How To File Income Tax Return (ITR) Online For Salaried Employees?

Filing Income Tax Return is mandatory for all who fall under the current tax slab, provided by the government of India. This includes all individuals, entities, and corporations. Every person earning an income in India is required to be aware of the Income Tax related rules and regulations. The Income Tax Act 1961 makes it mandatory for all income earners to give a report of their incomes, expenses and taxes to the Income Tax Department on a yearly basis, this is known as “Income Tax Return”. Online ITR filing is available for salaried employees, individuals, HUFs and Firms apart from LLPs. From all the people to whom ITR is applicable, the most common ones are salaried employees. Through this article, we will understand the process of how to file itr online for salaried employees.

Who is a salaried employee in ITR online filing?

Salary is one of the heads of Income as covered by Income Tax Return Act. Hence, the calculation of tax charges and incomes received is also calculated on the basis of the salary of a person. According to section 17 of the Act, the term salary for the purpose of filing online ITR for salaried persons include the following income:

- Wages;

- Pension;

- Gratuity;

- Advance payment of salary;

- Leave encashments; and

- PF up to the extent it’s chargeable as per laws;

All individuals who gain income by any of the above methods fall under the category of ‘salaried employee’ for the purpose of online ITR filing.

Do all salaried persons need to pay ITR online?

Only salaried employees with a total income of up to INR 50,00,000/- need to file ITR online with the help of form ITR-1 (Sahaj). Considering the up-coming due date for ITR filing for FY 2022-23, the salaried employees with an annual income up to Rs. 2,50,000/- are exempted from paying tax.

How to file ITR online for salaried employees?

You can prepare your income tax return online and offline using the downloadable utility. Read more about the downloadable utility in ‘How to file ITR online?‘ The online process for filing an ITR for salaried employee is very easy. As a salaried person, you can follow the simple steps below to DIY your online ITR filing:

Step 1: Visit the Tax e-filing portal

Click here to visit the tax e-filing portal.

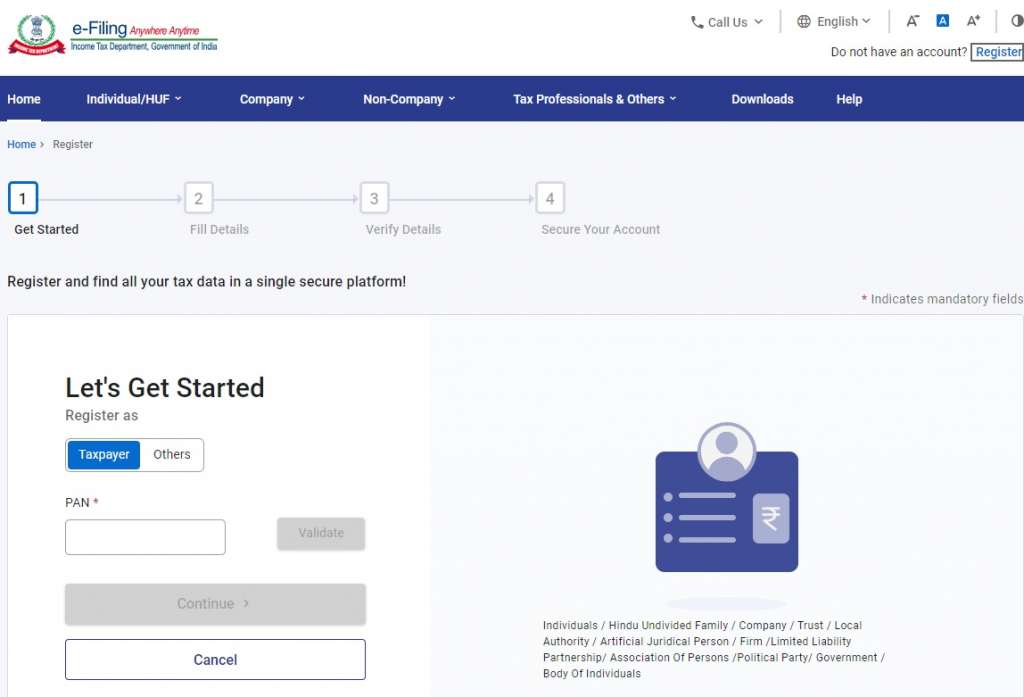

Step 2: Login/Register as a user

Then, you need to login using PAN, password, and entering captcha. However, if you do not have an account, you will need to register as a new user using your PAN details. Hence, it is mandatory to have an account on the portal to file ITR online for salaried employees.

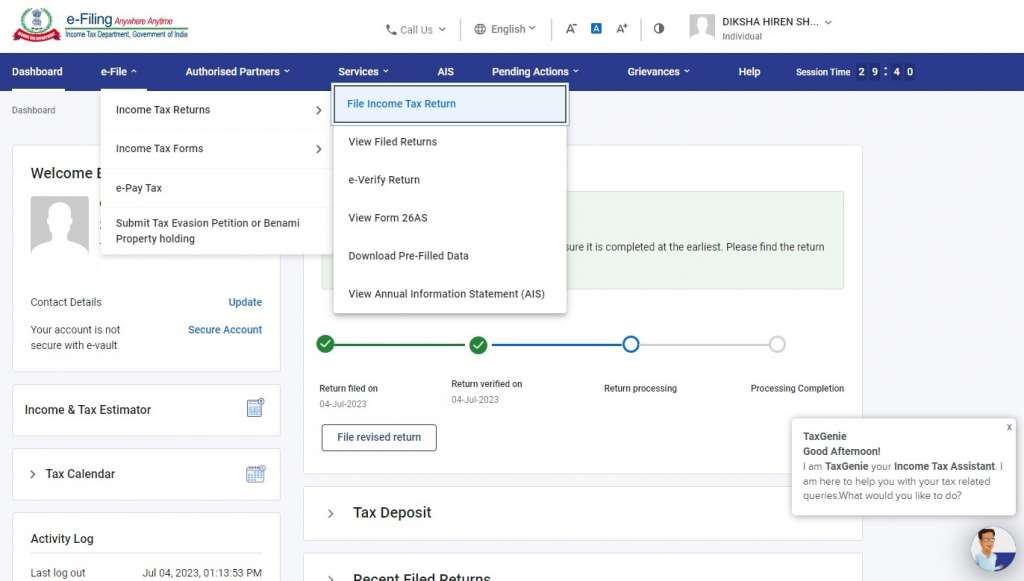

Step 3: Choose e-tax filing

Once you login to the portal, choose the ‘e-file’ option. From the drop down list, select ‘Income Tax Returns’ and ‘file income tax return’.

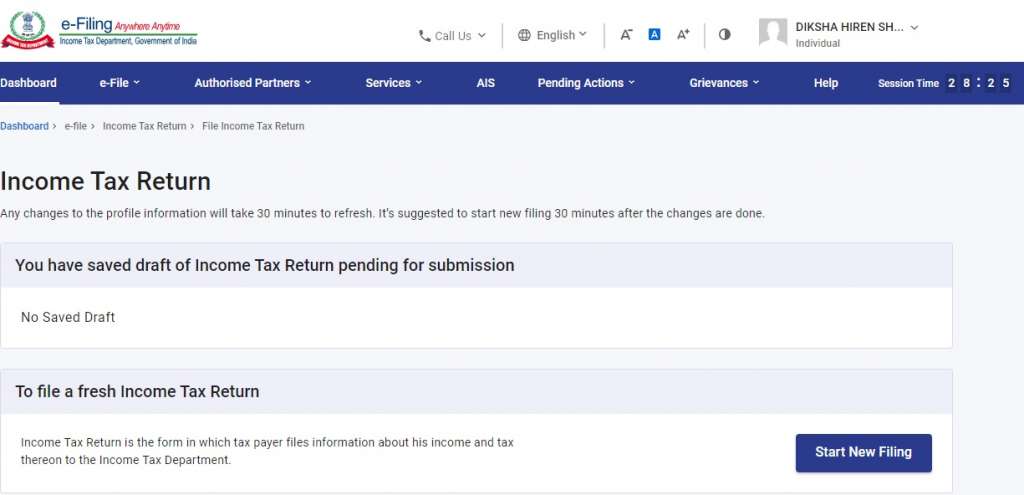

Step 4: Choose the filing method

You will then be redirected to a page, where you can choose either to continue from any prior saved ITR filing, or can file a fresh ITR Application.

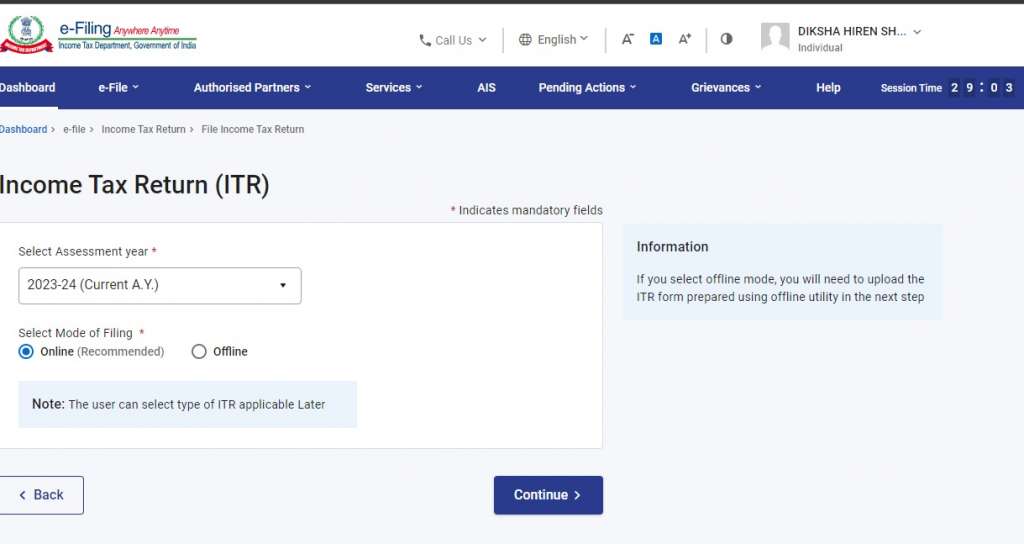

Step 5: Select the Assessment Year

Assessment Year is the year after the end of the financial year where income was earned. For example, if Amit wants to file ITR online for the income he received in FY 2022 – 2023, he will have to choose AY 2023-24 from the drop down menu. Further, from the modes of filing select ‘online’. Then, click on continue.

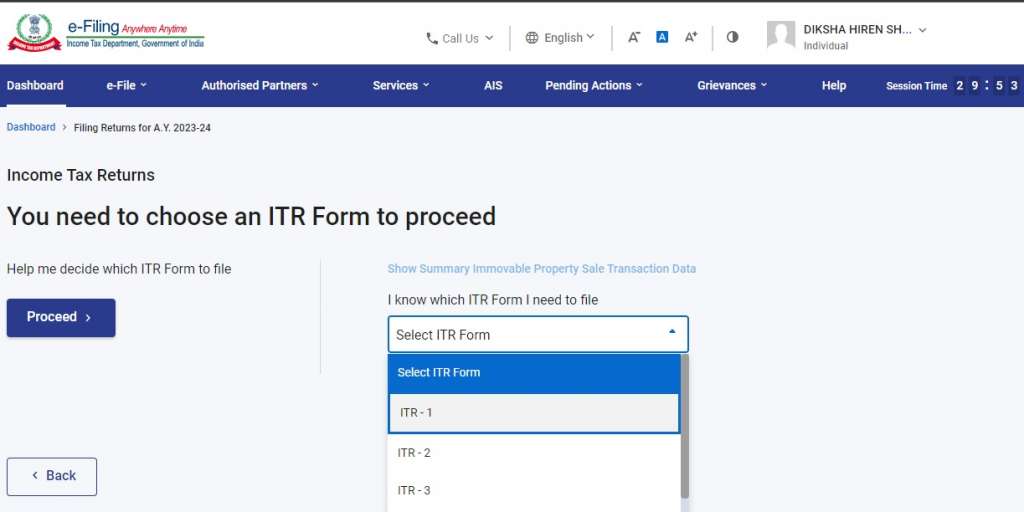

Step 6: Select applicable form for salaried employees

The applicable form for salaried individuals is from ITR -1. It is also known as the SAHAJ form. So, to file ITR online for salaried employees, you need to select the ITR form Sahaj 1. Then click on proceed. Know more about ITR 1 Sahaj Form: eligbility and documents requirement here.

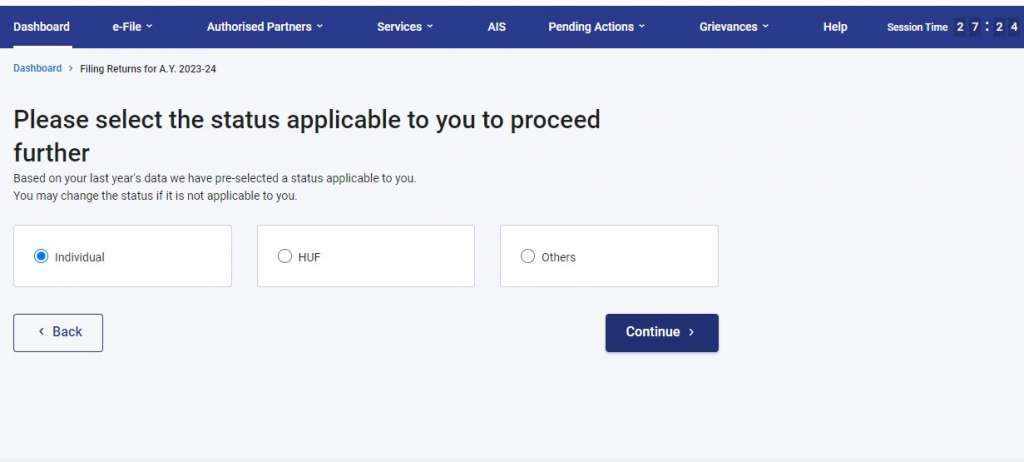

Step 7: Select Status

Here, you have to select from Individual, HUF and others. Select ‘individual’ to file ITR as a salaried person.

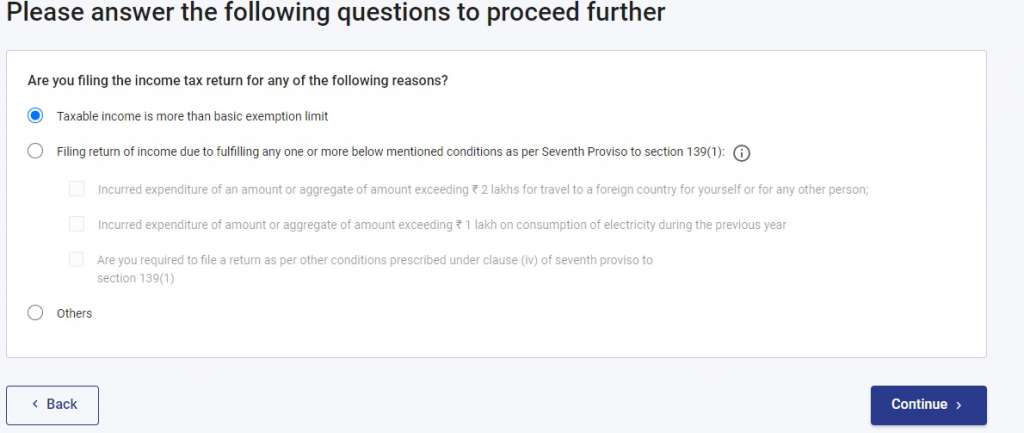

Step 8: Select the reason for filing ITR

You will have to choose whether you are filing the ITR because your income is not covered in the basic exemptions or for any other reason. Select the appropriate option and click on continue.

Step 9: Submit all relevant details

To successfully complete the ITR Filing for salaried individuals, you will need to provide and verify the following details:

Personal information

The personal information includes your PAN, aadhar, bank and other basic contact details. The PAN details will be auto populated in the form.

Gross Total Income

Here, the total income you received in a financial year will be computed by the details you provide. The details will include your salary, advanced salary, pension, gratuity, leave encashments, etc.

Total Deductions

You need to provide information related to deductions such as pension, provident funds, and other tax saving deductions.

Payment of Taxes

This includes the payment of taxes by you and the employer as well. TDS and TCS calculations, etc. and other such information is supposed to be filled here.

Total Tax Liability

Once you enter all the relevant details and give accurate information, the form will display your total tax liability, including the fees, other charges and mention of any returns, if applicable.

Step 10: Verification of ITR – 1 Form

Once you are able to furnish all information, you will have to complete the verification process to submit the itr online for salaried employees. You need to verify your ITR application through any of the following methods:

- Verification through DSC;

- Verification through Aadhar OTP;

- Pre existing code issued by a pre-verified bank; and

- E-verify later

Step 11: Final Submission to file ITR online for salaried employees

Once you verify your application, you can also save it and submit it later after previewing it. The submission must be done in an extremely careful manner, because once you click on submit, you will not be able to make any changes. After submission, you can login to the portal to keep a track on the ITR filing status.

Conclusion

Sometimes employees of a company think that the TCS and TDS deductions from the employers are enough and they do not hold any further tax liabilities. But, it is not true. Especially for freshers, it is very important to understand the concept of filing their income tax returns timely in an appropriate manner. As we can see, the process of how to file ITR online for salaried employees seems extremely simple and DIY. Yet, it is always advisable to connect with taxation experts before making any submissions. This will help you in avoiding any errors or hefty penalties due to errors. Who knows, you might even be eligible for an exemption that you’re not aware of? To get a better understanding, contact LegalWiz.in experts today!

Diksha Shastri

As a writer, Diksha aims to make complex legal subjects easier to comprehend for all. As a Lawyer, she assists startups with their legal and IPR drafting requirements. To understand and further spread awareness about the startup ecosystem is her motto.