How to efile ITR 3?

Out of the 7 different prescribed formats provided by the income tax department, ITR 3 is applicable to individuals and Hindu Undivided Families (HUFs) that earn income from proprietary business or professions. Income Tax Return filing is a very important aspect in all businesses and professions. When you are earning income from various sources, you need to give a statement of all incomes and expenses to the Income Tax Department. Filing ITR 3 allows all business owners and professionals to do so. This blog covers a step by step guide on how to file ITR 3.

Modes to file ITR 3

ITR 3 is the form applicable to individuals and HUFs that earn their income from proprietary business or a profession. However, not all proprietary business owners can file ITR 3. Which means, business owners that are claiming benefits under the presumptive taxation scheme need to file their returns through the ITR 4. Further, to get a better understanding of the applicability of ITR 3, you can read “What is ITR 3?”. As far as the mode of filing is concerned, you can file ITR 3 in any of the following manner:

- Offline Mode of filing ITR 3; and

- Online mode to file ITR 3.

Let’s take a look at both the modes in detail:

How to file ITR 3 offline

You need to follow the steps given below to complete ITR 3 offline filing:

Step 1: Download the offline utility

Go to the Downloads section of the tax e-filing portal by clicking here. Choose ITR 3 and select “Utility Excel Based”. You can then extract the form from the downloaded zip folder.

Step 2: Furnish details and validate ITR 3

Then, open the excel format of the form and furnish details in the following sequence:

- Part A;

- Part B; and

- Schedules to ITR 3.

Once you furnish all relevant information and compute the total tax liability, you can click on ‘Validate’ to complete validation of the information. Lastly, you need to save the data and download JSON format.

Step 3: Upload JSON format and verify

After generating the JSON format and saving it, you can visit the tax e filing portal and follow these steps:

- Login to the portal;

- Select ‘income tax return filing’ from the ‘e-file’ menu;

- Choose the assessment year, ‘offline mode’, and ITR – 3 form;

- Attach the JSON format; and lastly

- Submit and Verify.

How to file ITR 3 online?

According to the Income Tax Department, filing ITR 3 online is a more recommended manner of filing your returns. This process of filing ITR 3 online helps in computing the tax liabilities electronically on the portal itself. Further, it also allows you to complete the verification process without much hassle. Let’s dive into the step by step process on how to file itr 3 online:

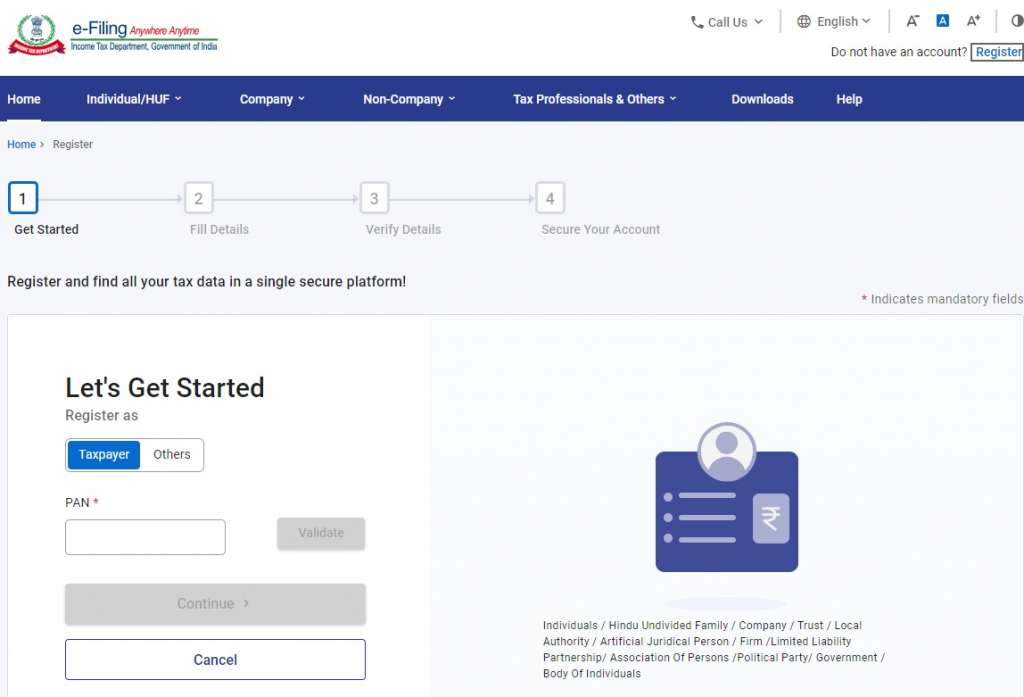

Step 1: Login to the Tax E-filing portal

In order to be able to furnish your returns online, you need to be registered as a user on the portal. If you already have your User Registration credentials, just enter them and log in to the portal.

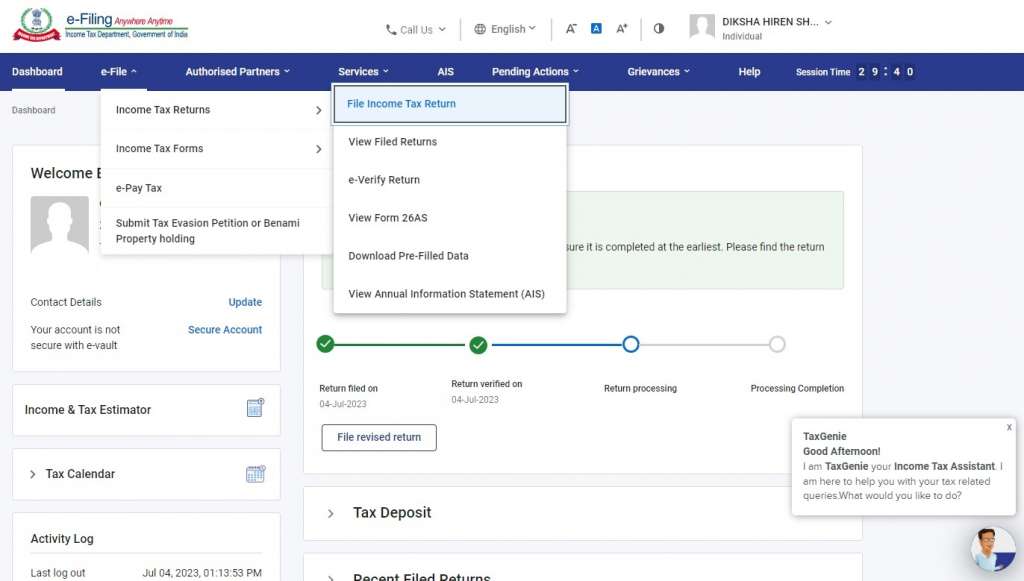

Step 2: Select ‘file income tax returns’

After you login, from the menu bar select ‘e-file’ and then, from the dropdown list click on ‘file income tax returns’.

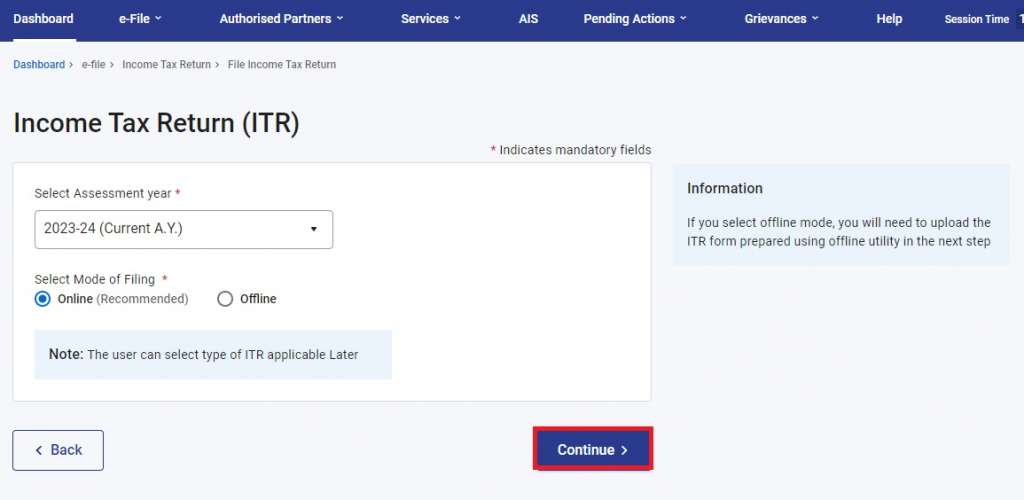

Step 3: Choose online mode

To file ITR 3 online, next, you will have to enter the appropriate assessment year and the mode of filing, ‘online’.

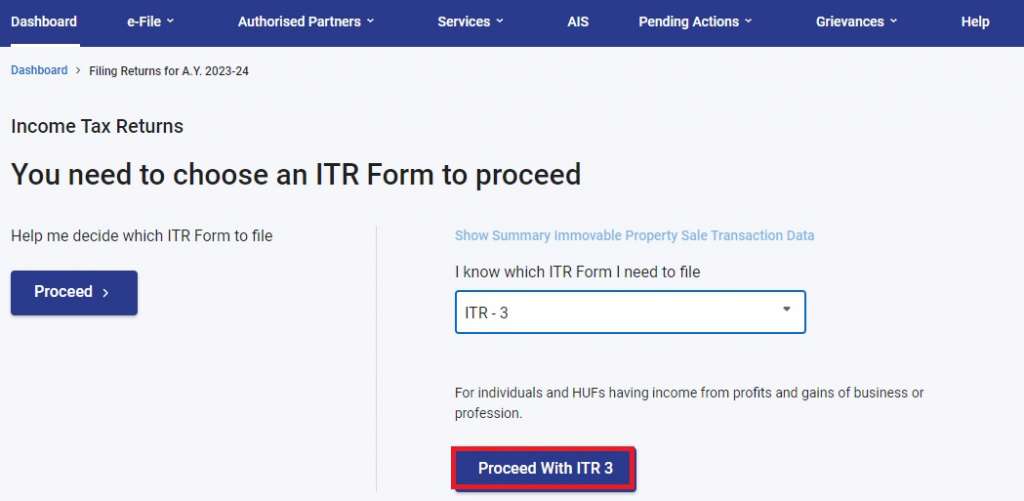

Step 4: Select the appropriate ITR form

Next, you need to choose the type of organisation and the appropriate form, i.e., ITR 3.

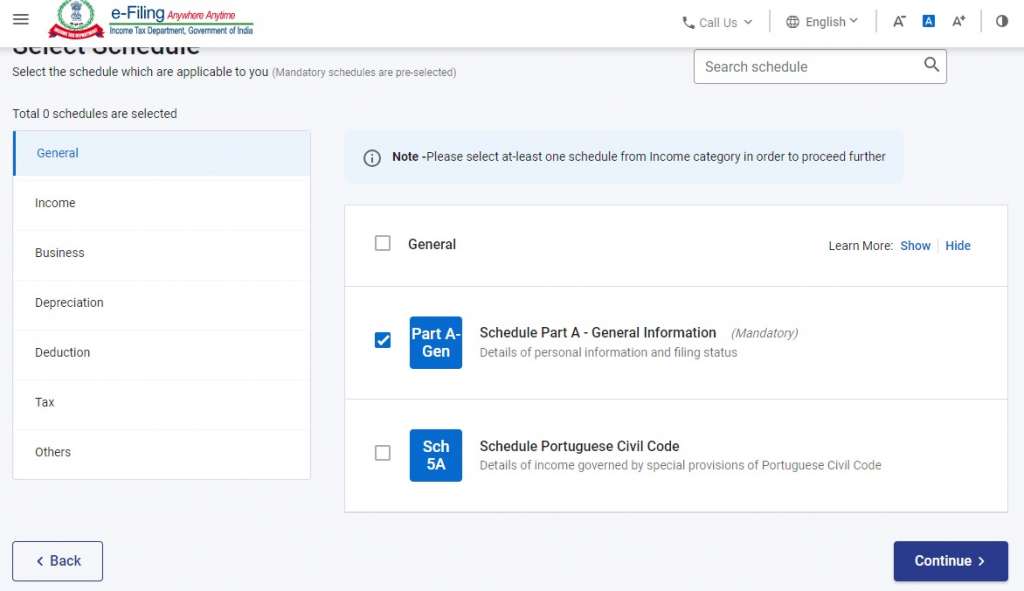

Step 5: Furnish information, verify and submit

After choosing the appropriate ITR 3 form, you need to furnish all the relevant information in the Part A, Part B and schedules to the ITR 3. Once you calculate your total income and tax liability, you can submit and verify the ITR 3 form.

How to verify ITR 3?

For all taxpayers furnishing their returns through the ITR 3 form, the following modes to complete the verification of returns are available:

- Digital Signature Certificate (DSC);

- Authentication through EVC (electronic verification code);

- Aadhar generated OTP;

- Verification through ITR V – sending physical and duly signed copy of the ITR V to CPC Bangalore.

Address of CPC Bangalore: Centralized Processing Centre, Income Tax Department, Bengaluru— 560500, Karnataka

Also Read: What is ITR 4?

What are the documents required to file ITR 3?

A fun fact of furnishing income tax returns is that these forms are annexure less. However, since you are required to furnish sensitive information to compute tax and liability, you can keep the following documents in handy for reference:

- Copy of Aadhar card;

- Form 16 or monthly salary slips (if a salaried individual);

- Receipts for income from rents;

- Bank Statement;

- Balance sheet and P&L account (if business owner); and

- Lastly, audit report information (applicable when audit is mandatory under section 44AB)

Conclusion

It is vital to file the income tax returns with accurate information in the prescribed formats. For this, you must always connect with certified experts. Now, you can get your returns filed from the comfort of your house. Connect with LegalWiz.in experts today to file your returns!

Frequently Asked Questions

Is it mandatory to provide balance sheet details in ITR 3?

Yes, if you are earning income from a proprietary business, it is mandatory to provide the balance sheet information.

What is the difference between ITR 3 and ITR 4?

ITR 4 also known as the sugam form is applicable to business owners that are entitled to presumptive taxation scheme. Whereas, ITR 3 is applicable to the other business owners and professionals.

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.