Difference between LLP and Private Limited Company

Introduction

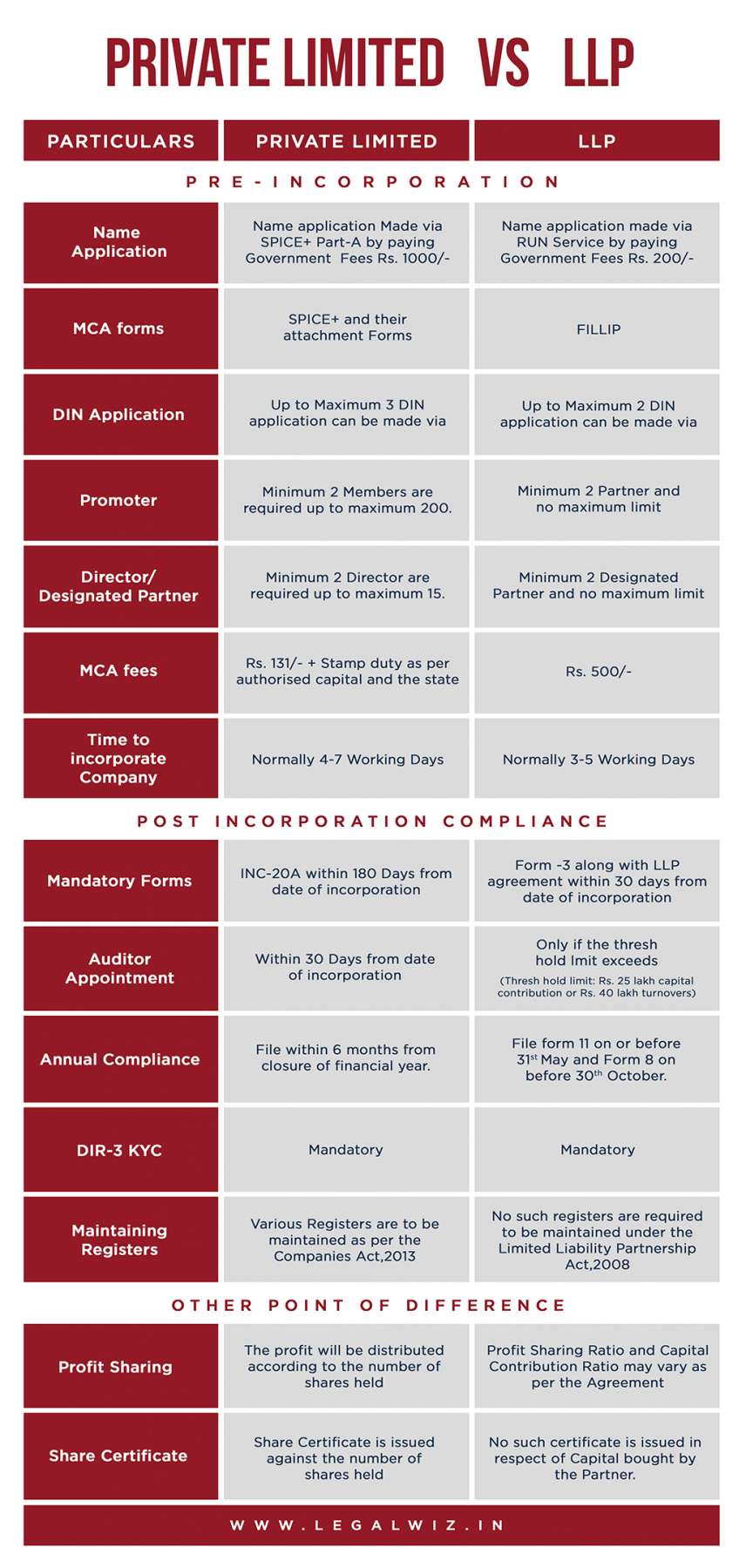

While starting a business, there is common confusion as to which form of organisation one should choose. There are different business structures that you can choose from to take off your business. Pvt Ltd Company registration and LLP registration are definitely the most popular ones among these. We understand that as an entrepreneur, you must consider the incorporation process, benefits, taxes and compliances, and a range of other factors before making your choice. Here are some points that highlight the difference between an LLP vs Pvt Ltd Company based on their Incorporation and Compliance Requirements.

Choosing LLP vs Pvt Ltd Company

Choosing between LLP vs Pvt Ltd Company is an important decision for any business. A lot of start-ups end up choosing to register a private limited company (Pvt. Ltd.). But an LLP is also a great choice, especially for smaller businesses. Understanding the difference between an LLP and a Private Limited Company can help you choose between LLP vs. Pvt ltd company easily. You should make the decision based on your own company’s requirements.

You should be aware of the benefits, and the costs, which structure canprovide an environment for your business to flourish, etc. So, let us take it one step at a time as we discuss the main differences between choosing LLP vs Pvt Ltd Company.

What are PLC and LLP?

Private Limited Company (PLC)

Private Limited Company registration is done under The Companies Act, 2013. A private company is a preferable type of organisation for bigger businesses. Especially if you are considering the long-term and sustainable growth of your organisation. It needs altleast two directors and two shareholders, with directors serving as managers and shareholders as the company’s owners.

Limited Liability Partnership (LLP)

The LLP Act of 2008 covers the registration of an LLP. Here, the owners and stakeholders are called Partners. At least two recognised partners are necessary for this type of business structure. Partners in an LLP, just like a Pvt Ltd company have limited liability. LLP is a hybrid organisation structure merging the flexibility of the Partnership and the limited liability of the Company Structure.

Pvt Ltd vs. LLP

| Private Limited Company | Limited Liability Partnership | |

| Min. Capital Requirement | Rs 100,000/- Authorised capital. No minimum requirement of paid-up capital | No minimum requirement specified |

| Creditability | Higher | Low compared to Private Company |

| Public Doc | MOA & AOA are available for public search | LLP Agreement is a private document and is not publically available. |

| Compliance Requirements | Higher | Low |

| Transparency | Transparency in the operations is higher compared to LLP | In comparison with a Private Company, transparency of operations is lower |

| Statutory audit | Mandatory since incorporation | Mandatory after exceeding the prescribed limit |

| Return to owner | Dividend to owners & Remuneration to directors | Share of profit, interest in capital & Remuneration |

| Number of Member | 2 to 200 | Min 2 – Unlimited |

| Tax benefit | Few | More |

Differences between LLP and Pvt Ltd Company

Investment needs

If the owners want to raise funds through external sources like venture capital and private Equity, then they should go for choose “company”. This is because LLPs cannot raise funds through such resources. A business should choose an LLP structure if it has limited investment needs.

Entrepreneurs that want to raise funds through angel investing, venture capitalists, private placement etc. prefer Pvt Ltd company registration. LLP on the other hand is suitable for smaller businesses due to fewer complianctheies.

Minimum Requirements for LLP vs. Pvt Ltd Company

A private limited company needs a minimum of two shareholders and two directors. A shareholder and a director are not necessarily two different individuals. However, one director must be an Indian national and must spend at least 182 days continuously in India. Furthermore, the registered office must be located in India. The office can be registered at either a commercial or a home address. At least two partners are necessary for LLP registration as well. One of the partners must be an Indian citizen and have resided in India for at least 182 days. LLPs, like PLCs, must have a registered office address in India.

Public Access to Documents

The operations, management and decision-making in both the strictures are governed by the respective constitutional/Incorporation documents. In the case of a Private Limited Company, the Memorandum of Association (MoA) and Article of Association (AoA) are the governing documents.

MoA and AoA documents are public in nature. Any third party by making payment of prescribed fees to MCA may find the main object and other details. Any third party interested in tracking the activities of a Private Limited Company can get the information. In addition, the public documents involve the Financial Statements of the Company. These documents can provide very useful insight to investors or any other contracting party regarding the operations of the company.

In the case of LLP, the governing document is the LLP Agreement, entered between the Partners of the LLP. Here, the LLP Agreement is registered with MCA, but that is not a public document. This in a way ensures the Privacy of operations of your LLP.

Return to Owners in LLP vs. Pvt Ltd Company

The prime interest of any owner in any business is yielding a healthy return from the capital and efforts invested in the entity. Registering a Private Limited Company allows the owner to withdraw profit by way of issuing dividends on the shares held by the owners. Here, the company receives the return on the capital invested. Furthermore, individuals holding the position of Directors can withdraw remuneration for their efforts in the operations and management of the company, subject to the limit prescribed under the provisions of the Companies Act, 2013.

In the case of LLP, working Partners of LLP may get the return in the form of remuneration, which is allowable up to a certain limit as prescribed under the Income Tax Act. Further, the share of profit as per the ratio decided in the LLP Agreement can be provided along with the interest levied on the capital invested in the LLP.

Statutory Requirements & Compliance

For both Pvt Ltd company and LLP, there is a cost involved to maintain the active status of the company. There are many annual, one-time, time-based, as well as event-based compliances that need to be taken care of. However, the annual compliances for an LLP are a lot lower in comparison to the compliances in the case of a Private Company.

Several restrictions such as Related Party Transactions, Accepting Deposits, Loans to Directors, making loans & investments, Corporate Social Responsibility etc. are laid on Private Limited Companies under The Companies Act, 2013. Limited Liability Partnership enjoys more flexibility of partnership in this case.

In the case of Pvt. Ltd. Company, one needs to fulfil the regulations which require the appointment of a statutory auditor within 30 days after the incorporation of the Company. Whereas in the case of LLP, Statutory Audit is mandatory when the annual turnover exceeds Rs. 40 lakh or the contribution of Partners exceeds 25 lakh rupees.

Any charge created or modified over the Assets of a Pvt Ltd Company requires to be registered with the Registrar, which is not the case with an LLP.

Taxability

LLPs must pay tax at a fixed rate of 30% of their total income. Also, there is a surcharge of 12 per cent if it’s total income exceeds one crore rupees. if a Private Limited firm earns less than 400 crores in the previous year, a 25% tax is payable. If the annual revenue exceeds 400 crores, the company must pay a 30% tax. Companies can also now choose between the new rates of 22 per cent (for existing companies) and 15 per cent (for new companies). However, doing so will exclude you from some deductions and exemptions.

Conclusion

Having discussed the major difference between LLP and Pvt Ltd, we can say that LLP is more flexible in terms of compliance as compared to a Private Limited Company. One should also look into the incorporation as well as post-incorporation provisions and then choose the form of business wisely.

We hope this blog helps you figure out the perfect structure for your business. However, it is always advisable to consult professionals when it comes to making such important decisions.

Frequently Asked Questions

What are the key distinctions between an LLP and a Private Limited Company?

The primary differences between an LLP (Limited Liability Partnership) and a Private Limited Company encompass aspects like incorporation, compliance, transparency, tax treatment, and returns to stakeholders.

Is there a minimum capital requirement for establishing a Private Limited Company and an LLP?

A Private Limited Company usually mandates a minimum authorized capital of Rs 100,000, but no minimum paid-up capital is specified. Conversely, an LLP does not have a minimum paid-up capital requirement.

Which entity enjoys higher credibility, a Private Limited Company, or an LLP?

Generally, Private Limited Companies are considered more credible due to their rigorous compliance obligations and greater operational transparency. LLPs, on the contrary, have fewer compliance requirements.

What are the public disclosure obligations for documents in a Private Limited Company and an LLP?

In a Private Limited Company, documents such as the Memorandum of Association (MoA) and Articles of Association (AoA) are publicly accessible, and financial statements can be scrutinized by the public. In contrast, the LLP Agreement registered with the MCA remains confidential, ensuring privacy.

Shreeda Shah

Shreeda Shah is a Chartered Accountant associated with Legalwiz.in as a Business Advisor. She has a good expertise over Direct Taxation and Indirect Taxation compliances.