How to check GST Registration Status with ARN?

Introduction

If you have recently applied for GST, it is essential to check your GST registration status to ensure that the process is moving forward smoothly. You can track your GST ARN status with the Application Reference Number (ARN) that you receive upon successful submission of your GST registration application. In this article, we will discuss how to check GST registration status with ARN and provide some helpful tips to track GST application status.

What is GST

GST or Goods and Services Tax is a comprehensive indirect tax system that has replaced various indirect taxes like excise duty, VAT, and service tax. GST has made the tax structure more straightforward and more transparent, and it has become mandatory for businesses in India to register under GST if their annual turnover exceeds a certain limit. ARN or Application Reference Number is a unique identification number; every GST application has an ARN.

Process to check GST registration status

To check GST registration status with ARN, you need to follow these simple steps:

Firstly, visit the official GST portal.

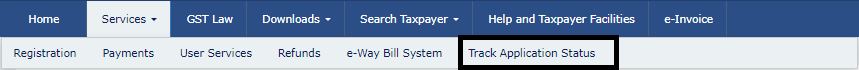

Next, click on the ‘Services’ tab and select ‘Track Application Status’ from the drop-down menu.

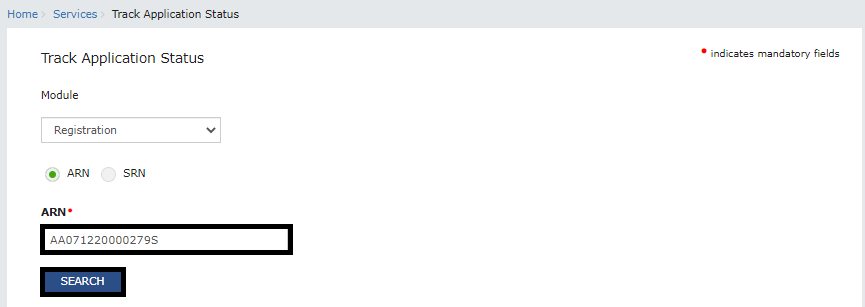

After that, select registration as your module.

Next, type in your ARN and click on the “Search” button.

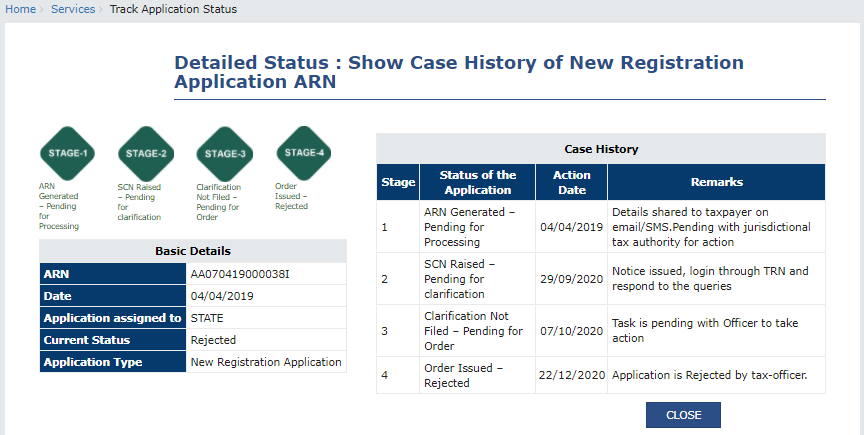

Finally, you will be shown your GST status.

Note: Apart from the official GST portal, there are other ways to check the GST ARN status. You can also conduct a GST ARN status check through SMS or email. However, the most reliable and efficient way to check GST registration status with ARN is through the official GST portal.

Meaning of different GST statuses

Once you have completed the above steps for checking GST registration status, you will see the status of your GST application. Your GST application might have any of the following status:

Pending for processing

If your GST application track status is ‘Pending for processing’, it means that your application is still under review, and you need to wait for further updates.

Site Verification Assigned

If on checking your GST registration status, it says “Site Verification Assigned”, that entails that your application is marked for site visit and verification to the Site Verification Officer.

Site Verification Completed

Once verification officer has completed their verification process, they submit its report to the tax officer.

Pending for Clarification

If the tax officer seeks any clarification, they issue a notice to the Applicant.

Clarification filed

This status is shown when you submit the clarification and are awaiting the order from tax officer.

Provisional registration granted

If your GST application track status is ‘Provisional registration granted’, it means that you can start doing business, but you still need to submit additional documents.

Approved

If your GST application track status is ‘Approved’, it means that your registration is complete, and you can start doing business without any further delay.

Invalid ARN

This means that the Application Reference Number (ARN) you entered is incorrect or has been rejected by the GSTN.

Cancelled

If your GST application track status is ‘Cancelled’, it means that your registration has been cancelled due to non-compliance or other reasons.

Rejected

If your GST application track status is ‘Rejected’, it means that your application has been rejected due to some errors or discrepancies. Accordingly, in such a case, you will need to rectify the issues and reapply for GST.

Withdrawn

This means your application is withdrawn, either by you or by tax officer.

Additional Tips

To help you track GST application status more efficiently:

Keep your ARN handy

Firstly, you need your ARN to track GST application status, so make sure to keep it safe and easily accessible.

Check regularly

Secondly, checking your GST registration status regularly will help you stay informed and take appropriate action if required.

Follow up with authorities

Finally, you should follow up with the GST authorities for an update if your GST application stays stuck at a specific status for too long.

Download your GST Certificate!

If your GST status is approved, you should download the GST registration certificate. The reason behind this being, that the GST certificate can come handy in any government related process you come across.

To help you avoid errors in the GST application:

Use correct information

Firstly, make sure to enter the correct details like PAN, Aadhar, bank account details, etc., in the GST application.

Verify documents

Secondly, check and verify all the documents before submitting them along with the GST application.

Consult a professional

Moreover, if you are not confident about filling up the GST application, it is advisable to seek professional help from a chartered accountant or a GST practitioner.

Conclusion

In conclusion, checking the GST registration status with ARN is a crucial step in the GST application process. By following the steps mentioned in this article, you can easily check the GST ARN status and keep track of the progress of your GST application. Regularly checking the GST application track status and taking necessary actions can help ensure a smooth and hassle-free registration process. Hence, make sure to check the GST registration status with ARN and take the necessary steps to avoid errors in the GST application.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.