How to file Form 24Q?

Introduction

Filing your Form 24Q TDS (Tax Deducted at Source) return for salary can be a daunting task, especially if you’re new to the process. However, understanding the steps and requirements can make it much smoother. In this guide, we will walk you through the process of filing your Form 24Q TDS return, covering important aspects such as what Form 24Q is, how to file 24Q TDS return online, how to fill out the annexure, filing online, and frequently asked questions.

What is Form 24Q TDS?

Filing your TDS return accurately and on time is crucial to avoid penalties and ensure compliance with tax regulations. Form 24Q is specifically meant for TDS on salaries. It contains details of tax deducted and deposited with respect to employees’ salaries.

Form 24Q is a quarterly statement of deduction of tax at source for salaries. Employers who deduct TDS from the salaries of their employees file this form. This form contains important information, including the PAN (Permanent Account Number) of the employer and employees, TDS amount, section codes, and annexure details.

Form 24Q – Annexure

Annexures are additional documents that provide specific details related to the TDS return. In the case of Form 24Q, two annexures are crucial:

- Annexure I: This section contains details of deductees, i.e., employees for whom TDS has been deducted.

- Annexure II: Annexure II holds essential information about the income details of employees, including taxable salary components.

Important points for filing TDS Return for Salary

Filing a TDS return for salary involves several steps, as outlined above. However, if you’re wondering how to file a 24Q TDS return online, it’s essential to highlight some key points:

- Mandatory Online Filing: It’s mandatory to submit the return online. This is especially important in situations such as when the deductor is a government officer when there are 20 or more deductees in a quarter, or when the previous year’s accounts were audited under Section 44AB of the Income Tax Act.

- Interest and Fees: Late filing can attract interest and fees. Make sure you file within the due dates to avoid penalties.

- Due Dates: The due dates for filing Form 24Q TDS return are as follows: July 31 (April to June), October 31 (July to September), January 31 (October to December), and May 31 (January to March).

How to File 24Q TDS Return Online

Filing your Form 24Q TDS return online is the most convenient and efficient method. Here’s how to file a 24Q TDS return online:

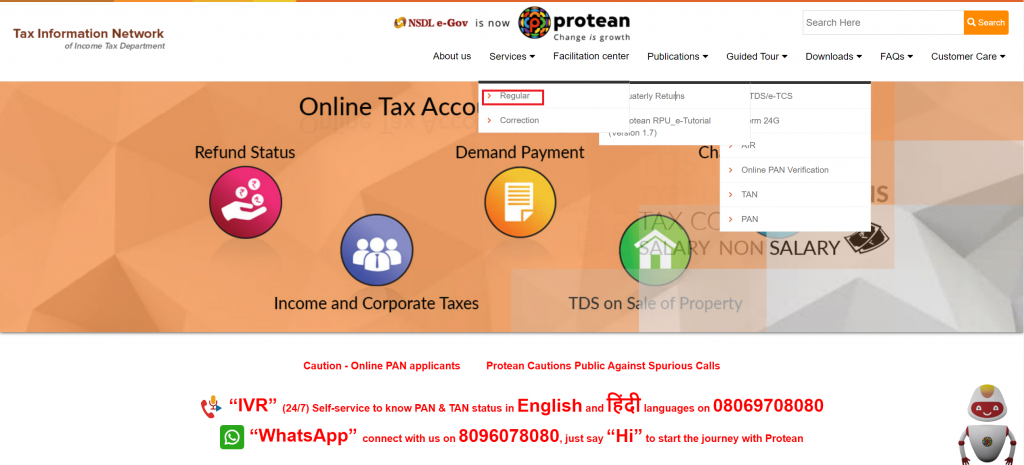

Step 1: Download the TDS utility

Download the TDS utility from the Protean website. Go to the downloads tab, and click on e-TDS/e-TCS. Next, choose quarterly returns, and then click on “Regular”.

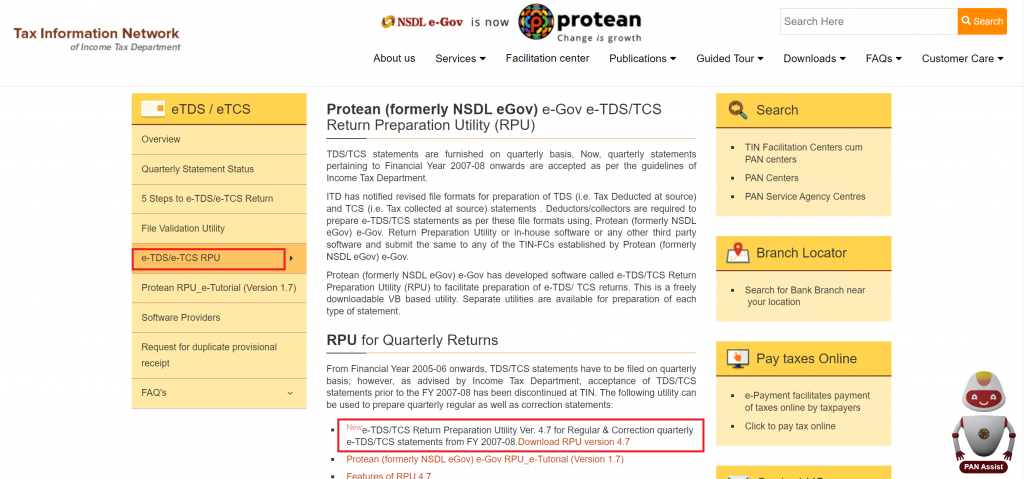

Step 2: Download RPU utility

Select e-TDS/e-TCS RPU from the list, and download it.

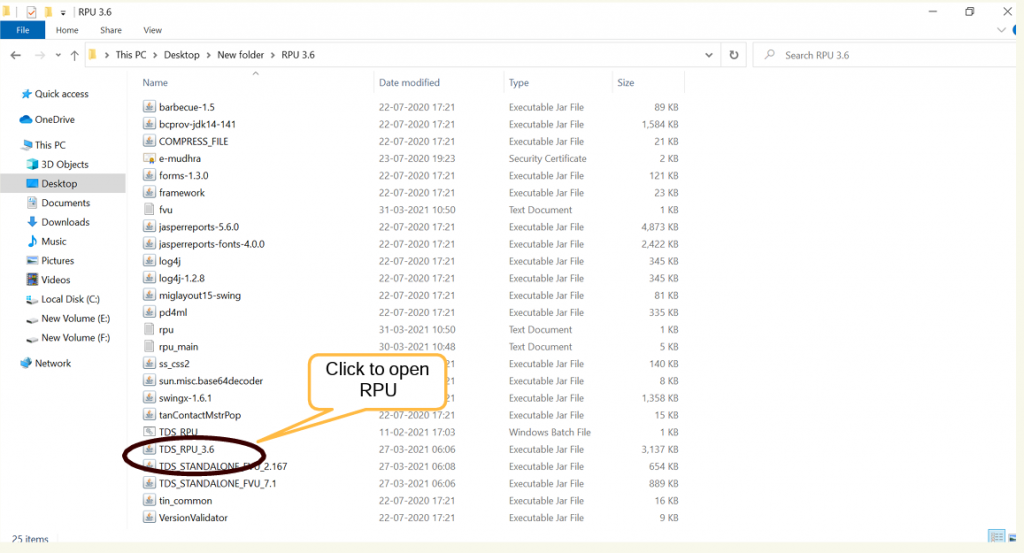

Step 3: Open the RPU tool

After Successful download open the tool. It will have been downloaded as a Zip folder, extract the file and open RPU. For detailed steps, you can refer to the user manual on Protean website.

Note: You need JAVA installed to be able to use RPU.

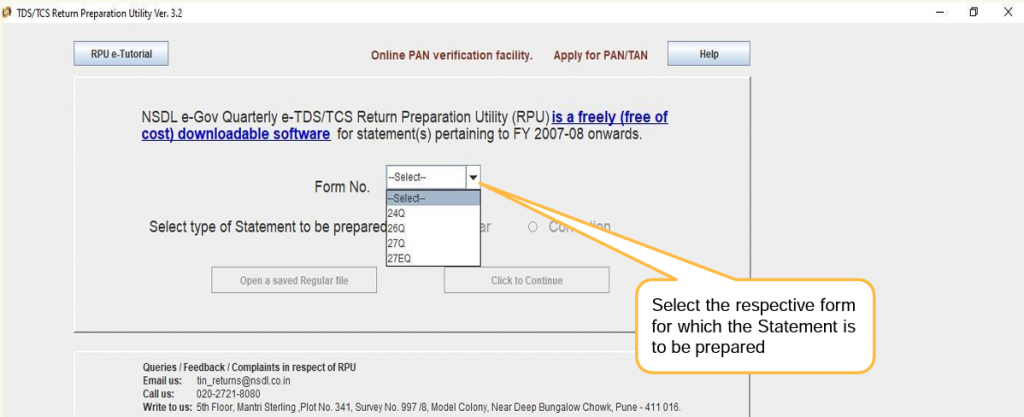

Step 4: Choose the form

Select form 24Q from the drop-down list and click continue.

Step 5: Provide relevant details

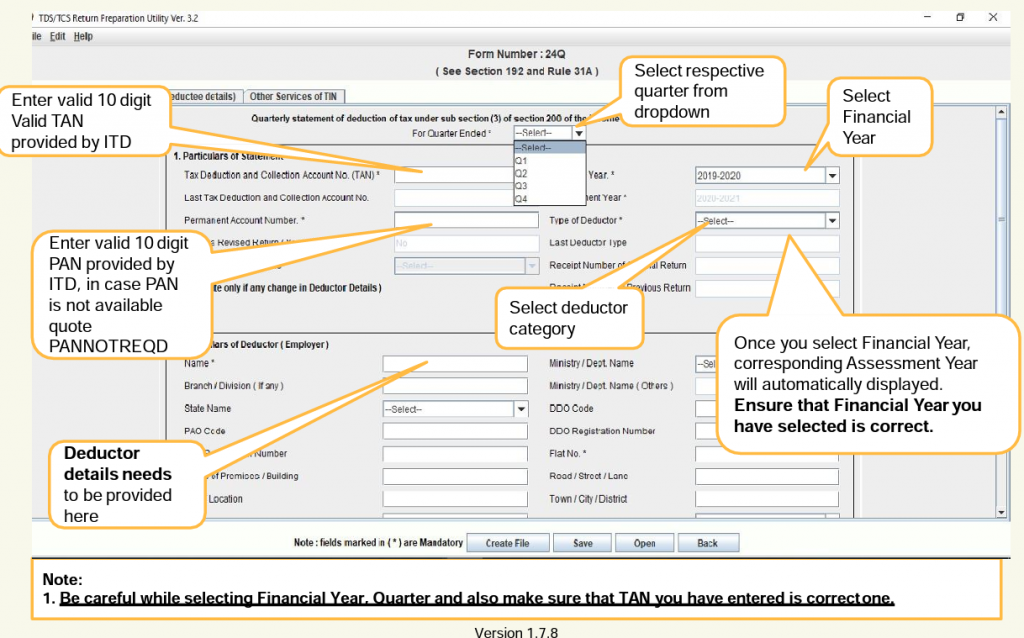

Enter all the relevant information. Relevant information will include:

- Employer’s details, including TAN, PAN, financial year, type of deductor, and employer information.

- Information about the tax paid, including TDS amount, surcharge, interest, and fees.

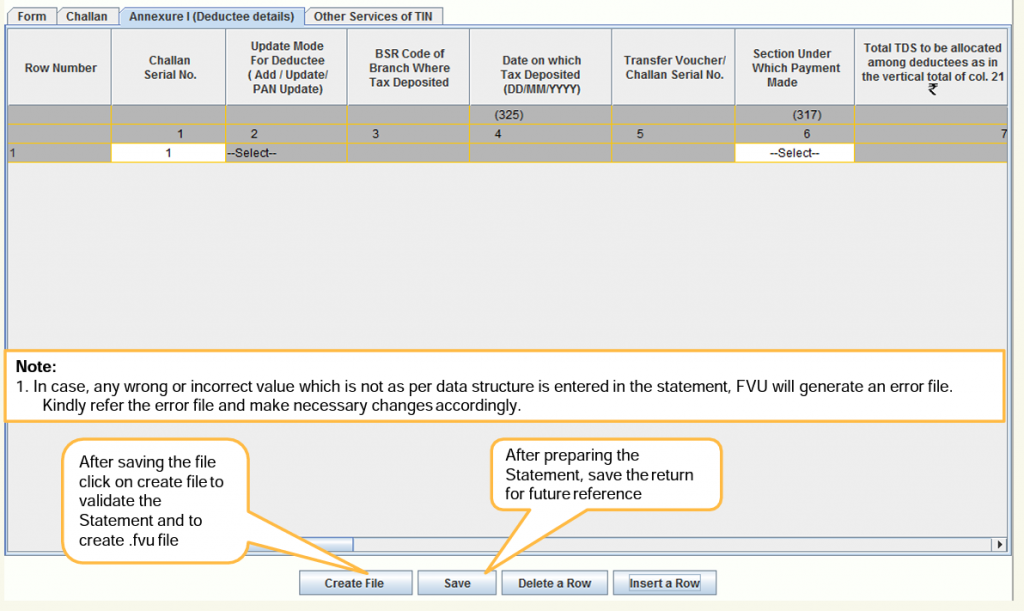

- Details for payments made via challans (go to the challans tab and add the relevant number of rows and details).

- Details of deductees (employees) to Annexure I.

- Filling Annexure II, containing the income details of employees.

Step 6: Save details & create file

After all the relevant data is added, click on “save”. Once saved click “Create file”.

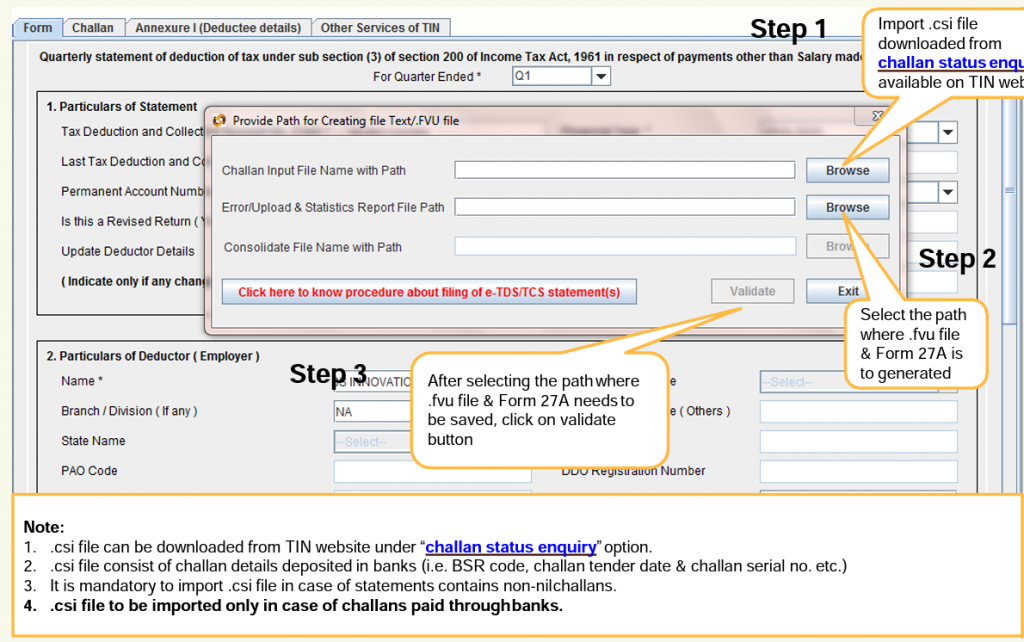

Step 7: Select where to save the file

After creating the file, select a location on your computer to save it. After all validations, the file will be successfully downloaded!

Step 8: Verify and submit the TDS statement

Finally, verify the downloaded file with FVU software, and then upload it on the income tax website.

Conclusion

Filing Form 24Q TDS return for salary can seem complex, but by following the steps outlined here, you can streamline the process and ensure compliance with tax regulations. It’s important to remember to file on time and accurately to avoid penalties. We hope our article has answered all your questions regarding form 24Q and how to file 24Q tds return online.

Frequently Asked Questions

What happens if I don't file my Form 24Q TDS return on time?

Late filing can result in penalties and interest charges. It’s essential to file within the due dates to avoid these consequences.

Can I file Form 24Q TDS return manually, or is online filing mandatory?

Online filing is mandatory in certain cases, such as when there are 20 or more deductees in a quarter. It’s recommended to check the latest guidelines for filing.

What information do I need to fill in Annexure II of Form 24Q?

Annexure II of Form 24Q requires income details of employees, including taxable salary components. It’s crucial to fill in this section accurately.

How do I calculate the TDS amount for Form 24Q?

The TDS amount is calculated based on the applicable tax rates and the income details of employees. Ensure you have accurate income data to calculate TDS correctly.

Can I revise my Form 24Q TDS return if I make an error?

Yes, you can revise your TDS return if you discover errors. However, it’s essential to do so within the specified time limits and follow the proper procedure for revision.

Monjima Ghosh

Monjima is a lawyer and a professional content writer at LegalWiz.in. She has a keen interest in Legal technology & Legal design, and believes that content makes the world go round.