How to file Form 26Q?

Introduction

If you’re an individual or an organization in India, dealing with income, you’re likely to encounter TDS or Tax Deducted at Source. This taxation mechanism mandates that a portion of your income is deducted at the source before it’s credited to your account. The Central Board of Direct Taxes (CBDT) oversees and regulates TDS rules and regulations. To comply with TDS regulations, individuals and organizations need to fill out TDS forms each financial year. Form 26Q is an essential part of the process, especially when it comes to TDS Returns. In this article, we’ll walk you through the process of How to file Form 26Q, a critical component of TDS return compliance.

What is Form 26Q

Before delving into How to file Form 26Q, let’s understand what is Form 26Q. Form 26Q is an essential document in the realm of Income Tax. It serves as an Income Tax Return (ITR) form, primarily used for declaring Tax Deducted at Source (TDS) on all payments, except salaries. This form is employed for reporting TDS under various sections of the Income Tax Act of 1961, including Sections 193, 194, 194A, 194B, 194BB, 194C, 194D, 194EE, 194F, 194G, 194H, 194I, and 194J. There are different TDS rates applicable under different sections, and each section has different forms.

What is the Use of Form 26Q?

Form 26Q has several critical applications:

- It is used to report TDS on all payments except salaries.

- Income from various sources like professional fees, interest on securities, director’s remuneration, and dividends is eligible for tax deduction at source under Form 26Q.

- Deductors must submit Form 26Q on a quarterly basis, and the applicable tax deductions are in accordance with sections 193, 194, and 200(3) of the Income Tax Act.

- Non-government deductors should provide their PAN, while government deductors should quote ‘PANNOTREQD’ when filing Form 26Q.

How to File Form 26Q: Step-by-Step Procedure

Here are the simplified steps for how to file Form 26Q:

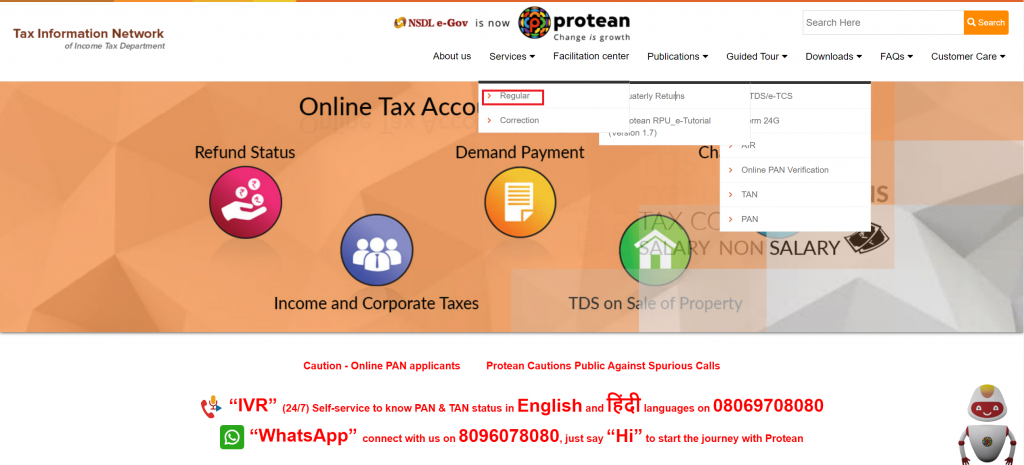

Step 1: Download the TDS utility

Download the TDS utility from the Protean website. Go to the downloads tab, and click on e-TDS/e-TCS. Next, choose quarterly returns, and then click on “Regular”.

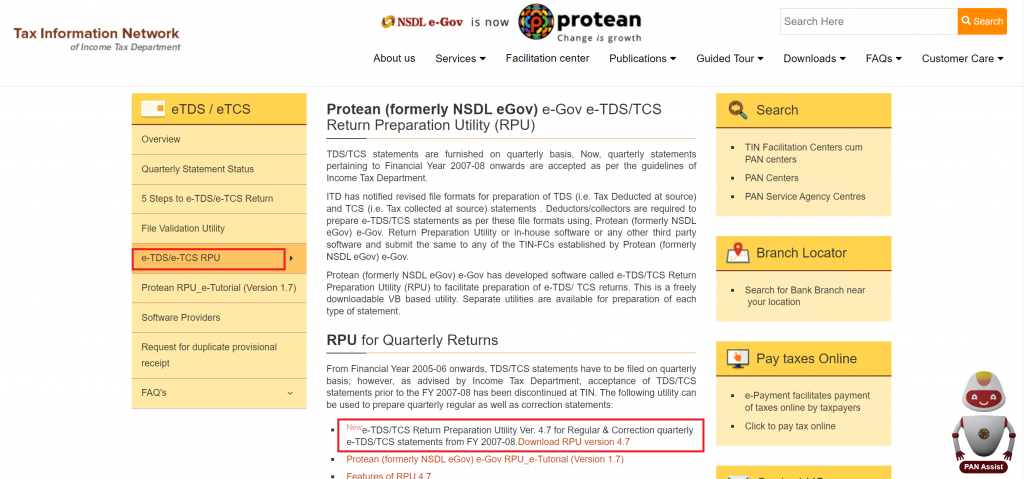

Step 2: Download RPU utility

Select e-TDS/e-TCS RPU from the list, and download it.

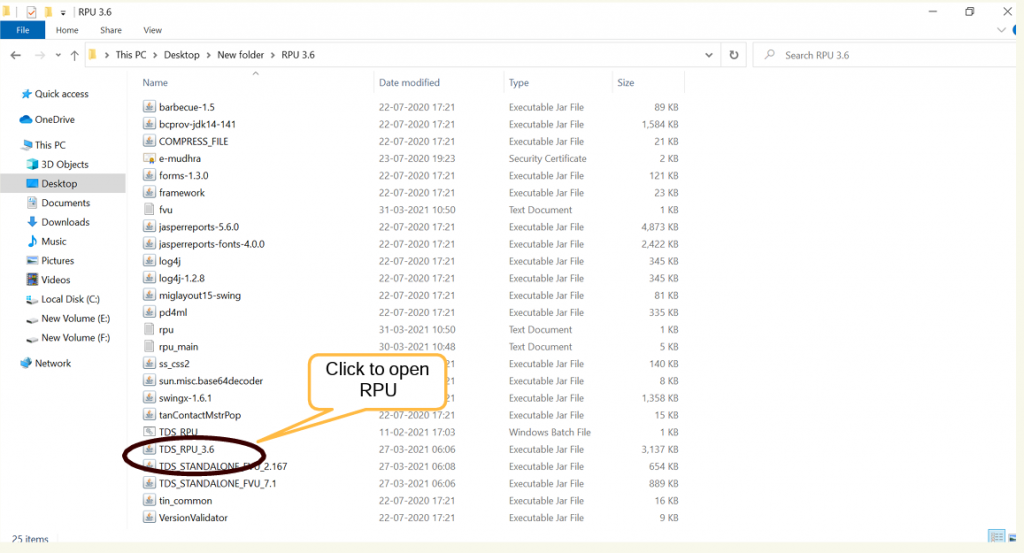

Step 3: Open RPU tool

After Successful download open the tool. It will have been downloaded as a Zip folder, extract the file and open RPU. For detailed steps, you can refer to the user manual on the Protean website.

Note: You need JAVA installed to be able to use RPU.

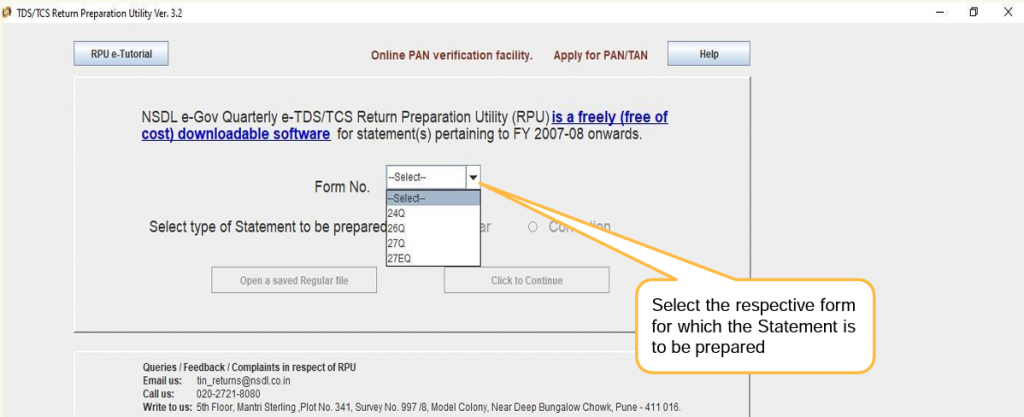

Step 4: Choose Form 26Q

Select form 26Q from the drop-down list and click continue.

Step 5: Provide relevant details

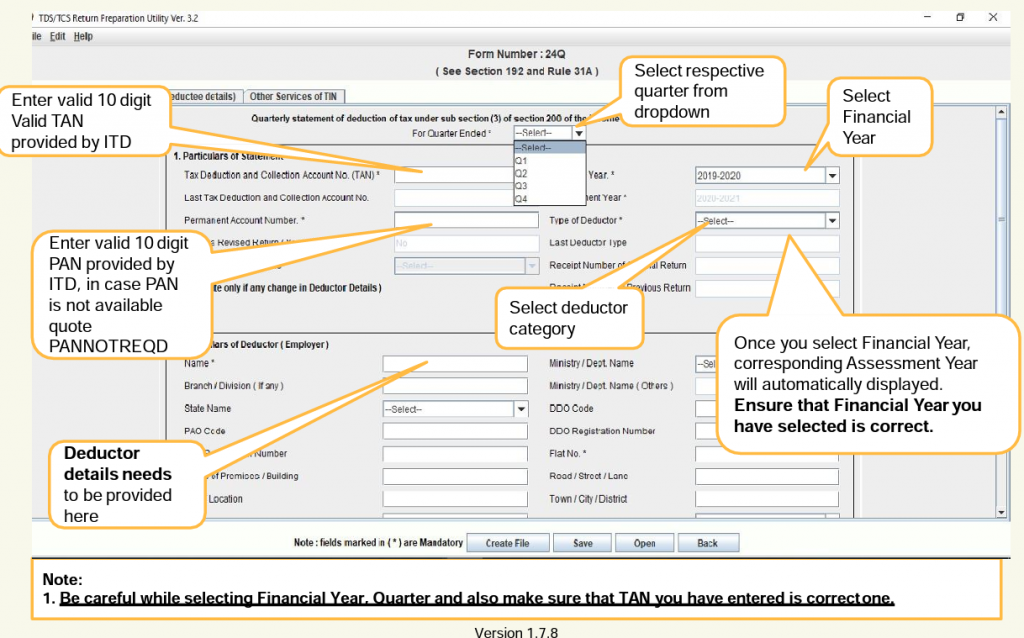

Fill in the information required for Form 26Q:

- Mention the financial year for which you’re filing the TDS.

- Specify whether you are a government or non-government deductor.

- Particulars of the Deductor: Here, you’ll provide information about the entity deducting the tax, such as the deductor’s name and address.

- Particulars of the Person Responsible for Deduction of Tax: Enter details about the person responsible for deducting tax, that is the name, address, and other necessary information.

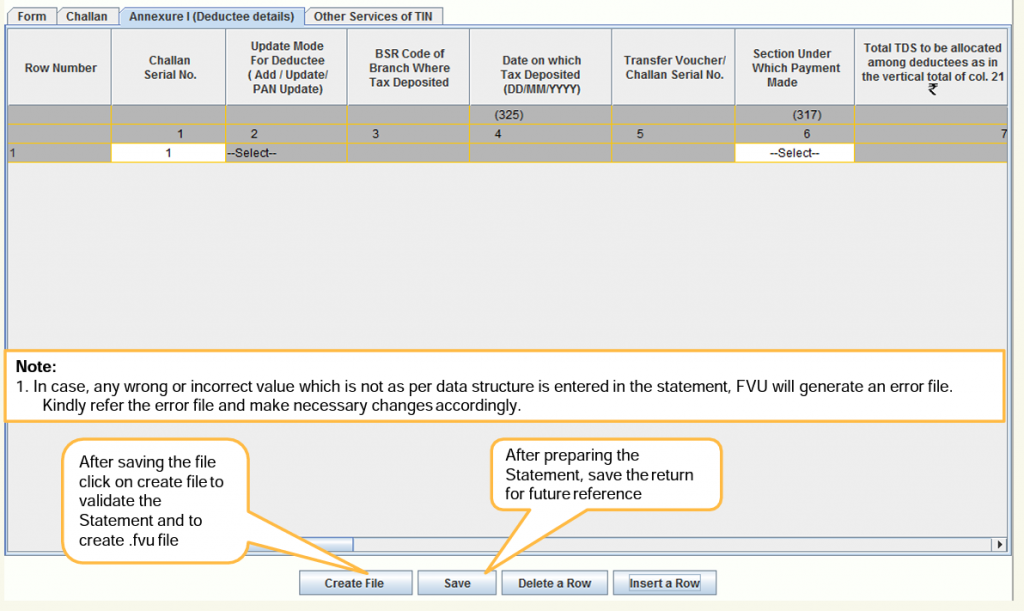

- Details of Tax Deducted and Paid: This section requires you to input details of the tax deducted and paid to the Central Government. This includes Challan particulars, such as the challan number, total amount deposited, mode of deposit, and date of deposit.

Step 6: Save details & create a file

After all the relevant data is added, click on “save”. Once saved click “Create file”.

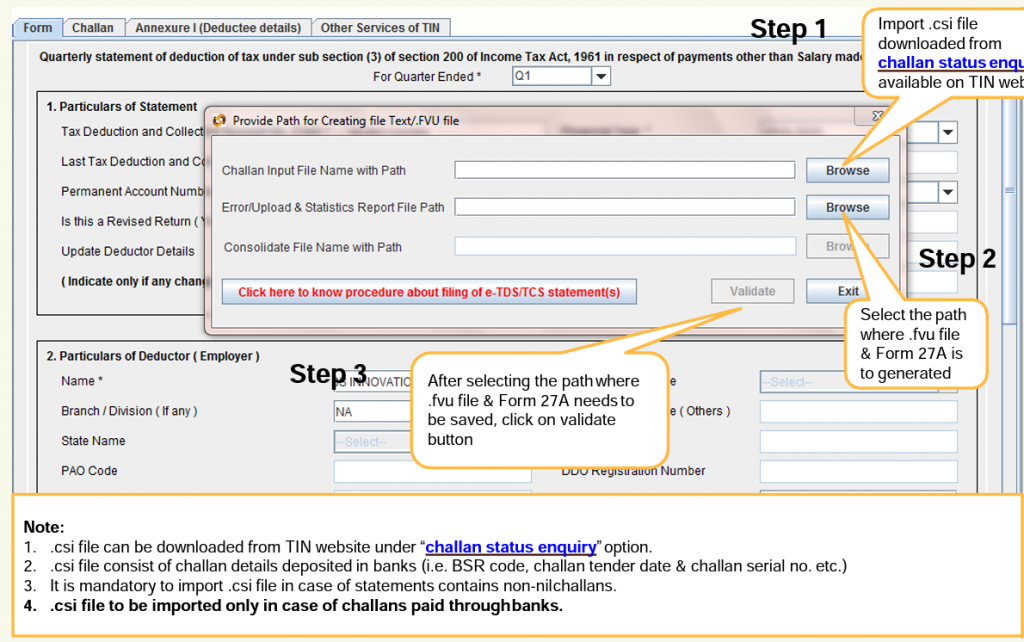

Step 7: Select where to save the file

After creating the file, select a location on your computer to save it. After all validations, the file for 26Q will be successfully downloaded!

Step 8: Verify and submit the TDS statement

Finally, the last step in our guide on how to file Form 26Q, is to verify the downloaded file with FVU software, and then upload it on the income tax website.

How to Download Form 26Q from TRACES?

Here is a step-by-step guide for downloading Form 26Q from the Tax Information Network (TIN) website or the Traces portal:

- Visit the official TRACES website.

- Log in using your User ID, password, and TAN (for deductors).

- Navigate to the ‘Downloads’ tab and select ‘e-TCS’ or ‘e-TDS’ from the drop-down menu.

- Choose ‘Quarterly Returns’ and click on ‘Regular.’

- This will take you to a page where you can access the ‘Form’ section.

- Select Form 26Q and initiate the download.

Note: If you need to download Form 26QE, follow the same steps, but select Form 26QE instead.

Form 26Q Sample Download

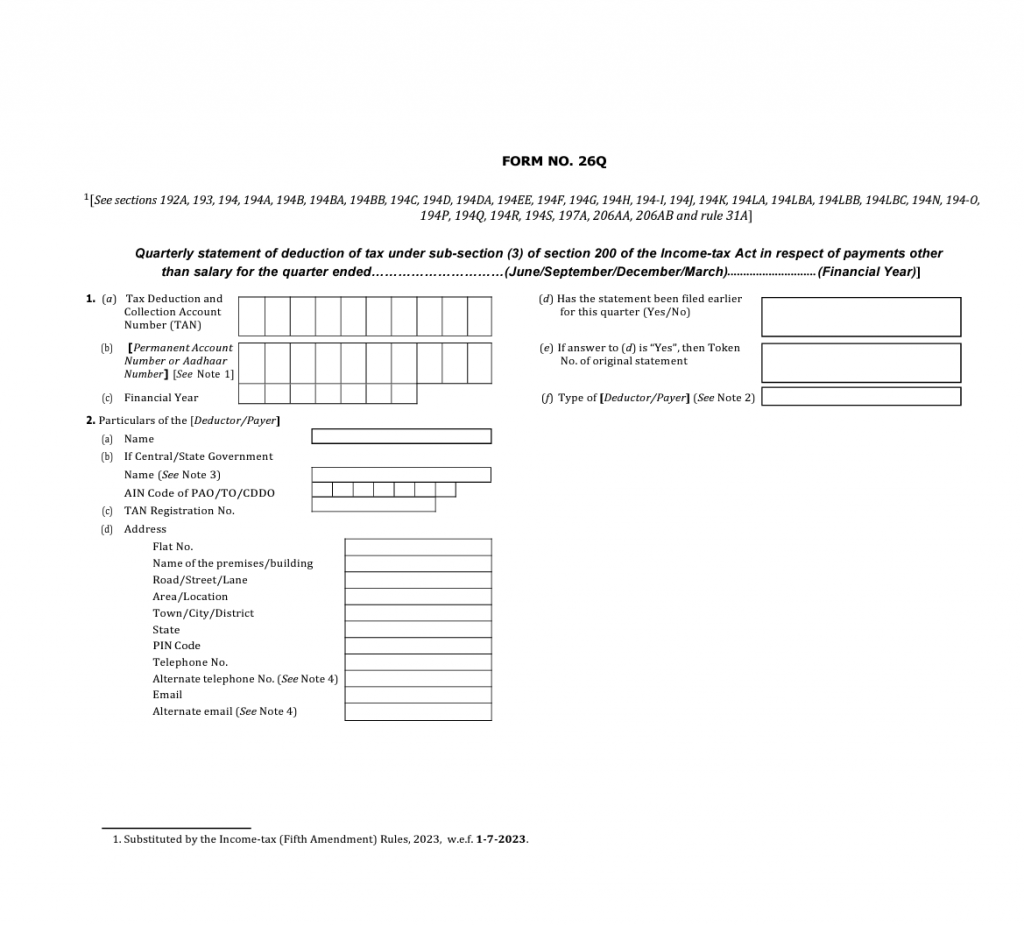

Form 26Q consists of four sections and an annexure:

- The first part captures essential information like TAN, PAN, the financial year, and the type of deductor.

- The second and third sections are for deductor and responsible person details.

- The fourth section is for details regarding tax paid and deducted.

- The fifth section, or annexure, collects information about the deductees.

Conclusion

Now that you have a clear understanding of how to file Form 26Q and its significance in TDS compliance, you can proceed with confidence in meeting your tax obligations. Remember that accuracy and timeliness are essential when dealing with tax matters.

Frequently Asked Questions

What is the deadline for filing Form 26Q?

Form 26Q should be filed quarterly, and the due dates for each quarter can be found on the official Income Tax website.

What happens if I submit incorrect information on Form 26Q?

Incorrect information may lead to penalties and additional tax liabilities. It’s crucial to double-check all details before submission.

Can Form 26Q be filed manually?

No, Form 26Q must be filed electronically on the official Income Tax website.

What should I do if I encounter technical issues while filing Form 26Q online?

In case of technical difficulties, you can seek assistance from the Income Tax Department or consult a tax professional for guidance.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.