Change in Partnership Deed: Know the Reasons and Procedure

Partnerships are one of the easiest business structures when it comes to formation and management. Minimum compliance requirement and straightforward dissolution rules make it one of the preferred choices for the small-scale business.

A partnership is basically formed when two or more individuals come together with an intention of earning profit from a common business activity. The works and terms of partnership firm are governed by the Partnership Deed, which is executed at the time of formation itself. However, during the course of this partnership, many instances may arise when few changes in the terms of partnership may be required.

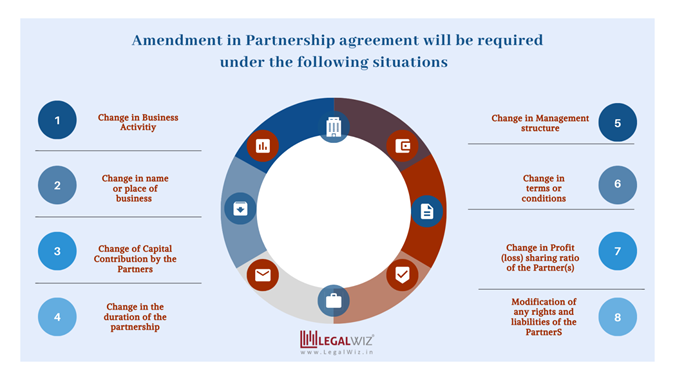

Instances that attract change in Partnership Deed frequently

- Change in Business Activities: This may include an addition, alteration or removal of business activities carried on by the partnership firm.

- Change in Name or Business Place: The partners can mutually decide to change the name of partnership and business place as and when required. These changes will not only invite the change in deed, but also the PAN card and other documents or registration in name of the firm.

- Change of Capital Contribution: Capital is the blood of business and so the need may arise frequently. Although working capital can be added more frequently, increase or decrease in the fixed capital also takes place once in a while. The change may be:

- Addition of capital in partnership.

- Reduction in the capital of partnership.

- Change in ratio of capital introduced by the Partner(s).

- Change in Management structure: Many firms decide on who shall be handling and responsible for certain work or department for better management of work. Where the designations or related changes are required, one can also amend the deed.

- Change of Terms or Conditions: The change in terms of the partnership or related to any clause is included here. It also includes a change in the manner of

- Addition of Partner;

- Appointment of Partner;

- Expulsion of Partner;

- Retirement of Partner; or/and

- Resignation of Partner.

- Change in Profit (loss) Sharing Ratio: Profit sharing ratio is surely interest for the partners and it completely depends on the mutual consent of the partners. As and when they feel for the change in such, it can be processed through partnership deed change.

- Modification of Rights and Responsibilities: The partnership deed contains clauses of the rights and responsibilities of the partners. Any change in same invites the change in partnership deed.

- Change of Duration of Partnership: Where the partnership is incorporated for a specified period, the partners may mutually decide to invite the extension of duration. The reverse may also be the case.

- Any other change whether addition, alteration or deletion of a clause in the Partnership Agreement.

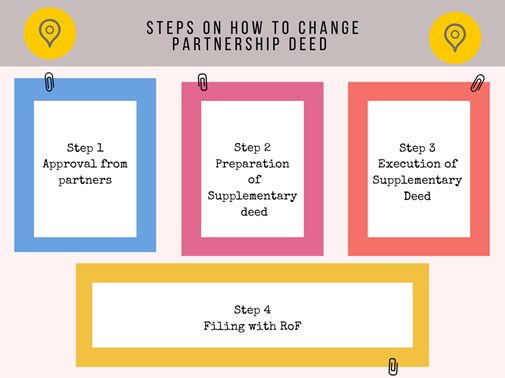

How to change Partnership Deed?

There are 4 steps to follow for changing the partnership deed:

Step 1: Take the mutual consent of partners.

Step 2: Prepare for making a supplementary partnership deed.

Step 3: Executing supplementary partnership deed.

Step 4: Do the filing with Registrar of Firm (RoF).

The partners are required to modify the partnership deed to make the proposed changes effective. The changes are made with an agreement called the Supplementary Agreement to the original partnership deed.

Each steps to make ammendements in partnership deed are explained below:

Step 1: Mutual consent of the partners

The first step in making a modification is to discuss the proposed changes and its implications to seek the consent of the partners. Without the consent of the partners, the changes are not possible in the partnership deed. Before contacting the counsel or the preparing the deed for change, the partners should first look after whether the other partners are ready for the changes.

Step 2: Preparation of the Supplementary Deed

Based on the requirement for change, the partners need to either prepare the supplementary deed or hire a professional who can assist in the matter. The professional will help you to draft the deed keeping in mind other related provision and consequences. As the draft agreement is prepared and partners’ consent is received after the review, one can proceed for execution of the agreement.

Step 3: Execution of Supplementary Partnership Deed

The execution of the deed will involve a number of formalities to be completed by the partners.

- Requirement of Stamp Duty

The deed may be executed for change in capital or otherwise. When it includes the change in capital of the firm, the stamp duty payable for execution of deed will be calculated based on the additional capital or the change. The rates for the attracted duty are prescribed by the concerned State Stamp Act. If there is no change in capital, the deed is executed by payment of Rs 100 as Stamp Duty.

- Signature & Notary

The partners of the firm are required to put their signature at the respective place provided in the supplementary deed. Further, it also requires putting their initials on the rest of the pages. Further, the deed is required to be attested by at least two witnesses. The witnesses to the agreement can be any person other than the parties to the agreement. The signed deed will then be required to be notarized by the competent person.

Step 4: Filing with RoF

Where the partnership firm is already registered with the Registrar of Firm (RoF) of the concerned state, the partners must file the supplementary deed along the applicable form with the RoF. The process of application with RoF will change from State to State and so here are general pointers. A complete application of modification is filed in the prescribed form to the RoF. Along with the application, copies of the following documents are required to be provided.

- Original Partnership Deed and Supplementary Agreement, if any executed earlier.

- Supplementary Deed as executed by the partners.

- If it includes the change of partners, the identity proof and address proof of the partners.

- Where the place of business has been changed, the address proof of the new place is provided along with the rent agreement (if applicable) and NOC from the owner.

Conclusion

A Partnership Deed acts as the spine of the Partnership firm. It can be modified and altered at any time according to the business requirements or partners’ willingness. The most essential element to bring change in partnership deed is to obtain the consent of partners in form of their signature on the deed.

The supplementary partnership deed will remain in force till the validity of the original partnership deed or the validity as expressed in it. The Partnership Deed and the addendum therefore at any time shall not override the provisions of the Partnership Act, 1932 and any other Act as may be applicable to the partnership from time to time.

CS Prachi Prajapati

Company Secretary with a forte in content writing! Started as a trainee, she is now leading as a Content Writer and a Product Developer on technical hand of LegalWiz.in. The author finds her prospect to carve out a valuable position in Legal and Secretarial field.

garte job prachi ji . really helpful to understand thankyou

Need to consult prachi mam regarding partnership deed change and bank objection

Thank you for reaching out to us! We have taken a note of your query and the team will connect with you shortly. Meanwhile, feel free to reach us at support@legalwiz.in.