How to File ITR 7 online?

The Income Tax Department allows the individuals and entities that are usually exempt from paying taxes, to furnish their statement of income and expenses through a single form ITR 7. This is mostly applicable only when such entities and individuals have an income more than that of the maximum exemption on taxes. All trusts, charitable institutions, research organizations, universities, political parties, etc. need to know how to file ITR 7. This article gives a step by step guide on the process of how to file ITR 7 online. Let’s dive into the step by step guide.

Modes to file ITR 7

As per the Income Tax Act, 1961 all persons (natural or legal) falling under sections 139(4A), 139(4B), 139(4C) and 139(4D) of the Act need to furnish their accounts using ITR 7. For a detailed guide on the applicability of ITR 7, you can read “What is ITR 7?”

You can file ITR 7 form in two modes, namely:

- File ITR 7 online; and

- Transmission of data electronically through offline utility

We will take a look at both the modes of filing ITR 7 in detail.

Steps to file ITR 7 via offline utility

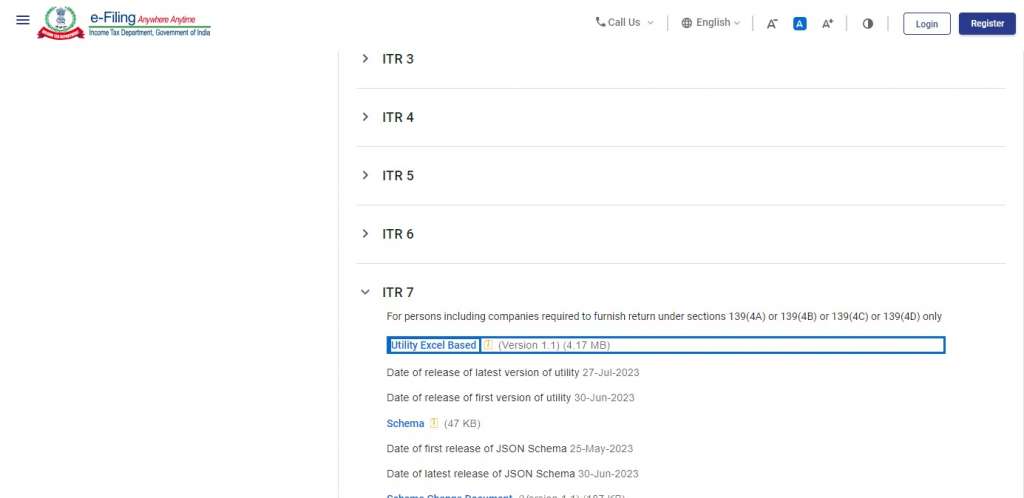

Step 1: Download ITR 7 offline utility

To file the ITR 7 using the offline utility, you need to go the the tax e-filing portal’s download section. Once you are on the downloads page, you will see a list of utility download options for all ITR forms. Click on the ITR 7 offline utility and download the excel utility in a zip folder.

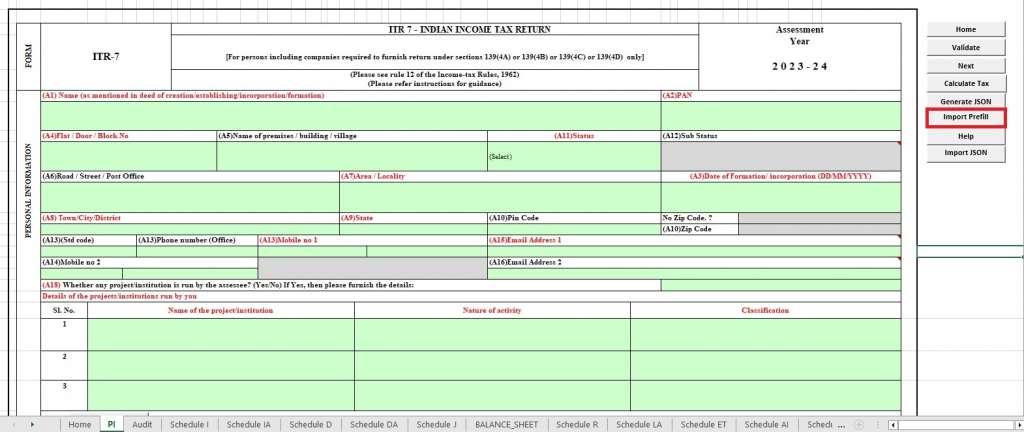

Step 2: Furnish details in ITR 7 form

After downloading the offline utility, you will have to furnish all your information in the parts as given in the excel format. You can also choose to pre-fill data from the ‘import pre-fill data’. Once the entire process of furnishing details is complete and you are able to compute the tax liability, you can click on ‘apply’ and then save your ITR 7.

Step 3: Upload and verify

Now that you have successfully computed your total tax liability, you can submit your ITR 7 on the tax e-filing portal. All you need to do is,

- Login to the portal;

- Select ‘income tax return filing’ from e-file menu;

- Select ‘offline’ mode of filing;

- Upload the .json form on the portal;

- Submit and Verify.

How to file ITR 7 online?

The online mode of filing ITR 7 is now highly recommended even by the income tax department. It is one of the easiest ways to furnish your ITR 7. Let’s dive into the step by step process.

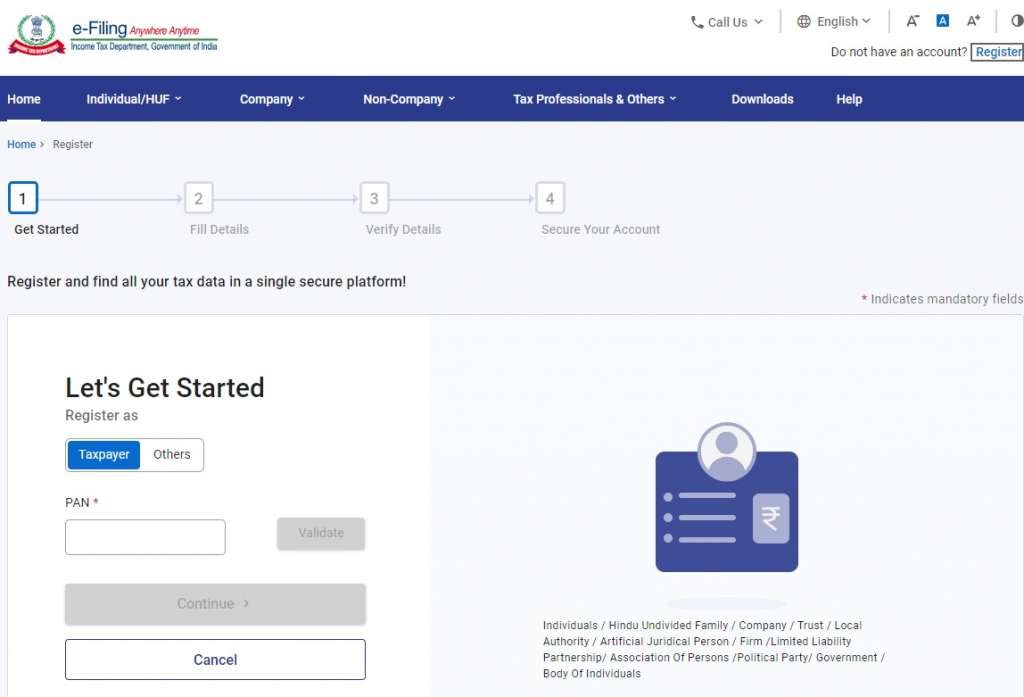

Step 1: Register as a user

The first step in furnishing online tax returns is to register yourself as a user on the tax portal. If you already have an account, all you need to do is enter the credentials and login.

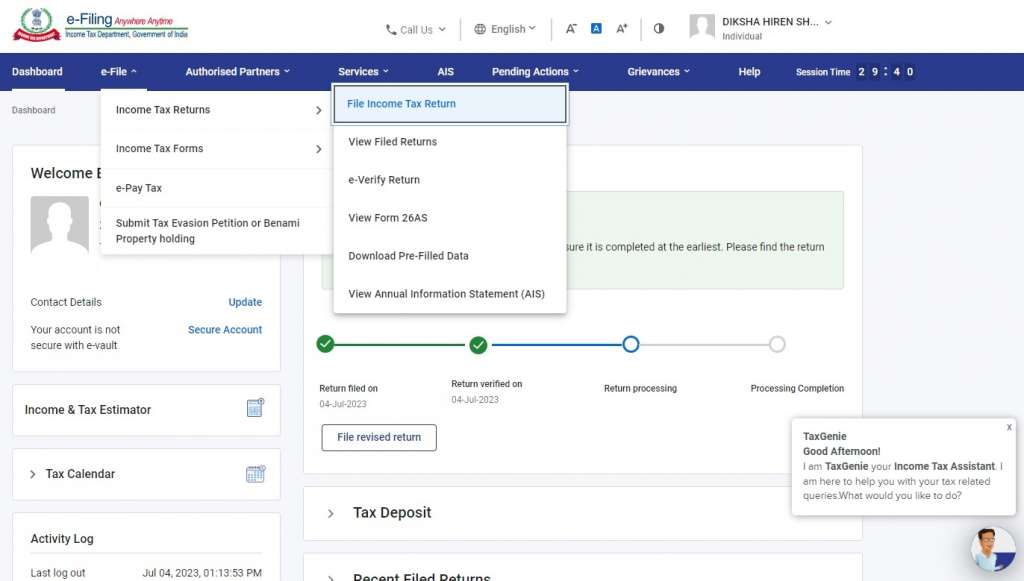

Step 2: Select “Income Tax Return Filing”

Once you login to the dashboard of the portal, you need to choose the ‘e-file’ menu and select ‘income tax return filing’ from the drop down list.

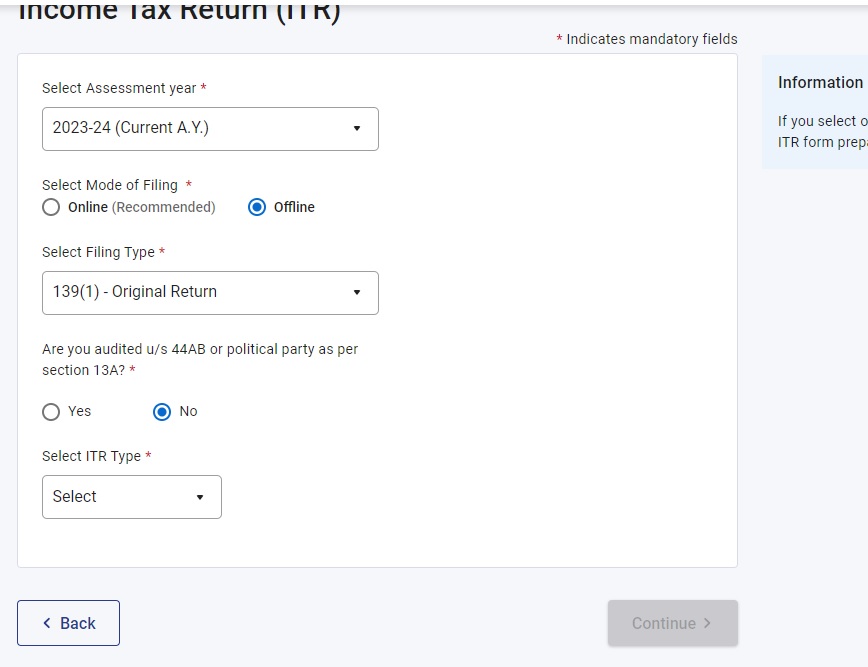

Step 3: Select your form and submit all details

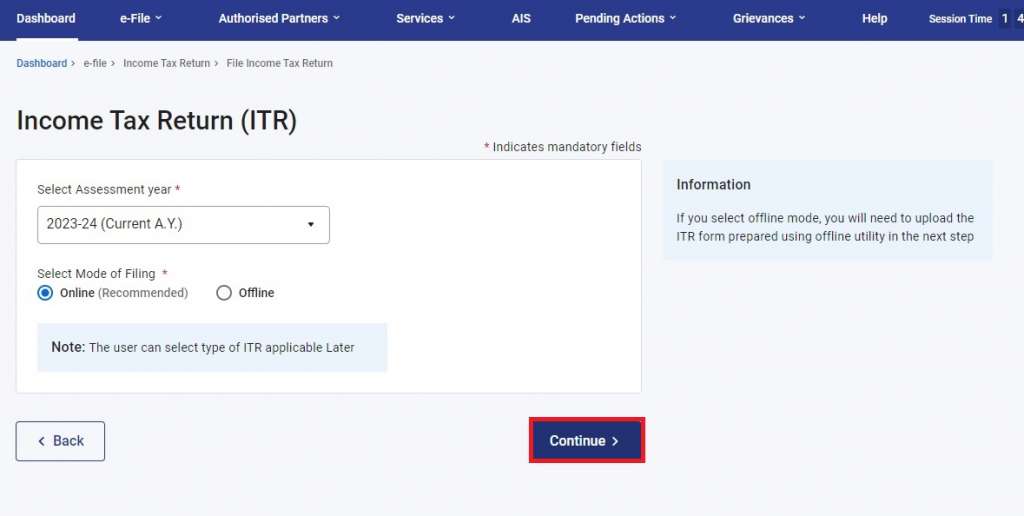

Then, you will have to choose:

- Online mode of filing;

- Assessment year for filing ITR; and

- ITR 7 form.

After choosing the form, you need to provide the details as required. As per the Income tax department, the ideal way of furnishing details in the ITR 7 is entering details in Part A, then in Part B and lastly furnishing all information in the Schedules to the ITR 7. Once you furnish all details, you can verify the ITR 7 form using either the Digital Signature Certificate (DSC) or through aadhaar generated OTP. After successful verification, you can submit the final form.

Also Read: How to file ITR online?

Documents required to file ITR 7

The ITR 7 form is an annexure less form. Which means that you do not need to attach any documents along with the form while filing ITR 7. However, it is important to match all information that you furnish with the reports you have. Example,

- If mandatory audit is applicable to you, then you need to see the audit reports and then furnish all the required information accordingly in the ITR 7 form;

- Further, while inserting details of your taxes collected and deducted, you can use the Tax Credit Statement (Form 26AS).

Guidelines to file ITR 7

The income tax department gives out instructions on how to file ITR 7. Keep these pointers in mind while you furnish your returns to make the process hassle-free:

- File details as indicated (if not, the application might get invalidated);

- Various tax and income related figures must be rounded off to the nearest multiples of ten rupees;

- All other figures need to be rounded off to nearest multiple of one rupees;

- Use of minus symbol (-) is mandatory in disclosing losses or negative figures;

- For figures with zero or nil value, you need to write ‘NIL’ in the appropriate column;

- Use ‘NA’ for all fields which are not applicable to you as a taxpayer.

How to complete the verification process through ITR V?

ITR V stands for Income Tax Return Verification document. If you have selected the mode of verification using the ITR V form, then you need to furnish the relevant details in the ITR V sent to you via e-mail by the income tax department. The authorized person needs to check all the details in ITR V, strike out the irrelevant details, and then, duly sign it.

Once you sign it, you need to take a copy of the ITR V and courier the duly signed copy to the following address within 30 days:

- Bag No.1, Electronic City Office, Bengaluru – 560100 Karnataka

Conclusion

Filing income tax returns in an appropriate manner is very important. If you fail to furnish your income tax returns accurately, the income tax department will issue notices. Hence, it is advisable to get experts to file your returns. Connect with LegalWiz.in experts today!

Frequently Asked Questions

Is it mandatory to complete verification through ITR V?

No, submission of ITR V is not the only valid mode of completing the verification of returns. You can do so, easily, with the Digital Signature Certificate while furnishing ITR online.

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.

“Great article! The step-by-step guide on filing ITR-7 online is clear and informative. Really helpful for NGOs and trusts navigating the tax filing process. Keep up the good work! 👍”