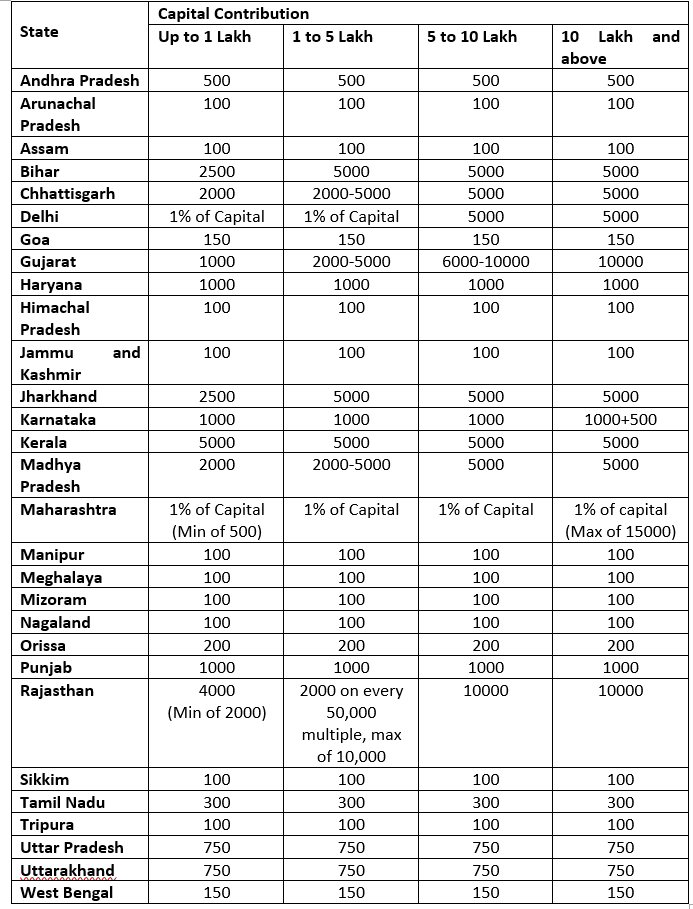

State-wise rates of Stamp Duty on LLP Agreement

When you want to start an LLP in India, the incorporation does not end with the issuance of an LLP certificate by the MCA. Within 30 days of issuance of the certificate, the designated partners need to submit the LLP agreement. This is an integral part of online llp registration in India. The submission of the LLP Agreement requires mandatory payment of stamp duty as applicable. Besides, these stamp duty charges for LLP agreement differ on a state to state basis. Hence, it is important to understand the state wise rates of stamp duty on the LLP agreement. Through this blog, you can get a detailed idea of the stamp duty on LLP agreements in Mumbai, Delhi, Ahmedabad, Chennai and more.

What is an LLP agreement?

An LLP agreement in India is the most primary document for Limited liability partnership firms. This agreement governs the roles and responsibilities of all designated and other partners of an LLP. The details of capital contribution, remuneration (if any), terms of partnership, etc. are all a part of the LLP agreement. Since this is a primary legal document, you need to get stamp duty on LLP agreement before submitting it.

The submission of an LLP Agreement is the final step of the LLP registration process. A valid LLP agreement has the signature of all partners of the LLP. Besides, the entire operations of the LLP can happen only on the basis of the LLP agreement. Further, if there are any disputes regarding the terms of LLP Agreement, the partners can also keep an option of arbitration open.

Also Read: Choose your LLP Company Name wisely!

What is the stamp duty on LLP agreement?

An LLP Agreement must be duly notarised on the stamp duty paper of appropriate value. In India, the matter of stamp duty is governed by each state differently. Hence, every state has a stamp duty for LLP agreement on the basis of its legislature. Besides, another factor contributing to the calculation of stamp duty on LLP agreement is the capital contribution in the LLP.

LLP Registration stamp duty charges by different states of India

Conclusion

It is evident that the stamp duty on an LLP Agreement depends on two factors:

- State of registration; and

- Capital contribution.

You can get appropriate stamp on LLP Agreement in two ways, either through a non judicial paper or by way of franking from the bank. Both these modes are valid for the MCA. Besides, not filing the LLP Agreement on time leads to a penalty of Rs. 100 per day. Get in touch with LegalWiz.in experts and commence your business activities today!

Frequently Asked Questions

What is stamp duty on LLP Agreement in Mumbai?

The stamp duty requirement on LLP Agreement in Mumbai is 1% of the capital contributed. However, it cannot be less than Rs. 500/- or more than Rs. 15,000/-

What is the LLP Agreement stamp duty in Telangana?

The stamp duty applicable in Telangana is Rs. 50, 100, or 200/- on the basis of your capital contribution.

What are stamp duty charges for LLP?

To figure out the LLP registration stamp duty charges, you need to know the minimum requirement as per state of registration and the capital contributed in the LLP.

CS Shivani Vyas

Shivani is a Company Secretary at Legalwiz.in with an endowment towards content writing. She has proficiency in the stream of Company Law and IPR. In addition to that she holds degree of bachelors of Law and Masters of commerce.