How to File Form 26QD Online?

Introduction

In the ever-evolving world of taxation, it’s essential to stay informed about the latest updates and procedures. One such crucial aspect of taxation in India is TDS on Rent of Property. Form 26QD is an important form when it comes to file TDS Returns. Specifically, if you encounter a situation where you need to make contractual or professional payments exceeding INR 50,00,000, then you must deduct TDS (Tax Deducted at Source) under section 194M. To do this, you’ll need to file Form 26QD, and in this article, we’ll guide you through the process of filing Form 26QD online.

What is Form 26QD?

Form 26QD is the instrument through which you report and deposit TDS on payments made to resident contractors and professionals. This form ensures compliance with tax regulations and facilitates a smooth flow of contractual and professional transactions. Let’s delve into the step-by-step process of filing Form 26QD online.

Steps to Fill Form 26QD

The new Income Tax e-Filing portal provides a user-friendly interface and streamlines processes to simplify your tax compliance journey.

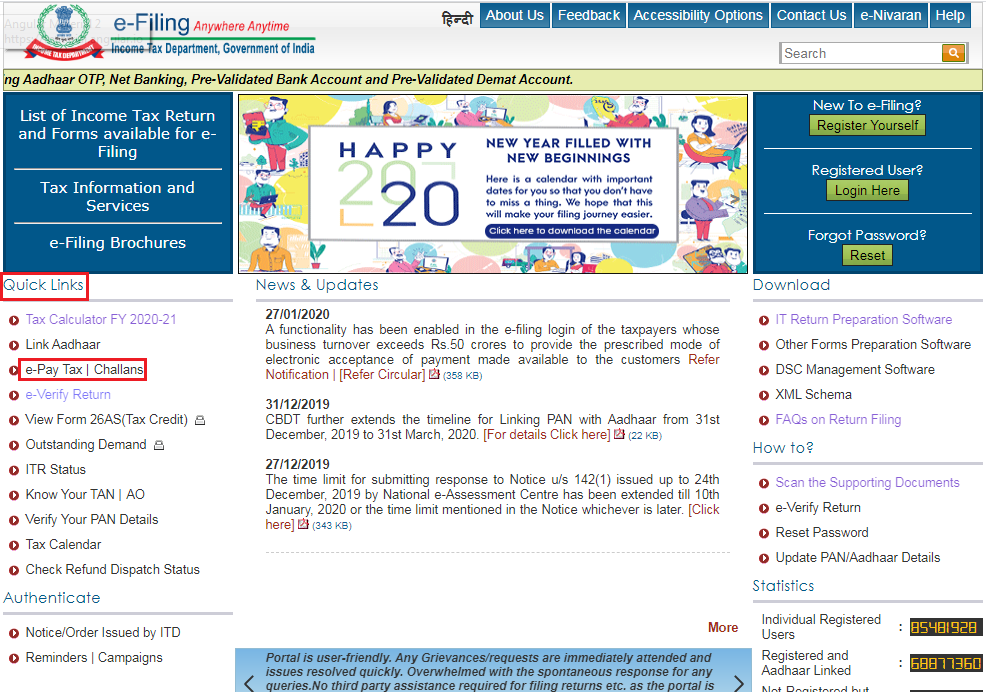

Click on the “e-Pay Tax | Challans” Option on the Income Tax e-Filing Portal

The journey begins with a visit to the Income Tax e-Filing portal, where you can access a range of tax-related services. Then, under the Quick Links section, you’ll find the “e-Pay Tax | Challans” option. Click on it to proceed.

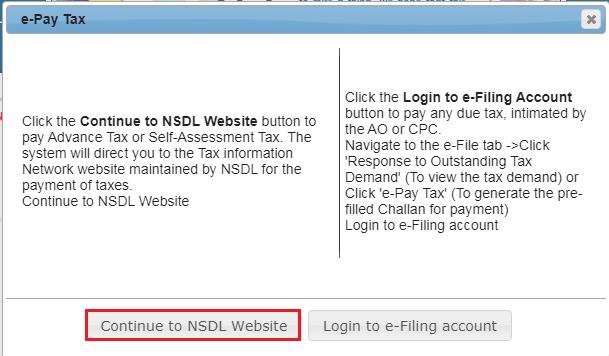

Continue to the NSDL Website

After clicking, you’ll be shown a dialogue box, click on continue. Then you will be directed to the NSDL website where you’ll initiate the Form 26QD filing process.

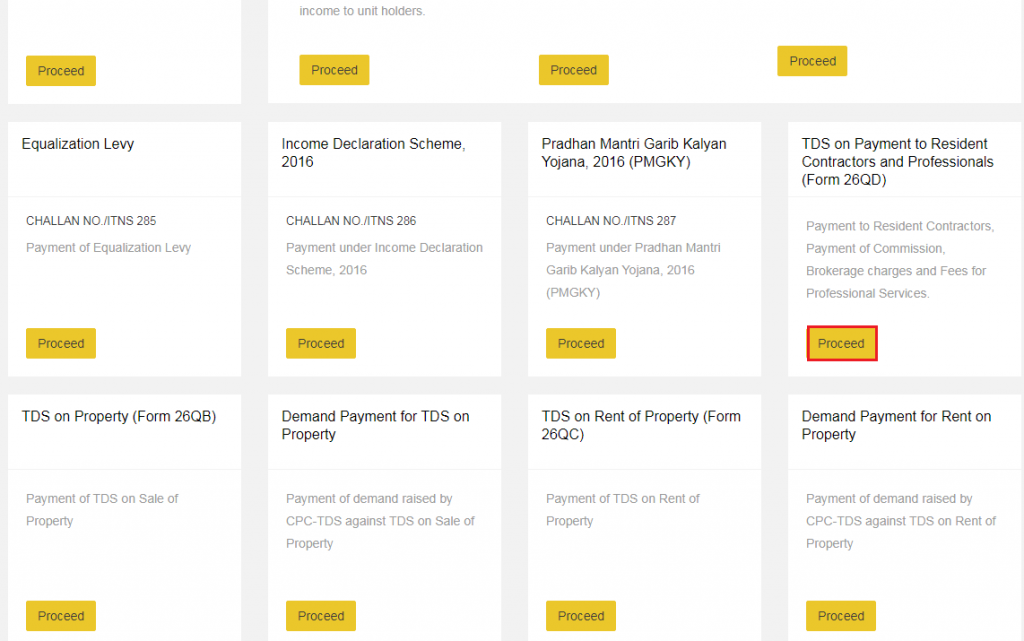

Proceed with the Form 26QD Section

Look for the Form 26QD section and then click “Proceed.” This step will take you to the actual form-filling process.

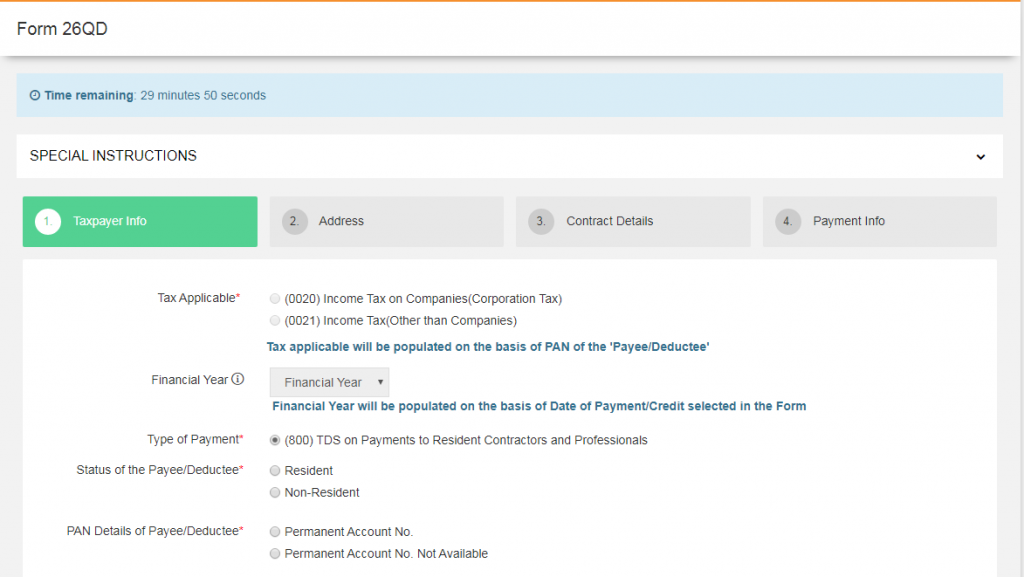

Fill Up the Form with the Required Details and Submit

In this section, provide all the necessary information, including details about the tenant, landlord, TDS, property, and any other required data. Finally, after you complete the form with accurate and comprehensive details, click on the “Submit” option. This signals the completion of the filing process.

Details Required in Form 26QD

To ensure a smooth and accurate filing process for Form 26QD, make sure you have the following details on hand:

- PAN of Deductor/Payer: This is the PAN card of the individual or entity making the payment.

- PAN of Deductee/Payee: The PAN card of the individual or entity receiving the payment.

- Nature of Payment: After that, specify the nature of the payment. State whether it was for work in pursuance of a contract, commission, brokerage, or fees for professional services.

- Date of Contract/Agreement: Provide the date on which the contract or agreement’s date came into being.

- Amount Paid: Clearly state the amount paid in the transaction.

- Number of the Certificate Under Section 197: If applicable, then include the certificate number issued by the Assessing Officer for non-deduction or lower deduction.

- Date of Credit: Indicate the date on which the payment was credited.

- Rate of TDS: Once the rest is done, specify the rate of TDS applicable to the transaction.

- Details of Payment of TDS: Finally, include details related to the payment of TDS, ensuring accuracy and compliance.

What is the Penalty for Filing Form 26QD?

The penalty for incorrect or delayed filing of Form 26QD can vary depending on the specific circumstances. Hence, it’s crucial to file the form accurately and within the specified timeframes to avoid penalties and legal complications.

What is the Periodicity of Filing Form 26QD?

The periodicity of filing Form 26QD depends on your specific transactions and tax obligations. Hence, you should consult with a tax professional or refer to the latest tax regulations to determine your filing frequency.

Conclusion

Filing Form 26QD online is an essential step for individuals and entities making contractual or professional payments exceeding INR 50,00,000. By following the steps outlined in this guide and providing accurate information, you can ensure compliance with tax regulations and facilitate smooth business transactions.

Frequently Asked Questions

What is the due date for filing Form 26QD?

The due date for filing Form 26QD varies depending on the financial year and the specific payment. Generally, Form 26QD must be filed within 30 days from the end of the month in which TDS is deducted. It’s crucial to consult the latest tax regulations or the Income Tax e-Filing portal for the most up-to-date due dates.

Can I revise Form 26QD after filing?

Yes, you can revise Form 26QD after filing if you discover any errors or omissions in the original filing. However, revisions should be done within the prescribed time limits, and it’s essential to follow the correct procedure for revisions to ensure compliance with tax regulations.

What are the consequences of incorrect information in Form 26QD?

Incorrect information in Form 26QD can lead to various consequences, including penalties and legal complications. It’s crucial to ensure the accuracy of the information provided in the form to avoid such issues. If you discover errors after filing, consider revising the form promptly.

Is Form 26QD applicable for all types of payments?

Form 26QD is primarily applicable to payments made to resident contractors and professionals when the payment amount exceeds INR 50,00,000. The form is used to report and deposit TDS on such payments. Different forms and sections may apply to other types of payments, so it’s essential to determine the appropriate form based on the nature of the transaction.

How can I check the status of my Form 26QD filing?

You can check the status of your Form 26QD filing on the Income Tax e-Filing portal. Log in to your account, navigate to the relevant section, and use the provided tools to track the status of your filing. Additionally, you may receive notifications or updates regarding your filing status through the portal or email.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.