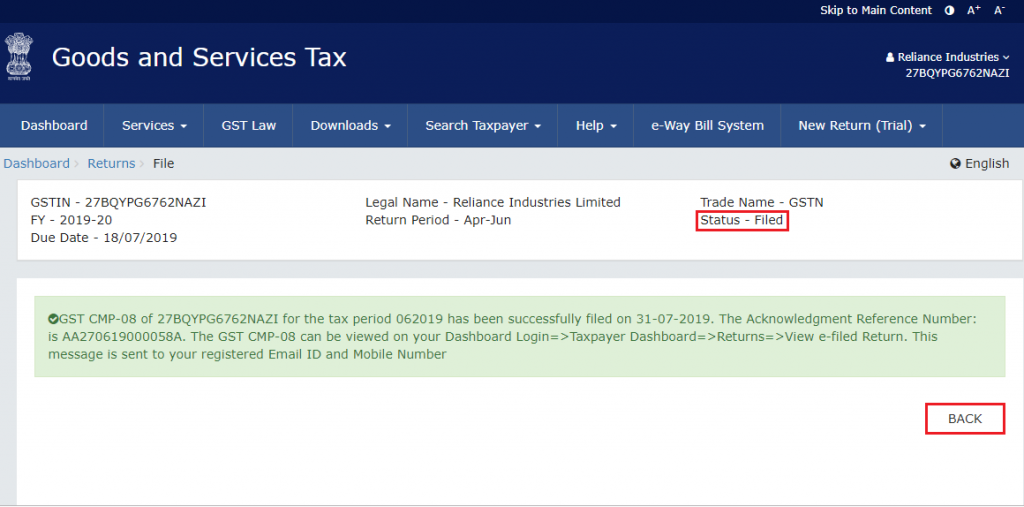

After the form is filed, a success message with the ARN (Application Reference Number) shows on the screen. The status of the Form will change to “Filed”. You can also click on the Back button to download a copy of your filed return.

Late Fee for CMP 08

If a taxpayer fails to file CMP 08 within the due date, a late fee of Rs. 200 per day (Rs. 100 under CGST and Rs. 100 under SGST) is charged until it’s filed. Additionally, the maximum late fee that can be levied is Rs. 5,000. If there is no tax liability for the quarter the late fee is Rs. 50 per day (Rs. 25 under CGST and Rs. 25 under SGST).

Conclusion

In conclusion, CMP 08 is a crucial form that GST taxpayers under the composition scheme need to file quarterly. Filing the form on time is very important because that can help businesses avoid any late fees or penalties. Understanding the applicability, due dates, and penalties associated with CMP 08 is essential for businesses that have opted for the Composition Scheme to comply with GST regulations. It is also important for businesses to keep in mind the implications of late filing, as the late fee can accrue quickly. Hence, it is advisable to seek the guidance of a tax professional or accountant to ensure the proper filing of CMP 08 and other GST returns. By staying compliant and up-to-date with GST regulations, businesses can avoid potential financial liabilities and focus on their core operations.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.